Crypto Mining Tax Guide: How Do I Report My Bitcoin Mining Taxes?

In this guide, we break down the basics of reporting your mining profits to the U.S. IRS.

This guide is purely for informational purposes only and is not tax or legal advice. You should consult a certified CPA or other tax professional when reporting your crypto mining taxes.

Like with any other industry, Uncle Sam wants a piece of your Bitcoin mining revenue, but how exactly are miners supposed to report their taxes?

In the Internal Revenue Service’s (IRS) eyes, Bitcoin and cryptocurrency miners have two taxation obligations to consider: 1) their mining revenue as a source of income, and 2) any capital gains they capture from selling their mined coins for USD.

https://luxormining.substack.com/embed

Do I Have to Pay Taxes on Crypto and Bitcoin Mining?

Short answer, yes. Long answer, maybe not, depending on how much you earn from mining and if you are considered a hobbyist or not.

Different entities (e.g., individual vs. a company) will use different forms to report on their mining revenue, but the bottom line is the same: mining revenue is taxed as a part of annual income.

If you’re part of a company doing this professionally, well, you’re probably not getting your advice from a blog post and likely have an in-house accountant to take care of everything for you.

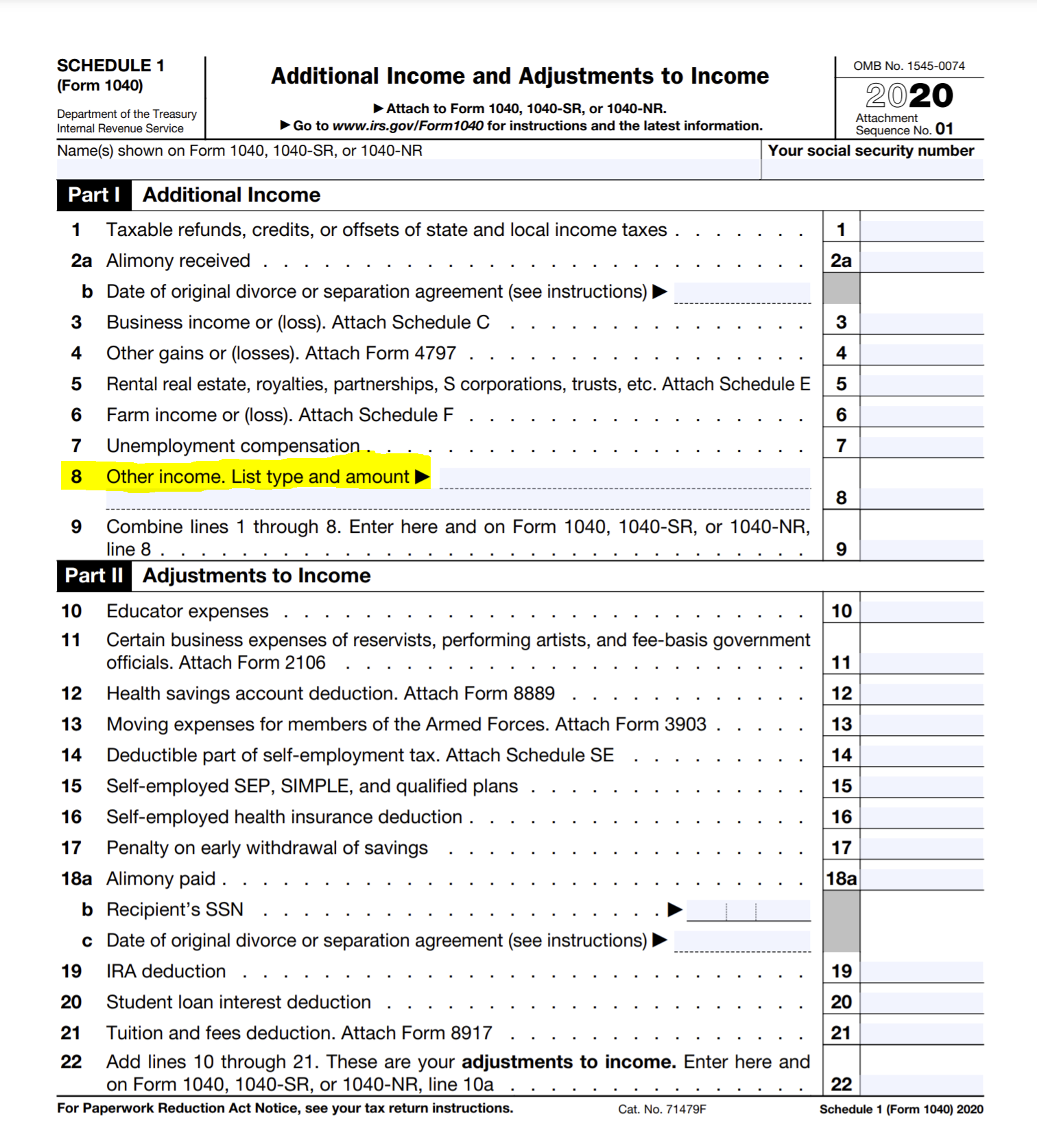

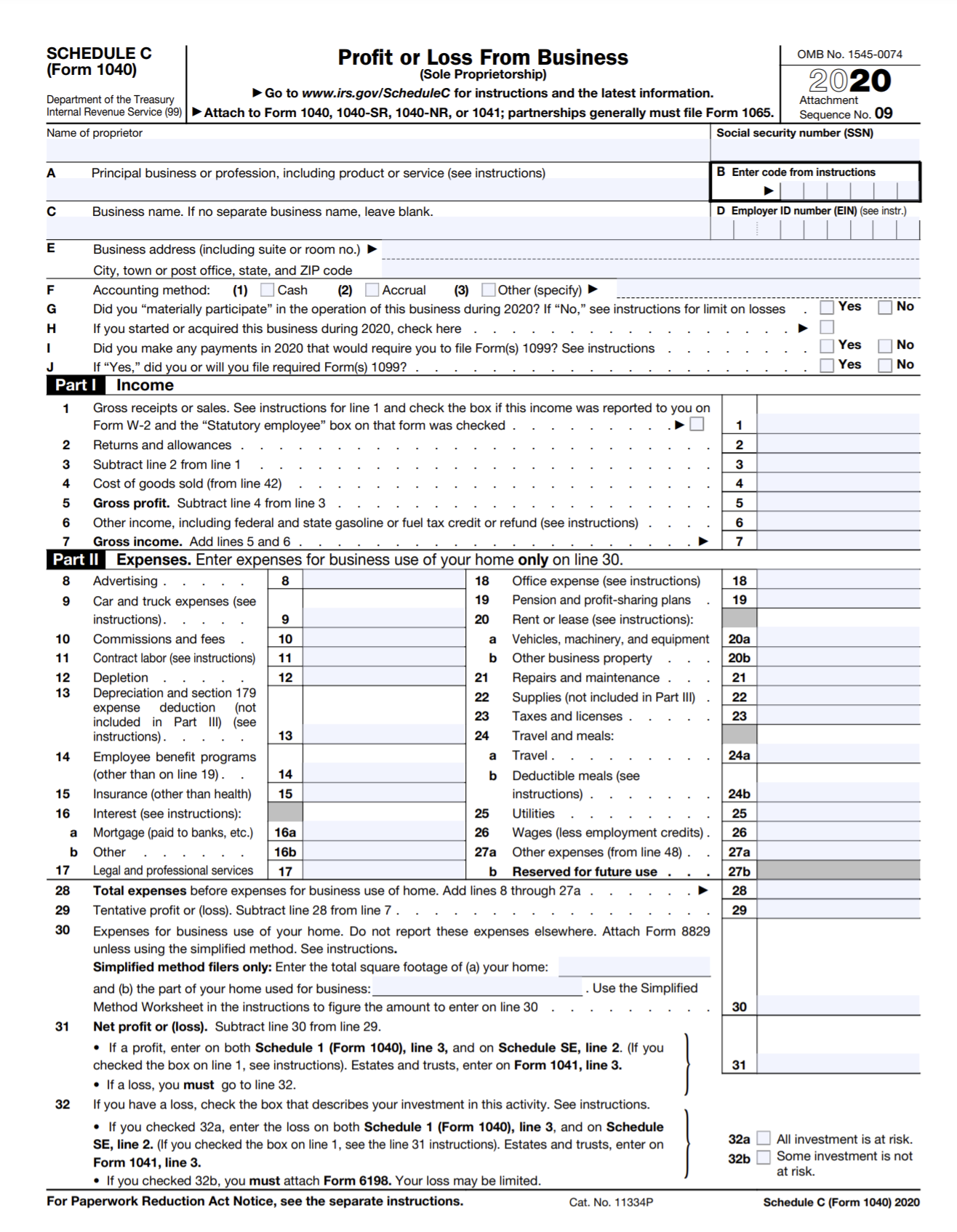

But if you are an individual miner, you basically have two filing options. If you choose to declare your mining income as part of a business (i.e., you classify your self-mining operation as a business venture) you can report the income under the Schedule C and on line 3 of Schedule 1 as part of your 1040 form

If you choose to not file your mining income as a business, then you add this to the “Other income” Line 8 on the Schedule 1 section of your 1040.

If you file with a Schedule C, you are entitled to deductions of ordinary and necessary business expenses against your mining income; if you file with Line 8 on Schedule 1 as a hobbyist, you are not (more on this later).

How to Report BTC Income as USD

When reporting your mining revenue, the tricky part is making sure that you are consistent with how you report the dollar amount of your earnings. For example, if you receive a payout from your mining pool every Friday, then it would behoove you to use the same reference price from the same site every time you log that income.

For example, if you receive 0.00123 BTC from your pool on August 20, 2021, you may reference the closing price of bitcoin that day from Coinmetrics, Coinbase, Yahoo! Finance, or some other price source. But you need to make sure that you use the same price source and the same price reference (in this case, opening price). Otherwise, you could game the reporting in your favor (i.e., take a price from one exchange that is lower than the spot price of another) or use opening/closing prices to your favor, which would backfire on you in the event of an audit.

Are Bitcoin Mining Profits Taxed As Capital Gains?

Just like when you sell bitcoin you buy on spot for USD or other goods, the bitcoin you earn through mining is subject to capital gains taxes whenever you liquidate or exchange it. The basis for your capital gains (i.e., the “purchase price” of your bitcoin) is based on the market value of the bitcoin when you receive your payout.

If you sell your bitcoin within a year of mining it, it is subject to a short term capital gains cost, which is calculated as regular income and thus could be up to 37% of the sale amount (depending on where you sit on the income bracket).

If you sell your bitcoin a year or later after you mine it, it’s subject to long-term capital gains, which could be anywhere from 10-20% depending on your income bracket (but is typically 15% or lower for most folks).

Can I Claim Deductions for Bitcoin Mining?

Yes, but only if you are mining professionally or as a business (i.e., if you are reporting the income as a Section C business).

These deductions could include Section 179 depreciation or other costs including electricity, repairs, pool fees, rented rack space, and even the equipment itself, as well as insurance costs, tax preparation fees, legal fees.

Consistency is Key

Unlike most tax reporting, where income is a known constant and expenses can be murky, in bitcoin mining, your expenses are often the most concrete detail in your reporting, whereas your revenue (which comes in the form of a volatile cryptocurrency which has changed as much as $10k in a day) is not so cut and dry.

Put another way, it’s up to you to report the dollar amount of your earnings when you file. No employer does this for you and there’s now way for the IRS to know what the fair market value of your mining rewards were at the time of payout.

With that in mind, the most important thing to consider when filing your mining taxes is that consistency is key. You want to be sure to be consistent with the data source you are using to convert your BTC earnings into USD earnings, and you want to make sure that you’re using the same data point (i.e., closing or opening price).

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.