Bitcoin Mining Around the World: Sweden

Sweden is one of Europe's larger Bitcoin mining hubs.

Sweden has become one of Europe's last bitcoin mining refuges thanks to its stranded hydropower. But what else defines the bitcoin mining industry in this Arctic outpost?

This is the first article in a series describing the bitcoin mining industry in various countries. Why do bitcoin miners flock to specific countries while avoiding others? And which countries have the most potential for developing new mining operations? These are questions that we will answer in this article series.

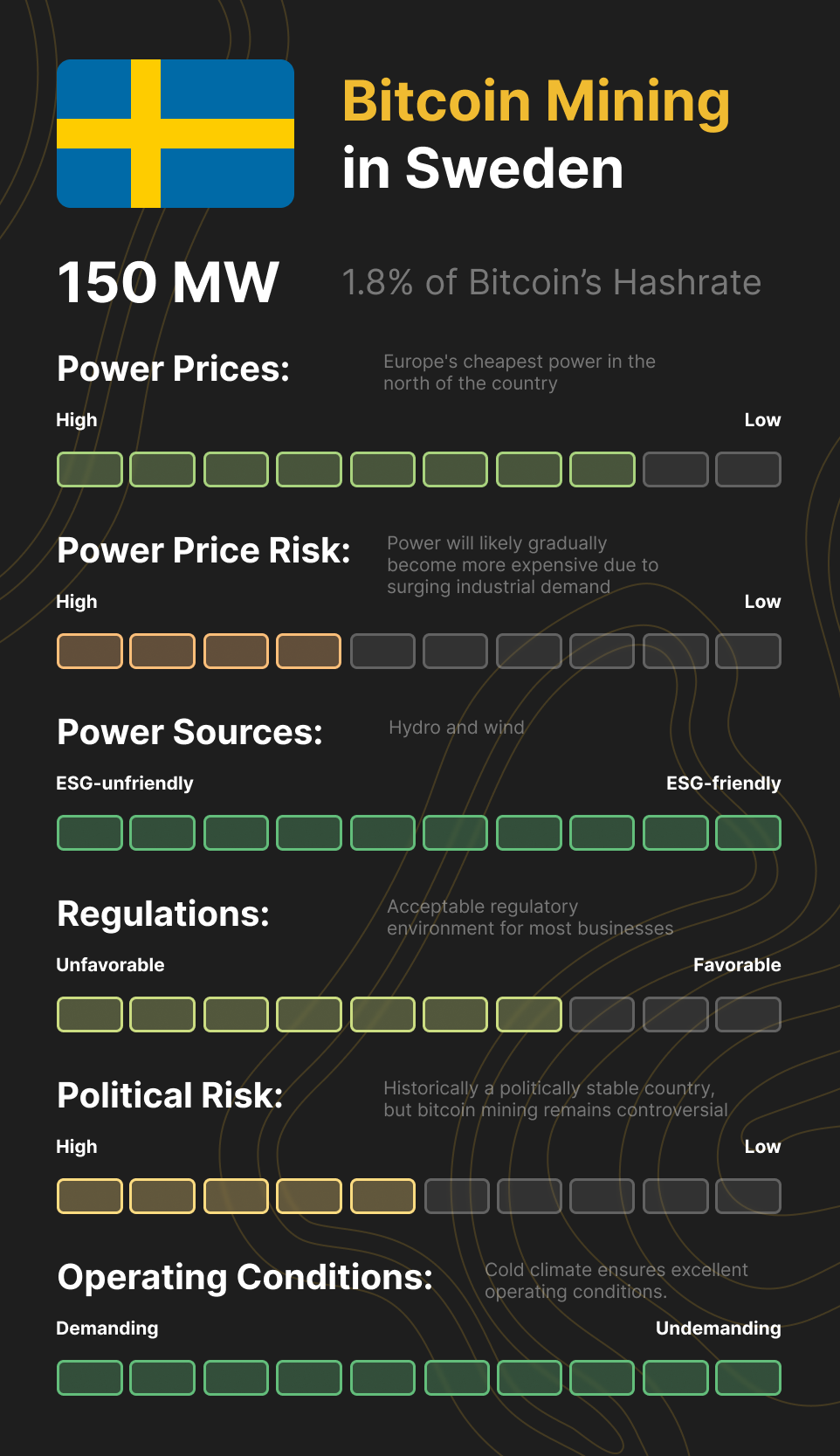

In this article, I explain why Sweden has attracted the largest bitcoin mining industry in Europe. At the end of the article, I give the country a bitcoin mining score based on several factors, including power prices, power price risk, regulatory environment, political risk, and operating conditions.

One of the last European bitcoin mining refuges

Let’s first establish the size of Sweden’s bitcoin mining industry. I will first provide an existing estimate before coming up with my own number.

Cambridge University periodically publishes its Bitcoin Mining Map estimating the percentage of hashrate originating in different countries. According to the latest version from January 2022, Swedish miners generate 0.84% of Bitcoin’s hashrate. Multiplying this percentage by the Bitcoin network’s electricity consumption at the time gives us a Swedish bitcoin mining power consumption of 80 MW.

Cambridge’s estimate is more than a year old and is based on a top-down methodology using data from only four mining pools. I will now provide an updated estimate based on identifying as many Swedish bitcoin mining facilities as possible and getting power consumption approximations from Swedish miners.

I estimate the Swedish bitcoin mining industry to consume around 150 MW. This power consumption should equal a Swedish share of the global hashrate production of 1.8%, based on Hashrate Index’s Bitcoin Mining Energy Consumption Index, which currently sits at 8.1 GW. In addition, Sweden houses several GPU facilities that mined ether pre-merge and are now mining altcoins or doing high-performance computing.

Who mines bitcoin in Sweden?

Generating well above 1% of Bitcoin’s hashrate, Swedish miners are not the biggest but still important contributors in securing the Bitcoin network. Who are they, and where do they operate?

Sweden’s bitcoin mining industry consists of a handful of international players and a few local data centers doing mining as one of many activities. The most prominent international players are Hive Blockchain, Northern Data, and Genesis Digital Assets.

The entire industry is located in the northern part of the country, where they have access to an abundance of stranded renewable energy. The biggest mining hub in the region is Boden, a small industrial town where both Hive Blockchain and Northern Data operate.

An abundance of renewable energy

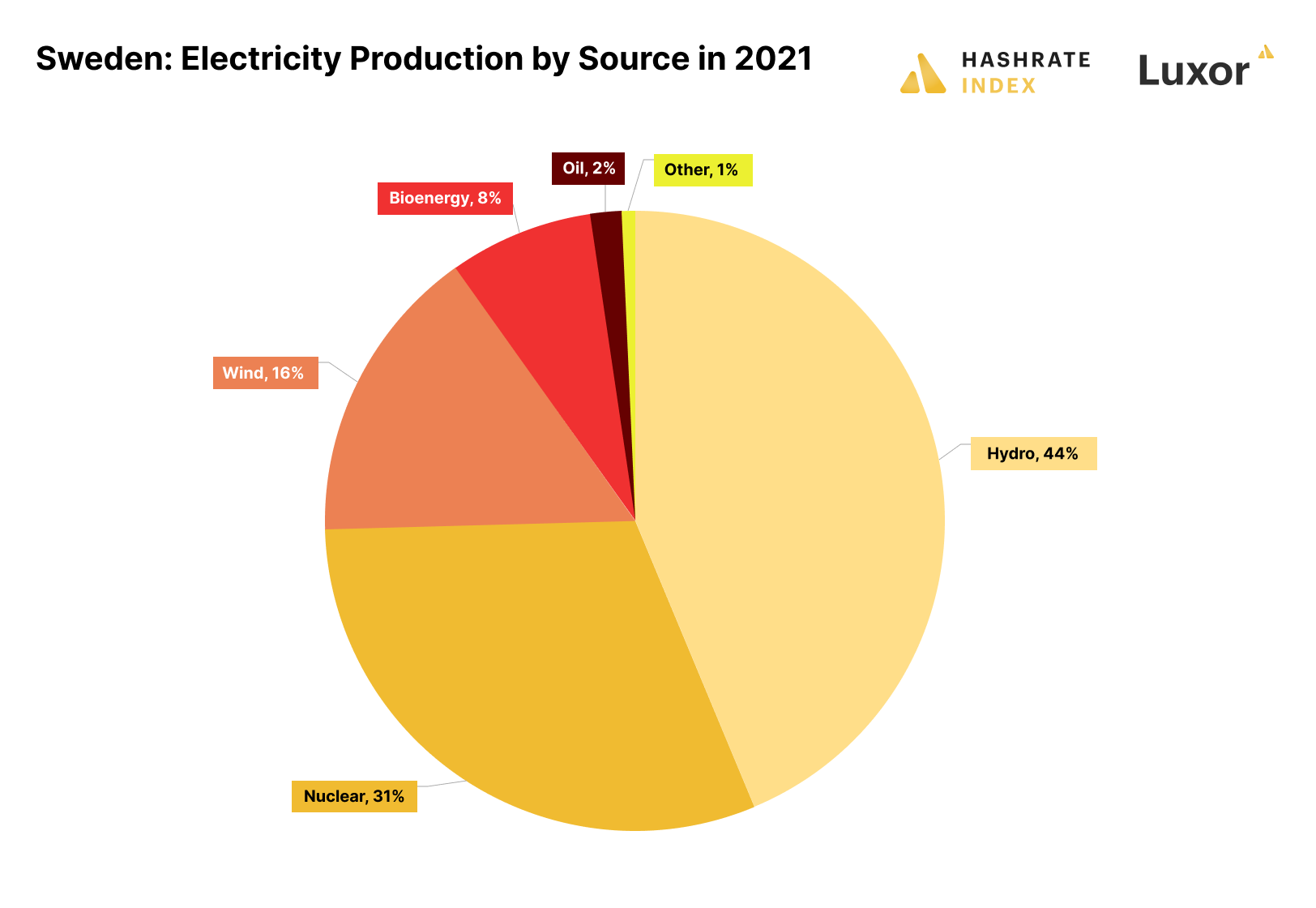

The main reason why Sweden has attracted a sizeable bitcoin mining industry is due to its abundance of renewable energy. Sweden is an electricity powerhouse, generating the fifth-most electricity per capita globally in 2021.

Sweden has become a popular destination for bitcoin miners looking to claim carbon neutrality, as 98% of the electricity comes from ESG-friendly sources. A combination of hydro and nuclear is the backbone of the electricity system, with 44% and 31% generation shares, respectively. The country also sees a rising share of wind power, which currently generates 16%.

Sweden is a large country with a varied terrain. In the north, numerous rivers transport water from the mountains along the Norwegian border to the Gulf of Bothnia. This geography is perfect for hydropower, which the industrious Swedes have exploited by building a total hydropower capacity of 16.4 GW.

The landscape of the south is flat, with few rivers suitable for hydropower generation. The Swedes solved this problem by developing several nuclear power plants in the 1970s. The Swedish government originally planned to phase out nuclear, but Europe’s current energy crisis has changed their minds. Sweden will likely not follow the example of Germany and jeopardize its energy security by reducing its nuclear capacity.

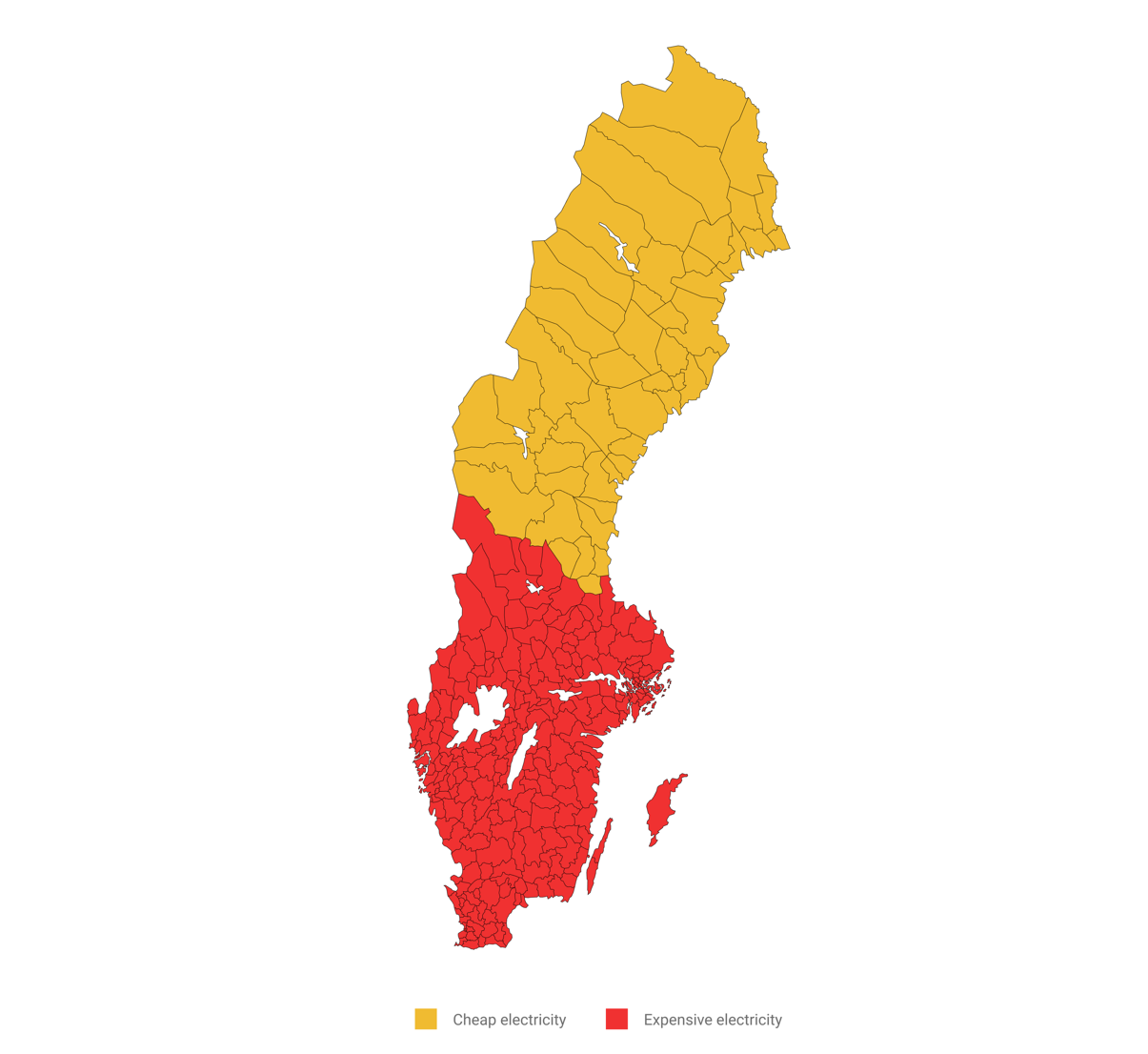

Electricity is only cheap in the north

Sweden is Europe’s third-largest country by area. Most of the country’s 10 million population live in the southern part. Meanwhile, as explained in the previous section, virtually all the hydropower is generated in the north.

The vast distances between the northern hydropower plants and the demand centers in the south make it challenging to build the necessary transmission capacity to unify these isolated hubs. Therefore, significant transmission constraints exist between the north and south, preventing the outflow of the zero marginal cost hydropower from the north.

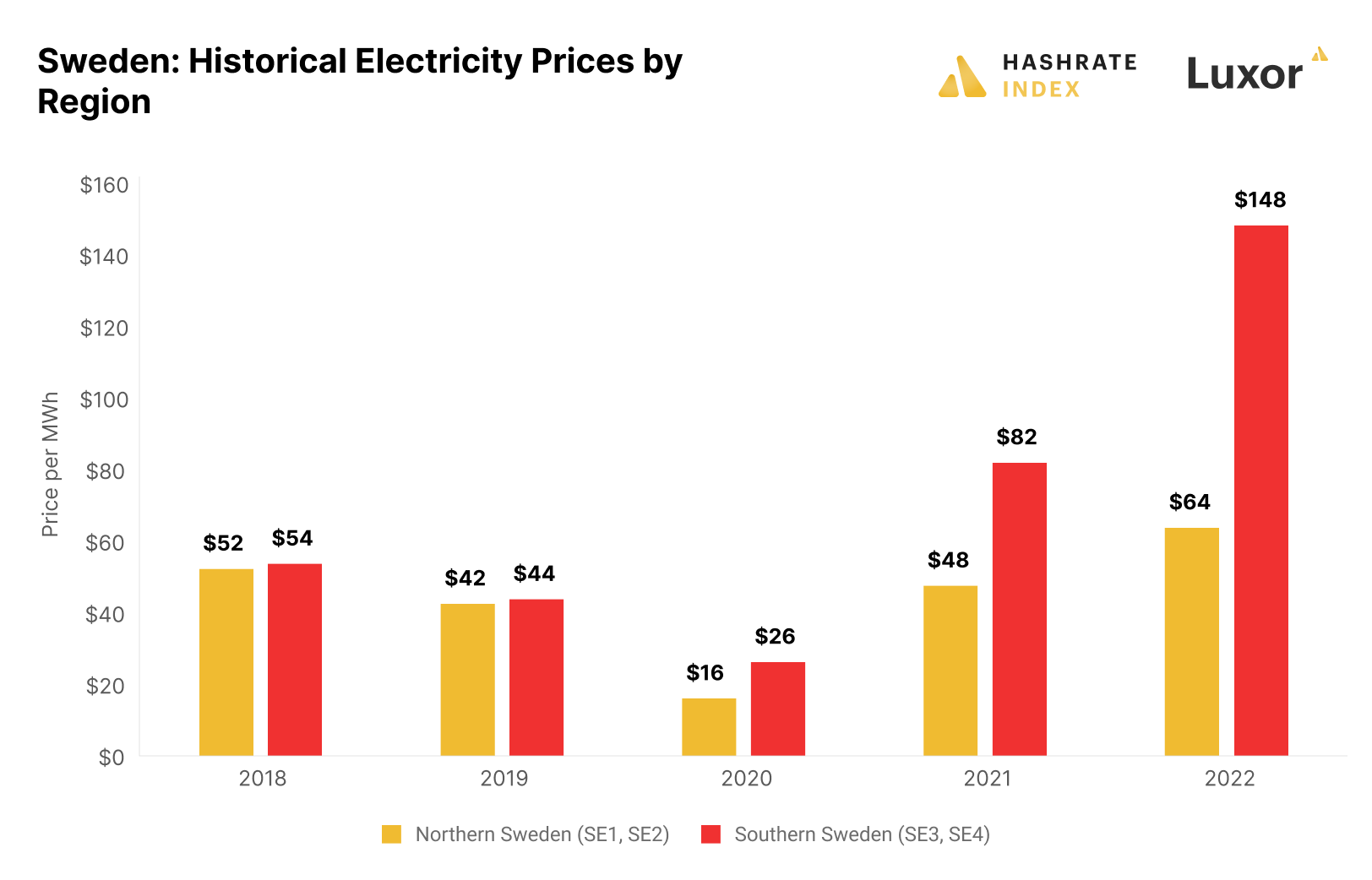

Due to transmission constraints, the Swedes have split their electricity market into four price zones. In this article, we will refer to the two northernmost price zones as “northern Sweden” and the two southernmost price zones as “southern Sweden”. As shown in the map above, electricity is cheap in the north and expensive in the south.

Electricity prices weren’t always high in southern Sweden. As shown in the chart above, electricity prices were historically similarly low in the northern and southern parts of the country, but significant price differences suddenly emerged in 2021. Southern Sweden is well-connected with the European electricity market through submarine power cables. Therefore, the surging electricity prices in Europe from the second half of 2021 quickly spread to southern Sweden.

Between 2018 and 2020, southern Sweden's average spot electricity price was only $41 per MWh. In 2021, the price rose to $82 per MWh, rendering bitcoin mining prohibitively expensive. In 2022, the average price reached an unprecedented $148 per MWh, pushing even the most energy-efficient ASICs into cash flow negative territory. This electricity price increase devastated southern Sweden's miners, who went bankrupt or moved up north.

Meanwhile, electricity prices in northern Sweden have stayed at around the same levels as before the energy crisis. The substantial transmission constraints between the north and south of Sweden have shielded electricity consumers in northern Sweden from the worst energy price inflation. Our newly published 2022 year-end report describes how the energy crisis has affected the bitcoin mining industry.

According to industry insiders, miners in Sweden can expect to lower their yearly average all-in electricity price by about 25% through demand response initiatives. For instance, Hive, operating in Sweden, announced in December that it earned a substantial income by reducing its power consumption in response to market signals.

Will electricity stay cheap in northern Sweden?

In the previous section, I established that electricity is cheap in northern Sweden. But will it stay that way? Let’s find out.

Three factors can influence the development of electricity prices in northern Sweden: the development of the local electricity generation capacity, changes in the local electricity demand, and expansion of the transmission capacity between northern and southern Sweden. Let’s evaluate these three factors one after the other.

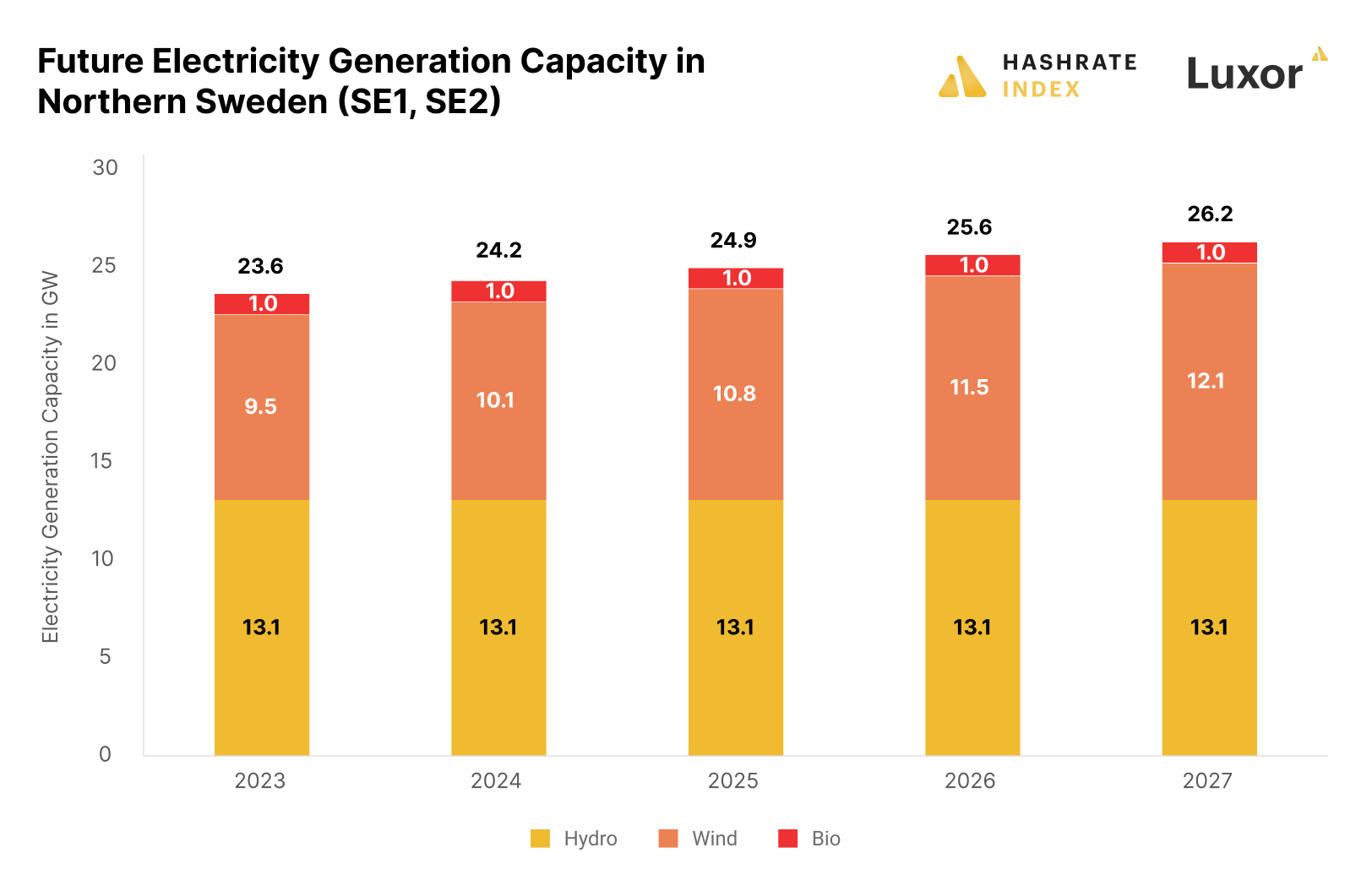

As explained, hydropower is the backbone of the electricity system in northern Sweden. Unfortunately, there are no plans for building out additional hydropower capacity. Northern Sweden’s only electricity generation capacity increase in the near future will come from wind power, which is estimated to increase by 22% between 2023 and 2027.

As shown in the chart above, northern Sweden's total electricity generation capacity is estimated to increase by 11% between 2023 and 2027, corresponding to a meager 2.6% yearly increase. Even more worryingly, this entire capacity increase will come from weather-dependent wind power with a significantly lower capacity factor than hydro. The constrained supply leaves little room for increasing demand without rising prices.

That brings us to our next question: how will the local electricity demand in northern Sweden develop in the coming years? It will likely massively increase as a handful of enormous electricity-intensive industrial projects are under development. These industrial companies are drawn to northern Sweden due to the electricity price discrepancies between traditional industrial powerhouses like Germany and northern Sweden.

These industrial projects are heavily tied to the EU’s and Sweden’s ambitions regarding the energy transition and include battery factories, green steel production, and the electrification of Europe’s largest iron ore mine. All these projects will demand enormous amounts of electricity. For instance, the electrolyzer that will generate hydrogen for green steel production will consume 800 MW by 2030 - more than five times as much as Sweden’s entire bitcoin mining industry. The electrification of the iron ore mine demands even more electricity, as it will require an estimated 2,300 MW by 2030.

We now know that the electricity demand will increase substantially in northern Sweden without a corresponding increase in the electricity generation capacity. Let’s then analyze our final factor: development of the transmission capacity.

The Swedish transmission system operator plans to eliminate the transmission constraints between northern and southern Sweden by investing heavily in transmission capacity through a project called NordSyd. Still, it will take up to 20 years to complete these transmission expansions, so the electricity markets in northern and southern Sweden will remain relatively separated for the foreseeable future.

Due to the projected enormous industrial electricity demand increase towards 2030, I expect prices in northern Sweden to converge towards the higher prices in southern Sweden. Still, miners in northern Sweden will likely continue to enjoy low electricity prices for at least three to five years.

Sweden provides excellent bitcoin mining operating conditions

There are few countries where operating a mining farm is easier than in Sweden. This Arctic country's cold climate provides natural cooling to heat-producing mining operations. The average monthly temperatures in Boden, Sweden’s bitcoin mining capital, ranges from -9C (-15F) to +17C (+62F) between the coldest and warmest months. The air is also very clean. The climate barely gets any better for bitcoin mining.

The benign climate means maintaining and running a mining operation is more straightforward than in hotter bitcoin mining hubs like West Texas. Miners can easily run air-cooled operations and don’t need to worry about building additional cooling infrastructure. In addition, machines could last longer.

The low failure rate due to the cold climate also means lower maintenance requirements, which could reduce operating costs. I have heard about some smaller miners in the region who sometimes leave their facility running for several weeks without any employees present except for periodic security checks. Try to do that in West Texas during the scorching summer heat.

In addition, even the sparsely populated northern Sweden provides decent access to labor. Most suitable locations for mining are located relatively close to towns with at least 20,000 inhabitants, and the population generally has a great understanding of IT, with one of Sweden’s leading IT universities in the region.

A politically stable country, but bitcoin mining is controversial

Sweden has historically been one of the most politically stable countries globally. The country’s politicians and regulators have traditionally been business-friendly and open to innovation, proven by the country’s ranking as number 10 on the World Bank’s Ease of Doing Business Index. The low political risk, favorable regulatory environment, and general business friendliness have fostered an innovative business climate, resulting in one of Europe’s leading IT industries.

Taxes are relatively low in Sweden compared to many European countries, with a corporate tax level of 21%. On the other hand, the VAT rate is 25%, which also affects imported products, including ASICs. Still, Swedish miners can avoid the import VAT by registering their companies in the Swedish VAT registry.

The country has a massive conventional data center industry, represented by companies like Facebook, Google, Microsoft, and Amazon. The Swedish Government has been eager to attract data centers, particularly in the northern part, and has even helped them establish operations. Swedish electricity producers have also set up initiatives to attract energy-intensive data centers, including bitcoin miners.

Still, on a political level, bitcoin mining remains is controversial. Swedish politicians and regulators have persistently expressed negative attitudes toward the industry. The most notable example is from 2022, when two Swedish financial regulators attempted to get the EU to ban proof-of-work. Luckily, they failed.

Although the bitcoin mining ban attempt was unsuccessful, Swedish government officials keep looking for ways to curb the industry, with the Swedish Energy Minister stating “We need energy for more useful things than Bitcoin”.

Swedish miners are currently, as part of the broader data center industry, eligible for a reduced power tax of SEK 0.006 ($0.00057) per kWh, compared to the ordinary SEK 0.392 ($0.038) per kWh. The Swedish government proposed to remove data centers' eligibility for this reduced power tax from July 1st, 2023. Unfortunately, there seems to be a broad political consensus to increase the power tax, and miners will likely have to pay this power tax from July 1st.

The competition for grid connections is severe in northern Sweden due to the massive influx of electricity-intensive industries. These industries are heavily supported by the Swedish Government and the EU and will likely win the battle for future electricity allocations. Swedish miners already find it increasingly harder to get access to new electricity.

Conclusion

Thanks to its cheap renewable energy, cold climate, and political stability, Sweden has attracted a significant mining sector generating well above 1% of Bitcoin’s hashrate.

Stranded hydropower has spared northern Sweden from the energy price inflation that has ravaged Europe since late 2021, making the region one of Europe's last bitcoin mining refuges. It’s important to note that electricity is only cheap in northern Sweden - not in the southern part of the country.

Sweden has historically been a politically stable country with an excellent regulatory environment for most businesses. Still, bitcoin mining remains controversial. Swedish regulators are eager to reduce the industry's size to make room for other electricity-intensive industries that align with Sweden’s and the EU’s ambitions, and recently proposed to increase power taxes from July 1st, 2023.

The competition for electricity with these government-approved industries gives the Swedish bitcoin mining industry little additional room to grow. In addition to the increasing political opposition, there is also significant electricity price risk. The massive growth of industrial power consumption in northern Sweden will likely lead electricity prices in the region to increase drastically over time.

Still, as it takes time to develop these industrial projects, bitcoin miners likely have at least three to five good years left in a stable country with low power prices and excellent operating conditions.

Are you scaling a Bitcoin mining operation and in need of mining software, services, or hardware? We can help. You can reach us here.

A big thanks to those who helped me with insights for this article. A special thanks to Frank Arild Aadnevik (Exakraft), Daniel Jogg (Enerhash), and Denis Rusinovich (Maveric Group).

If you have any questions about mining in Sweden, please DM me on Twitter @jmellerud

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.