Bitcoin ASIC Prices Correlate Differently to Bitcoin Price Depending on Market Environment

Bitcoin ASIC prices for different models and efficiencies react differently to Bitcoin's price depending on market conditions.

How correlated are rig prices to the Bitcoin price?

Driven by bitcoin bull runs in recent years, the bitcoin mining industry has grown exponentially. As more new miners join the space and existing miners are scaling up their operations, ASIC procurement becomes crucial to business development and financial planning.

It is ideal for miners to optimize their capital allocation between USD and bitcoin if they are setting aside funds to buy ASICs in the next few months. If BTC price rises and rig prices rise with it, miners who trade their USD into BTC would best maintain their purchasing power when the payments come due. By contrast, if rig prices do not follow the movement of Bitcoin's price, it might not be worthwhile to leave all the funds in BTC in order to maintain ASIC purchase power.

The following analysis on correlation between rig prices and Bitcoin price movements will explore strategies to maintain ASIC purchasing power.

Bitcoin ASIC Price Correlation to Bitcoin Price

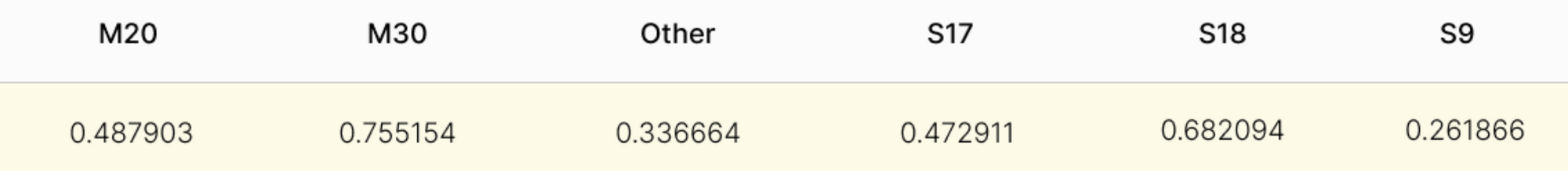

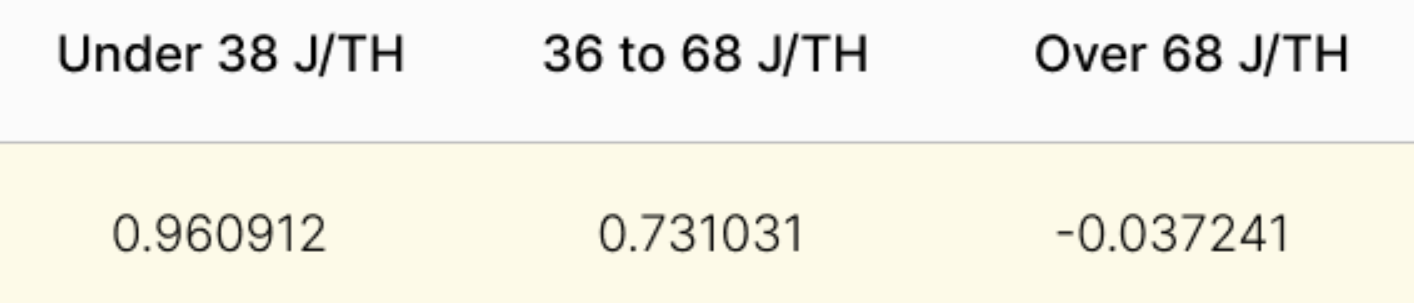

If we analyze the correlation of the price of different machines to Bitcoin, we can see that rigs with higher efficiency are more correlated to Bitcoin's price.

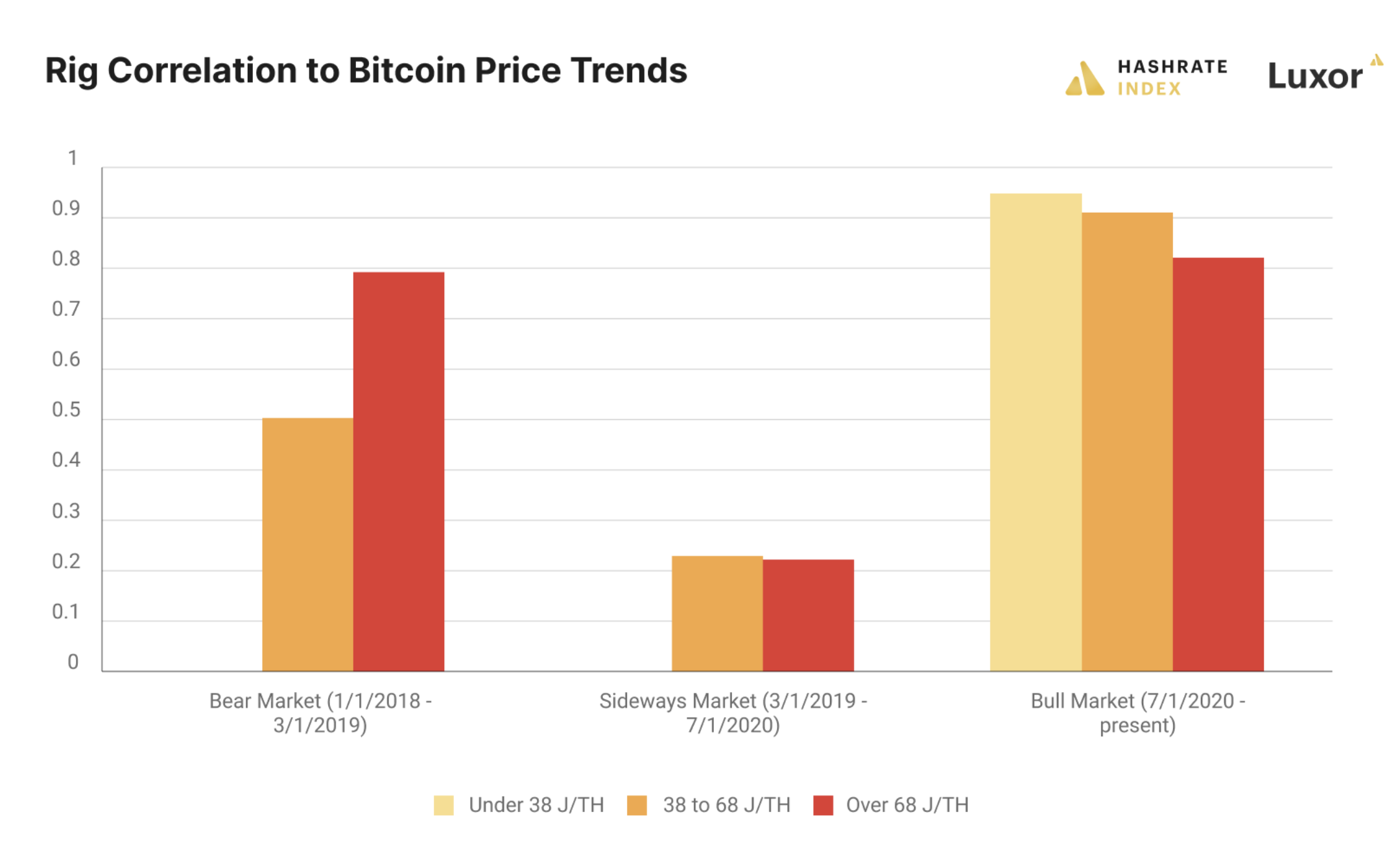

If we group the machines by their efficiency tiers, the difference in correlation is even clearer.

Bitcoin ASICs grouped by efficiency tiers and their correlation to Bitcoin price movements

We could interpret this as less efficient rigs aren’t as in demand when new generation machines enter the market. If this is true, we would expect the correlation of rig prices for older models to the price of BTC to decrease when new generation rigs come out.

However, the correlation is not this simple.

What influences the correlation between rig prices and Bitcoin price is more than just the rig efficiency. We separate the rigs in three categories: low efficiency (Above 68 J/TH), mid-level efficiency (38 to 68 J/TH) and high efficiency new generation rigs (Under 38 J/TH). The efficiency tiers measure how many shares (revenue) the machine can produce per unit of energy (cost). W/TH and J/TH are interchangeable as one watt is equivalent to electricity flowing at a rate of one joule per second in the metric system.

Here are some popular models in each efficiency tiers:

- Above 68 J/TH: oldest generation equipment including Bitmain S9s and S15s, Innosilicon T2s, etc.

- 38 to 68 J/TH: semi-old generation includes Bitmain S17 series, MicroBT M20 and M32 series.

- Under 38 J/TH: new generation includes Bitmain S19 series and MicroBT M30 series.

If you want to read more on ASIC power efficiency, we have an article here on Energy Consumption (kWh) to Hashrate (PH/s) Guide for Bitcoin Mining

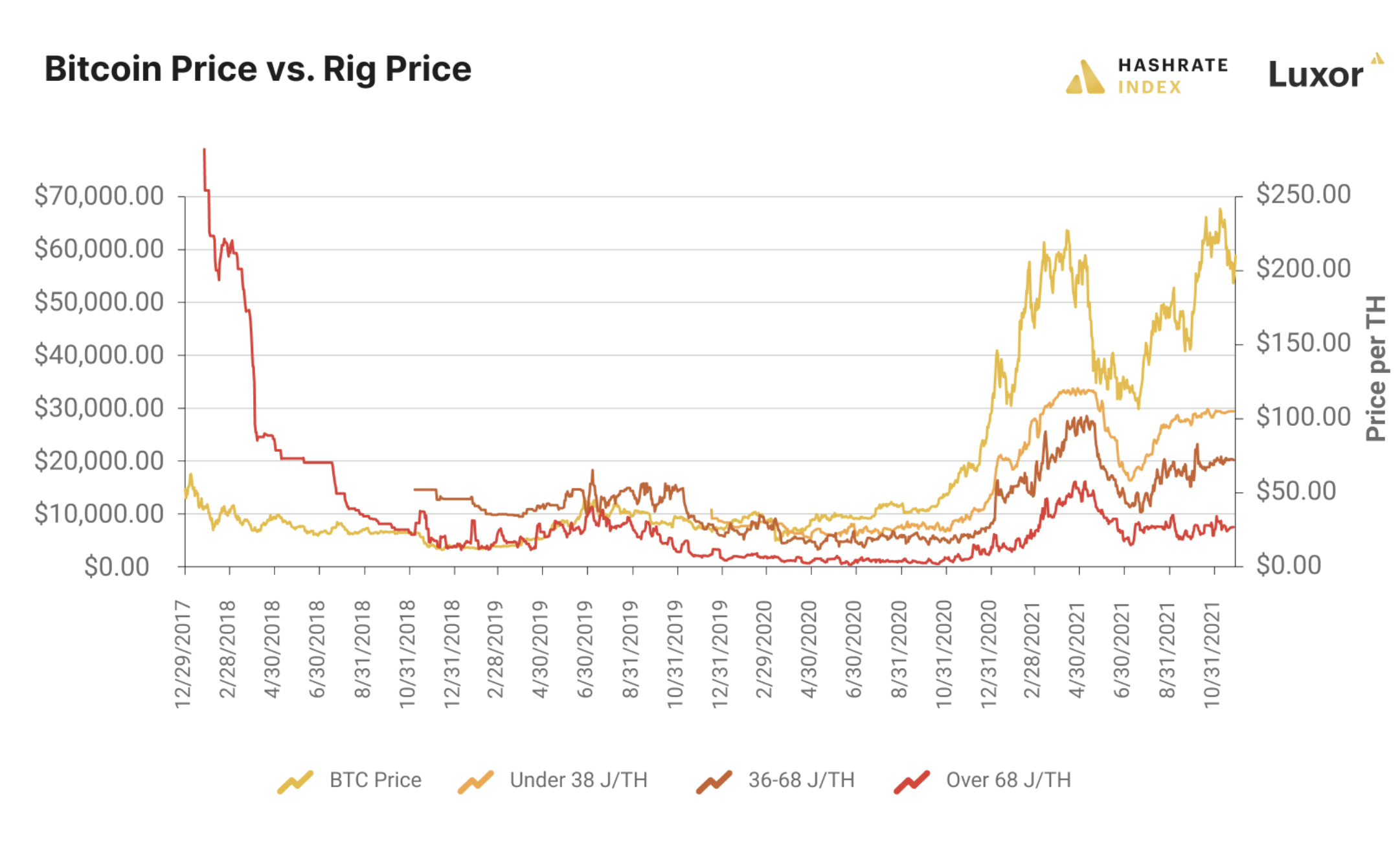

Bitcoin Price Cycle Affects Rig Prices Differently

The low efficiency models maintained a high price correlation with btc until the mid-level efficiency rigs came out in late 2018. However, the relatively newer models (38 to 68 J/TH) had an even lower price correlation with BTC than the lower efficiency category (Above 68 J/TH).

After the most recent and most efficient rigs came out in late 2019, rig prices in all efficiency tiers became highly correlated with Bitcoin’s price. This leads us to believe that the debut of new and faster rigs does not necessarily change the price correlation to BTC for older models.

Efficiency, then, is just one factor rather than the key to the correlation.

If we plot the trend line of rig prices of different efficiency tiers against Bitcoin’s price, you can see that BTC was in a bear market in 2018 before the mid-level efficiency rigs came out later that year, and Bitcoin entered a bull market in the middle of 2020 soon after the newest and most efficient models came out.

Bitcoin price charted along with Bitcoin ASIC prices for different efficiency tiers

If we analyze the correlations at different points in Bitcoin’s market cycle, we can see that, in a bull market (7/1/2020-present), rig prices are highly correlated with Bitcoin’s price in all the efficiency tiers. But when bitcoin is trading sideways (3/1/2019 – 7/1/2020), the price correlation drastically decreases. In the bear market (1/1/2018 – 1/1/2019), rig prices are still correlated with Bitcoin’s price but not as strong as in the bull market.

Interestingly, in a bear market, less efficient models have stronger correlation to Bitcoin’s price compared to more efficient models, while more efficient models have a stronger correlation in the bull market. In a sideways market, the correlation is closer for mid-level and low-level efficiency tiers.

If the Bitcoin market trend is bullish, then it is best for miners to keep the ASIC fund in BTC. This is particularly important for miners who want to buy the newest generation rigs as faster machines are expected to have the highest price correlation to BTC in the bull market. On the other hand, it might not be worthwhile to hold all BTC and take the risk if BTC is going sideways, especially if payment is expected in the short term. As rig prices tend to move following the Bitcoin price in bear market, it is obvious that allocating all funds to USD is the safest choice due to the high volatile nature of Bitcoin's price.

This article was authored by Yijing Yuan, formerly a data analyst for Luxor.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.