⚡️ Player 3 Has Entered the Game

Happy 175-days A.H. everyone.

The long hashrate battle of Asia vs North America just got more interesting with South America entering the arena in a big way.

Thanks for sticking with us for 8 months of mining updates. As part of this celebration, we are going to be hosting a giveaway. If you share this newsletter with one of your contacts you will enter into a draw for some Luxor Mining Shirts and other mining swag.

Share with your Friends & Colleagues

SPONSORED BY EZ Blockchain

EZ Blockchain has a selection of mobile mining units available including their new SmartBox, one of the top products on the market.

Mobile units can provide a number of benefits to a mining operation and are usually one of the easiest ways to scale up.

Please help support the newsletter by supporting them.

Trading Update

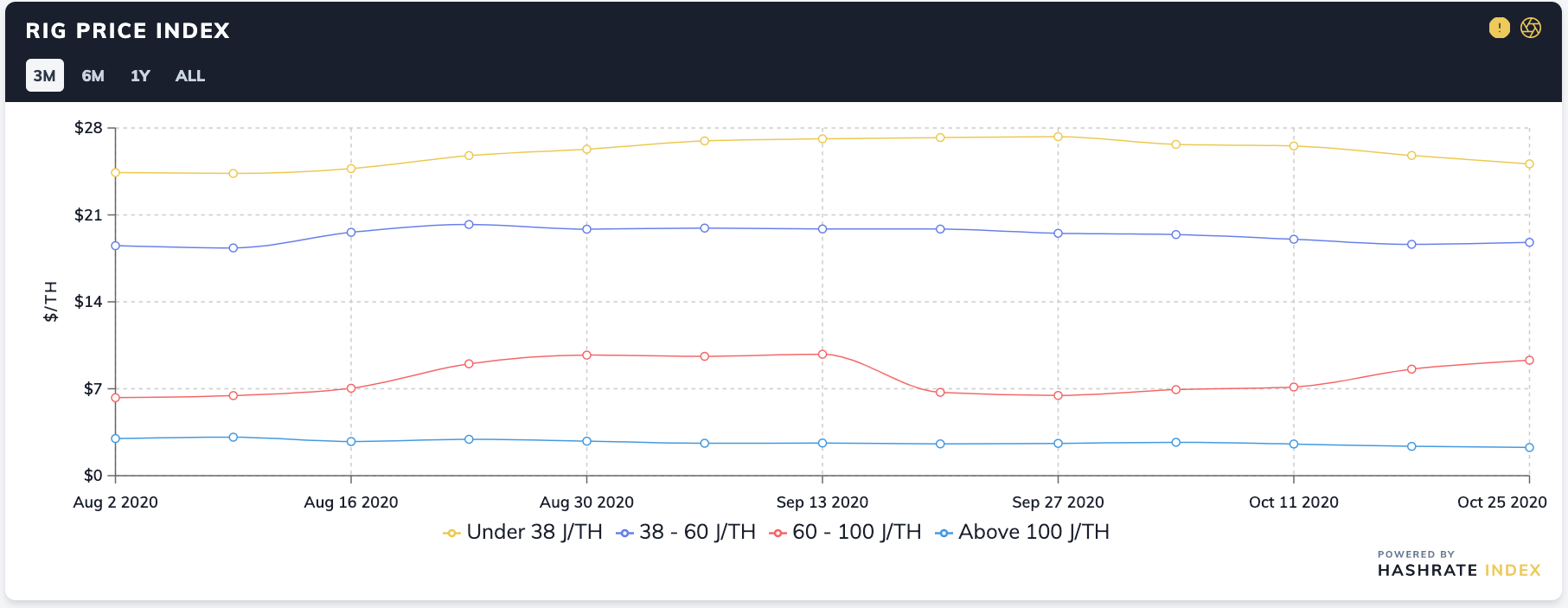

Rig Price Index

New generation equipment prices have continued to decline over the past two weeks, as the majority of facilities have gone through with their equipment upgrade and are likely waiting for next year’s product before investing again. The secondary markets, specifically around the S9s increased in price by 30%, as reports of machines heading to South America continue.

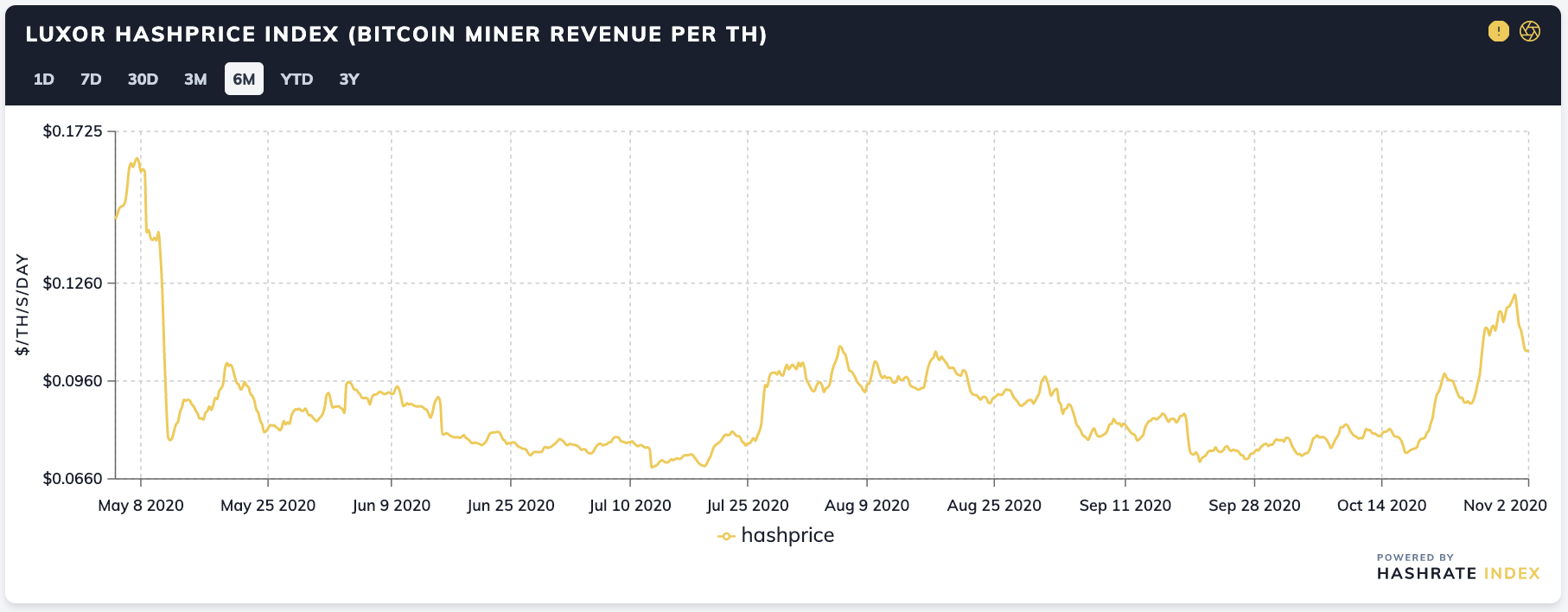

Hashprice Index

Mining revenue broke 12 cents a TH on Saturday, the first time since the halving. This came from a combination of high transaction fees (~25% of the block reward) and high Bitcoin prices. Difficulty is expected to decrease by ~15.5% tonight, meaning Hashprice will be increasing significantly for the upcoming difficulty epoch.

The main reason for this drop is because the rainy season in Sichuan, China ended last week. A good percentage of miners in this region are moving their machines to Xinjiang, Inner Mongolia or abroad. So hashrate has since started to slowly come back online and most of it should be back within the next week or so.

Difficulty Futures

FTX’s Q4 2020 Difficulty Future is up ~1.3% from the last update to 21.346 T. This represents an expected ~48% increase for the rest of the quarter over the current difficulty. Seems like a glaring mispricing, but does show that the market thinks that a lot of hashrate will come back online after the migration of machines in China has been completed.

Mining News

South America, the New Frontier

- South America is primed for growth in the mining industry. In Venezuela, energy is essentially free, although there are certain risks associated with operating there. In other countries, there is also an abundance of cheap power and a large value proposition for Bitcoin given government capital controls.

- Bitfarms is the first public, institutional mining company to make a large play into South America, announcing an MOU for 200 megawatts of power at an average price of US$0.02 per kWh. That is an extremely low price for electricity, much lower than Bitfarms’ current cost in Canada. Of course, moving out of Canada brings additional risks and potential fees to deal with.

- DOCTORMiner launched the first South American Mining Pool in partnership with Luxor. They are providing South Americans a private pool option, in light of the Venezuelan government announcing interest in building a nationalized mining pool. The UX is focused on Spanish speakers first.

Iran’s Master Mining Plan

- Iran has furthered its national Bitcoin mining plan by creating a new law that will require private miners to sell their mined Bitcoin to the Central Bank.

- This move is prompted by international sanctions that have made it hard for them to pay for imports and limited their ability to use any dollars they hold in reserve. (article). Iran's foreign exchange reserves might be getting depleted but they still have one of the largest oil and gas reserves in the world. As we know mining is the process of taking energy and turning it into money. A perfect solution for the country.

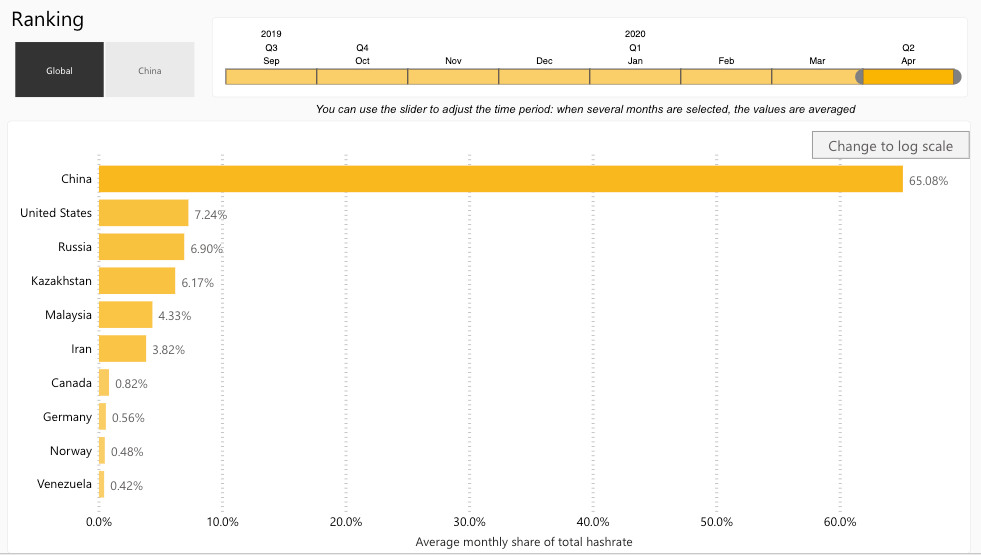

- At an estimated 3.82% of the Bitcoin Network (Cambridge), this would generate Iran $0.5mm a day at current mining revenue. Given imports of $50.4bn a year (2019), this Bitcoin could fund 0.37% of Iran’s imports, a pretty significant amount for a country.

Layer1 Appears on AMA

After months of silence, Layer1 has appeared on a public forum (AMA) to comment on some of the ongoing accusations and business updates for shareholders.

Alex didn’t comment too much on the lawsuit for patent infringement by Lancium but it was announced that the judge in West Texas denied their motion to dismiss the patent infringement suit and it will be going to court.

Other topics discussed included previous financing rounds, management shakeup, the current roadmap, and how progress has been.

Russian Colos Aim to Attract Foreign Miners

- A law proposed by the Russian Ministry of Finance will make it illegal for Russian miners to sell their Bitcoin, even if mining is technically legal. This means that operators will need to fill their facilities with hosted machines from foreign miners.

- Bitriver has probably been the most marketed Russian mining farm to the West so far. Now a new company called MineSpot is developing out a mega facility (article). Expecting a lot more marketing campaigns to be targeted at Western miners from these Russian facilities in 2021.

Mining Educational Content

There is a potential fork for BCH coming up on November 15th. What does this mean for Bitcoin Miners? Earlier this year we analyzed the effect of the past two large SHA-256 hard forks on the value of hashrate.

Fork’s Effect on SHA-256 Hashprice

About Luxor

Luxor is a US-based mining company.

We run a best-price platform for SHA-256 (Bitcoin) and Equihash. We operate mining pools for Dash, Zcash, Horizen, Decred, Sia and more.

We also run mining data website, Hashrate Index.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.