⚡️ Hashrate Index Roundup 9/4/21

In today's letter: bitcoin miners mined 15% more BTC in August than in July, older generation rig prices were flat last month, and more juicy databits.

Happy September, y’all!

Bitcoin’s price is on the up-and-up again, and hashprice—while not around its yearly highs—is still juicy, even as mining competition is revving up in the aftermath of China’s crackdown.

As evidenced by the last difficulty adjustment (the second largest upward bump of the year), Hashrate has come online quicker than most industry participants expected. The next adjustment, which will be upward again, should be less severe than the past three, though it’s showing us yet again that difficulty is chasing hashrate and having a hard time keeping up.

It’s still a great time to be mining, and as miners hunt down the best hardware to cash in on this golden opportunity, we’re starting to see discrepancies in ASIC values as miners prioritize the most efficient equipment on the market.

But before we get ahead of ourselves, let’s go through the data step-by-step.

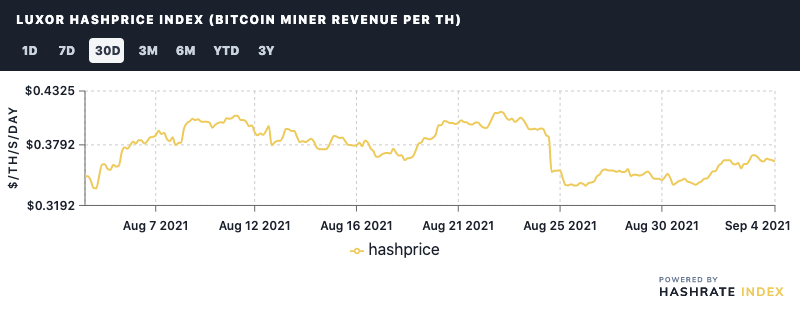

Hashprice Index

- Bitcoin Price (24H): $49,984

- Hashprice (TH/s/day): $0.3626

- Average Fee Percentage per Block (24H): 1.61%

- Network Hashrate (7-day SMA): 126.97 EH/s

Hashprice

Hashprice is inching its way back up the profitability pole and is $0.36/TH at the time of writing.

You know the drill: if price continues to climb, then hashprice will climb with it, though a boost in block space demand, which would drive fees higher, would also lend miners a hand here.

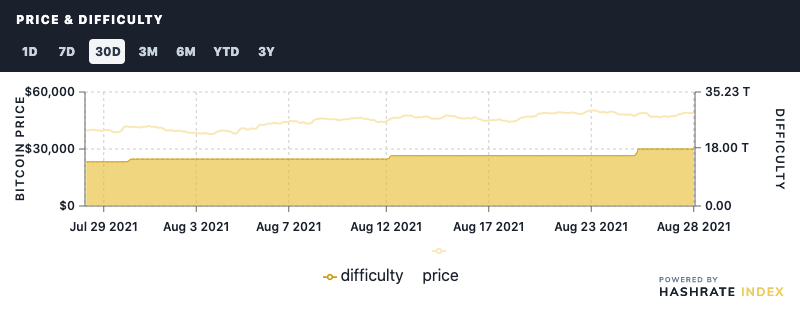

Price and Difficulty

As it currently stands, we’ve got another positive upwards adjustment coming up soon. The roughy 2-3% bump will come sometime early next week, most likely on the 8th and will mark the fourth such adjustment in a row, though it won’t be nearly as drastic as the last, 13% positive adjustment.

Hashrate has come online faster in the latter half of this year than many expected, and Bitcoin’s difficulty adjustment is having a hard time keeping up. For example, block times were, on average, 8.2 minutes in August as opposed to the targeted ~10 minutes set by the protocol, hence the succession of positive adjustments.

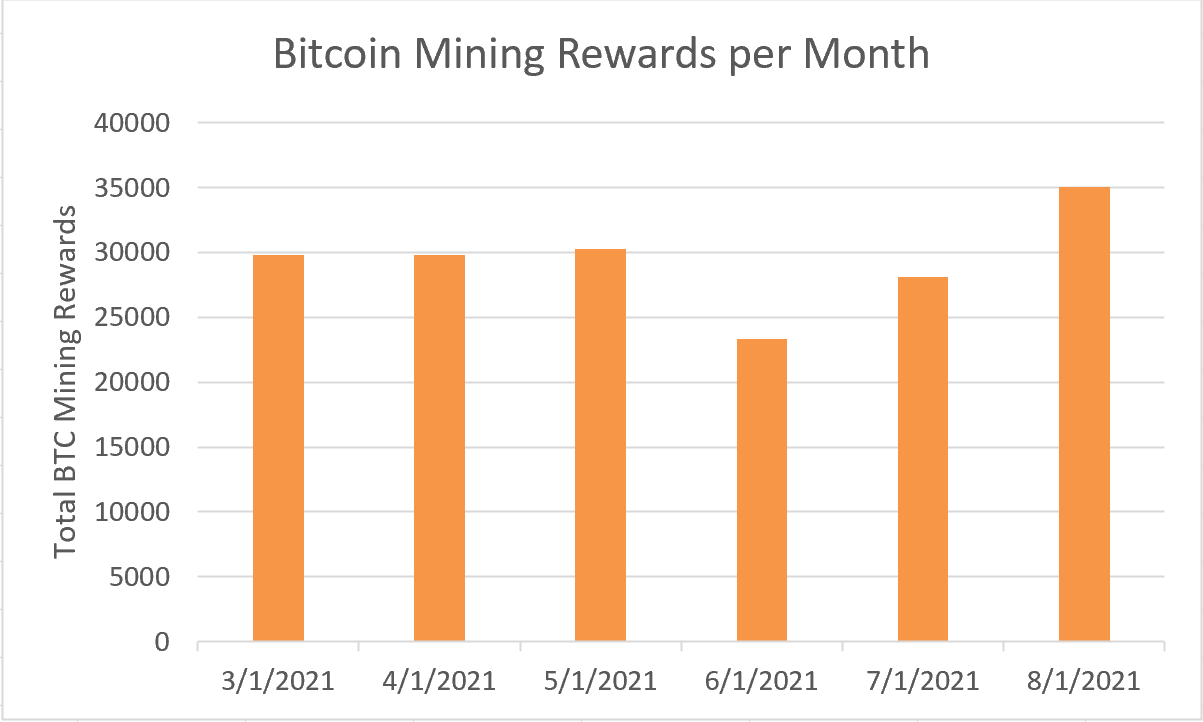

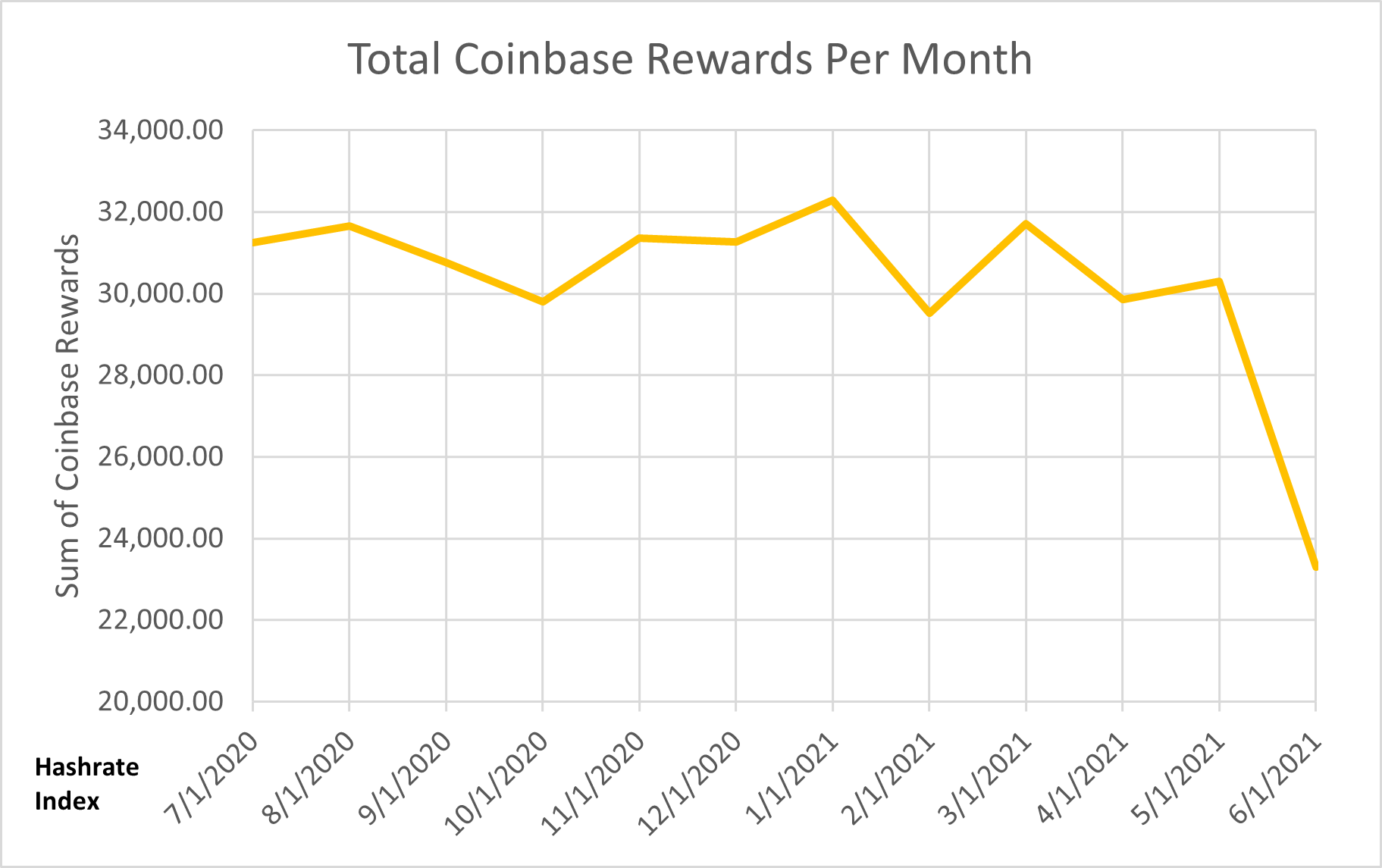

With the gushes of hashrate coming online, miners are producing blocks more quickly than usual, so they mined just over 35,000 BTC in July (as opposed to the roughly 28,500 BTC they would have mined given 10 minute block times and the current fee market).

We had the opposite problem in June, funnily enough, when miners produced some 23,000 BTC; after China’s hashrate blackout, miners were still hashing under a pre-China crackdown difficulty but with roughly half the computing power. This led to much slower block times (~12 minutes) and a record-breaking 27% downward adjustment.

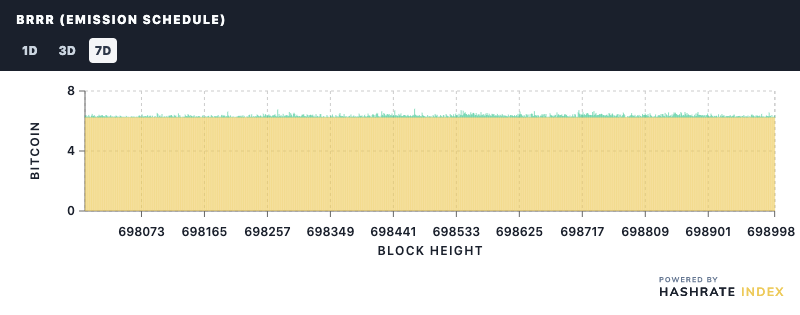

BRRR (Emission Schedule)

Fees as a percentage of block rewards are still low, low, low…

Over the past week, fees constituted between 1-2% of all miner rewards. As we said above (and have been saying in every roundup for about a month or so now), if the fee market picks up to levels we saw in the Spring, miners would be making considerably more than they are now.

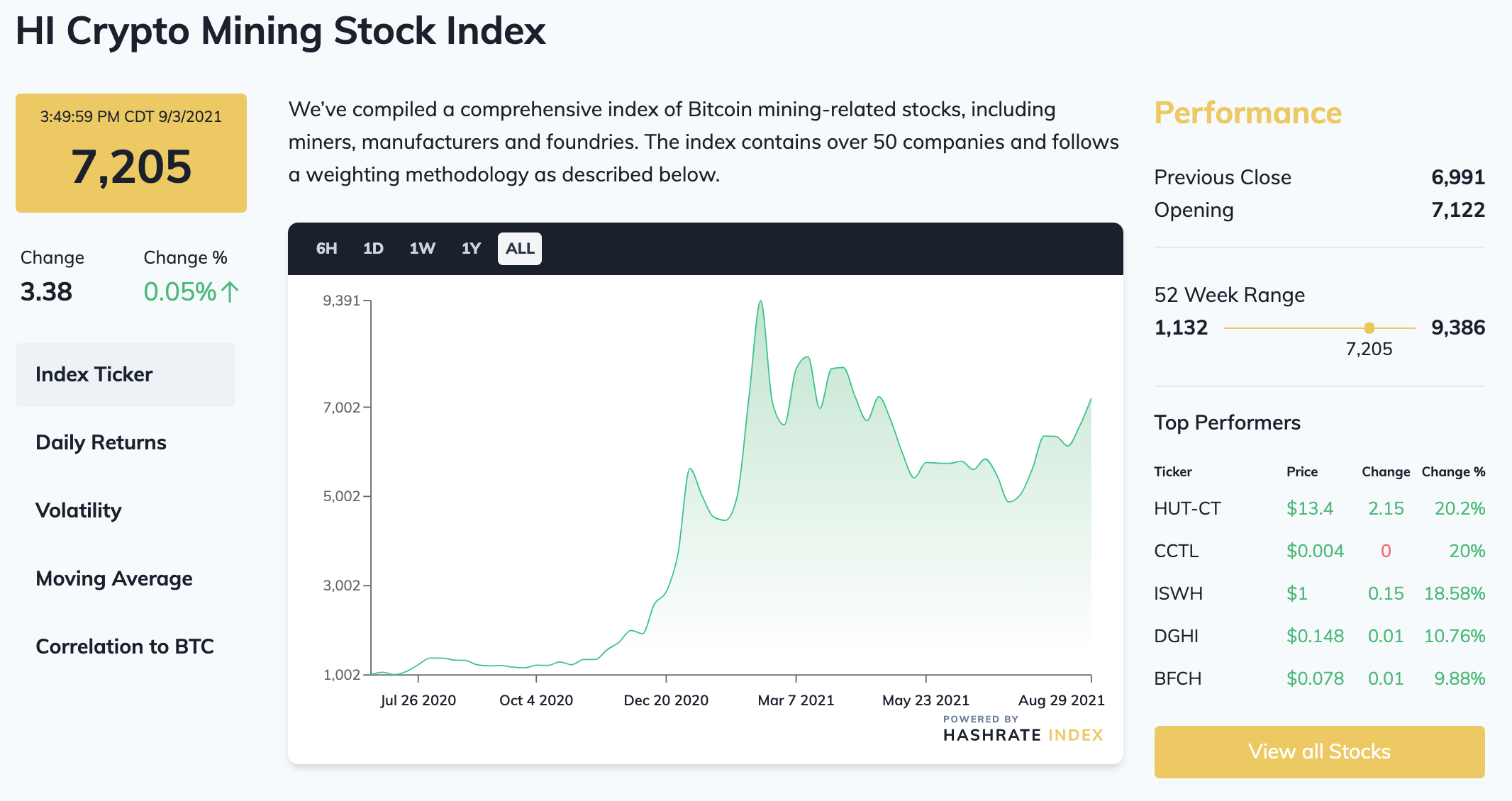

Crypto Mining Stock Index

The index had one of its best weeks since launch, rising 8.6% compared to Bitcoin’s more modest 3.2%. By comparison, the Viridi Cleaner Energy Crypto-Mining & Semiconductor ETF ($RIGZ) rose 9% last week.

In our index, Hut8 (+20%) and Bitfarms (+9%) were the largest gainers this week out of all the industrial self-miners.

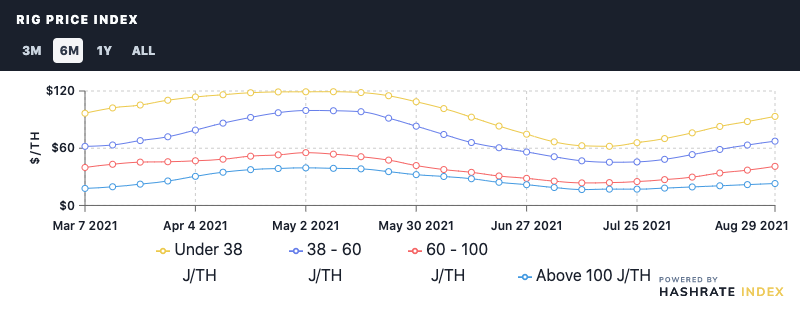

Rig Index

- Capex/TH (<35J/TH): $93.36 (+6%)

- Estimated Payback Period: 290

Rig Price Index

Rig price are still surging, rising last week for the sixth week in a row.

Over the past week, the average prices for the following efficiency buckets changed:

- Under 38 J/TH: $93.36 (6.1%)

- 38-60 J/TH: $67.41 (6.4%)

- 60-100 J/TH: $41 (10.7%)

- Over 100 J/TH: $23 (4.7%)

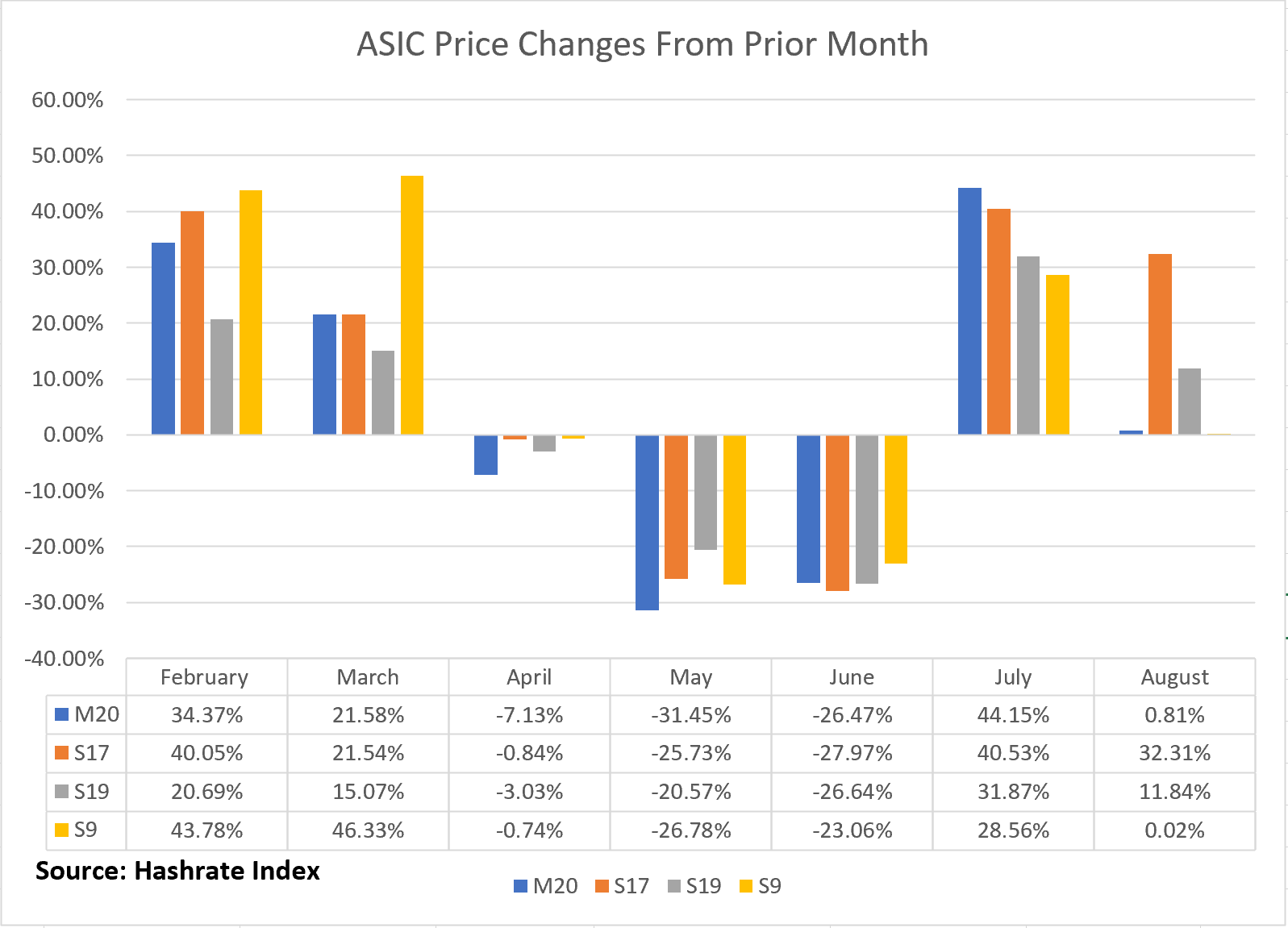

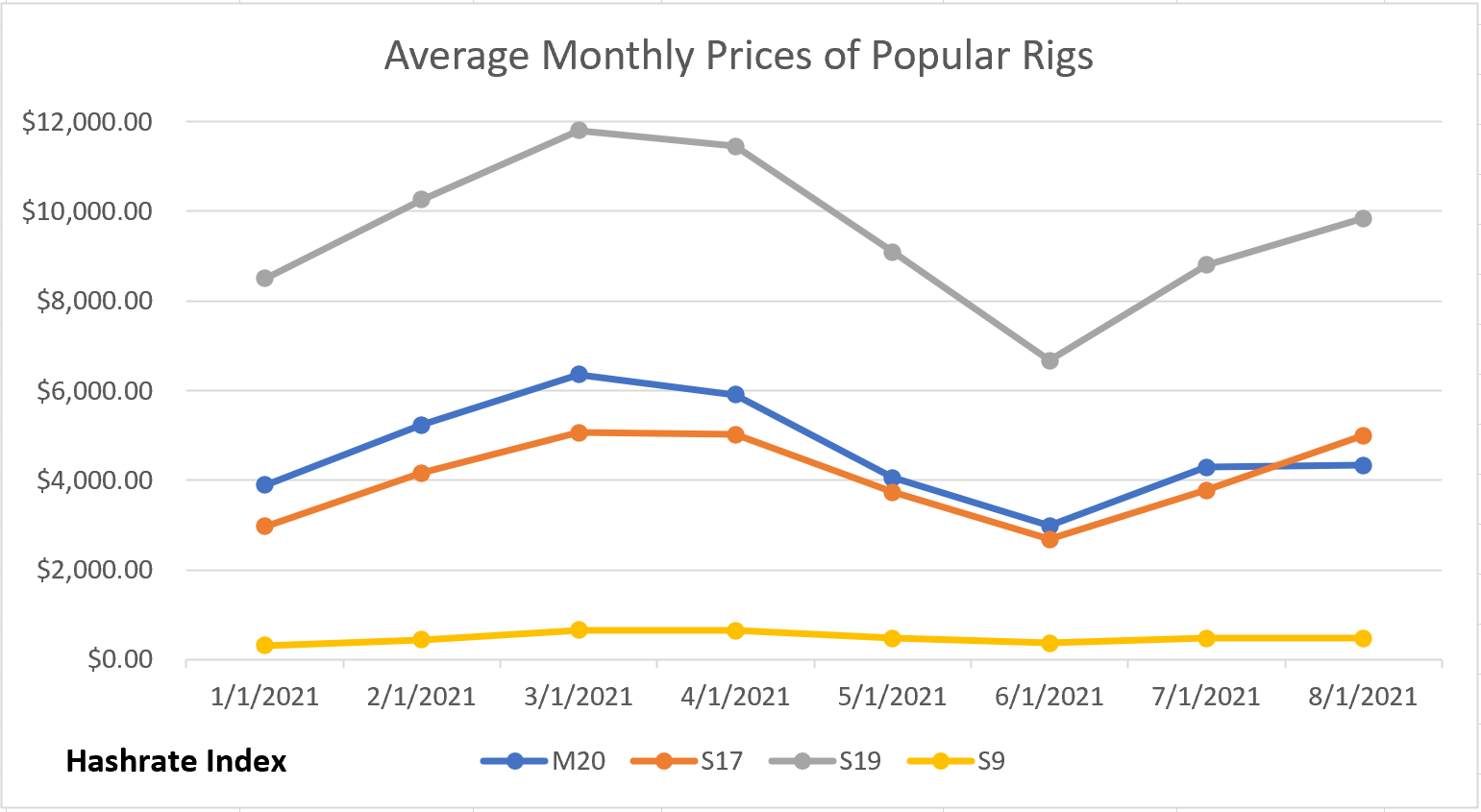

We also updated our Popular Rigs Price index this week and noticed something interesting: the average price in August for older generation machines, like the S9 and M20, didn’t budge by any notable degree, while prices for rigs like the S19 and even mid gen ones like the S17 moved considerably.

As more S19s and other new gen rigs enter the North American market, industrial-scale farms are swapping out older hardware for newer hardware wherever they can. Rack space is scarce, so it makes more sense economically to fill shelves with more efficient machines which can produce more hashrate while consuming less energy (one S19, for e.g., has the same output of eight S9s and is roughly three times as power efficient).

So to make the long short, miners are flooding the market with these older rigs right now and they aren’t as in demand. Some of them will only be offline for so long, though, as operators in sites with near-free power scoop them up to juice whatever life they can out of them in the meantime.

Profitability of Popular SHA-256 ASIC

Week-over-week, the per-day reward potential rose a smidge for popular rigs:

- Antminer S19 Pro: $40.00

- Antminer S19: $34.54

- Whatsminer M30S++: $40.72

- Whatsminer M30S: $32.00

- Antminer S17+: $26.54

- Whatsminer M20S (70TH): $25.45

- Antminer S9: $4.18

Happy Hashing, and have a stellar weekend!

-Luxor Team

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.