How Bitcoin Mining Revenues Evaporated Over the Past Months

Bitcoin mining revenues have hit rock bottom due to a lethal combination of growing global hashrate and the falling bitcoin price.

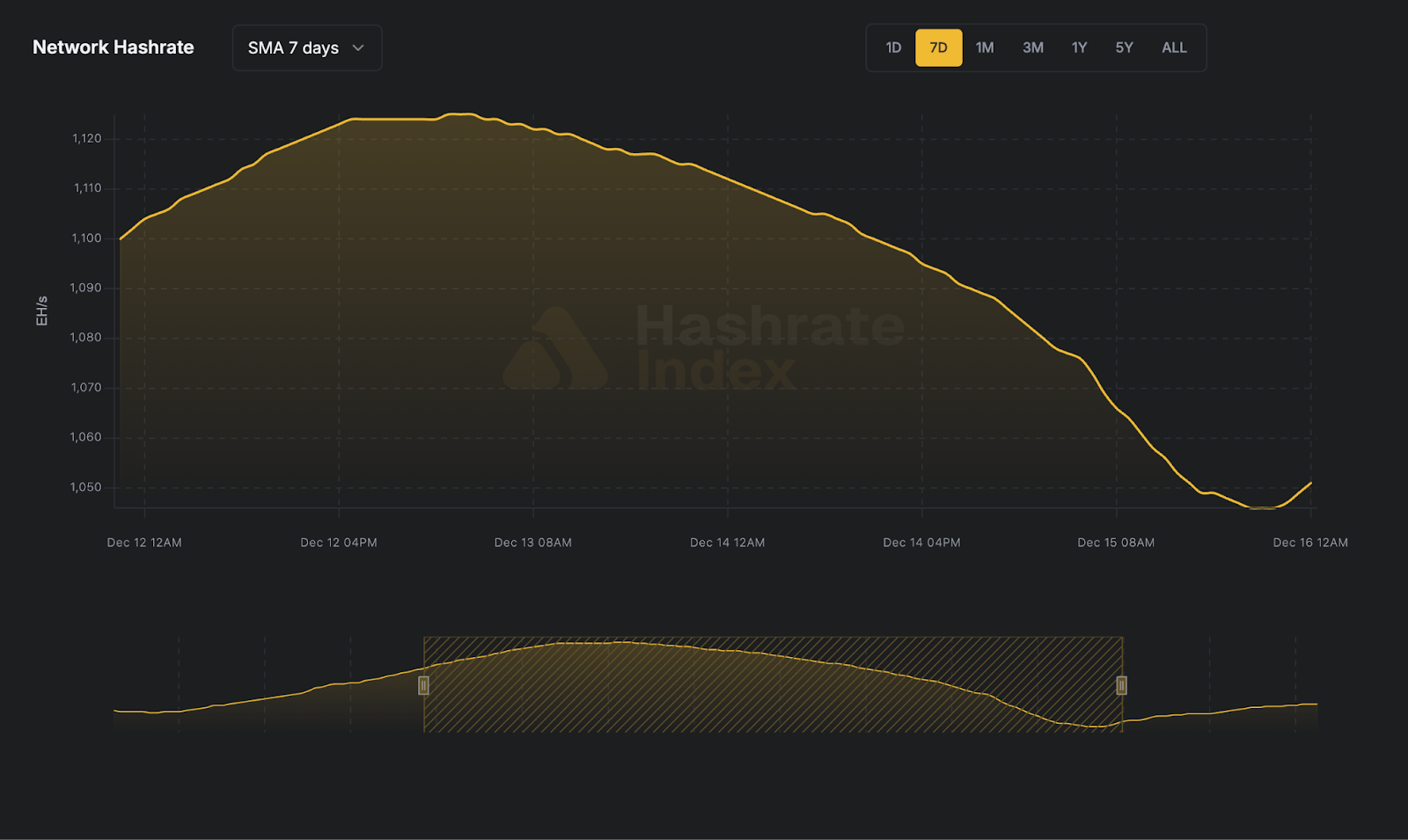

Even though we are in the middle of a bear market, bitcoin miners continue ramping up hashrate financed by massive equity raises. This hashrate ramp-up has led the Bitcoin network to increase its mining difficulty on several occasions lately, and it currently sits at an all-time high.

Meanwhile, the bitcoin price keeps hovering around the 2017 high of $20k, 71% below its $69k all-time high. Due to this combination of rising difficulty and the falling bitcoin price, miners dig out fewer and less valuable bitcoin than before.

This article analyzes how the falling miner revenue has affected mining margins, showing that many mining operations are now close to being underwater.

Bitcoin miners have never produced less bitcoin per unit of hashrate

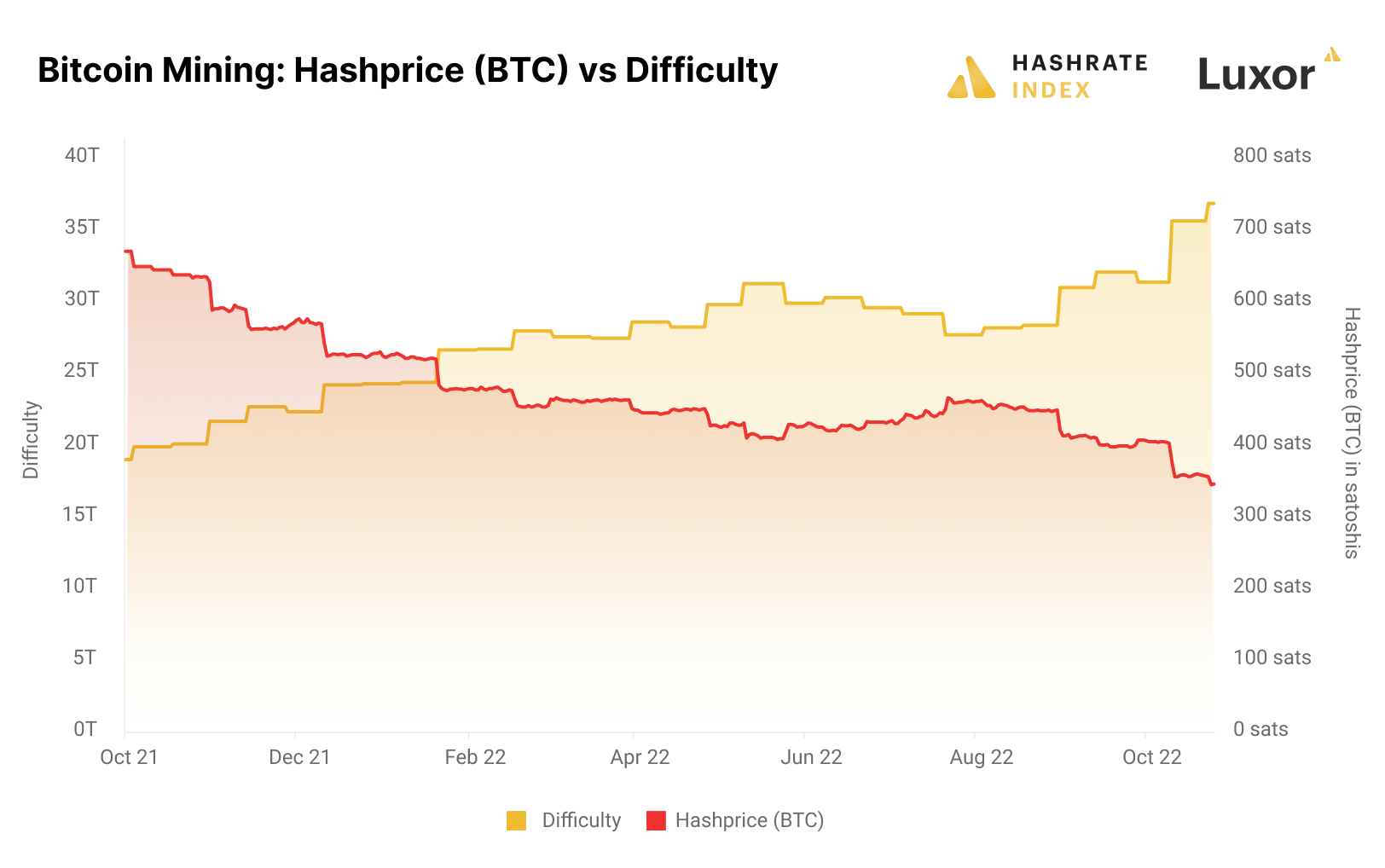

A bitcoin miner's job is to turn electricity into hashrate and for that job, it is compensated in bitcoin. A miner's daily bitcoin compensation for a unit of hashrate is called the bitcoin-denominated hashprice. This number is determined by the block subsidy, transaction fees, and difficulty.

Bitcoin's block subsidy is fixed, while transaction fees have been marginal and stable over the past year. We should therefore focus on the difficulty alone when analyzing the recent developments in the bitcoin-denominated hashprice.

Rising difficulty means that the competition for Bitcoin's block rewards is higher, and each unit of hashrate will generate less bitcoin. The rising difficulty leads to lower bitcoin-denominated revenue or a lower bitcoin-denominated hashprice.

The chart above shows the inverse correlation between the bitcoin-denominated hashprice and the difficulty. One year ago, when the difficulty was almost 50% lower than currently, bitcoin miners could squeeze out nearly 50% more bitcoin per TH/s.

The big miners have several EH/s (1 million TH/s) of capacity. To show how this impacts their bitcoin production capabilities, 1 EH/s now produces 3.5 bitcoin per day, compared to 6.7 bitcoin one year ago. Only the miners who have more than doubled their hashrate over the past year earn the same amount of bitcoin as they did in October last year.

The bitcoin-denominated hashprice will likely keep trending downwards as the difficulty keeps growing due to more hashrate coming online. It looks particularly bad in the long-term: In the spring of 2024, Bitcoin will halve the block subsidy from 6.25 bitcoin to 3.125, which will lead to a massive drop in the bitcoin-denominated hashprice.

The falling bitcoin-denominated hashprice means that miners who want to keep their bitcoin production intact long-term have no choice but to rapidly grow hashrate to gain an even bigger share of Bitcoin's total hashrate. This is the strategy of the public miners, who expect massive machine deliveries going forward.

Bitcoin miners have never made less dollar per unit of hashrate

Not only have one unit of hashrate never generated less bitcoin than now, but the value of this bitcoin has also evaporated. During the golden days of bitcoin mining in October 2021, the average bitcoin price was $59k, corresponding to a 66% decline from today's level.

To bake the bitcoin price into the bitcoin-denominated hashprice, Luxor provides a dollar-denominated hashprice index. The hashprice accounts for all variables affecting bitcoin mining revenues, showing a miner's dollar revenue per unit of hashrate. It's a great metric to measure bitcoin miner revenues for several reasons. Most importantly, it captures all the components affecting the miner revenue: the bitcoin difficulty, the block subsidy, transaction fees, and the bitcoin price. For this reason, Luxor recently launched a non-deliverable hashprice forward contract, letting miners fully hedge their revenues.

Most miners probably wished this derivatives product existed earlier, as they would have loved to hedge their revenues when the hashprice was sitting at an all-time high in October 2021. Since then, a lethal combination of the 50% decline in bitcoin production caused by the growing difficulty and the approximate 70% bitcoin price decrease has led the hashprice to plummet by 84% since its all-time high.

A miner who doubled its hashrate during the past year would have kept its bitcoin production intact, but its dollar-denominated revenues have still declined by around 70% since bitcoin's all-time high. This shows that although growing hashrate is important for protecting miner revenues, mining revenues are still tremendously affected by swings in the bitcoin price, making hedging hashprice a prudent decision for a miner.

Only energy-efficient machines fed by low-priced energy are cash flow positive

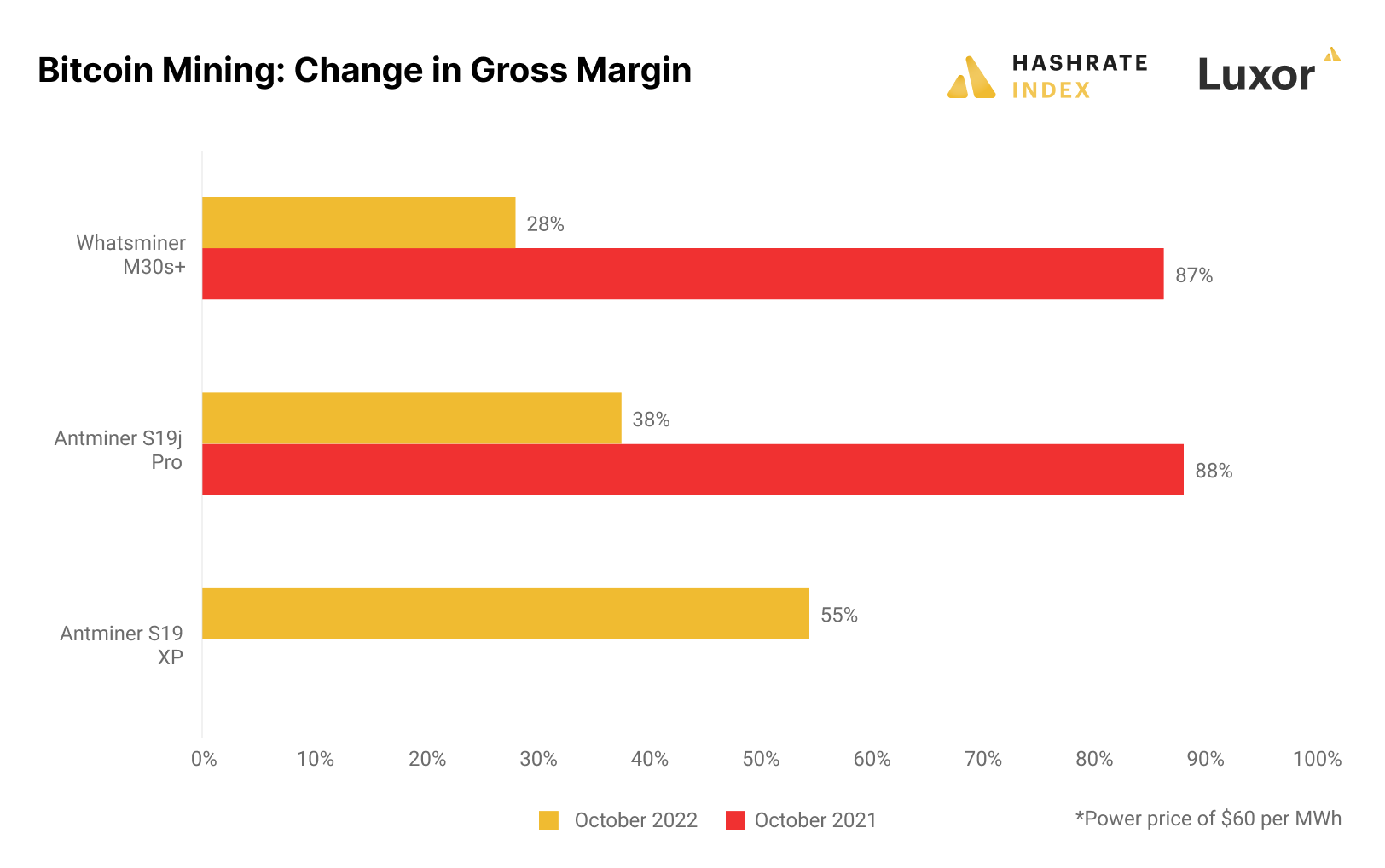

An 84% decrease in revenues without a corresponding cost decline is devastating for any business' margins. After operating with enormously fat margins during the bitcoin gold rush of 2021, reality has now hit miners in the face, as their margins have immensely compressed.

At its peak in October 2021, the most energy-efficient mining machine on the market printed a gross margin of 88%, assuming an electricity price of $60 per MWh. In other words, a miner with an okayish electricity price could produce 1 bitcoin for energy worth only 0.12 bitcoin.

We see that the margins have evaporated over the past year. Machines that operated at close to 90% gross margins at the peak in 2021 now barely scrape by at 30% - 40% gross margins. A 30% gross margin may not sound too bad, but remember that this margin should cover all non-energy costs like salaries and administration.

The Antminer S19j Pro was the most energy-efficient model on the market in October 2021, then operating at 88% gross margins. It has now seen its gross margin decline to 38%. The Whatsminer M30s+ is relatively energy efficient and operates at a 28% gross margin at a $60 per MWh energy price. The majority of Bitfarms' fleet consists of that machine.

The Antminer S19 XP is the most energy-efficient machine on the market, except for the hydro-cooled versions. Many publicly traded miners made enormous orders of this machine, and the first batches were delivered in July 2022. Miners using this machine are still making decent margins of 55%. One thing is certain – these machines will not be unplugged from the network.

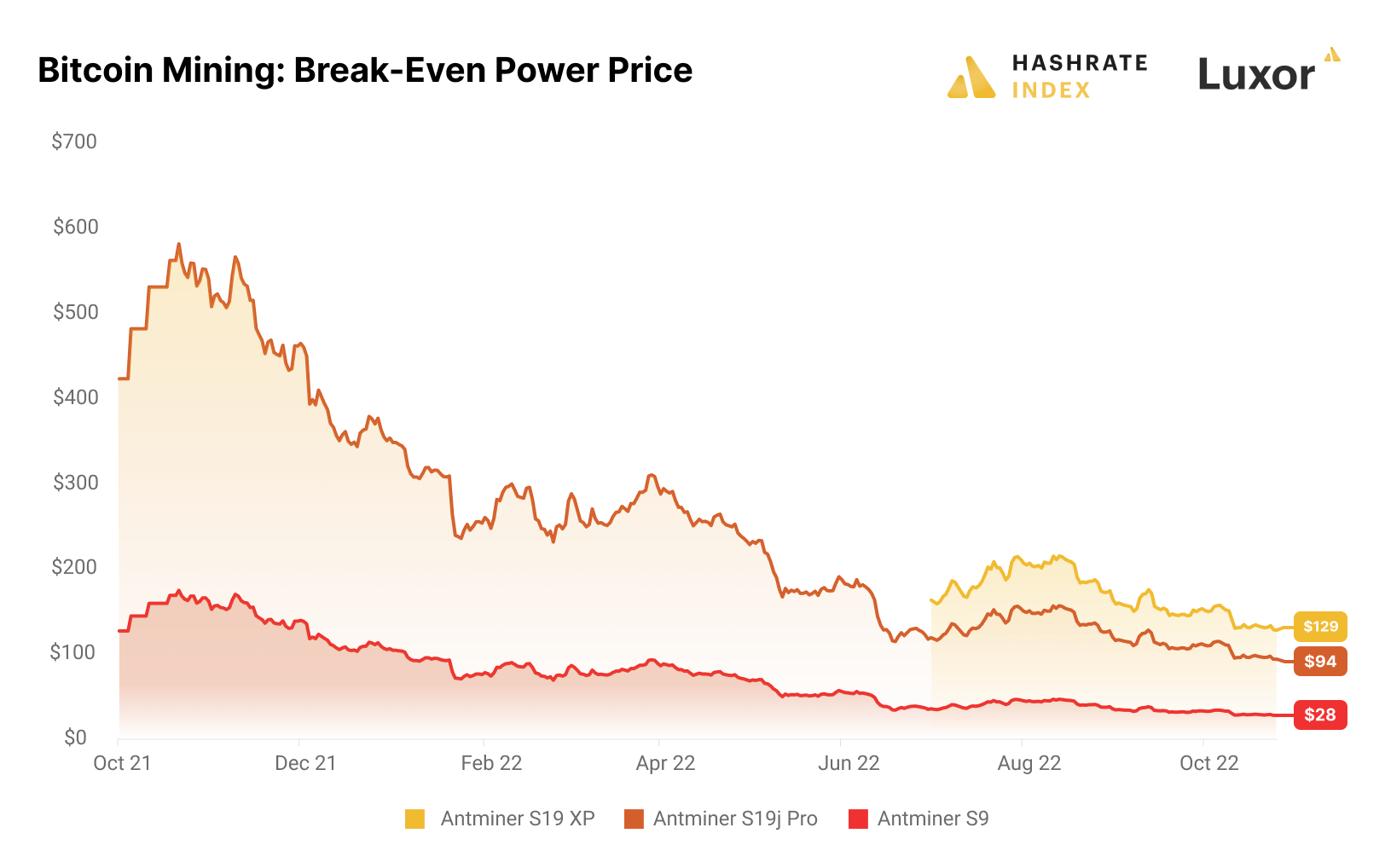

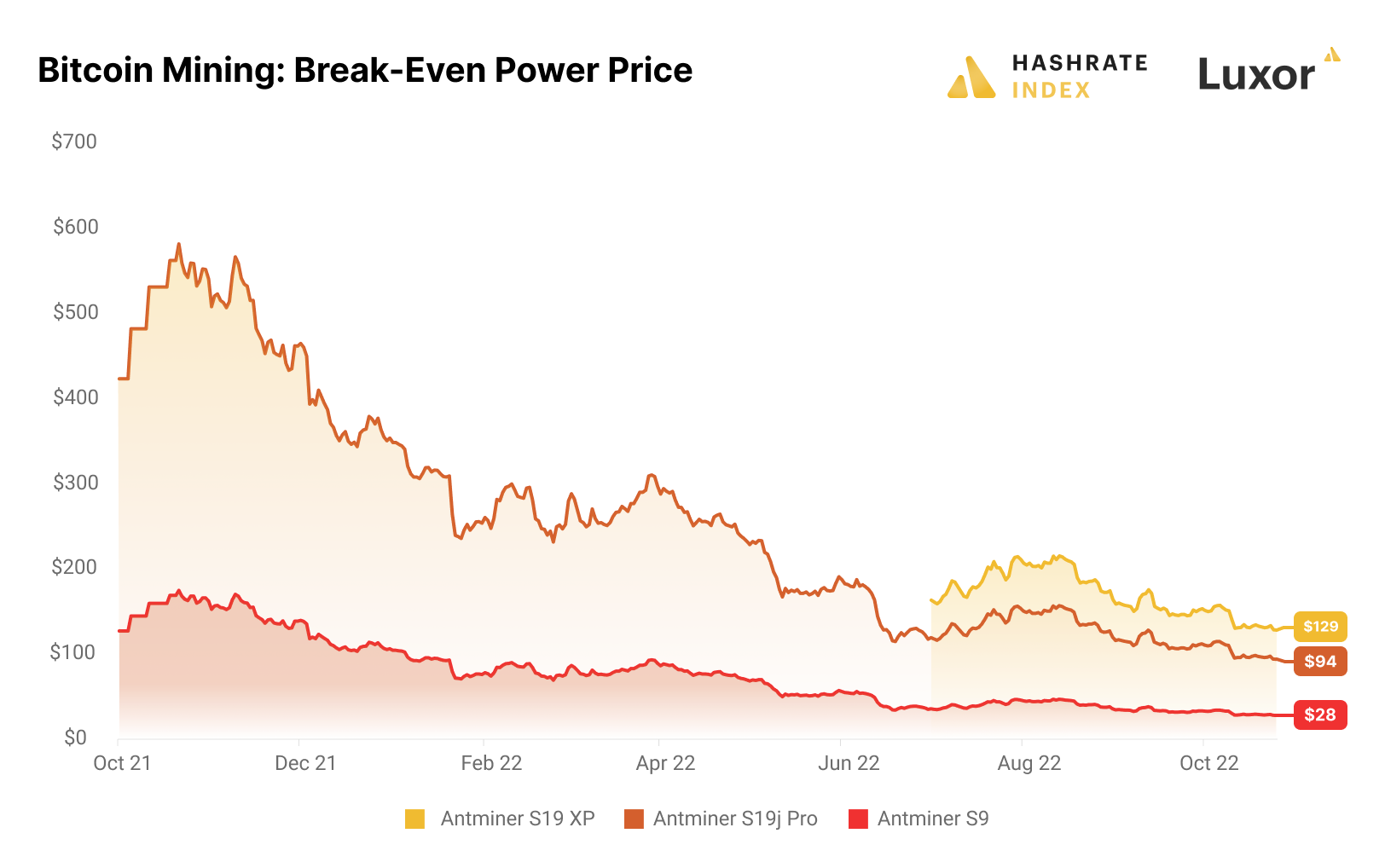

Another way to illustrate the falling mining revenues is by looking at the break-even power price of different mining rigs. As we can see in the chart below, the break-even power price of the Antminer S19 XP is currently $129 per MWh. For perspective, the average power price in the energy crisis affected Germany this year has been $250 per MWh. Although it is much lower than the average German electricity price, $129 per MWh is relatively expensive for a bitcoin miner, meaning that most miners running this machine should still make good profits.

Things are looking bleaker as we move to the less energy-efficient machines. The Antminer S19j Pro has a break-even energy price of $94 per MWh. As I will soon show, many miners' hosting rates are in that price territory.

Moving down to the loyal workhorse Antminer S9, which has been operational since 2016, we see that it now requires energy priced at less than $28 per MWh to be cash flow positive. Such a low energy price cannot be found on any grids in the western world, except for a few outposts like northern Norway, where the average electricity price this year has been $15 per MWh.

At the beginning of the article, I explained how the hashprice has plummeted over the past year. The table above shows the break-even hashprice for different machines paying different electricity prices.

The current hashprice is now $70 per PH/s. Miners running an S19 XP are making decent margins even with an electricity price of $0.1 per kWh ($10 per MWh). The S19j Pro needs much cheaper energy and only makes a decent gross margin at electricity prices below $0.07 per kWh. The mid-tier efficient machine S17 should have access to electricity priced below $0.05 per kWh to make a decent margin of 23%.

The problem is that getting access to such cheap electricity is very difficult amid the current energy crisis, which has led to surging energy prices all over the globe. Even though the worst energy price inflation has been concentrated in Europe, the United States has also been exposed as prices for transportable fuels, like oil, natural gas, and coal, have surged due to the rising global demand.

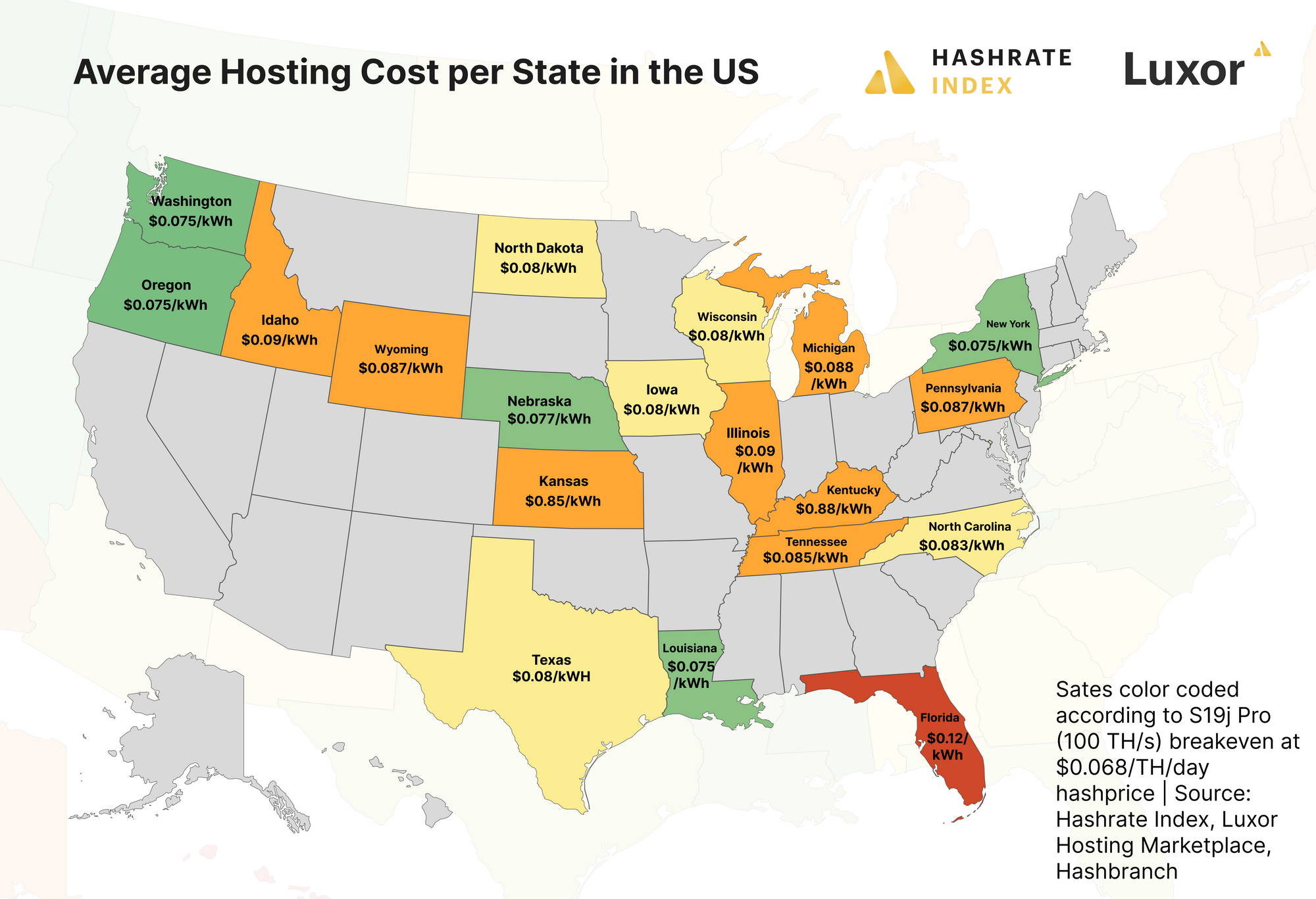

The energy price inflation has led to considerable increases in hosting costs globally. The map above shows the average hosting cost per state in the United States. In most states, the average hosting cost is not far from the break-even electricity price of the Antminer S19j Pro of $0.094 per kWh.

The cheapest states, Washington, Oregon, Louisiana, and New York, all offer average hosting costs of $0.075 per kWh. This cost gives the S19j Pro a meager gross margin of 20%, meaning this machine at this hosting rate will be underwater if the hashprice drops below $53 per PH/s. The hashprice is currently $70 per TH/s, meaning it will only have to drop by 24%, which might very well happen during the coming months as the difficulty keep surging.

How will bitcoin mining revenues develop over the coming months?

As explained in this article, bitcoin mining revenues depend on three factors: 1) the bitcoin price, 2) the difficulty, and 3) the transaction fees. We should only consider the bitcoin price and the difficulty in the short term.

Nobody knows what will happen to the bitcoin price, and I'm not going to predict whether the bear market will worsen or a bull market will suddenly unfold. I have no idea; therefore, I use today's $20k price as a base case price in my prediction.

Regarding the difficulty, I'm confident it will keep growing into 2023 as Bitcoin's hashrate keep increasing. The public miners have massive expansion plans in the coming months, and private miners are adding hashrate as well. A continuous difficulty increase combined with a flat bitcoin price will push the dollar-denominated hashprice further down, and it might dip below the feared $0.05 level. Lower miner revenues, combined with surging energy costs, will undoubtedly create problems for many miners, and some of them might capitulate and unplug their machines in the coming month.

This article is based on mining profitability analysis from our recent Q3-2022 report. Give it a read to learn more about how mining profitability has changed over the previous months.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.