Lancium v. Layer1 (2020)

Happy 100-days A.H. (After-Halving) everyone.

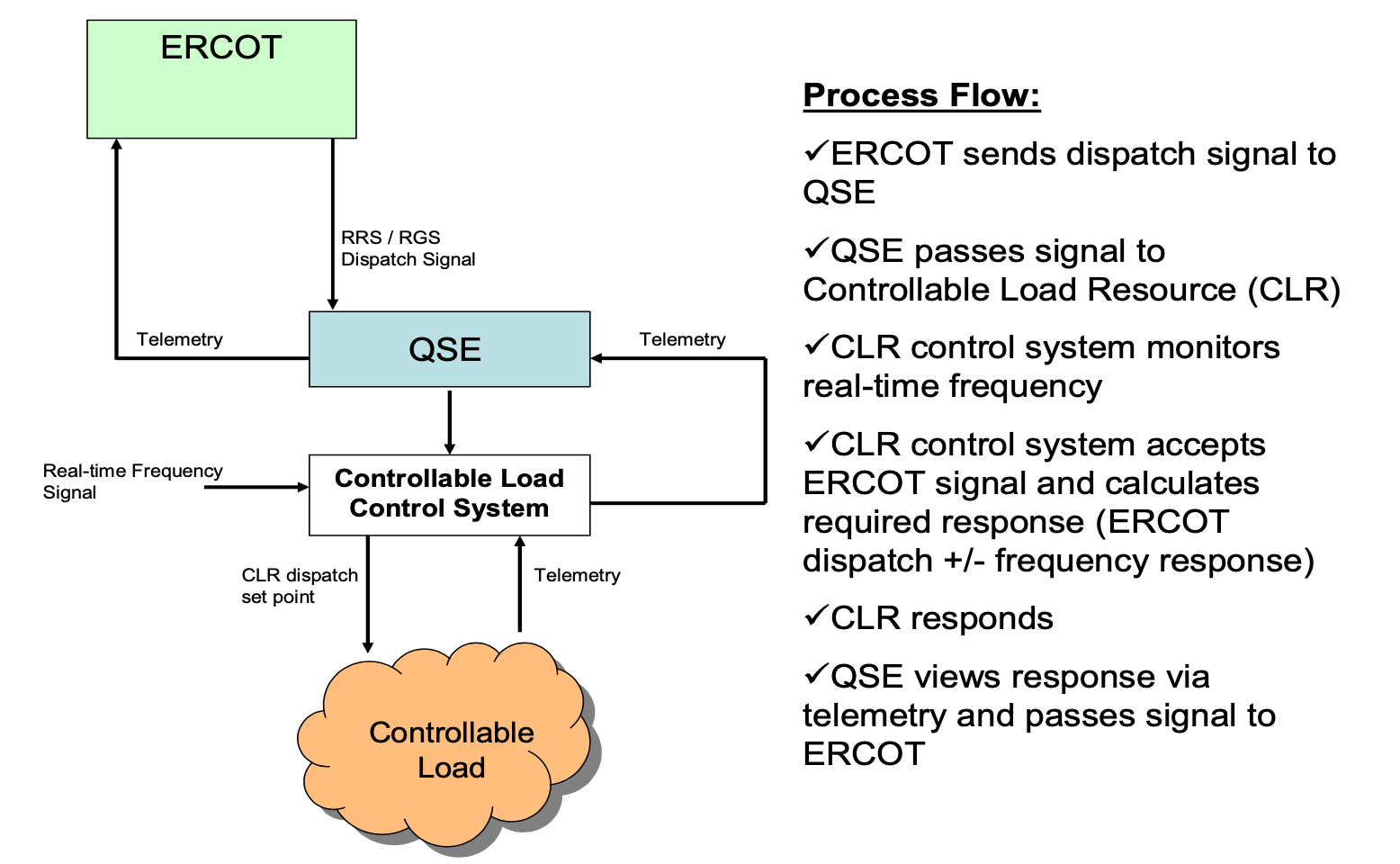

We have been talking about Controllable Load Systems for the past few months, highlighting their ability to transform the energy systems in North America for the better. Now the viability is being questioned as Lancium brings a patent lawsuit against Layer1 for leveraging this technology.

This update we also cover Lubian, Flared Gas in Texas, Bitmain, TSMC, Ethereum Classic 51% attack, Nicehash, Kazakhstan’s new mining tax and Shell coming into the space.

If you like this newsletter please share it with your friends & colleagues.

Trading Update

Commentary

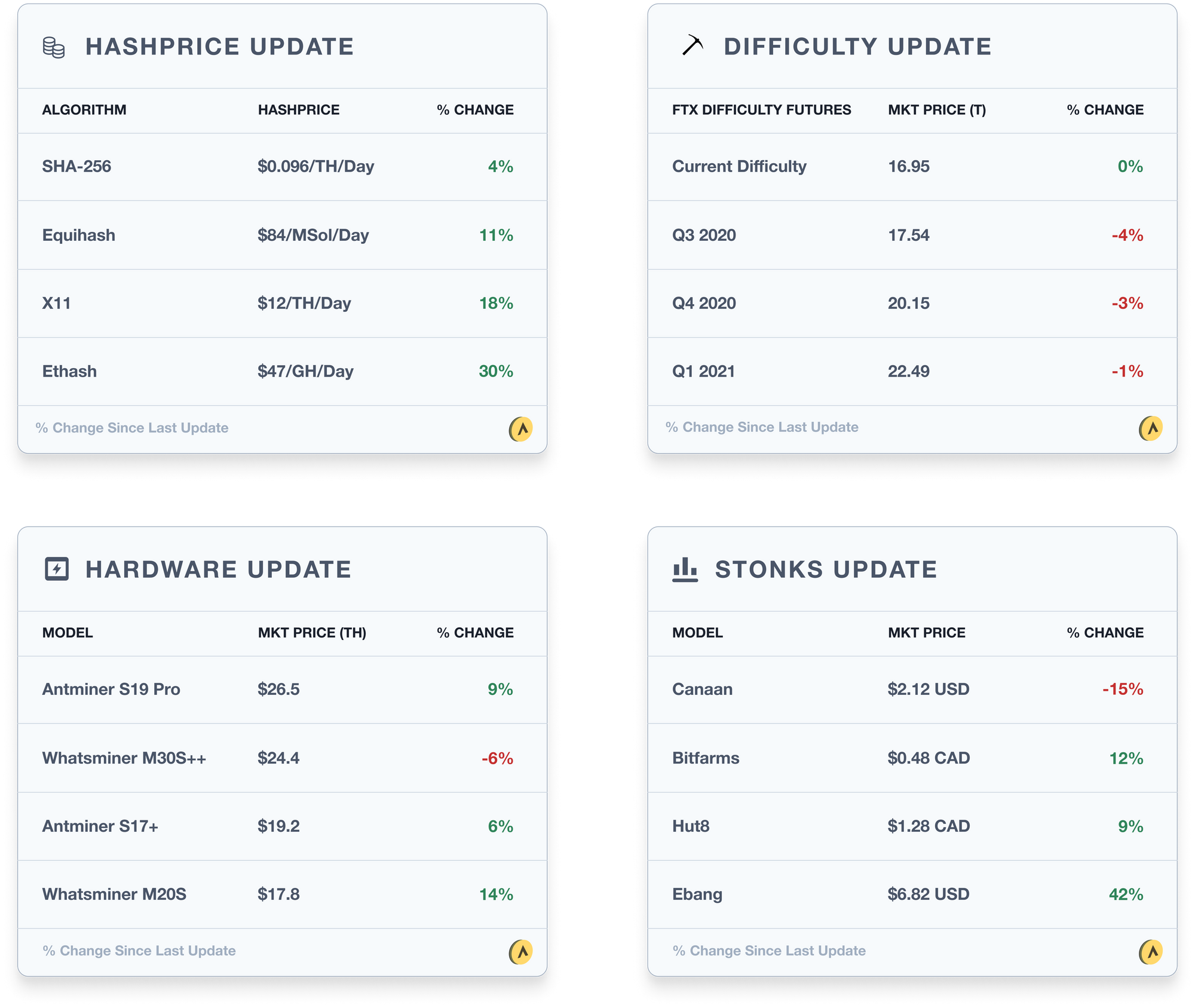

- Positive price movement and transaction fees have continued to drive hashprice up. Since 2017 we haven’t really seen a period where price was increasing without hashrate being able to catch up. With the delays at Bitmain and the market on the verge of a bull run, we could see a similar situation that would greatly expand miners’ margins.

- FTX Difficulty Futures have been trading down. Last update we discussed the mispricing on the Q3 2020 contract when it was at 19.5, it seems like the market has since corrected (overcorrected?) down to 17.5. Difficulty is expected to increase by 6 to 7.5% in 6 days’ time.

- Hardware continues to trend up, especially old machines (100J/TH +). S9s increased by over 20% during the period, as miners are preparing for the situation described above.

- Marathon Group and Riot have been wining in the public markets recently, highlighting that US-listed companies may be better positioned than Canadian and UK-listed ones (twitter). Ebang also saw a good gain, announcing a new venture into a crypto exchange.

Mining News

A few updates from the past couple of weeks in the mining industry:

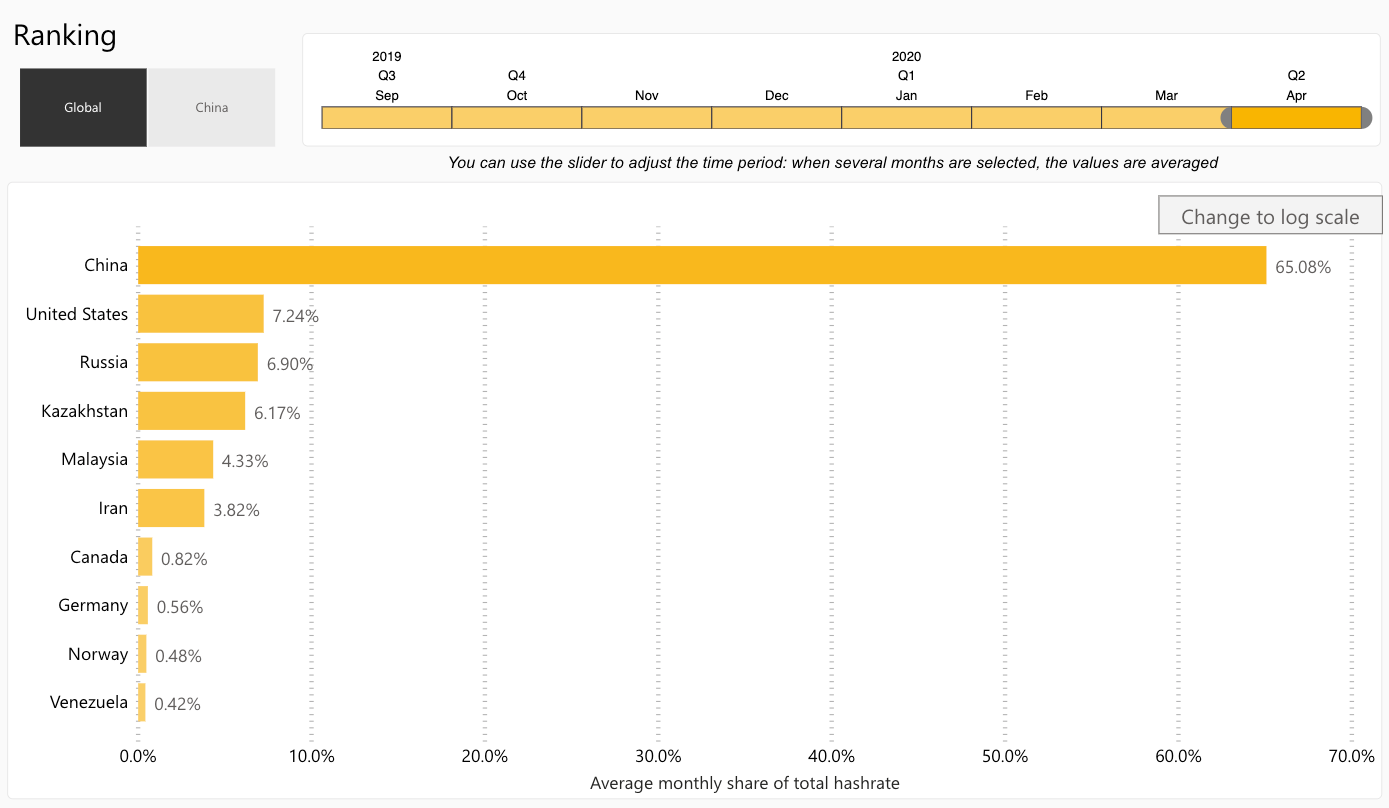

On May 13, a mining pool named Lubian suddenly appeared on blockchain explorers with 6PH, ranking fifth in the world. It had been rumoured that they were mining previously but were not public. A recent article has come out that covers more detail on this once secretive mining operation. There are only four shareholders in the mining operation they describe as a “Low-key Money Maker”. Also, the majority of their mining occurs in Iran, meaning that estimates to date have significantly underestimated Iran’s share of the mining industry. (article - translate to English)

Lancium, a Texas-based, SBI-backed company is suing Layer1, the Thiel-backed startup for patent infringement. Specifically, the suit is "by manufacturing, using, offering to sell, selling, and/or importing infringing systems and methods for adjusting power consumption” It is unclear whether this lawsuit will only apply to Layer1 or other mining firms and data centers using this response-demand technology. It doesn’t seem to be only targeted at Layer1 as Lancium stated they would actively defend their technologies. Beyond the potential financial harm, reputations are also at risk so expecting this to be a long-battle between the two Texas miners. Having this type of response technology has been a key pillar in Layer1’s value proposition. (article)

- Texas regulators are moving forward with proposed administrative changes to regulations on oilfield flaring. Under the proposal, companies seeking to flare gas will face a more detailed application form and have to offer more thorough justifications for why they need to flare. Flared gas is a waste of resources and is perfect to be used for crypto mining. Innovative companies like Great America Mining, Upstream Data and Crusoe are leveraging this wasted energy and turning it into something useful. This increased regulation could be a strong tailwind for miners in the space. (article)

- I’m done apologizing for covering Bitmain, it’s just going to have to be apart of every newsletter… with the ongoing battle going on its no surprise that operations have been affected. Miners were told that the machines they ordered and pre-paid for have been delayed. Orders scheduled for June/July have been delayed until September/October. (twitter)

- Luckily Bitmain did get a win, TSMC announced that they were one of 7 companies (Advanced Micro Devices, Apple, Bitmain, Intel, MediaTek, Nvidia and Qualcomm) that been assigned to receive the new 5nm chips. Bitmain is the only ASIC manufacturer on that list, which may be the saving grace for the struggling giant. Although Whatsminer is taking a different strategy, Bitmain will likely be the first manufacturer with 5nm chips (Antminer S21??). It is my understanding that in this context Bitmain refers to the side controlled by Jihan. (article)

- Two Chinese government-backed chip projects have hired more than 100 veteran engineers and managers from TSMC. This seems to be a play to make China competitive in chip production and bring the manufacturing onshore. In an era where more and more technologies, such as 5G, are becoming national security considerations, will chip production be next? (article)

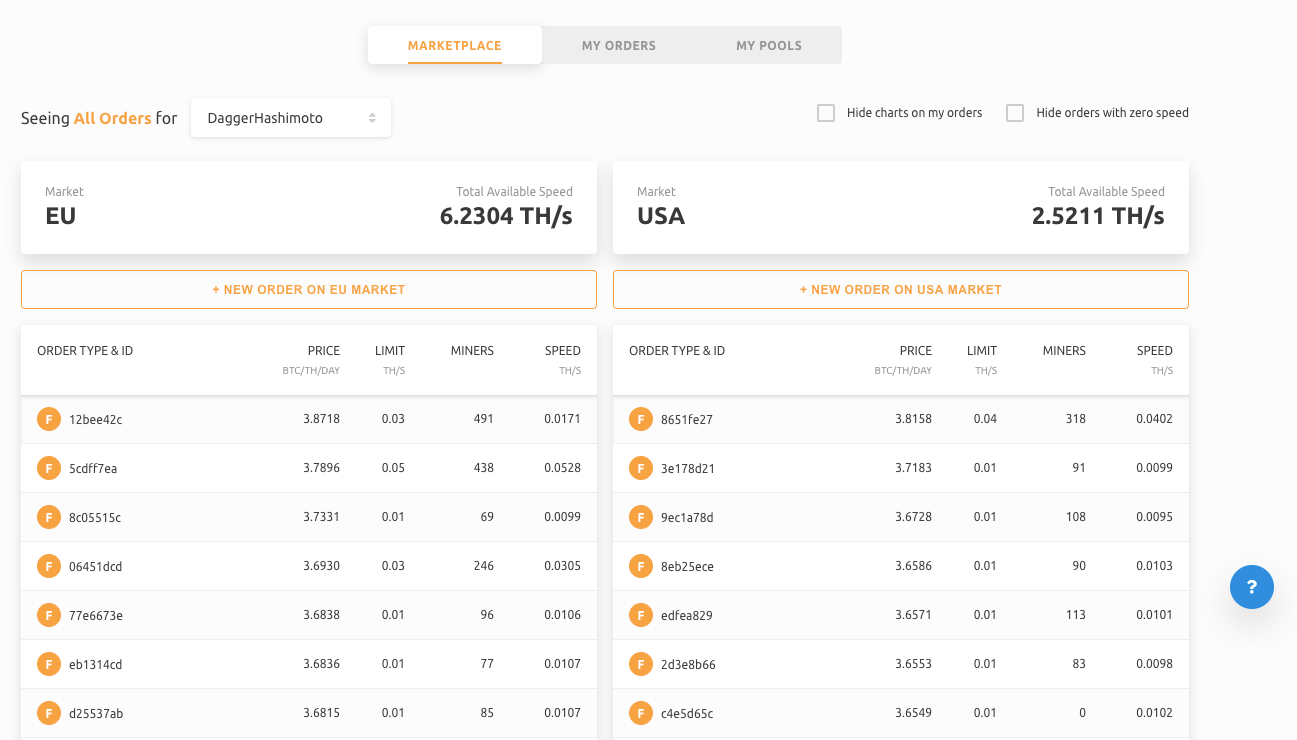

- Last week Ethereum Classic (ETC) got 51% attacked again. More than $5mm was stolen from exchanges costing only $200k in hashpower from the Nicehash market. I logged into Nicehash this morning to check out the Ethash market and can see that there is ~9TH of hashrate available, while the Ethereum Classic network is only ~2.5TH…. I’m almost certain another attack will happen, although exchanges are starting to put in place more security measures. In an era of hashpower markets, projects need to focus on algorithm dominance and gathering more hashrate if they want a secure network. Getting lawyers to defend your blockchain is busch league, ETC should focus on building a defensible and secure network. (article)

A proposal made by the government of Kazakhstan aims to impose a 15% flat-rate tax on crypto mining. This type of discrimination to crypto mining is not new nor is it novel to CIS region. Even in Washington State and Quebec, crypto miners have been unfairly singled out and targeted by the government. So this risk exists in almost region of the world, the key is having good local government relations. (article)

Last month Shell made mining news by announcing a partnership with Lancium. Now they have partnered with Asperitas to create liquid immersion solutions that can be leveraged in mining. Super bullish to have Shell move into the space. (article)

Mining Educational Content

Powerplants and electricity suppliers are becoming aware of the benefits of bitcoin mining for their operations. As such, mobile bitcoin mining setups are increasingly popular.

There are both benefits and downsides with these setups. We did a deep dive into them below & reviewed some existing products.

Check it out here:

About Luxor

Luxor is a US-based mining company.

Luxor currently runs mining pools for the following cryptocurrency networks – Bitcoin, Dash, Zcash, Monero, Horizen, Decred, Sia, LBRY, Komodo, Pirate and Sia Prime.

We launched a new Equihash Profit Switching Algorithm called Luxor Switch and Catalyst which allows altcoin miners to receive payments for their hashrate in Bitcoin.

We can be found on Twitter or Discord.

Footnotes

* Machine Prices from Hashrate Index

* SHA-256 Hashprice based on a weighted average of BTC, BCH, BSV, & DGB.

* Equihash Hashprice based on a weighted average of ZEC, ZEN, ARRR, & KMD.

* X11 Hashprice based on a weighted average of DASH & AXE.

* Ethash Hashprice based on a weighted average of ETH & ETC.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.