How Much Debt and Equity Have Public Bitcoin Miners Raised in 2022?

Raising money in a bull market is easy – adding value in a bear market is the hard part.

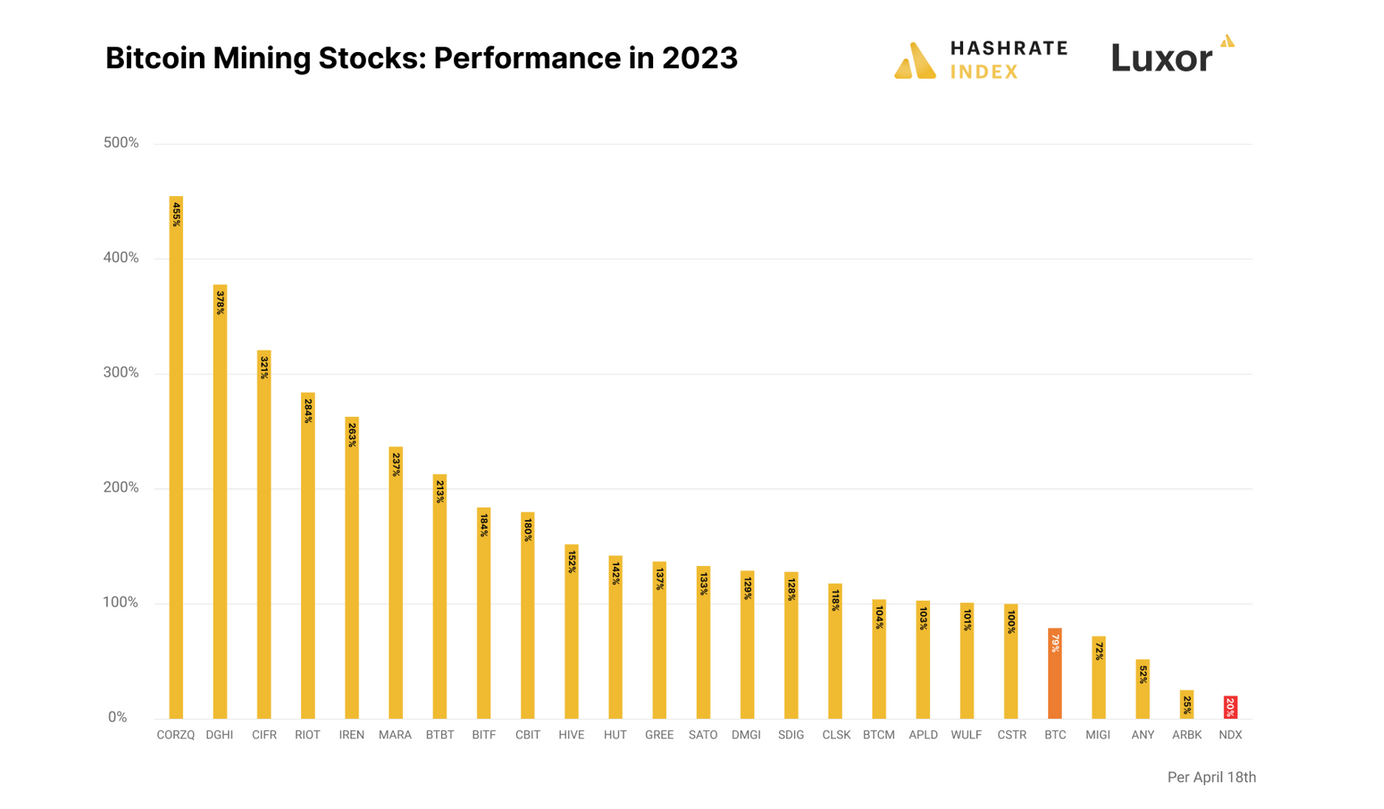

As investors get battered and bruised by the bear cycle, we can take a look at historical performance of public Bitcoin companies to see who has added the most value with shareholder money.

Bitcoin mining is a capital intensive pursuit, with mining companies often turning to capital markets to raise money to build large scale mining operations. Many investors have questioned the real value publicly traded Bitcoin mining operators return to their shareholders. In our analysis, we will review historical equity and debt raises for many of the big operators.

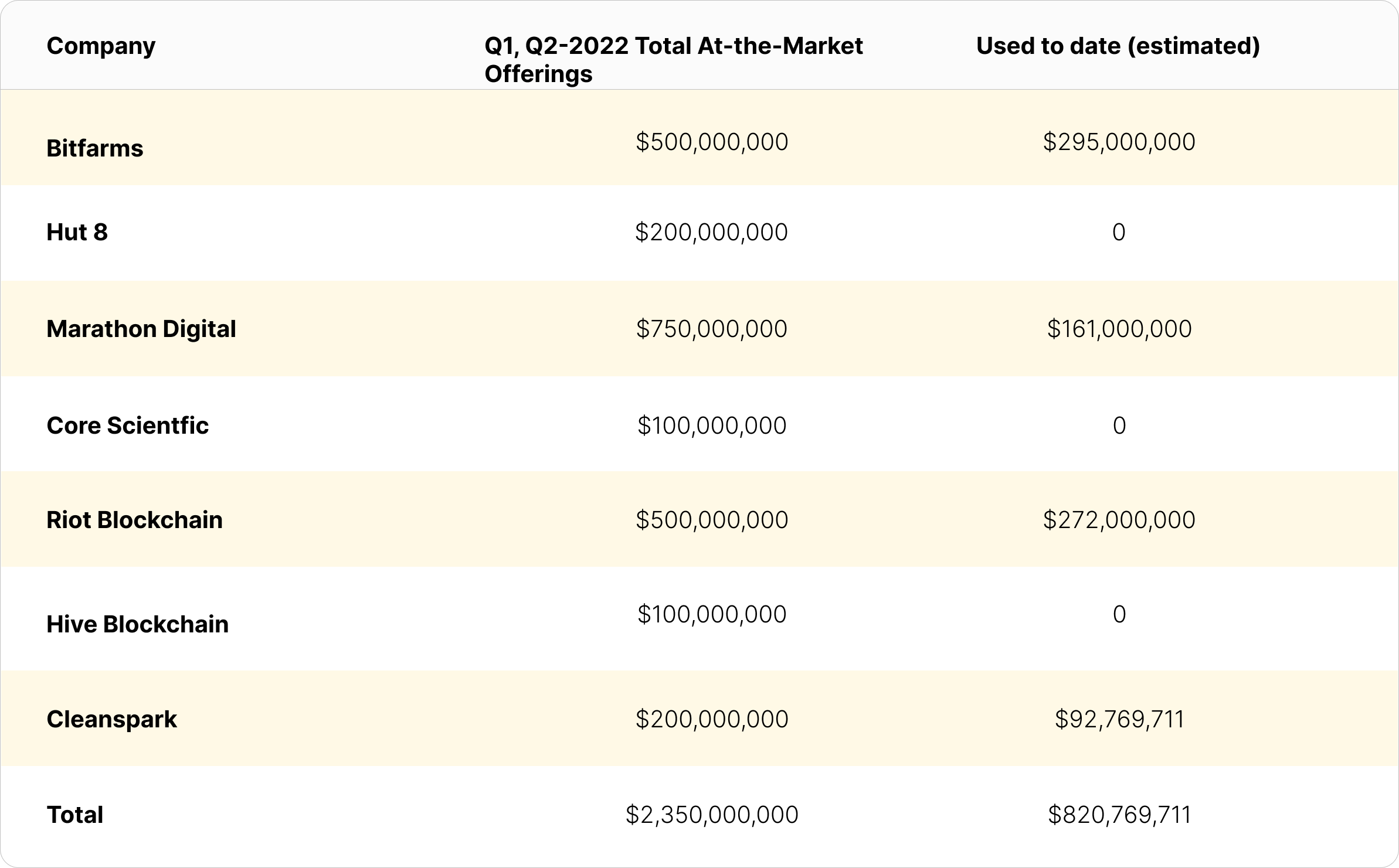

As Market Conditions Sour, Public Bitcoin Miners Turn to At-the-Market Offerings

At-the-market equity offerings (ATM) have become the dominant source of capital for Bitcoin mining firms in the down market. Shareholders prefer not to see these offerings as they dilute the value of existing equity in the underlying business, especially when stock prices are depressed like in the current market environment. In an ATM offering, the newly issued shares are sold into the secondary market through a designated broker at the prevailing market price. Once the shares are issued and sold, the cash proceeds are delivered to the Bitcoin mining firm.

As you can see below, the largest public Bitcoin miners have outstanding At-the-Market offerings in place with a total value of $2.35 billion (these ATM offerings were all put forth in Q1 and Q2 of this year). Expect to see a lot of share issuance with these offerings for the remainder of the year. Proceeds from these offerings will likely be used to expand or purchase distressed mining assets.

To estimate how much of each ATM offering has been used, we extracted the quarterly share issuance from each miner's Statement of Cash Flows from their 10-Q filings. These estimates on include Q1 and Q2 numbers since public miners have not released their Q3 financials yet.

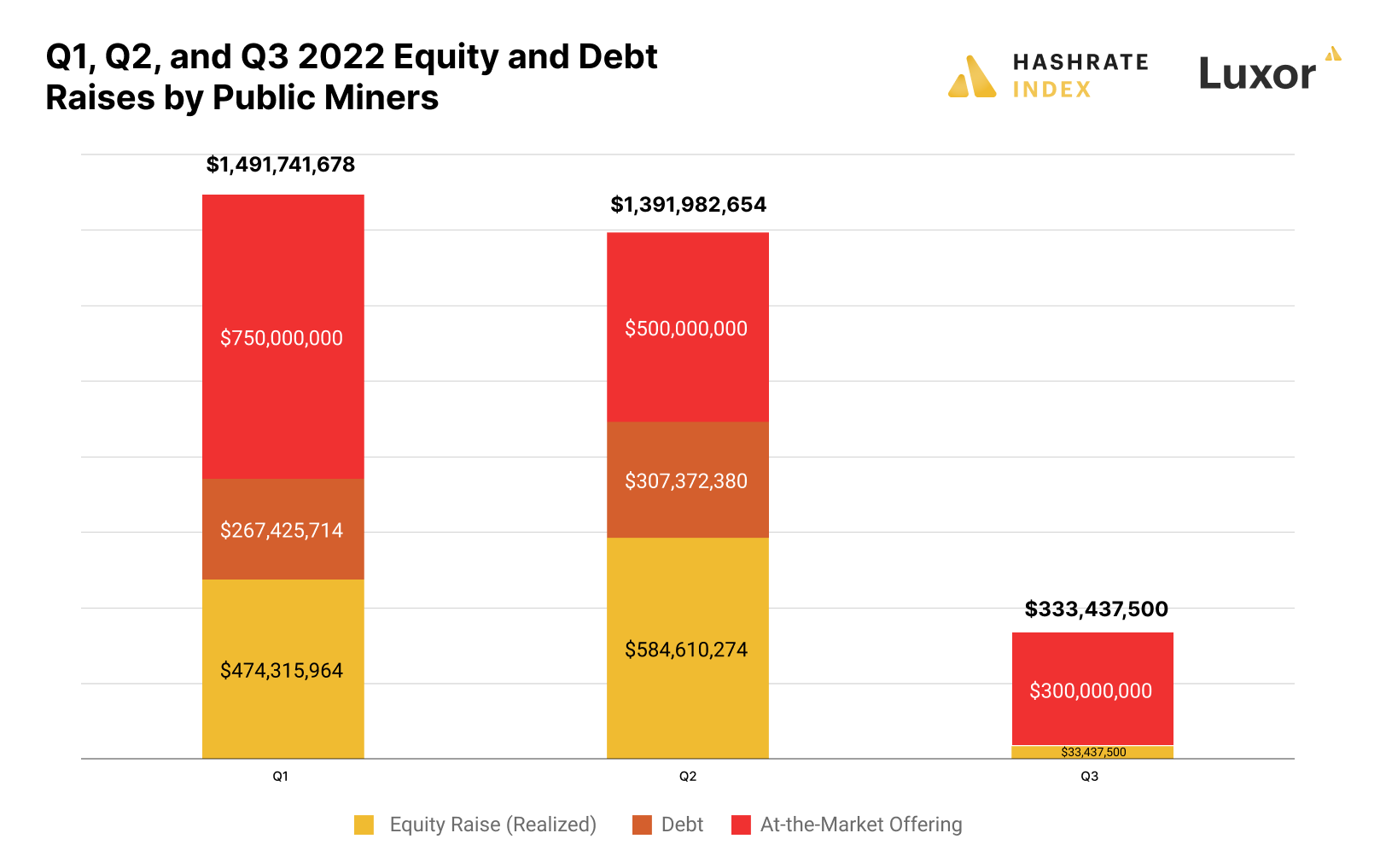

Public Bitcoin Miner Equity and Debt Funding in 2022

With the bear market coming into focus during the late stages of Q2 2022, most of the capital funding for miners came from equity fundraising. During the first quarter of this year, 70% of funding was in equity, while the remaining 30% came from debt. Moving into Q2 2022, the trend continued with equity funding representing about 70% and debt representing about 30% yet again. Expect to see an even larger share of equity funding for Bitcoin miners for the remainder of the year.

We can’t know for sure how much debt and equity each miner raised in Q3 until they file their 10-Qs for the quarter, but in the chart below, we provide a limited look at fundraising and financing so far into Q3 based on press releases and other public filings. We distinguish between at-the-market equity offerings and other equity fundraising.

Companies included in analysis: Bitfarms, Hut 8, Marathon Digital, Core Scientific, Riot Blockchain, Hive Blockchain, Argo, Cleanspark, Mawson, Tera Wulf, Bitnile, Cipher Mining, Iris Energy, DMG Blockchain, Greenidge, and Cathedra Bitcoin | Source: Public miner disclosures, public filings

Which Public Bitcoin Miners Are Delivering on Their Fundraising and Financing?

Let’s take a deeper dive into the long-term value these miners are delivering by measuring and comparing shareholder value creation over time with capital funded through public markets.

In this article, we present two key metrics:

- Total equity raised to market value

- Total dollars raised to enterprise value

The goal is to measure and compare who is delivering the best shareholder value based on historical capital raises.

The Total Equity Raised to Market Cap multiple shows investors how much total equity a public Bitcoin miner has raised over time divided by the total market capitalization of the business. A low ratio means investors have captured more value relative to the total equity raises. A higher ratio means that mining companies have raised far more equity dollars than the underlying value of their business.

Some key assumptions for for equity raises

- Equity share consideration to acquire assets is included, as it creates accretive assets and income to business.

- Warrants exercised are included since this cash hits a company's treasury

- Options exercised are included since this cash is considered funding for the business

- Equity raises are the most common source of funding. We tracked historical equity raises from either an IPO or a company changing its primary business to Bitcoin mining.

Cleanspark for now has the highest total equity to market cap among its peers, but you will see their ratio drop next quarter as they have acquired more hashrate during the bear market. Argo Blockchain and Marathon Digital have the lowest ratio amongst their peers. One of the core reasons these two firms have added so much value over time, is that they aggressively invested in mining expansion at the end of the crypto winter in 2020. With rig prices hitting new lows in this bear market, operators that acquire cheap hashrate stand the greatest chance of adding the best bang for the buck to shareholders.

The Total Dollars Raised to Enterprise Value ratio takes all-time debt and equity raises and divides this total by the miner's enterprise value. This ratio shows investors how much total capital including outstanding debt a company uses to create shareholder value over time. By using this metric, investors can observe all the levers in the capital structure that create value over time. A low multiple means investors are getting the most value relative to total dollars funded. A higher ratio means investors are paying a higher value for every dollar funded.

As we can see, Cleanspark attained the highest multiple amongst peers, though again, we should see a decline in the future since Cleanspark acquired significantly more hashrate via two recent acquisitions. Marathon Digital and Argo continue to show lowest multiples among their peers as they acquired productive capacity during bear markets.

Bottom Line: Investors need to be mindful that, during this bear market cycle, miners will sizably dilute shareholders via equity offerings. On the flip side, as we move out of the bear market, Bitcoin miners who aggressively acquired or expanded have shown that they are adding the most value to long-term shareholders.

Disclosure: This author is long Hut 8, Bitfarms, and Cleanspark

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.