Hashrate Index Roundup (September 30, 2024)

September Surge sets the stage for an optimistic October.

Hello world, happy Monday!

Bitcoin trended up slightly throughout the past week, increasing by 2.25% from ~$64,350 to a local peak of ~$65,800 before trickling back down to a current price of ~$63,100, which is around 17% away from the all-time high of $73,750 recorded on March 14. Price action throughout the month turned out to be positive in contrast with historical trends as we close out September with a 6.88% gain. Year-to-date performance stands at 42.80%.

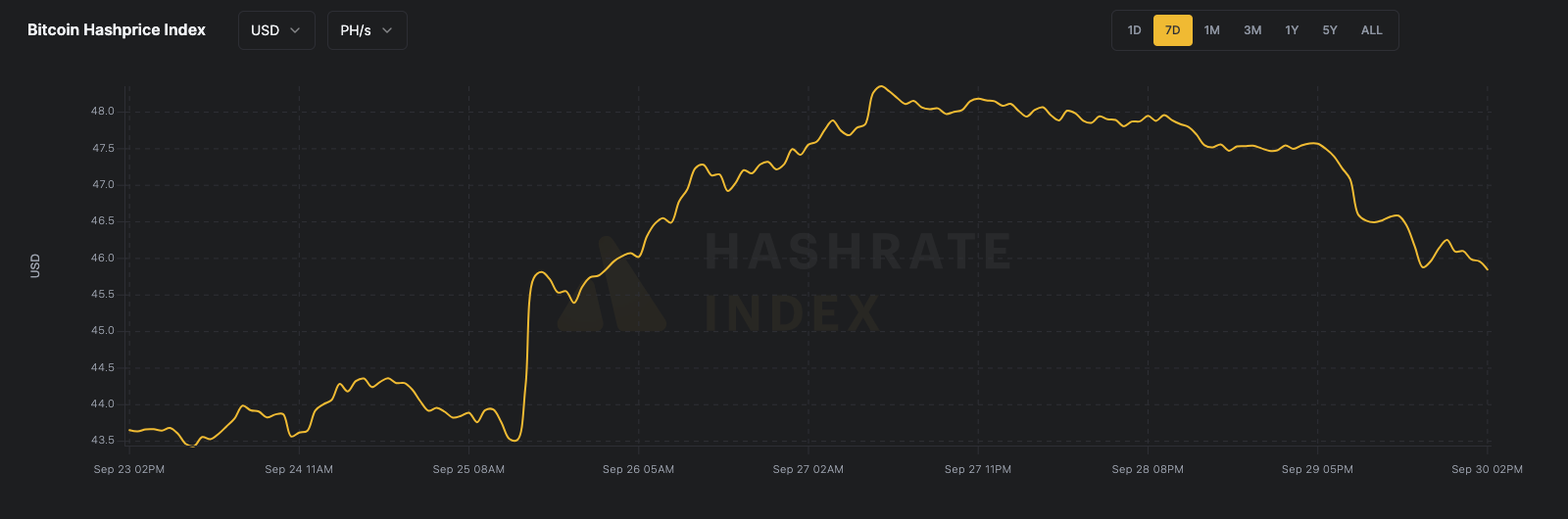

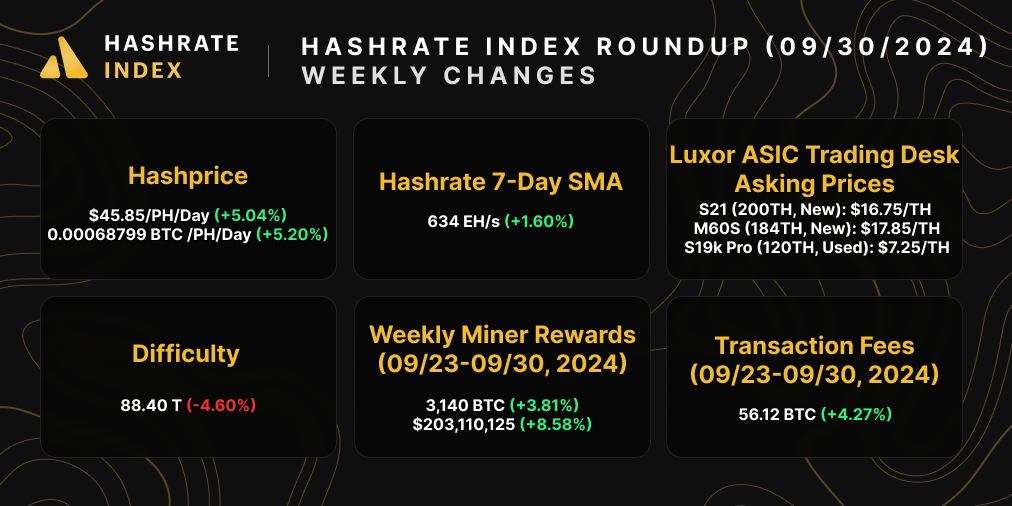

Hashprice responded with a healthy uptrend throughout the week, increasing by 5.04% from $43.65 per PH/s/Day to $45.85 per PH/s/Day, at the time of writing. A sudden surge of 11.12% occurred between September 25-27 as network difficulty adjusted down by 4.60% in tandem with an increasing Bitcoin price and relatively higher transaction fees being collected. Hashprice moved from $43.52 per PH/s/Day to $48.36 per PH/s/Day. A welcome surprise for those miners online and hashing.

Beyond price action in Bitcoin and hashprice, global network hashrate showed a very slight dip with the 7-day simple moving average (SMA) decreasing by 1.60% from 635EH/s to 630EH/s throughout the week. Zooming out, hashrate has oscillated around this range throughout the month, save for an uptick which recorded an all-time high of 700EH/s on September 08. The overall trend throughout September may be reflective of diminishing curtailment as the Summer heat dies down and we shift into Fall, in addition to gains from fleet refresh programs as industrial miners turnover current machines into next-gen ASICs.

Blocks were found at an average time of around 10 minutes 21 seconds throughout the week, a slight pick up in pace as compared to the week prior at 10 minutes 31 seconds. We estimate a healthy decrease in difficulty of ~4.60% for the upcoming adjustment expected to occur on October 10th.

Sponsored by Luxor Firmware

At $44/PH/Day, hashprice is close to – or at – breakeven for many miners depedning on operating cost and machine model type. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

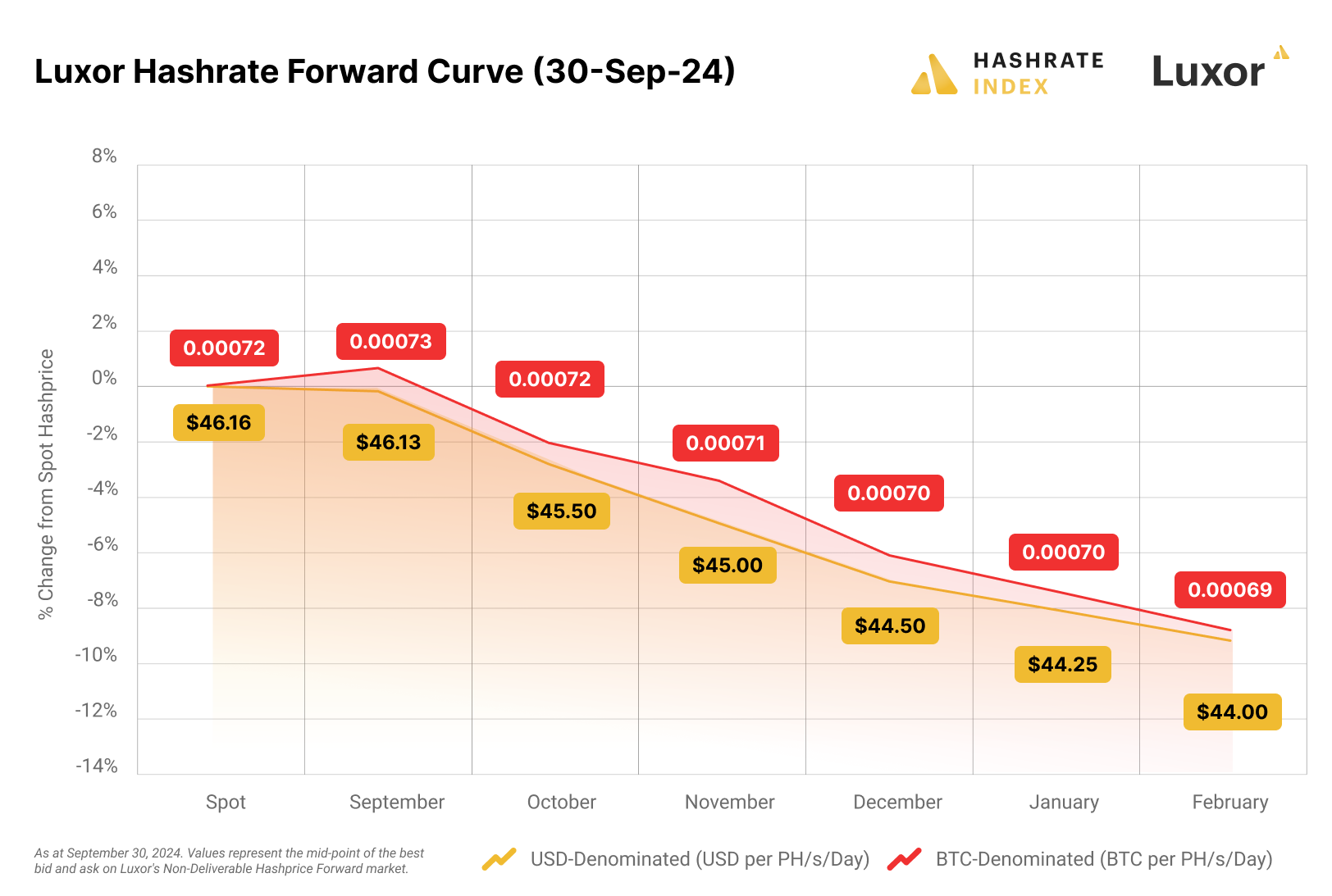

Luxor Hashrate Forwards Market Update

For this week's Hashrate Forwards market update, USD contracts are trading in contango whereas BTC contracts are trading in backwardation. Miners can lock in a ~$44.00 hashprice for up to six months into the future.

Bitcoin Mining Market Update

A positive trend for this week's update. Hashprice is up, hashrate is steady, network difficulty is down and expected to decrease. Miners collected a total of ~3,140 BTC in block rewards, equivalent to ~$203.1 million. Transaction fees constituted 1.89% of block rewards totalling 56.12BTC, equivalent to ~$3.67 million.

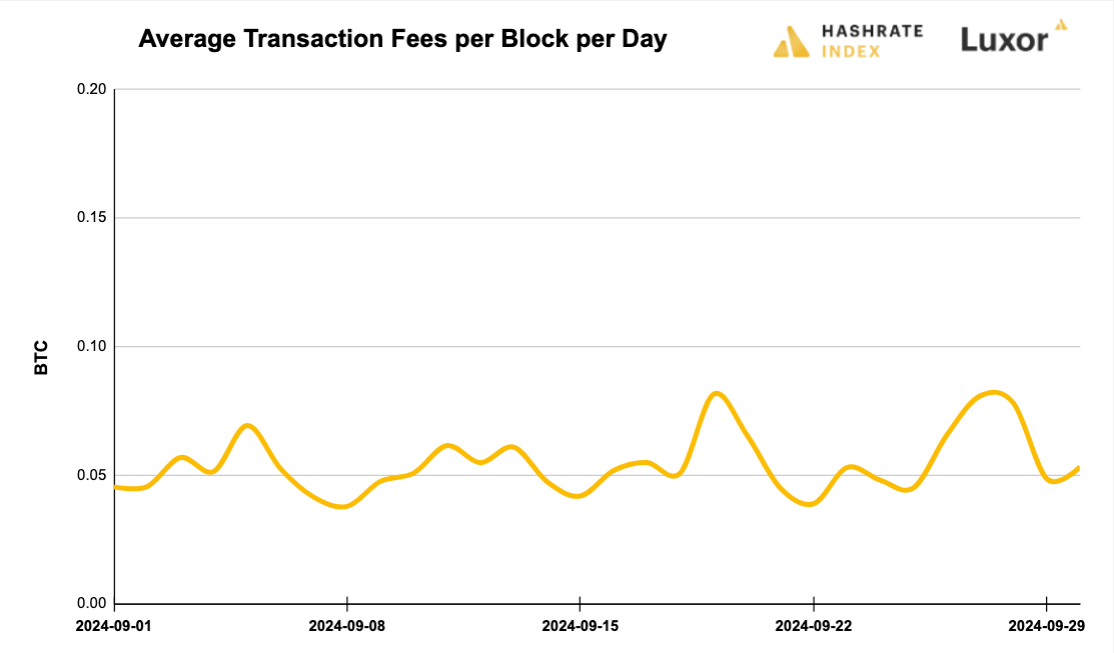

Bitcoin Transaction Fee Update

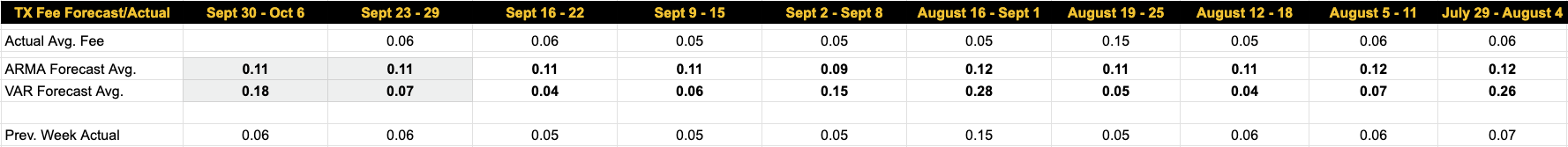

Over the past week, Bitcoin miners collected an average of 0.0599 BTC per block per day in transaction fees compared to the prior week's 0.0557 BTC, a 7.54% increase.

Our transaction fee projection models are becoming more relatively bullish as we expect a low-fee, low-volatility environment to change in the medium term. For this week, our VAR model forecasts 0.18 BTC per block per day and the ARMA estimates 0.11 BTC per block per day.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Hut 8 GPU-as-a-Service Vertical Goes Live with Inaugural Deployment

- Swan Bitcoin lawsuit targets former executives, implicates Tether

- Bitdeer Completes Testing of its Latest SEAL02 Bitcoin Mining Chip

Bitcoin Mining Stocks Update

Bitcoin mining stocks trended up throughout the past week, reflecting a 6.90% increase in our Bitcoin Mining Stock Index.

5-day changes to Bitcoin mining stocks as of prior week's market close:

- RIOT: $7.84 (+9.27%) | Mkt Cap: $2.38B

- HUT: $13.08 (+14.79%) | Mkt Cap: $1.19B

- BITF: $2.25 (+11.94%) | Mkt Cap: $0.94B

- HIVE: $3.35 (+5.25%) | Mkt Cap: $0.40B

- MARA: $17.29 (+11.12%) | Mkt Cap: $4.58B

- CLSK: $10.13 (+9.87%) | Mkt Cap: $2.56B

- IREN: $8.85 (+13.10%) | Mkt Cap: $1.68B

- CORZ: $12.16 (-1.94%) | Mkt Cap: $3.14B

- WULF: $4.94 (+12.22%) | Mkt Cap: $1.89B

- CIFR: $4.11 (+37.46%) | Mkt Cap: $1.35B

- BTDR: $8.44 (+16.25%) | Mkt Cap: $1.17B

- FUFU: $4.35 (+23.58%) | Mkt Cap: $0.71B

- CAN: $1.06 (+1.92%) | Mkt Cap: $0.30B

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.