Hashrate Index Roundup (May 20, 2024)

Bitcoin is pumping, but is it pumping hard enough to move the needle for Bitcoin's hashrate?

Happy Monday, y'all!

Things are starting to look up (sort of...)

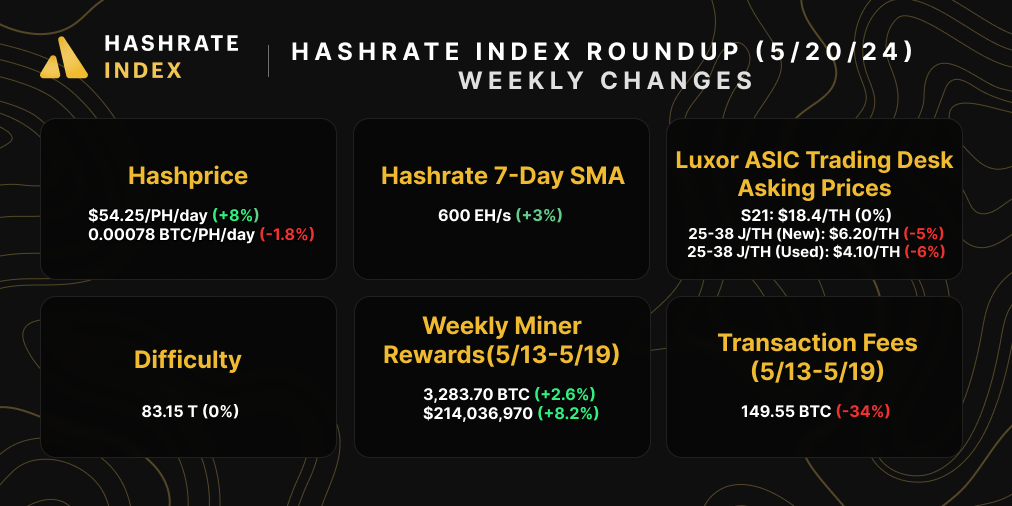

As I write this, bitcoin has rallied to ~$70,000, which is giving hashprice a nice little face-lift. Of course, this is all relative considering that hashprice is now $55/PH/day, which was last Halving epoch's all-time low. So the face-lift might have removed some wrinkles, but hashprice is still pretty ugly all things considered.

The good news is that current mining economics are so compressed that they are stunting hashrate growth. And even though Bitcoin's price rally is making way for some hashrate to come online, this growth has been slow-going during the current difficulty epoch, so the next difficulty adjustment should be minor (in the ballpark of +1%).

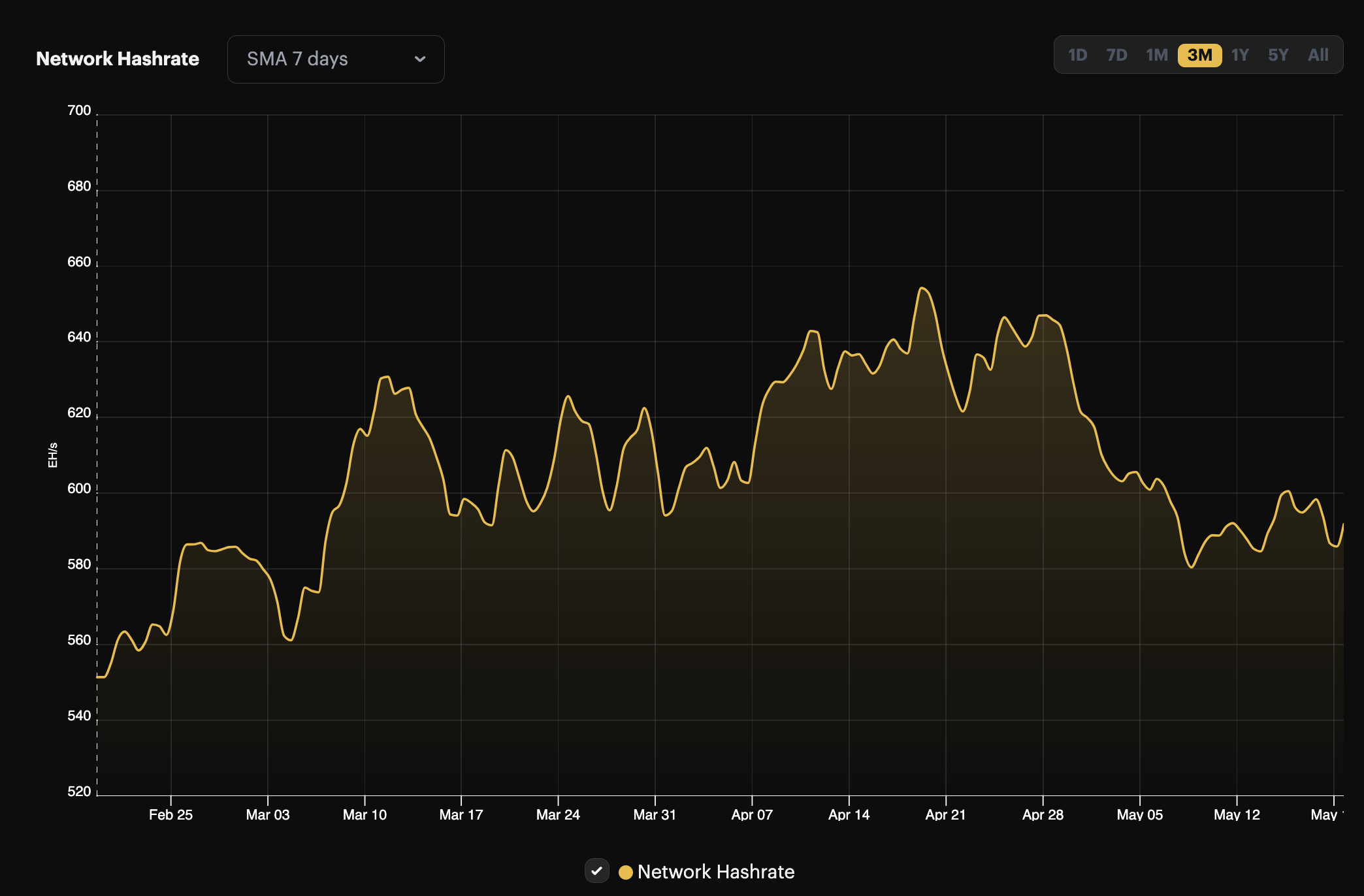

On that note, Bitcoin's hashrate seems to have bottomed for now, and it's back to 600 EH/s on the 7-day average. Whether it grows, stagnates, or drops from here will largely depend on what Bitcoin's price does for the rest of the year. With hashprice compressed and the North American summer ahead of us (which will likely force miners in the US to heavily curtail), we wouldn't be surprised to see hashrate putter along between 600-700 EH/s throughout Q2 and Q3.

It's worth noting that, even if Bitcoin transcends its all-time high in the coming weeks/months, the summer could still restrict hashrate due to curtailment events from industrial-scale miners. Of course, miners in other regions around the world could offset this curtailment, and as such, the rate of change to hashrate in the coming months could provide insights into how quickly (or not) hashrate is expanding in areas outside the US.

Sponsored by Luxor Firmware

The Fourth Halving has come to pass, so it's never been more prudent for miners to optimize their operations. LuxOS, Luxor's Antminer firmware, can help miners get the best bang for their hash by increasing energy efficiency when necessary and increasing hashrate when opportune. Plus, when running LuxOS, Bitcoin miners who use Luxor's Bitcoin mining pool can access 0% fees. Start supercharging your fleet with LuxOS today.

Luxor Hashrate Forwards Market Update

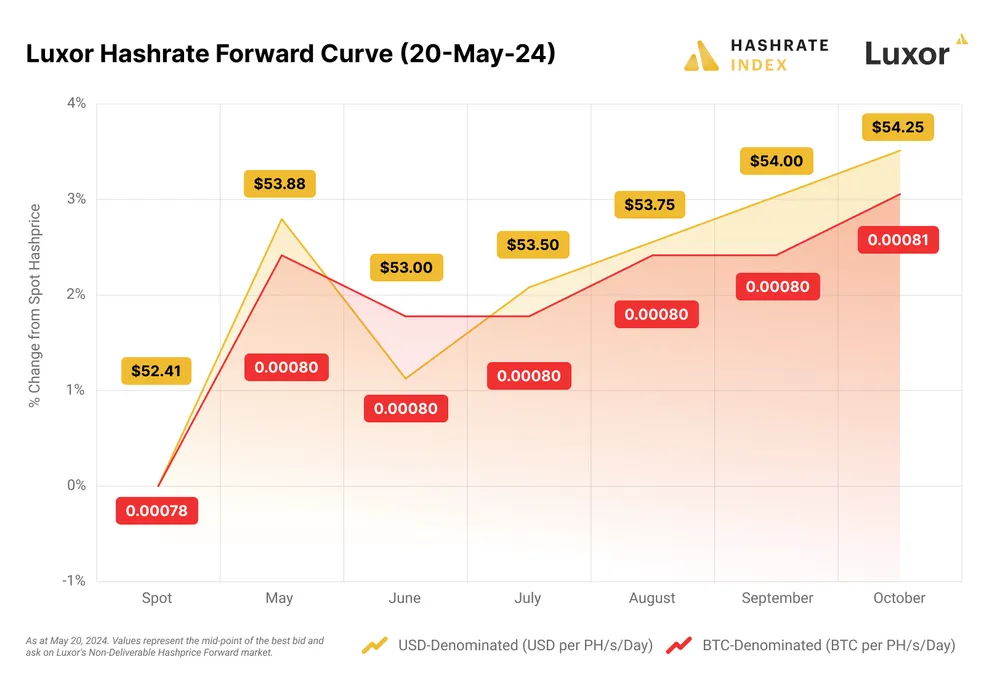

As we noted in last week's update, Luxor's Hashrate Forwards markets have been trading in contango since the Halving, which means that the future quotes for hashprice are trading above spot price.

For this week's update, this trend continued, with hashrate traders generally bullish on the trajectory of hashprice over the next 6-months. These expectations suggest that hashrate traders expect some combination of Bitcoin's difficulty to fall / stagnate over the coming months, transaction fees to pick up, and/or bitcoin's price to increase.

Bitcoin Mining Market Update

For this week's market update, hashprice and hashrate are both up, but transaction fees are down. Mining rewards in BTC, though, are up over the week since block times are speeding up with the rise in hashrate. ASIC prices are still in flux, with new-gen (25-38 J/TH) rigs falling significantly, while S21 prices stayed put.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Bitcoin Miners Targeted by Venezuela in Latest Crypto Crackdown

- AEP Ohio flags cryptocurrency miners as it proposes tariffs, discounts for data centers

- Miners Eye Middle East as Next Region for Growth

- Biden Order to Halt China-Tied Bitcoin Mine Beside Nuke Base Came as U.S. Firm Just Bought it

- Oklahoma saddles up bill of rights for crypto wranglers and miners

Bitcoin Mining Stocks Update

Bitcoin is ripping, so y'all know what that means: Bitcoin mining stocks are ripping even harder. Every stock in our update is up with the exception of one, and our benchmark Crypto Mining Stock Index is up 5%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $10.96 (+17.72%)

- HUT: $9.95 (+28.22%)

- BITF: $1.84 (+17.63%)

- HIVE: $2.62 (+15.93%)

- MARA: $22.32 (+32.7%)

- CLSK: $18.31 (+20.78%)

- IREN: $6.36 (+33.05%)

- CORZ: $3.92 (+9.50%)

- WULF: $2.14 (+8.38%)

- CIFR: $3.99 (+9.62%)

- BTDR: $6.03 (+10.64%)

- SDIG: $2.95 (-2.32%)

New From Hashrate Index

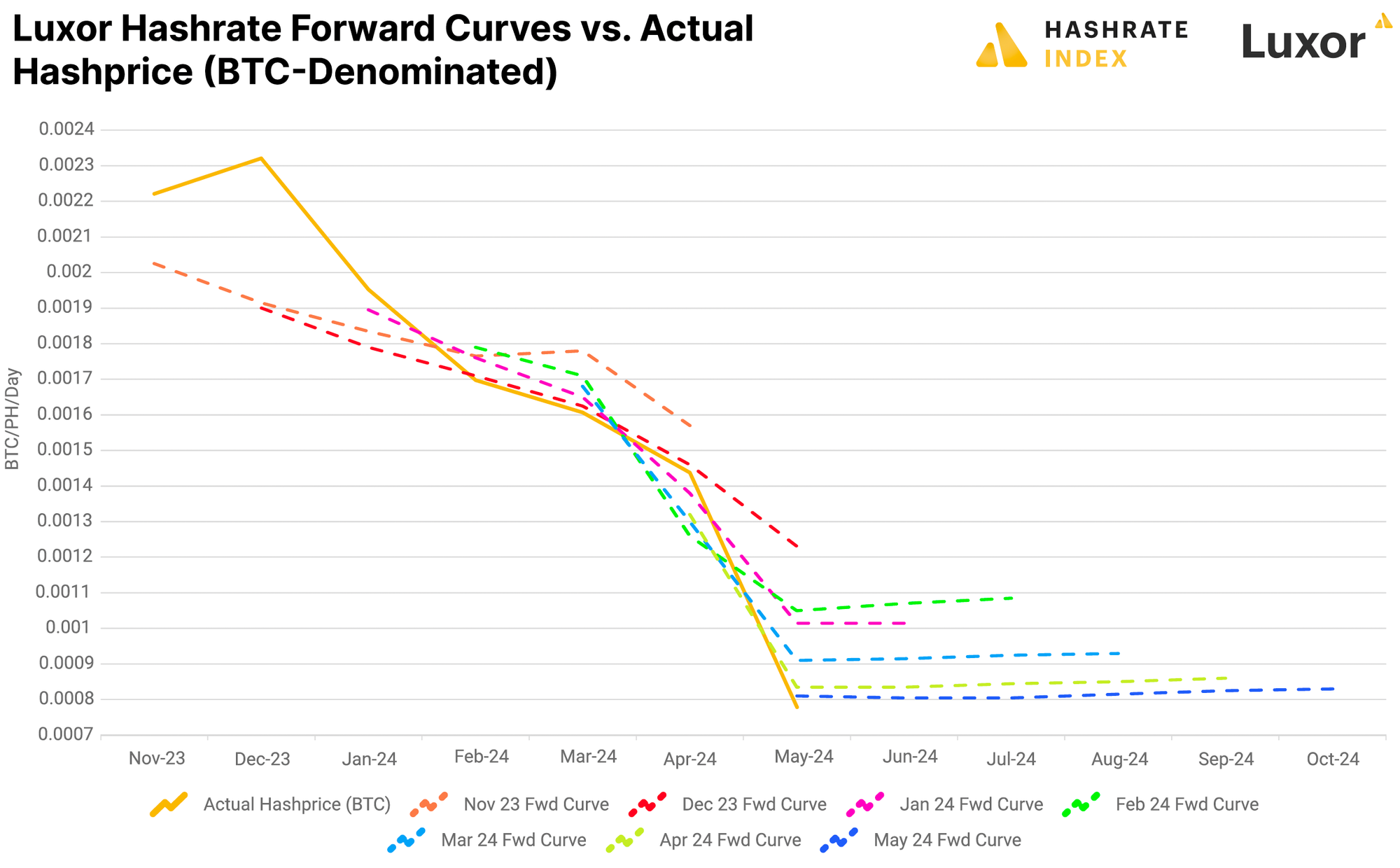

Does the Hashrate Forward Curve Predict Future Hashprice?

Navigating the complex landscape of Bitcoin mining requires not only cutting-edge technology but also an acute understanding of market dynamics. Among the critical tools at the disposal of the Bitcoin mining industry are Luxor's Hashrate Forwards. This post explores the historical data of the Hashrate Forward Curve to assess its efficacy in predicting future hashprices and to identify potential opportunities for extracting alpha.

Hashrate Index Q1-2024 Report: The Specter and Fallout of the Halving

Our Q1-2024 report is here, and in light of the Fourth Bitcoin Halving, we decided to shake things up for this report by running the numbers for Q1 while also diagnosing the immediate impact of the Halving.

In this report, we provide a recap of Q1-2024 through the lens of the Fourth Bitcoin Halving, and we include data through April and the first week of May where applicable to show the immediate impact of the event on network data, hashprice, ASIC prices, Bitcoin mining stocks, and other aspects of the mining industry. You can download the full report below:

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.