Hashrate Index Roundup (March 19, 2024)

The Fourth Bitcoin Halving is a month away, and hashprice is dropping from its 2024 high.

Happy Monday, y'all!

Before we jump into today's analysis, a quick announcement form the Luxor side of the business:

Today, the Luxor Derivatives Desk announced its latest offering: Hashrate Futures. In partnership with the Bitnomial exchange, Luxor is launching the first-ever, CFTC-regulated Bitcoin mining futures product at the end of March. These Hashrate Futures will be the exchange-traded counterpart to Luxor's Hashrate Forwards; the monthly contracts will be 1 PH/s in size, cash settled, and use the Hashprice Index as the reference rate.

With the Fourth Halving on the horizon, the Luxor team believes that these Hashrate Futures will be instrumental for helping miners hedge revenue uncertainty before and after the event.

And with that, let's dive into the latest from the Bitcoin mining data front.

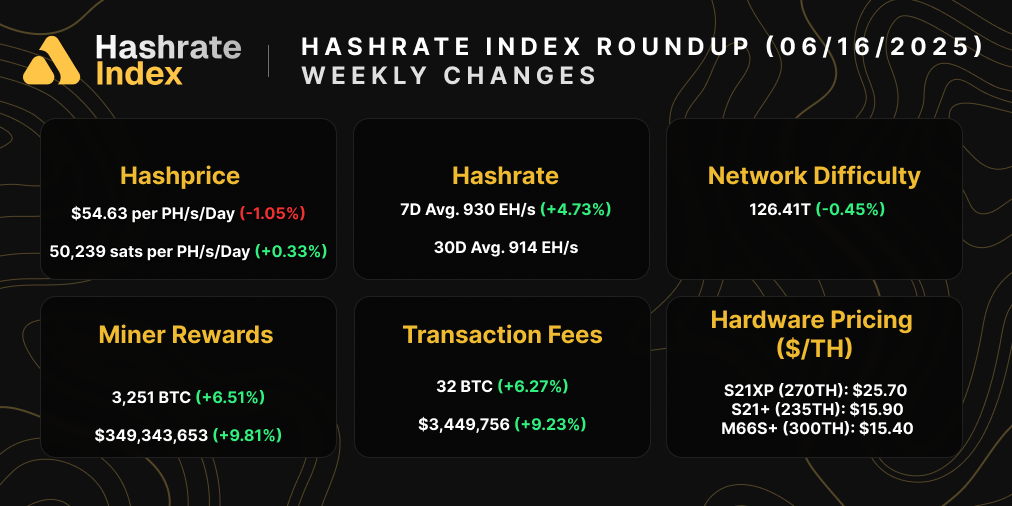

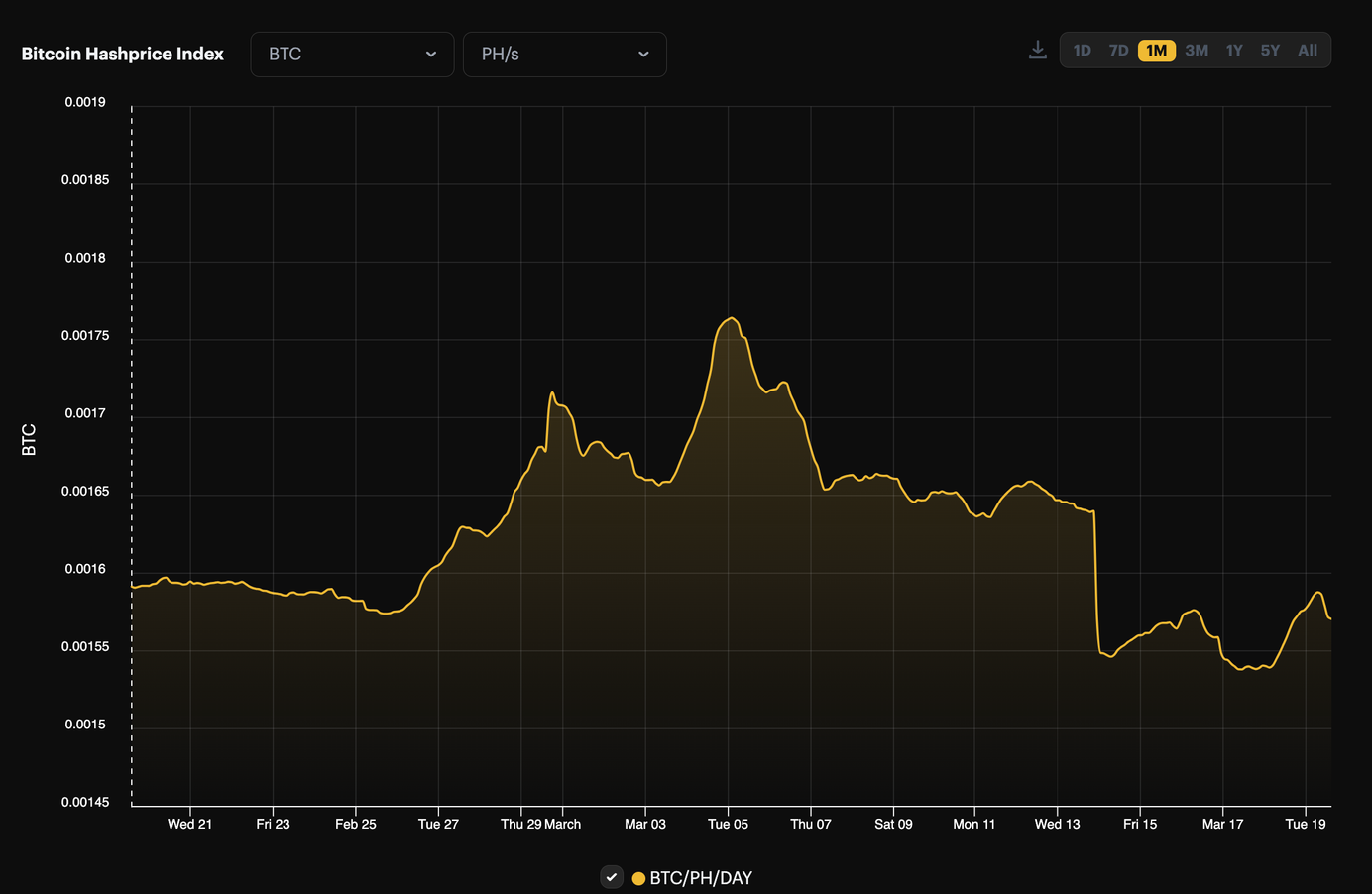

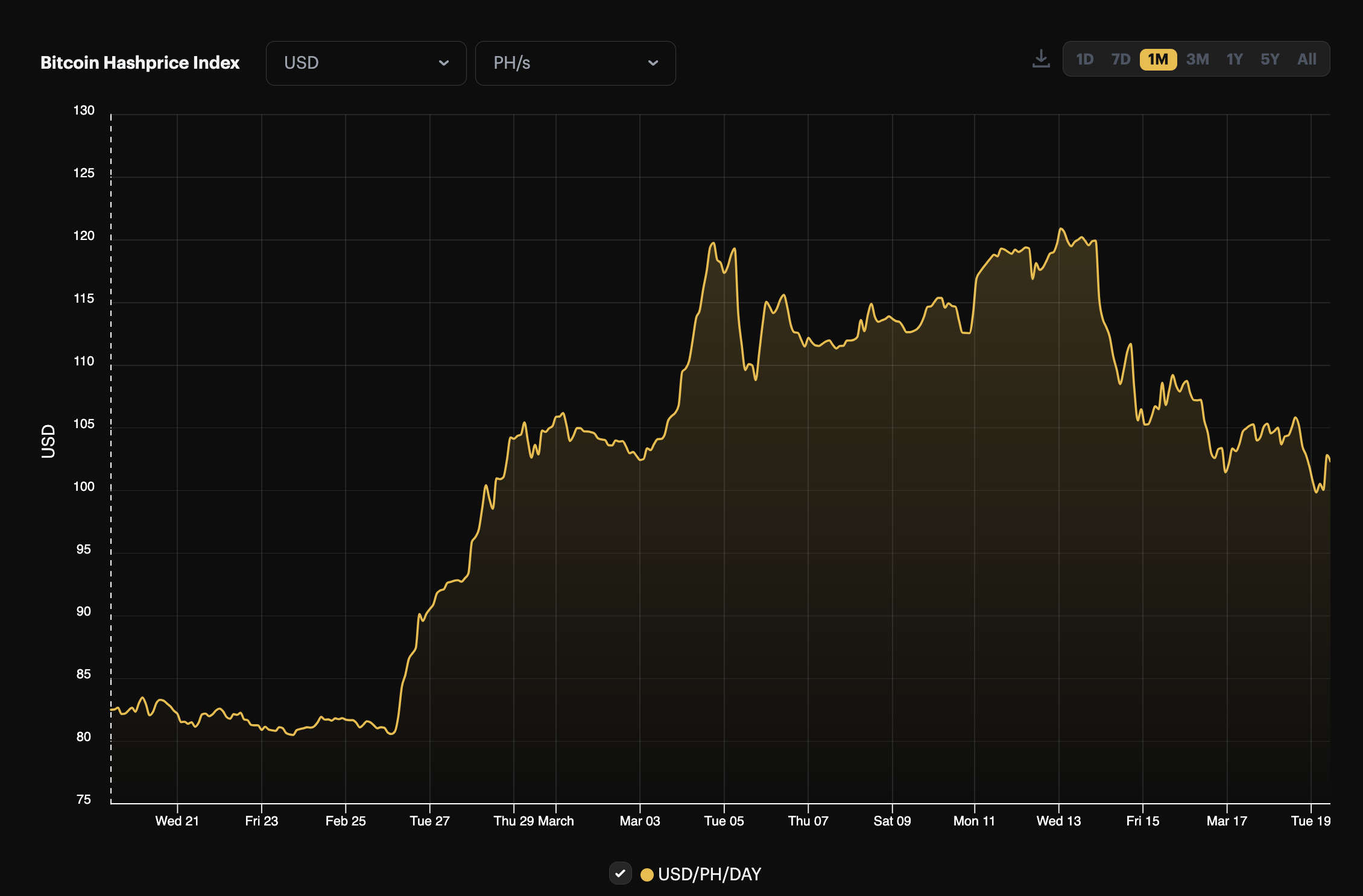

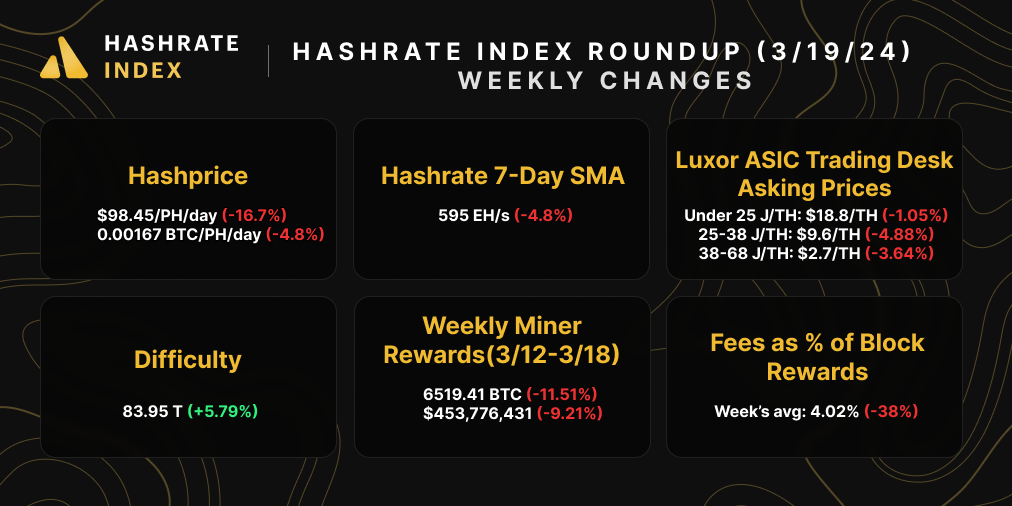

Bitcoin is cooling off from its all-time high, so hashprice is too. It's down roughly 17% from its 2024 peak, and Bitcoin's retracting price isn't the only culprit – last week's 5.79% positive difficulty adjustment also took its toll.

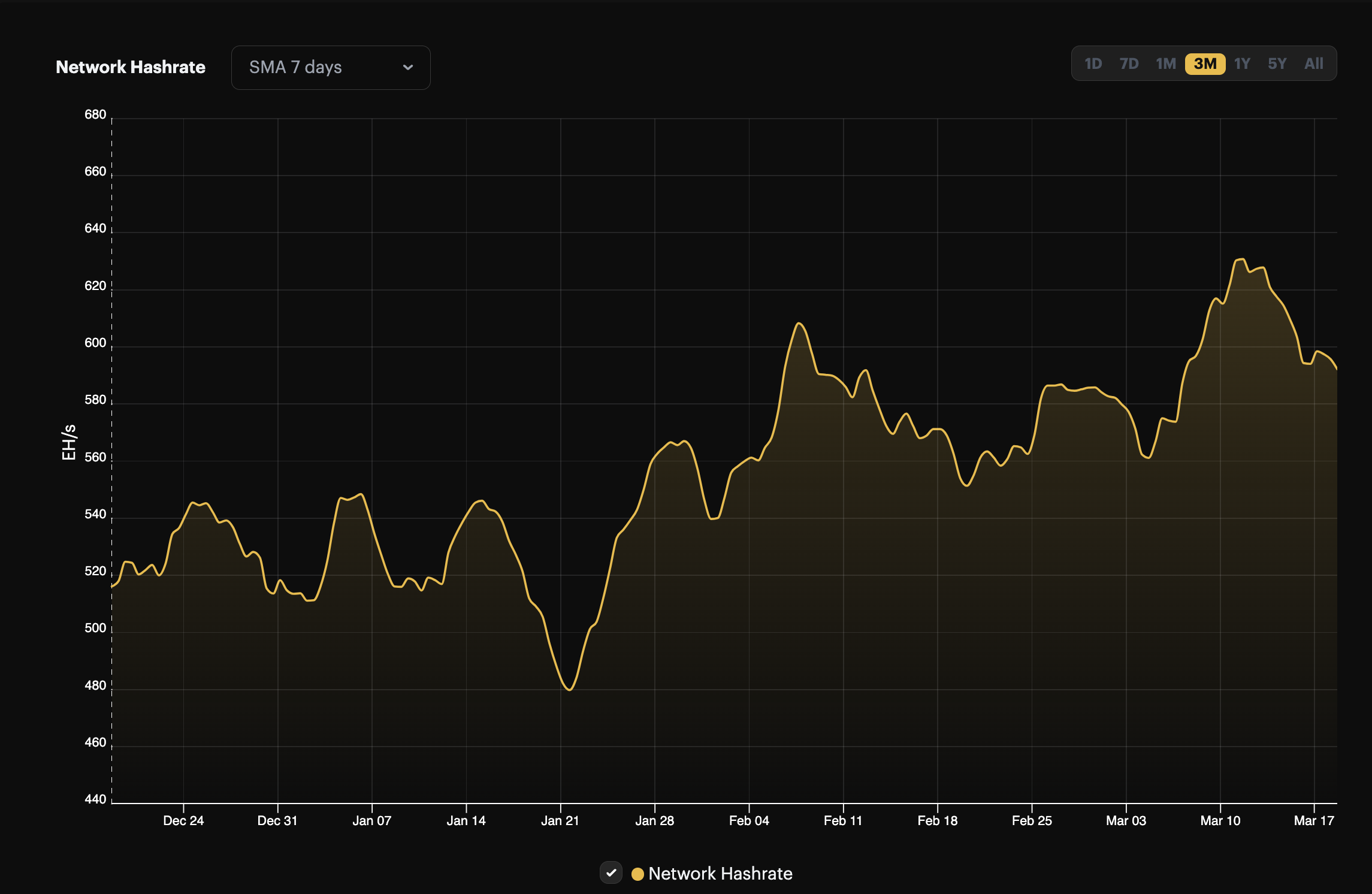

Hashrate is tapering off as well after hitting an all-time high on the 7-day average of 631 EH/s on March 11. It's down 6% from this peak, which could mean a good outcome for the next difficulty adjustment, the second to last one before the Fourth Halving in April.

Let's hope that we do get a negative adjustment next go around, because every block counts this close to the Halving: as long as block times stay in line with the current trend, the Halving is exactly one month away...

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting orders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

Bitcoin Mining Market Update

All red for our mining update this week, with the unfortunate exception of difficulty. Transaction fees fell below 5% of block rewards, and ASIC prices continued to fall ahead of the Halving.

Bitcoin Mining News

Here are last week's top headlines for Bitcoin mining news:

- Luxor Looks to Help Bitcoin Miners Hedge Halving Risk With New Hashrate Futures

- Why most bitcoin mining stocks are down amid a persistent crypto rally

- Bitcoin Miner Marathon Plans to Make Purchases to Offset Rewards ‘Halving’

Bitcoin Mining Stocks Update

Bitcoin mining stocks have been funky lately. Amid Bitcoin's run-up to an all-time high in the last two weeks, these stocks were actually falling in price. So either investors have started pricing in the Halving's revenue shock, or the Bitcoin ETFs really are eating into the market share of these stocks. That said, now that bitcoin is dropping again, Bitcoin mining stocks are falling still. Every stock but four in our update is red this week, and our Crypto Mining Stock Index fell 1.3% over the week.

Weekly changes to Bitcoin mining stocks:

- RIOT: $11.09 (-5.05%)

- HUT: $8.05 (+13.38%)

- BITF: $2.24 (-3.86%)

- HIVE: $2.96 (-5.13%)

- MARA: $19.32 (-3.64%)

- CLSK: $16.49 (0%)

- IREN: $4.49 (-8.55%)

- CORZ: $3.08 (-11.24%)

- WULF: $1.72 (-2.27%)

- CIFR: $4.10 (+32.26%)

- BTDR: $7.43 (+13.09%)

- SDIG: $3.91 (-5.56%)

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.