Hashrate Index Roundup (March 11, 2024)

Bitcoin's price is ripping, which raises the question: how much will the Fourth Halving actually affect Bitcoin miners?

Happy Monday, y'all!

The bulls are on parade, friends.

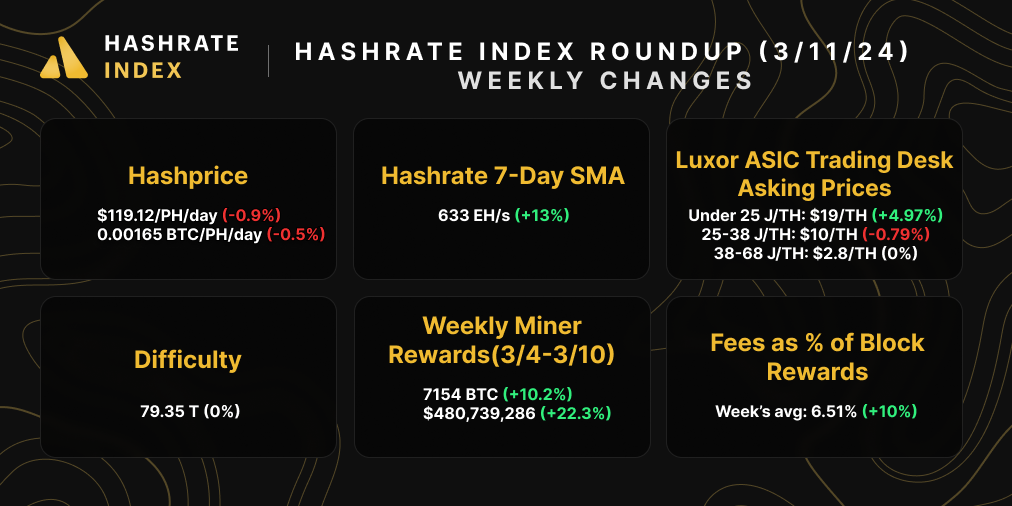

Bitcoin broke above its all-time high today, surging as high as $72,700 to set a new record. As a result, hshprice is riding high too, rising to $119/PH/day on the bullish price action.

So far in Q1-2024, Bitcoin's average USD-denominated hashprice has been $88/PH/day. So long as this doesn't drop below $81/PH/day (Q4-2023's average), this quarter is on track to post the highest average hashprice since Q3-2022.

The data point serves as a testament to the stunning reversal in fortune that Bitcoin miners have experienced in the current bull market, and it also calls into question just how much hashrate may come offline following the Fourth Halving in April.

To demonstrate the point, let's posit a hypothetical for what would happen to the average miner if the Fourth Halving happened today. Hashprice would drop to $59.50/PH/day, a level that miners experienced as recently as mid-October of last year. Now, let's assume that the average miner is operating with $0.06/kWh power and has a fleet efficiency of 31 J/TH (a figure we derived from Coin Metric's MINE-MATCH nonce analysis). Under this hypothetical, the average miner would still be earning $14.90 for every petahash of computing power they employ – not exactly a feast, but not a famine, either. Going further, with a fleet efficiency of 31 J/TH, the average miner would have a breakeven power cost of $0.08/kWh if hashprice were $59.50/PH/day

If Bitcoin's price stays abreast of the two difficulty adjustments that will take place between now and the Fourth Halving, it's entirely plausible that an insignificant amount of hashrate will come offline in the immediate aftermath of the event.

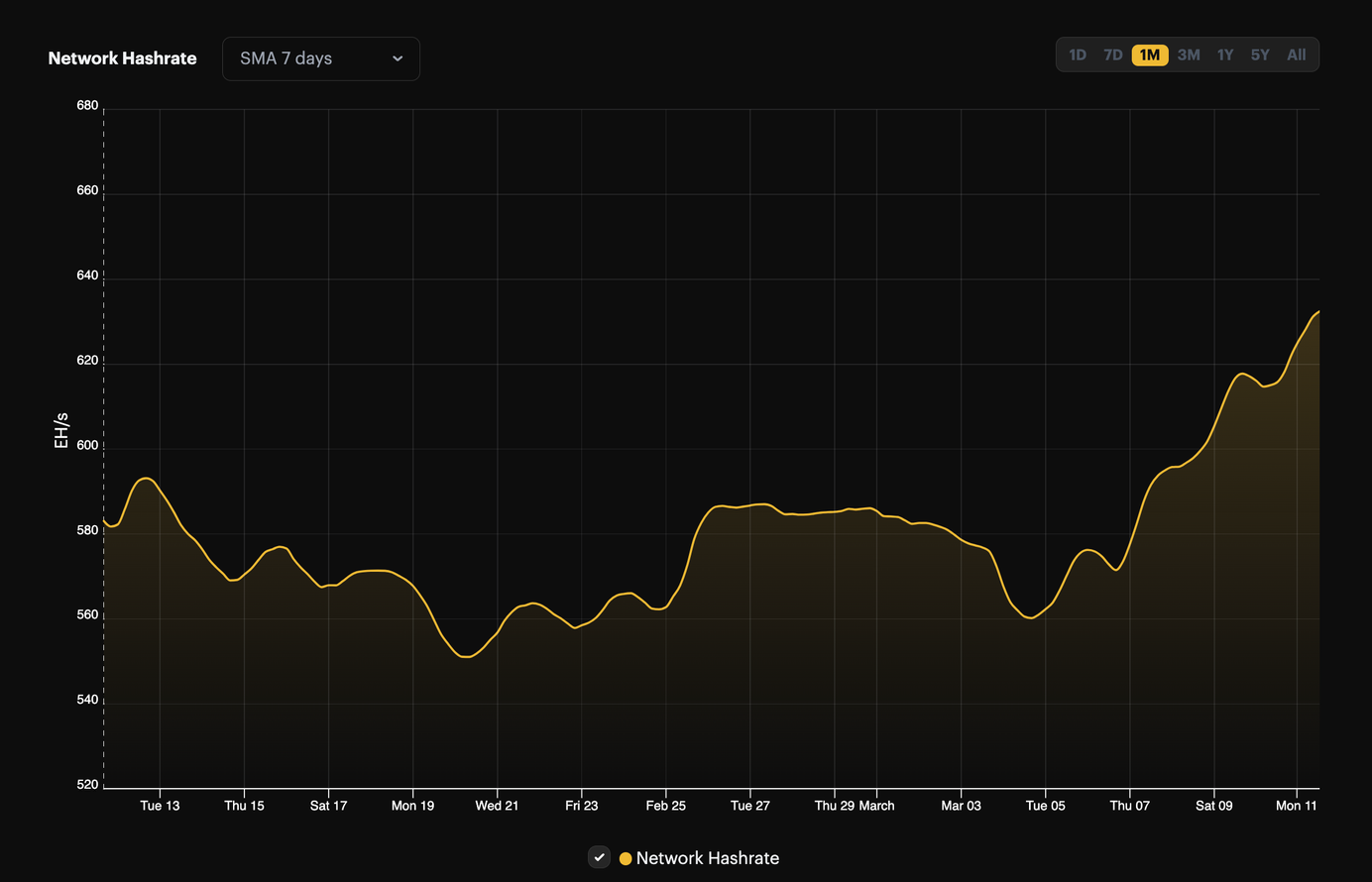

We'll see where difficulty is before the Halving, though, because miners are tearing through blocks currently as they deploy ever-more hashrate to take advantage of a juicy hashprice. With blocks coming in at 9 minutes and 24 seconds on average this difficulty epoch, the next adjustment in two days could be in the ballpark of 6.4%.

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting orders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

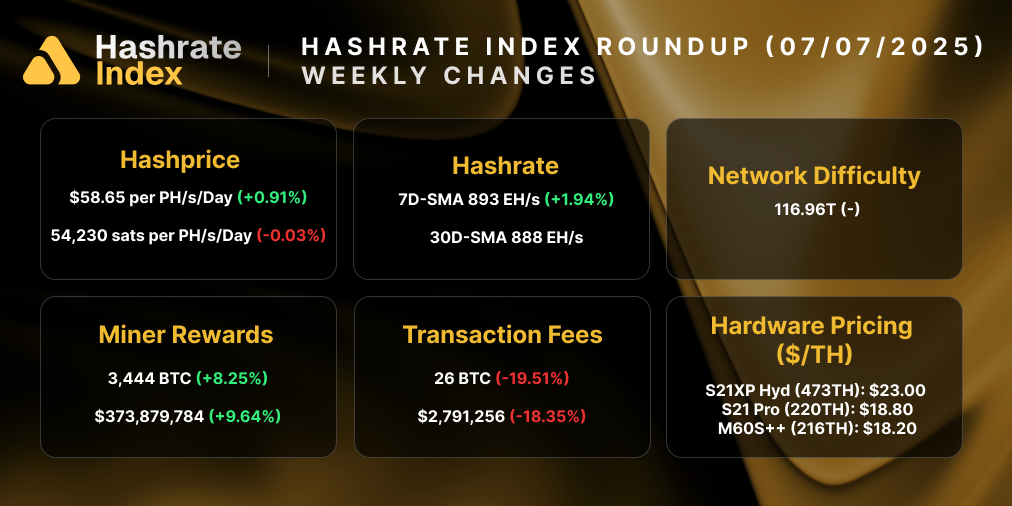

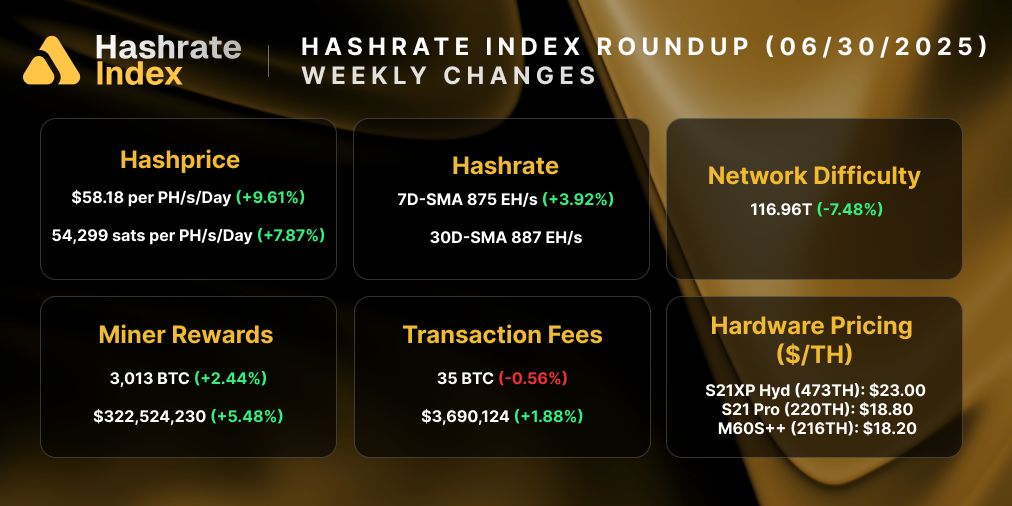

Bitcoin Mining Market Update

It's mostly a sea of green for this week's market update. In the ASIC market, next-gen models saw substantial price increases, while new-gen models fell in price as miners are increasingly factoring in post-halving profitability to their ASIC procurement. Transaction fees rose moderately, hashrate rose substantially, and hashprice was essentially flat.

Bitcoin Mining News

Here are last week's top headlines for Bitcoin mining news:

- President Biden Again Proposes Crypto Mining Tax, 'Wash Sale Rule' for Digital Assets in New Budget

- Miners continue money-conscious moves ahead of the Bitcoin halving

- Hut 8 Shuts Canadian Bitcoin Mining Site to Strengthen Efficiency and Financials

- Kungsleden, Inc. agreed to acquire Cathedra Bitcoin Inc. in a reverse merger transaction

Bitcoin Mining Stocks Update

In a nearly-unprecedented shift, Bitcoin mining stocks have been trading inversely to bitcoin's price over the last two weeks. Every stock but two in our update is red this week, and our Crypto Mining Stock Index fell 5.4% over the week.

Weekly changes to Bitcoin mining stocks:

- RIOT: $11.78 (-9.52%)

- HUT: $7.08 (-14.39%)

- BITF: $2.39 (-7%)

- HIVE: $3.13 (-3.13%)

- MARA: $20.64 (-16.64%)

- CLSK: $16.91 (+5.82%)

- IREN: $5.08 (-5.08%)

- CORZ: $3.71 (-3.64%)

- WULF: $1.82 (-1.63%)

- CIFR: $3.16 (+2.60%)

- BTDR: $6.33 (-4.95%)

- SDIG: $4.44 (-9.20%)

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.