Hashrate Index Roundup (July 8, 2024)

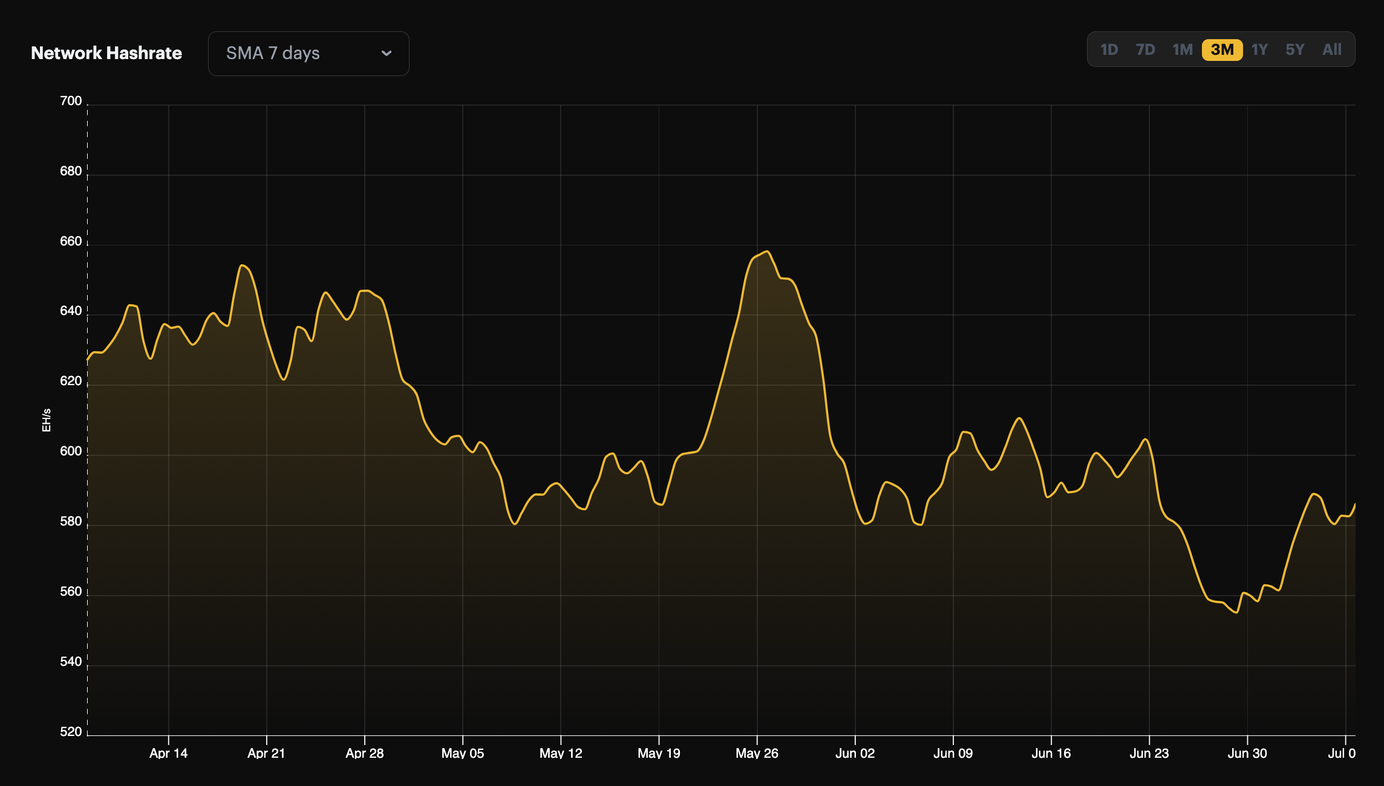

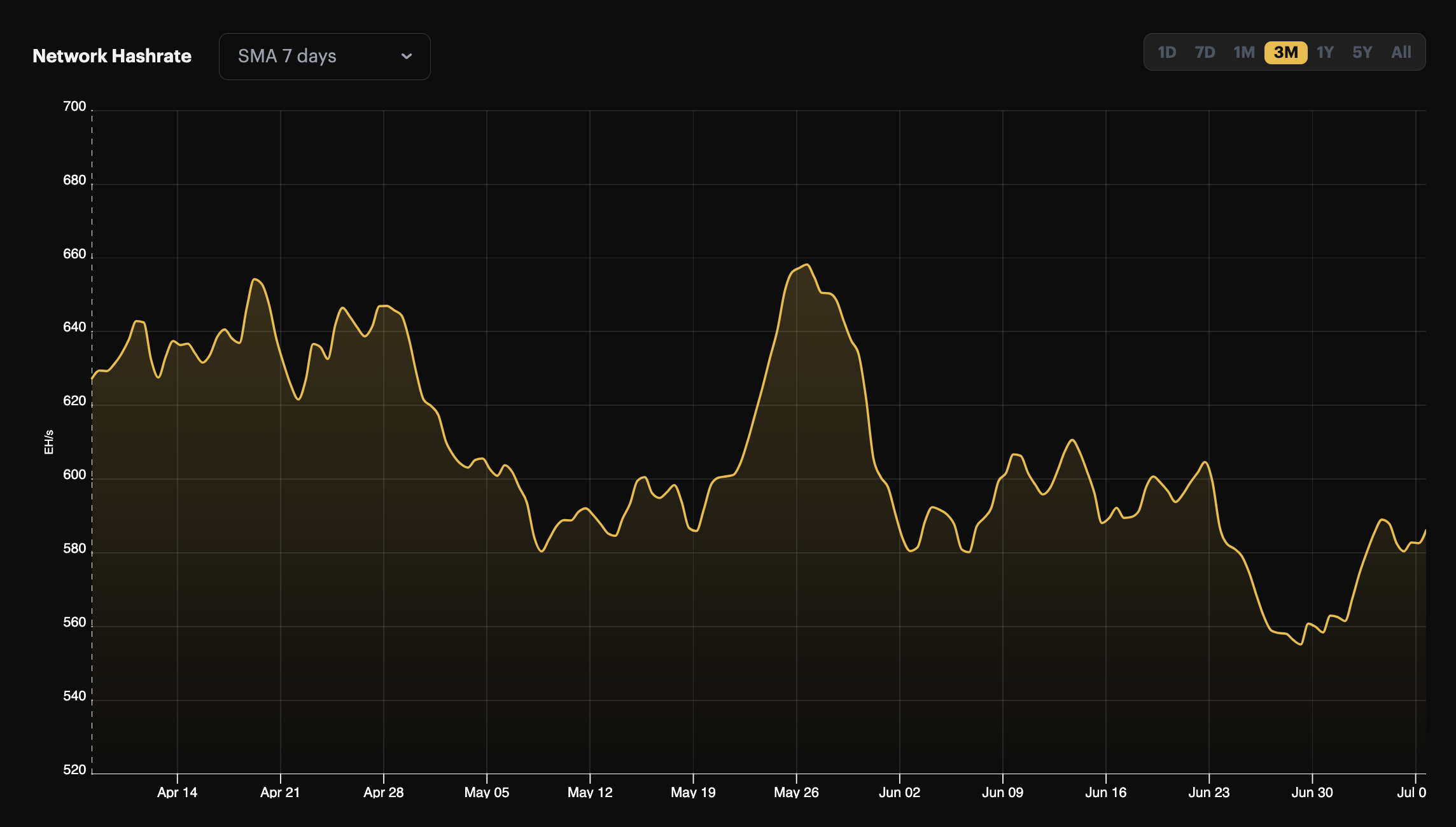

Hashprice hit a new all-time low last week, and Bitcoin's hashrate continues to be all over the place.

Happy Monday, y'all!

It's getting choppy out there, friends.

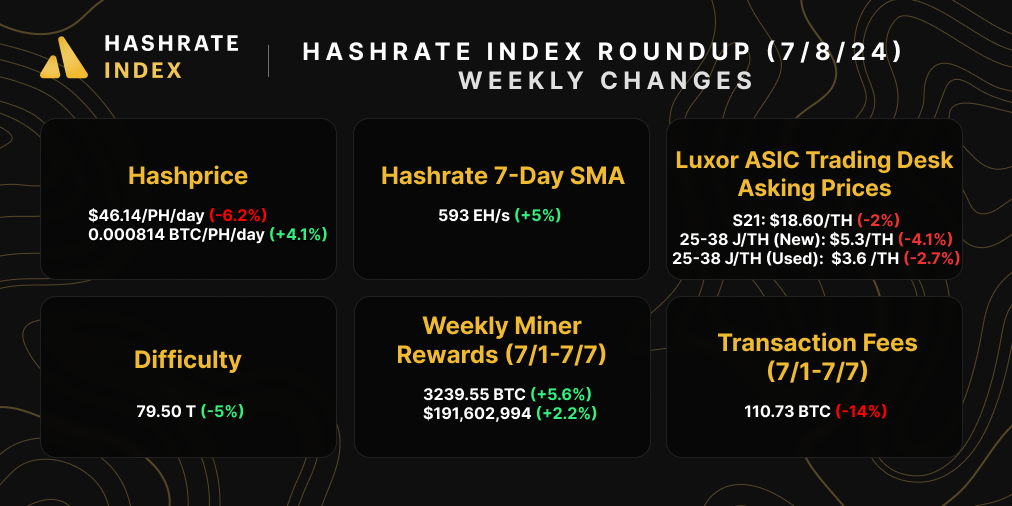

As most of you already know, Bitcoin's price took a tumble last week amid ongoing liquidations from the German government. Bitcoin is floating just above $56,000 as a result, and this is bad-bad-not-good for hashprice – so bad, that hashprice revisited its all-time low last week, falling to $44.31/PH/Day.

And hashprice graced this low despite a 5% downward difficulty adjustment on the 4th of July. Given the drawdown in Bitcoin's price, this downward adjustment caused fewer fireworks than miners had hoped it would.

Still, last week's adjustment was the third negative adjustment in a row. The last time we saw so many consecutive negative adjustments was the summer of 2021, when China's Bitcoin mining ban was in full swing. This time, the streak follows a tumultuous summer for Bitcoin's hashrate in the aftershock of the Fourth Halving. Since the event, Bitcoin's hashrate has fallen 10%. That said, it started to rise from the depths of its multi-month low last week.

As we enter the hottest period of the year in the US, heatwaves could exacerbate the hashrate stagnation. For Q3-2024, changes to Bitcoin's hashrate will result from a constant tug-of-war between heat-related curtailment, hashprice volatility, and miners deploying new ASICs.

Let the games begin.

Sponsored by Luxor Firmware

At $45/PH/Day, hashprice is close to – or at– breakeven for many miners. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

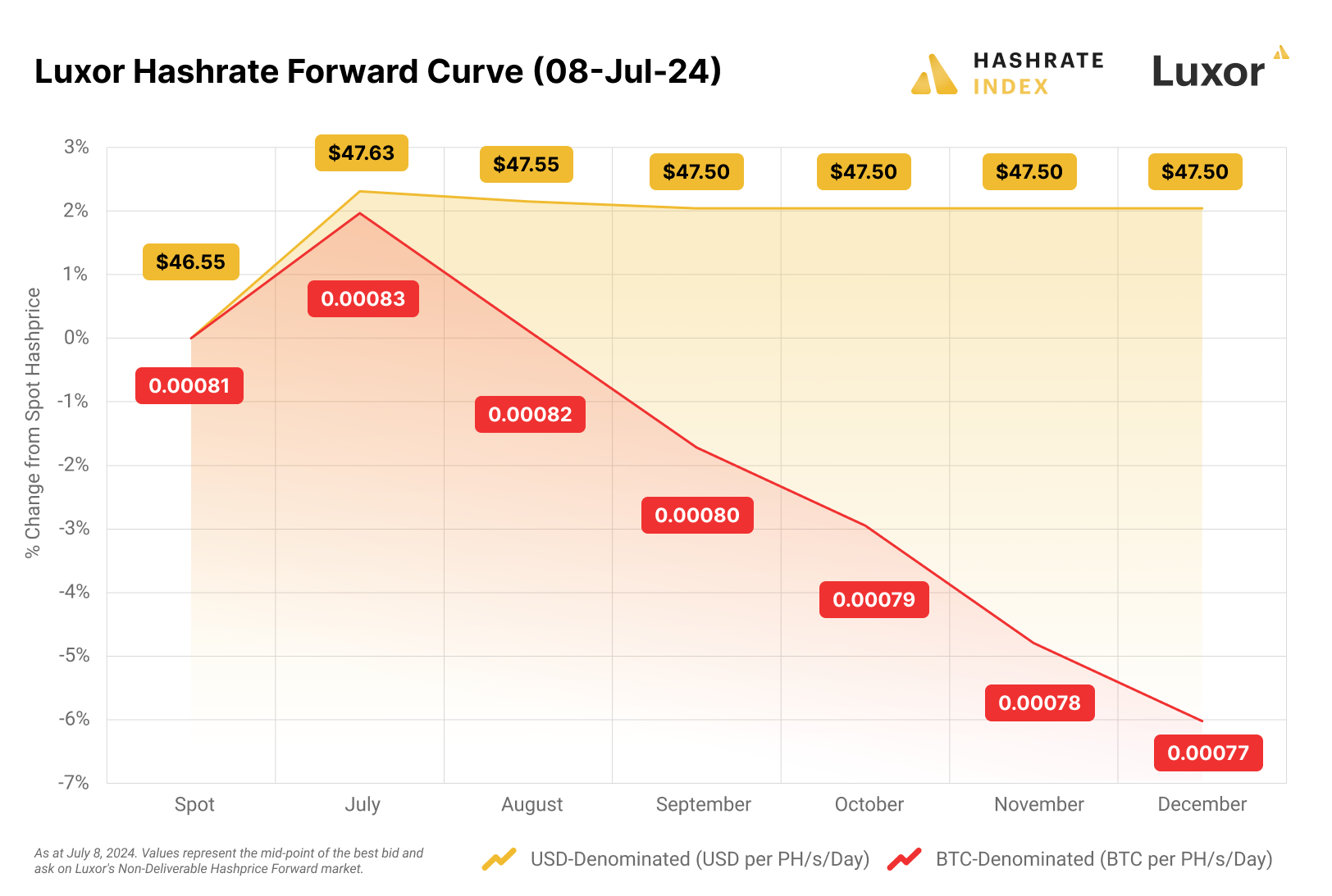

Luxor Hashrate Forwards Market Update

For this week's Luxor's Hashrate Forwards markets update, USD contracts are flat from July on, while BTC contracts are trading below spot.

Bitcoin Mining Market Update

A bit of a salad for this week's market update. Hashprice is down in USD terms but up in BTC terms thanks to last week's -5% difficulty adjustment. Block times are speeding up again as hashrate rises, in part thanks to the adjustment, so mining rewards are actually up, not down as we would expect. The ASIC market continues to correct.

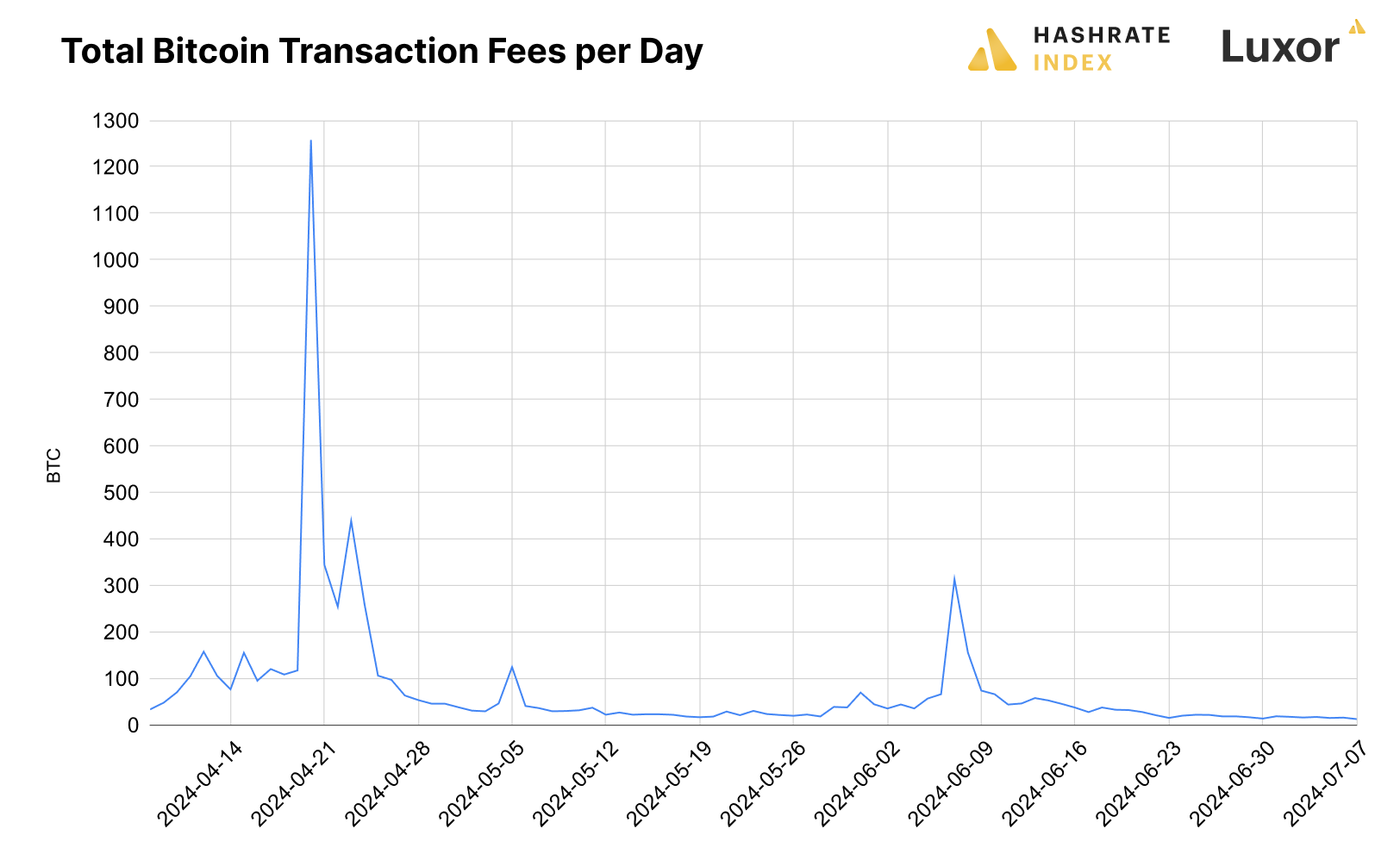

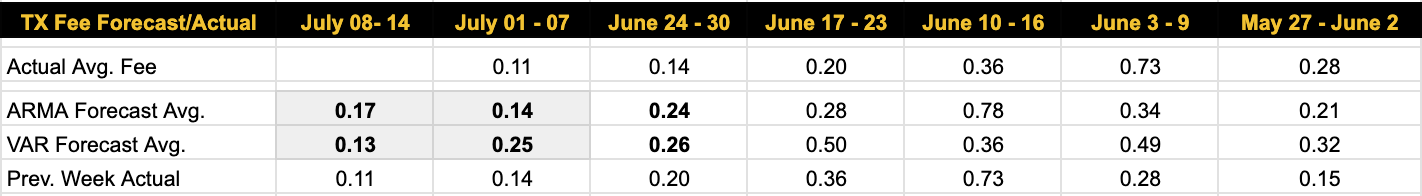

Bitcoin Transaction Fee Update

Transaction fees are still receding, so much so that volumes are the thinnest they've been since Q3-2023. Yesterday, the Bitcoin network processed 12.32 BTC in transaction fees, the lowest level in nearly 9 months (October 15, 2023 witnessed 11.4 BTC in transaction fees).

Unsurprisingly, our projection models are reflecting this bearish transaction fee action. For this week, the VAR model forecasts 0.13 BTC per block – the ARMA, 0.17 BTC.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Bitcoin Miner Bitfarms Names New CEO as Riot Takeover Attempt Heats Up

- Private Equity Giants Are Circling Bitcoin Miners on AI Allure

- Germany Still Holds $1.3B Worth of Bitcoin, Blockchain Data Show

Bitcoin Mining Stocks Update

Bitcoin mining stocks are a mixed bag this week. Some are in the red, although not nearly as much as we would expect given Bitcoin's price drawdown. Those that are in the green are largely those companies that have announced an AI/HPC strategy. Our Crypto Mining Stock Index is down 1%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $9.40 (+0.27%)

- HUT: $17.48 (+15.73%)

- BITF: $2.66 (-0.56%)

- HIVE: $3.42 (+8.92%)

- MARA: $19.50 (-4.18%)

- CLSK: $15.42 (-5.80%)

- IREN: $14.63 (+26.67%)

- CORZ: $10.36 (+11.22%)

- WULF: $6.47 (+18.66%)

- CIFR: $4.62 (+9.09%)

- BTDR: $12.42 (+19.42%)

- SDIG: $3.86 (-11.47%)

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.