Hashrate Index Roundup (July 15, 2024)

Bitcoin surged bigly over the weekend, and hashrate may have found a bottom.

Happy Monday, y'all!

Bitcoin is showing signs of life after tanking to a monthly low of $54,000 at the beginning of July. Bitcoin's current rebound began in earnest on Saturday, curiously coinciding with an assassination attempt on former President Donald Trump at a rally in Butler, Pennsylvania. At the time of writing, Bitcoin is just shy of $64,000 and up 12% over the week and 6% over 24 hours.

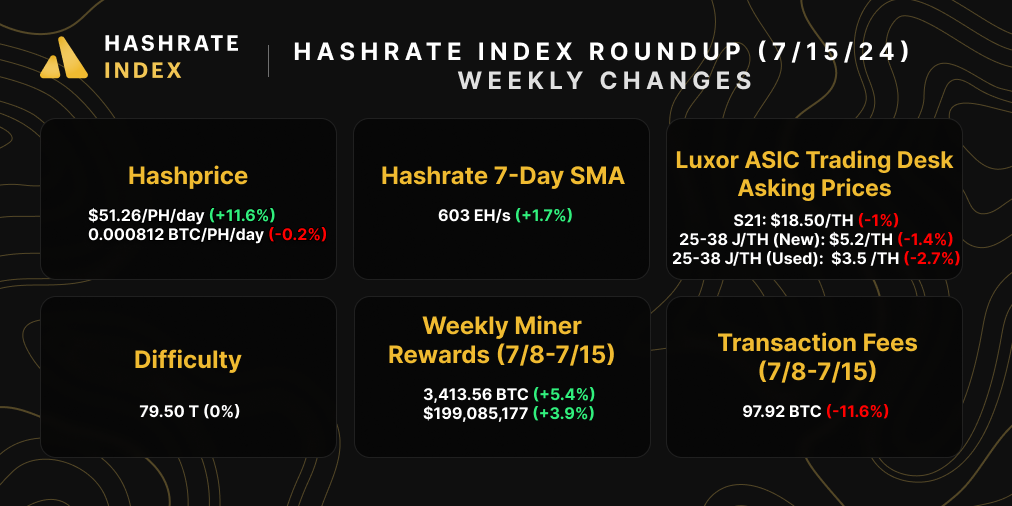

The rally is breathing much-needed life into hashprice, which is back above $50/PH/Day at the time of writing. Hashprice is still down on the monthly, but a beleaguered Bitcoin mining industry will take all the help it can get right now.

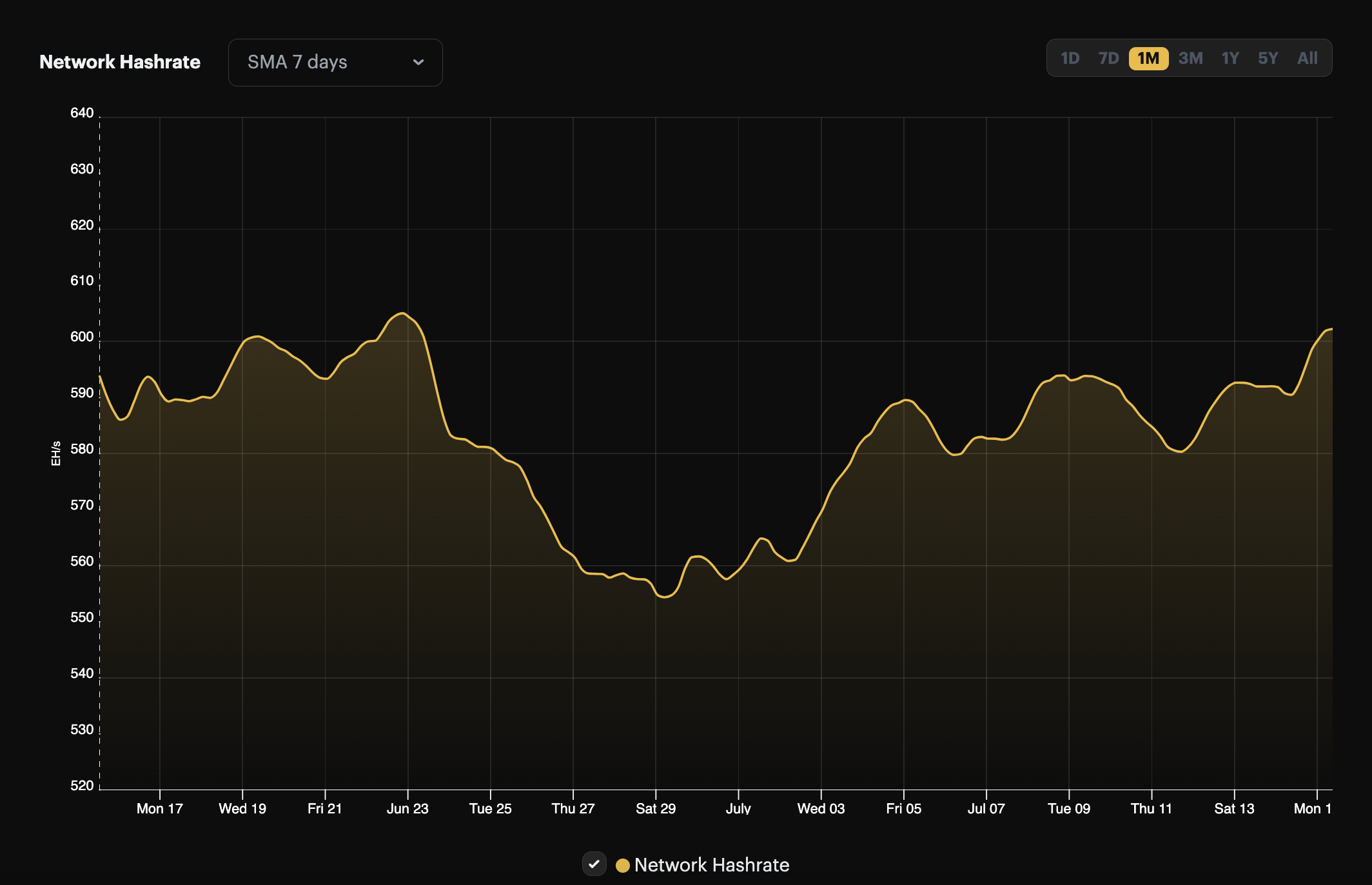

Bitcoin and hashprice aren't the only thing that are rallying. Bitcoin's 7-day average hashrate is back above 600 EH/s for the first time since June 23. It's unclear whether or not the network is out of the woods just yet, but maybe hashrate has found a post-Halving bottom – but we should probably wait to see how brutal the summer will be on the grid in the US before we can be sure.

As it stands, with hashrate rebounding, Bitcoin's difficulty is poised for a nasty positive adjustment this week. With block times at 9 minutes and 36 seconds on average, our estimate projects that the next adjustment in roughly 4 days could be to the tune of 4% or more. So miners should enjoy the (albeit very tiny) rally to hashprice while it lasts, because we're likely going back below $50/PH/Day soon unless Bitcoin continues marching upward or transaction fees take a turn for the better.

Sponsored by Luxor Firmware

At $50/PH/Day, hashprice is close to – or at– breakeven for many miners. Improve the hashrate and efficiency of your S19 and S21 series rigs by downloading LuxOS firmware today!

Luxor Hashrate Forwards Market Update

For this week's Hashrate Forwards market update, USD and BTC contracts are trading in backwardation.

Bitcoin Mining Market Update

A mixed bag for this week's update. Hashprice is up bigly USD terms but it's virtually unchanged in BTC terms. Block times are speeding up again as hashrate rises, so mining rewards are up in BTC terms despite BTC hashprice being slightly down, and the ASIC market continues to fall across the board.

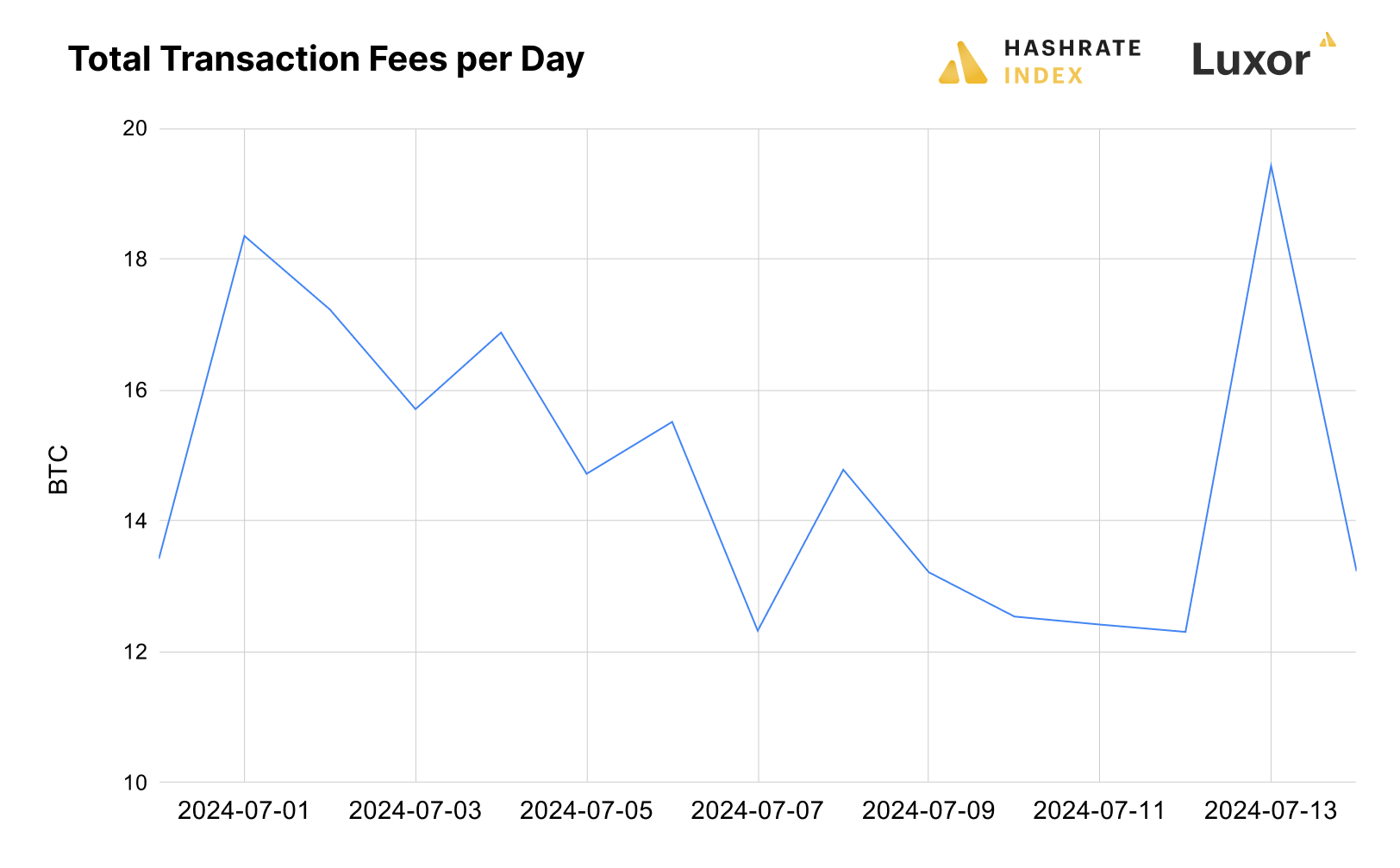

Bitcoin Transaction Fee Update

Transaction fees are still in the gutter, which is great for users but not so good for miners. Over the past week, Bitcoin miners reaped a measly 97.92 BTC in transaction fees, an 11.6% decrease from the prior week's 110.73 BTC.

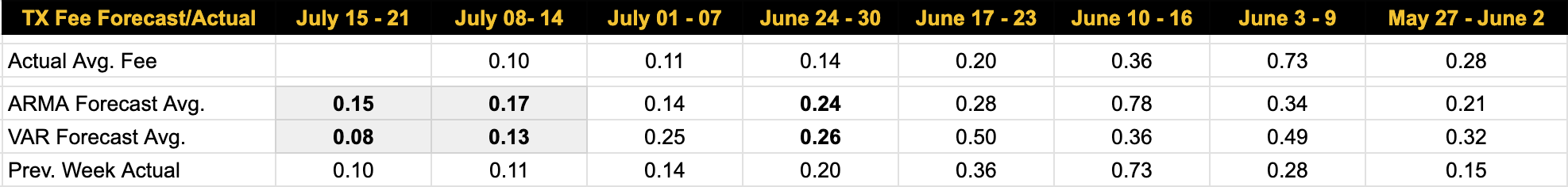

Unsurprisingly, our projection models are still bearish in light of this continued decline. For this week, the VAR model forecasts 0.08 BTC per block (the lowest since we started recording these projections), and the ARMA estimates 0.15 BTC.

Bitcoin Mining News

Here are the latest top headlines for Bitcoin mining news:

- Bitcoin miner Bitfarms sets vote date on Riot's attempted takeover step

- Crypto stocks surge alongside Bitcoin price rally

- Bernstein says 'Goldilocks scenario' is emerging for bitcoin miners amid 'Trump factor'

Bitcoin Mining Stocks Update

Bitcoin mining stocks surged to open the week in response to Bitcoin's own price rise. All of the stocks in our update are up save one, but our Crypto Mining Stock Index is flat week-over-week.

Weekly changes to Bitcoin mining stocks:

- RIOT: $11.48 (+21.48%)

- HUT: $20.00 (+13.25%)

- BITF: $2.77 (+2.59%)

- HIVE: $3.84 (+11.95%)

- MARA: $24.58 (24.39%)

- CLSK: $18.30 (+16.78%)

- IREN: $12.00 (-19.06%)

- CORZ: $11.01 (+6.48%)

- WULF: $6.00 (+2.06%)

- CIFR: $5.98 (+27.23%)

- BTDR: $11.48 (-7.79%)

- SDIG: $3.95 (+1.02%)

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.