Hashrate Index Roundup (January 7, 2024)

We're ringing in the new year with all-time highs for Bitcoin's hashrate and difficulty.

Happy New Year, y'all!

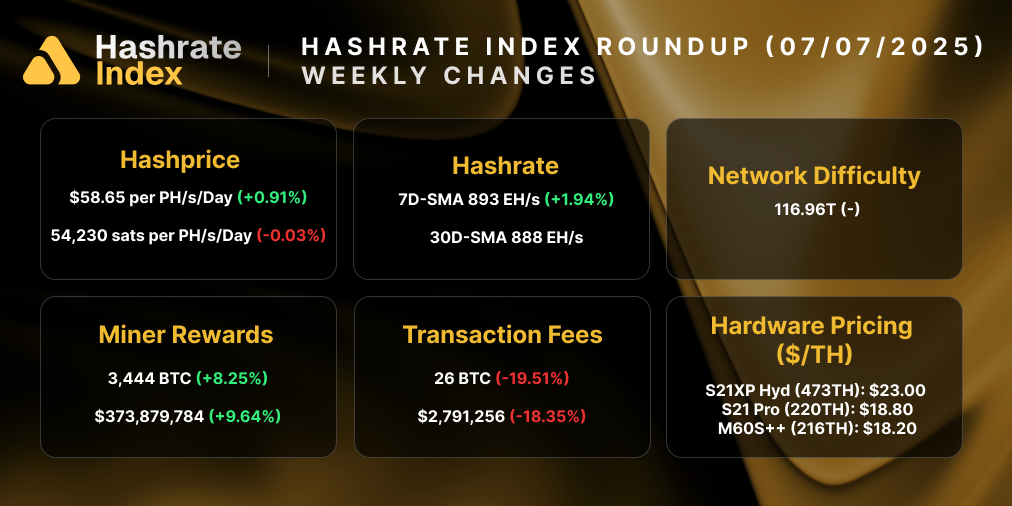

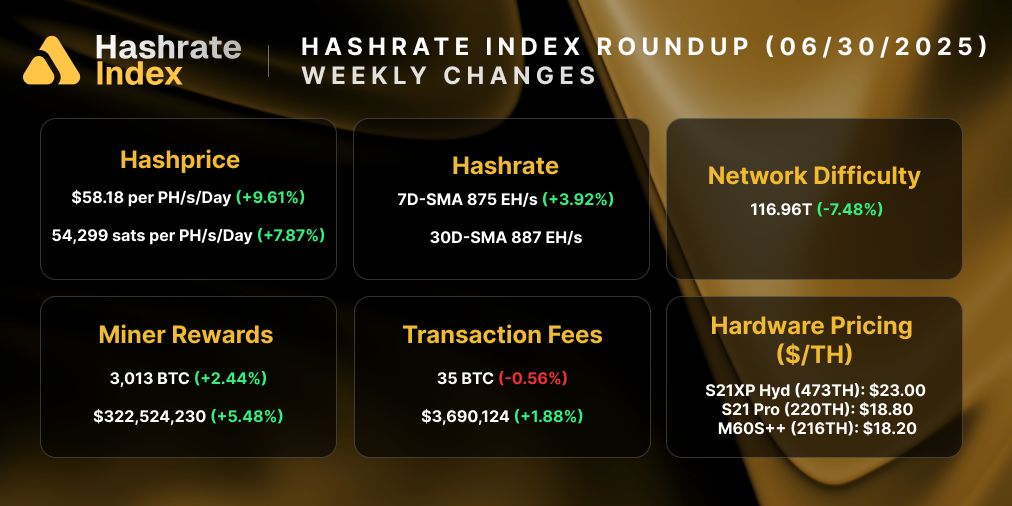

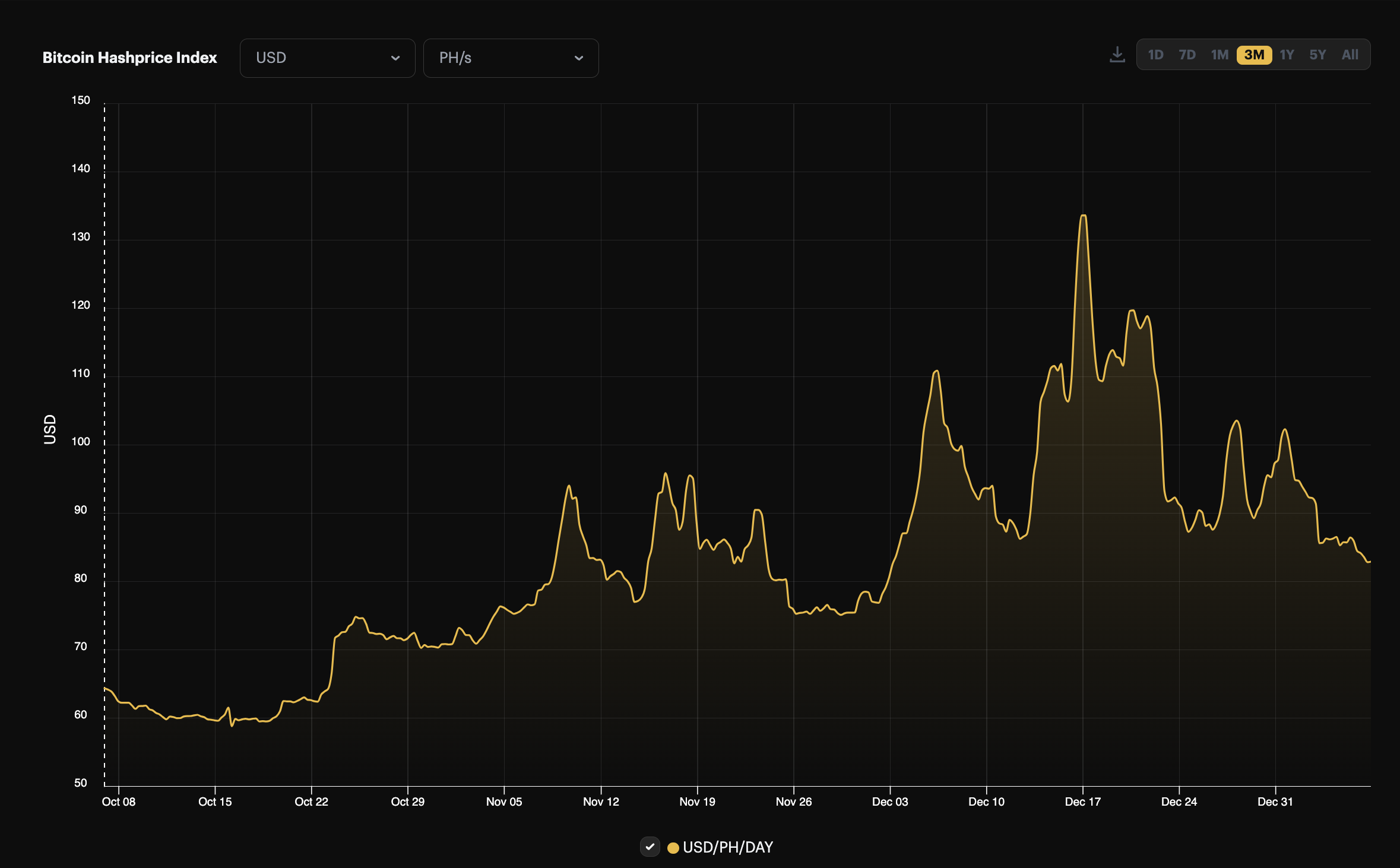

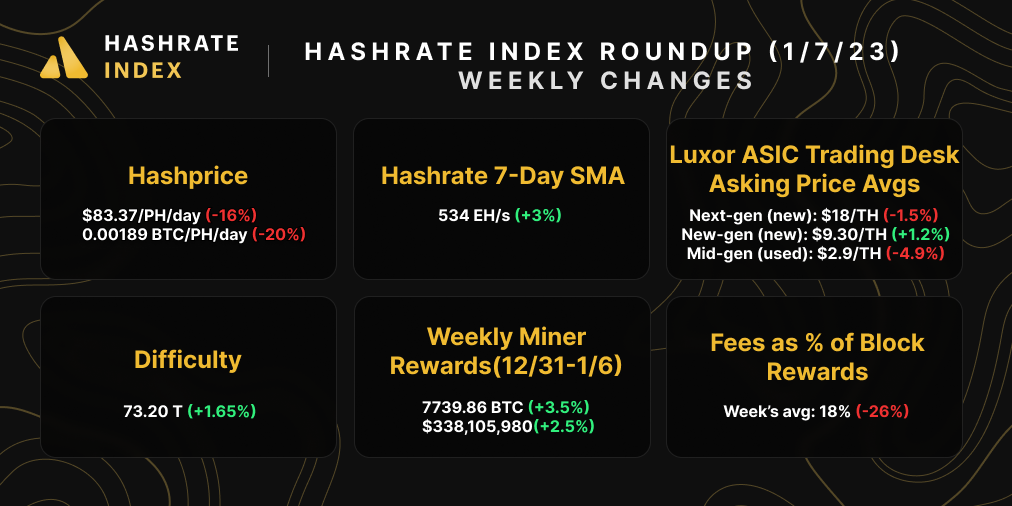

Bitcoin's hashprice is cooling down to start 2024. Since New Year's Eve, hashprice has fallen 16.4% from $99.50/PH/day to $83/PH/day. The decline follows an ebullient Q4-2023 where hashprice averaged $81/PH/day, the highest quarterly average of 2023.

As spot hashprice drops closer to its Q4-2023 average, a deflation in transaction fees is leading the decline. From November through December – the period when hashprice really took off last quarter as a result of increased inscription minting – transaction fees averaged 20.5% of all block rewards; last week, this share dropped to 14%. That's still well above 2022's average of 1.65%, but it's enough of a decrease from Q4-2023 to contribute to the current reduction in hashprice.

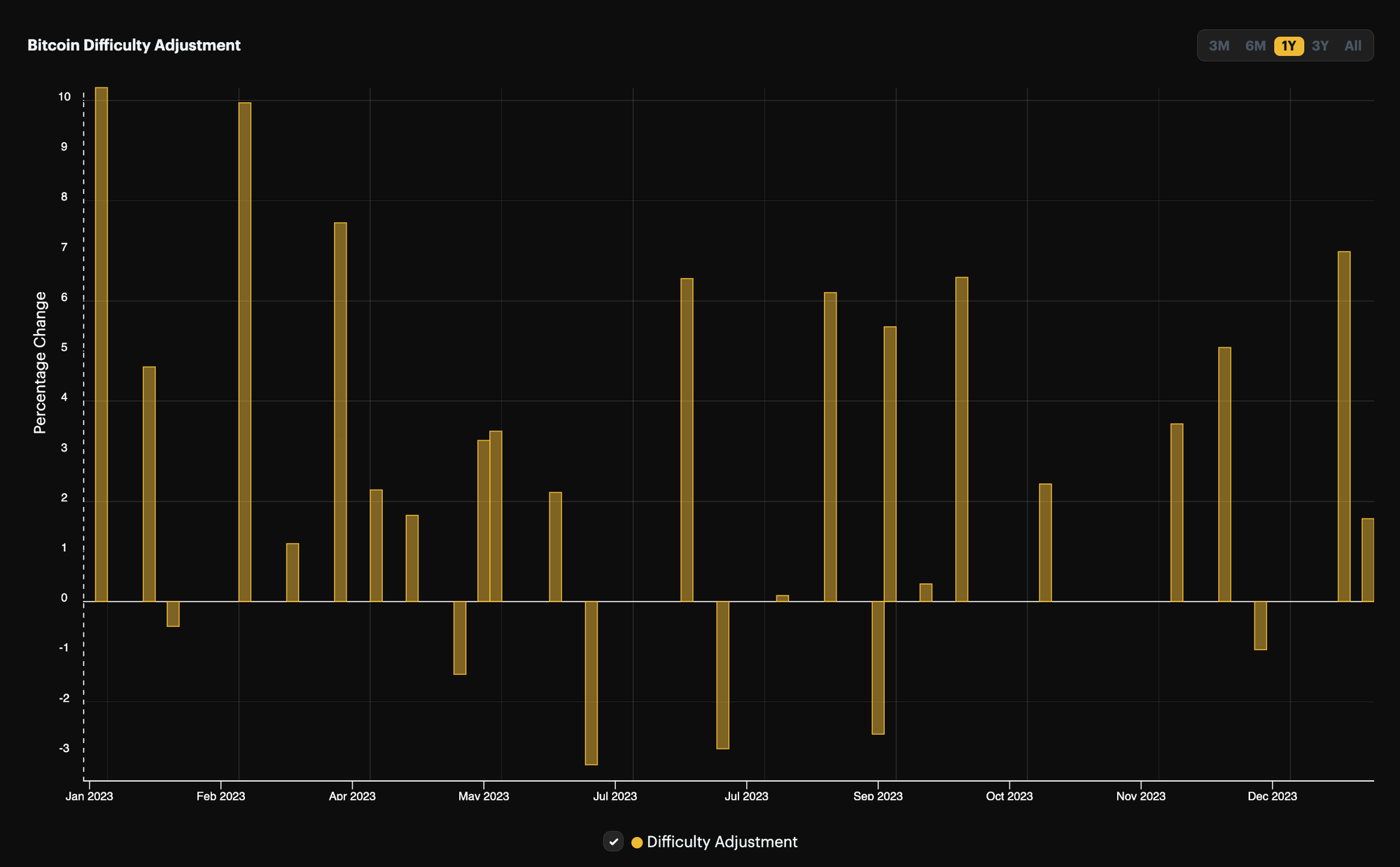

The other contributing factor, per usual, is Bitcoin's ever-rising difficulty. The Bitcoin network's difficulty had its first adjustment of 2024 on January 5, rising 1.65% to an all-time high of 73.20 T. This positive adjustment followed a 6.98% rise on December 22, 2023, the fourth highest adjustment of last year, and it came on the back of Bitcoin's hashrate hitting an all-time high of 549 EH/s on the 7-day average and 525 EH/s on the 30-day average this past week.

Last quarter (and really, most of last year for that matter) was a godsend for a beleaguered Bitcoin mining industry which entered 2023 on a low note. Now, hashprice is waning, difficulty is rising, and Bitcoin's blocks are ticking ever closer to the Fourth Halving. We're just over 15,000 blocks away from the event, which should take place around April 21, 2024 (give or take a couple of days).

The Halving harbors the potential to bring miners back to the dog days of all-time low hashprice. Of course, there's always the hope of an extended bull market to keep margins afloat, a tantalizing prospect that's perhaps not out of the question considering the reportedly-imminent Bitcoin ETF approval.

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting preorders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

Bitcoin Mining Market Update

This week's market update is lit up like Christmas lights: an even mix of red and green. As stated earlier, transaction fees dropped significantly from the prior week. In the ASIC miner market, changes in asking prices were mixed, with new-gen rigs rising, next-gen rigs falling marginally, and mid-gen rigs falling significantly.

Bitcoin Mining News

Here are last week's top headlines for Bitcoin mining news:

- The African village mining Bitcoin

- Core to Settle $34M Claims Stemming from 70K Non-Existent Miners

- Judge declines to toss suit over Faulkner County crypto mine

- Bitcoin Miner CleanSpark Plans to Launch In-House Trading Desk This Year

Bitcoin Mining Stocks Update

After a blockbuster 2023 in which most Bitcoin mining stocks generated triple digit returns, public miners have had a rough start to 2024. Every miner in our update is down over the first trading week of the year, and our Crypto Mining Stock Index fell 9%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $14.83 (-16.87%)

- HUT: $11.90 (-27.5%)

- BITF: $2.72 (-19.05%)

- HIVE: $4.15 (-22.28%)

- MARA: $24.12 (-16.71%)

- CLSK: $10.21 (-22.87%)

- IREN: $6.19 (-28.85%)

- WULF: $1.93 (-11.87%)

- CIFR: $3.91 (-21.17%)

- BTDR: $8.11 (-38.75%)

- SDIG: $7.19 (-28.17%)

New From Hashrate Index

Hedging And Bitcoin Mining Risk Management

Over the years, as businesses have become more sophisticated in their operations, so too have their budgeting, risk management, financial analysis, and hedging strategies. Locking in revenues and commodity input costs through hedging has enabled these companies to plan operations more efficiently into the future and ensure sustainability and profitability.

Specifically, in the Bitcoin mining business, Bitcoin miners can now do the same. Miners are in the business of arbitrage - they aim to secure low energy input costs and high value Bitcoin outputs. These days, both the inputs (electricity) and the outputs (hashprice) can be hedged well ahead of time, enabling miners to budget and manage risk efficiently.

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.