Hashrate Index Roundup (January 29, 2024)

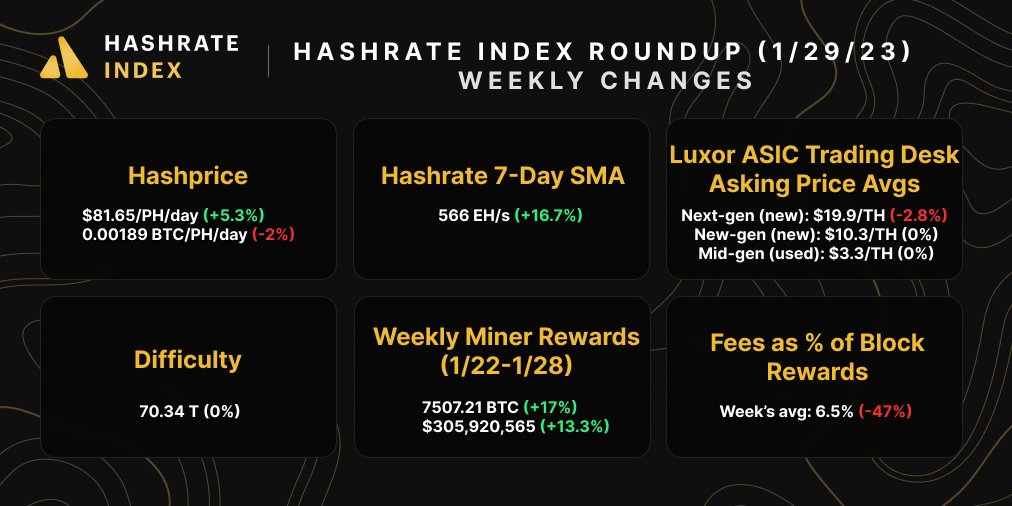

Bitcoin's hashrate hits an all-time high, and hashprice is back above $80/PH/day.

Happy Monday, y'all!

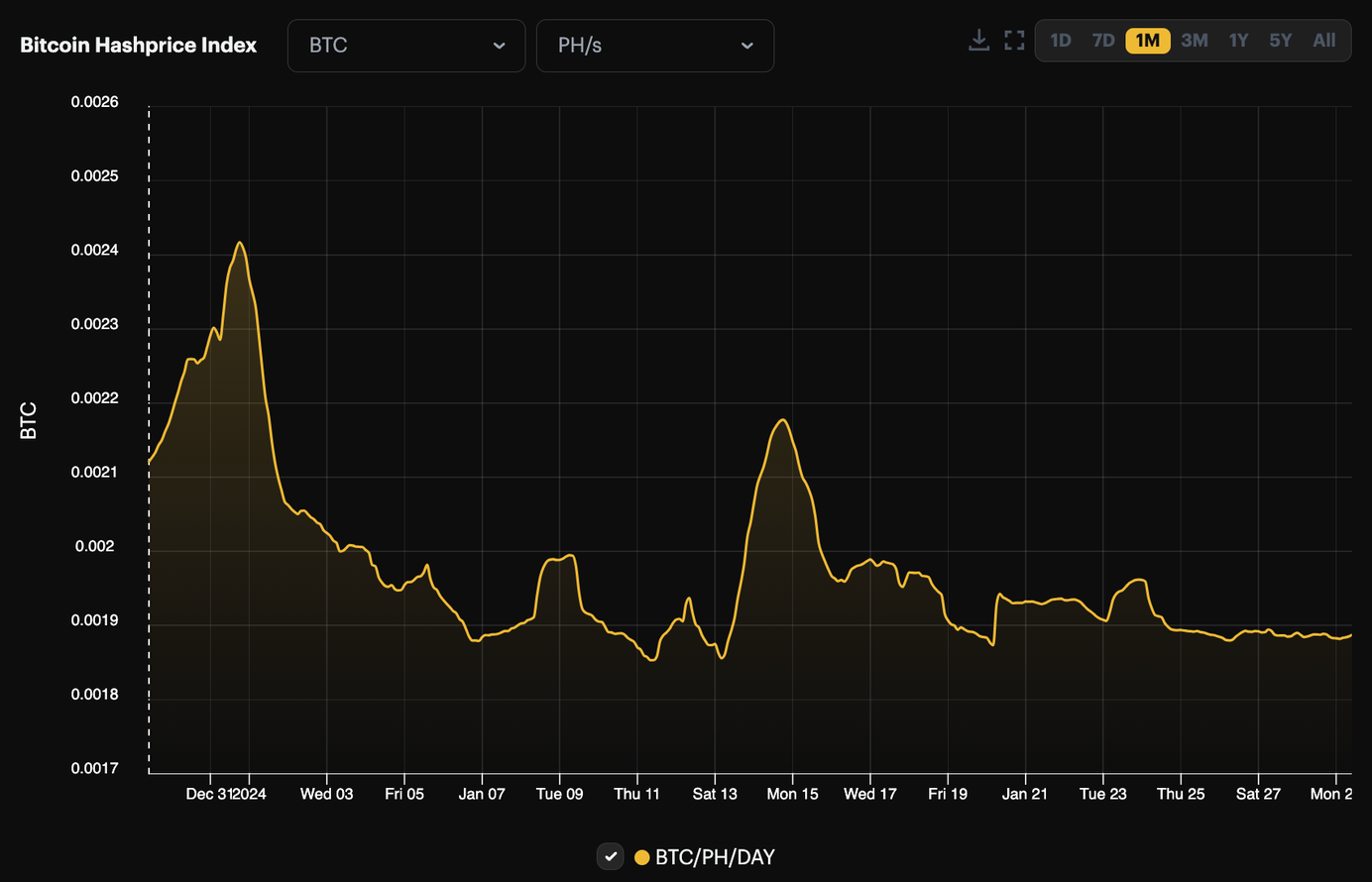

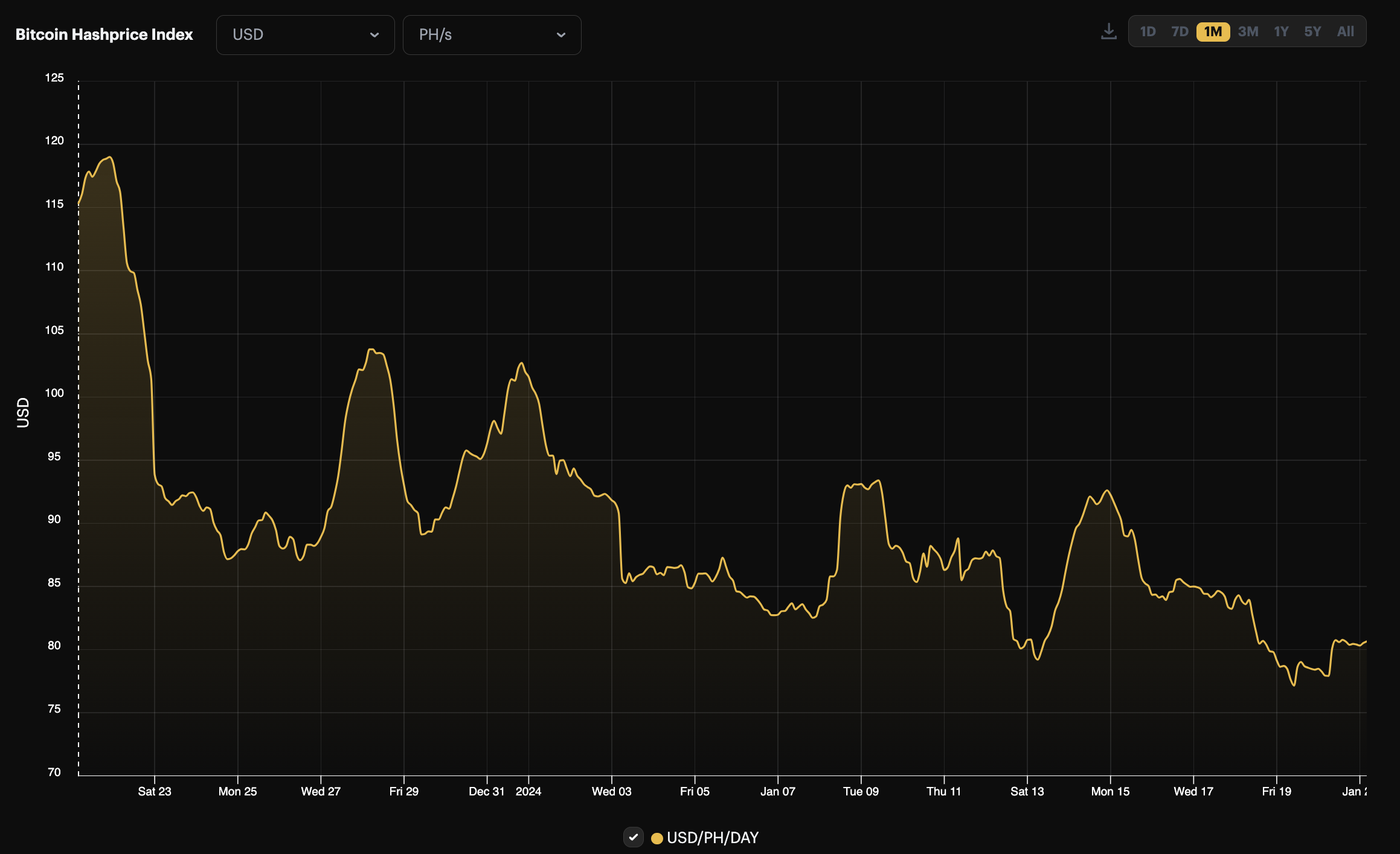

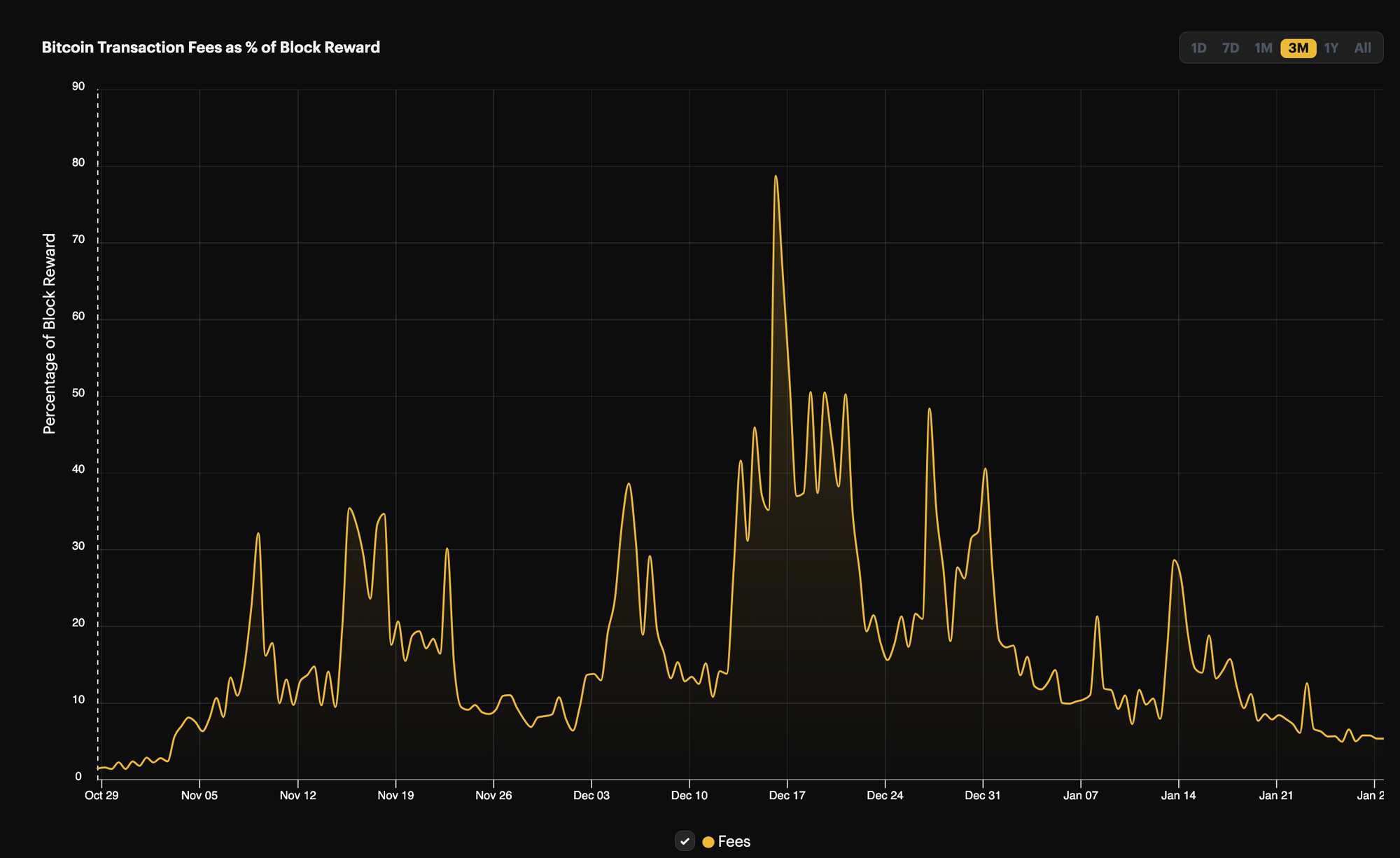

Hashprice hit a multi-month low last week, slumping to $73.96/PH/day on January 23. That was the lowest we had seen hashprice since the first week in November 2023, right before the biggest inscription minting frenzy ever pushed transaction fees – and by proxy, hashprice – on their longest run of the year. (To give an idea of just how lucrative the last two months of 2023 were for miners, Q4 was responsible for 63% ($501.8 million) of 2023’s total transaction fee rewards).

The hashprice dip coincided with Bitcoin's own price dropping below $39,000 for the first time since time since December 1, 2023, as well as a decrease in overall inscription activity. Fees as a percentage of block rewards are returning to their late October and early November levels. But Bitcoin's price is back above $36,000, so hashprice has rebounded back above $80/PH/day as a result.

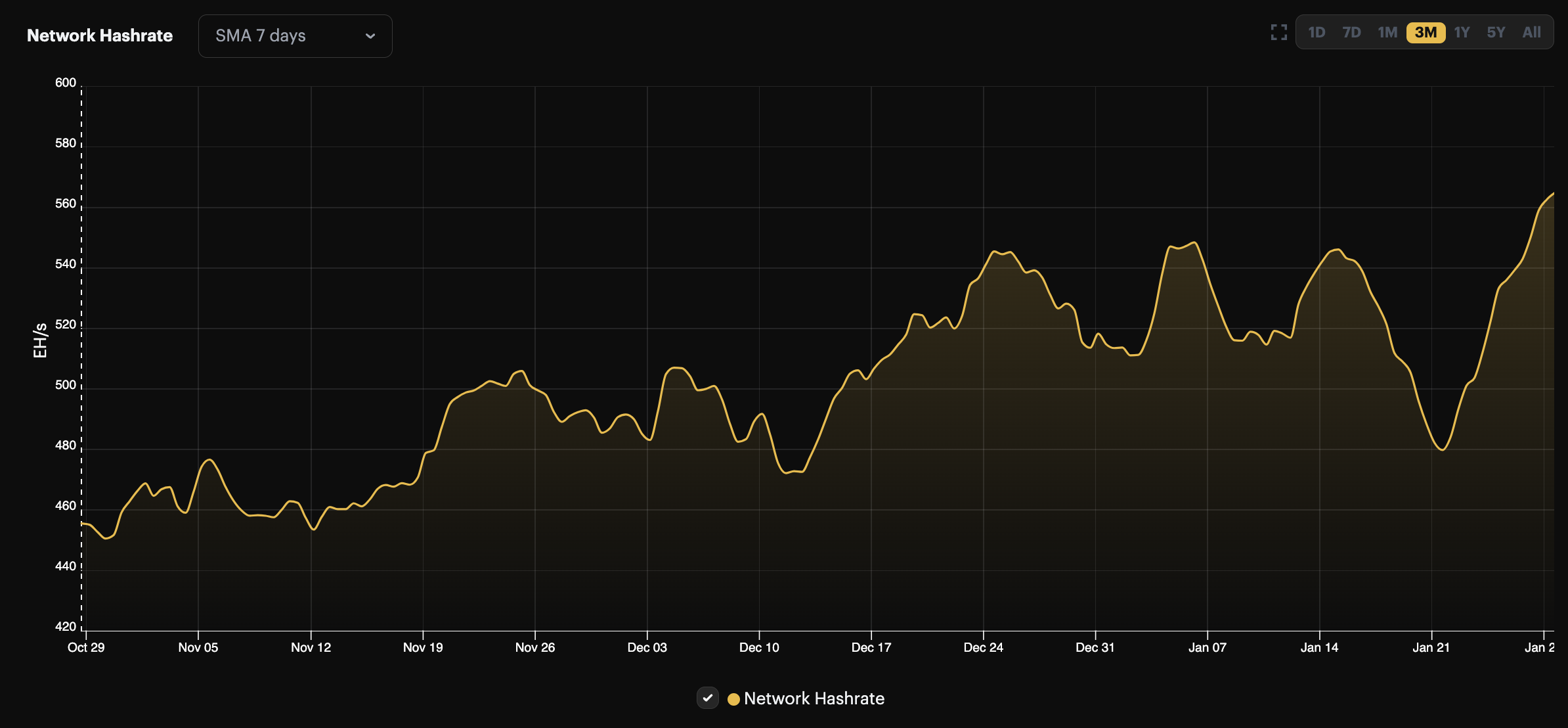

In other news, Bitcoin's hashrate is ripping again after tapering temporarily amid the arctic blast two weeks ago that gripped North America with bone-chilling temperatures. Today, Bitcoin's 7-day average hashrate hit an all-time high of 567 EH/s, and at 533 EH/s, the 30-day average is basically on-par with the all-time high set in early January.

Remember, on January 20, Bitcoin saw its largest downward adjustment since December 5, 2022 in response to the arctic blast-induced drop in hashrate. So with difficulty lowered and hashrate surging now, blocks are coming in at a blistering pace of 9 minutes and 13 seconds on average. As a result, we're currently estimating a whopping 8.5% difficulty adjustment, which would be the largest since February 24, 2023.

This would drop hashprice back below $80/PH/day unless Bitcoin's price increases substantially over the next three and a half days. Oh and the Halving is now less than three months away, too...are we having fun yet, y'all?

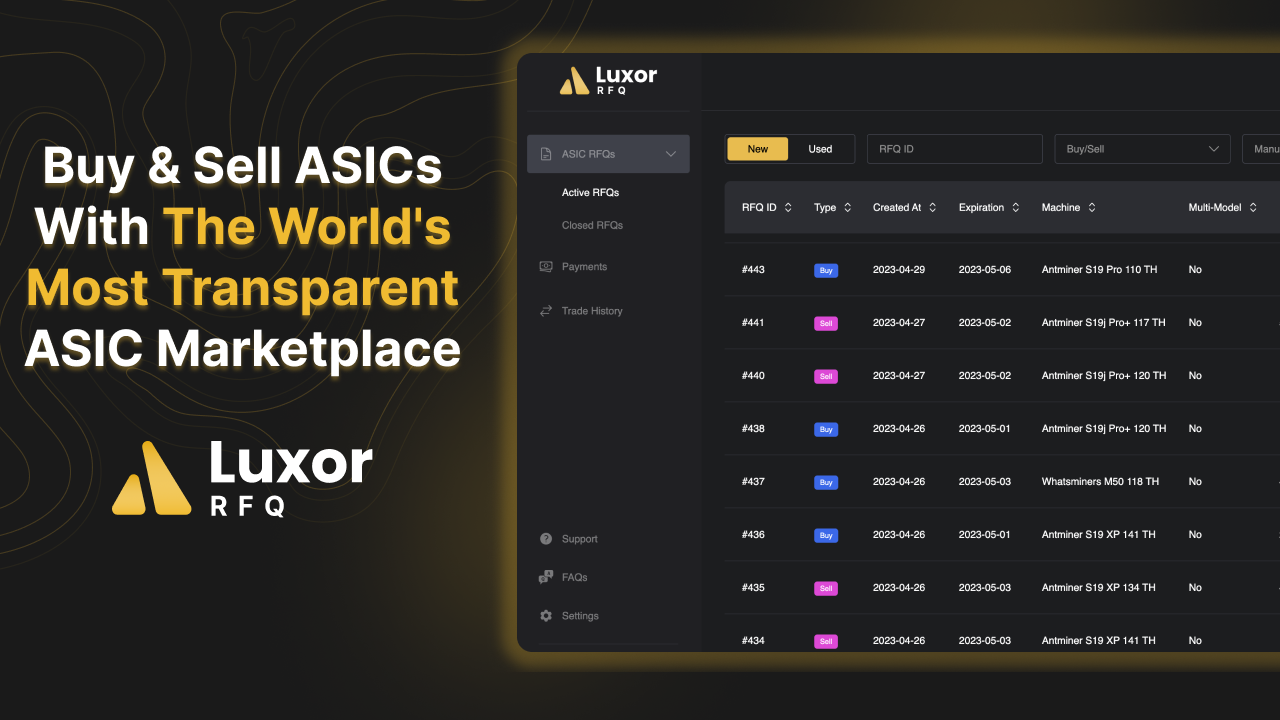

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting preorders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

Bitcoin Mining Market Update

A mixed bag for this week's market update with most data points leaning toward the green side. As we discussed above, transaction fees took a serious hit, with the week's average dropping below 7% for the first time in a while. Contrasting with last week, mining rewards were up over this past week, largely as a result of much-accelerated block times. In the ASIC miner market, new and mid-gen rigs didn't budge, but next-gen rigs saw a haircut, perhaps as a result of buyers factoring in the Halving block reward reduction as the event gets ever-closer.

Bitcoin Mining News

Here are last week's top headlines for Bitcoin mining news:

- Core Scientific returns to Nasdaq

- Academic Challenges United Nations Misleading Bitcoin Mining Study

- GRIID to Begin Trading on Nasdaq Global Market Under Ticker “GRDI”

- Swan Bitcoin Unveils Mining Unit as Parent Company Prepares to Go Public

Bitcoin Mining Stocks Update

Bitcoin mining stocks have bounced significantly over the last week in response to Bitcoin's own price rebound. Every miner in our update is up over the week, and our Crypto Mining Stock Index rose 5.7%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $11.55 (+12.90%)

- HUT: $8.42 (+27.68%)

- BITF: $2.40 (+18.23%)

- HIVE: $3.47 (+14.52%)

- MARA: $18.52 (+17.96%)

- CLSK: $8.53 (+24.71%)

- IREN: $4.48 (+7.43%)

- WULF: $1.88 (+38.09%)

- CIFR: $3.11 (+9.12%)

- BTDR: $8.99 (+37.04%)

- SDIG: $5.75 (+14.09%)

New From Hashrate Index

Bitcoin Mining Predictions for 2024

While the 2020 Halving didn’t directly cause the event, China’s 2021 Bitcoin mining ban and the subsequent Great Hashrate Migration have defined the Third Halving Epoch (2020-2024) and furnished the conditions for a mining market that has been markedly different from the Second Halving Epoch (2016-2020).

We believe that the Fourth Halving Epoch (2024-2028) will bring about even greater change and could be accompanied by yet another redistribution of Bitcoin’s hashrate to new geographies. For 2024 and the coming years, we (loosely) provide predictions in our latest article for Hashrate Index.

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.