Hashrate Index Roundup (January 21, 2024)

Gobs of hashrate came offline last week, and mining difficulty fell by its largest percentage since December 2022.

Happy Sunday, y'all!

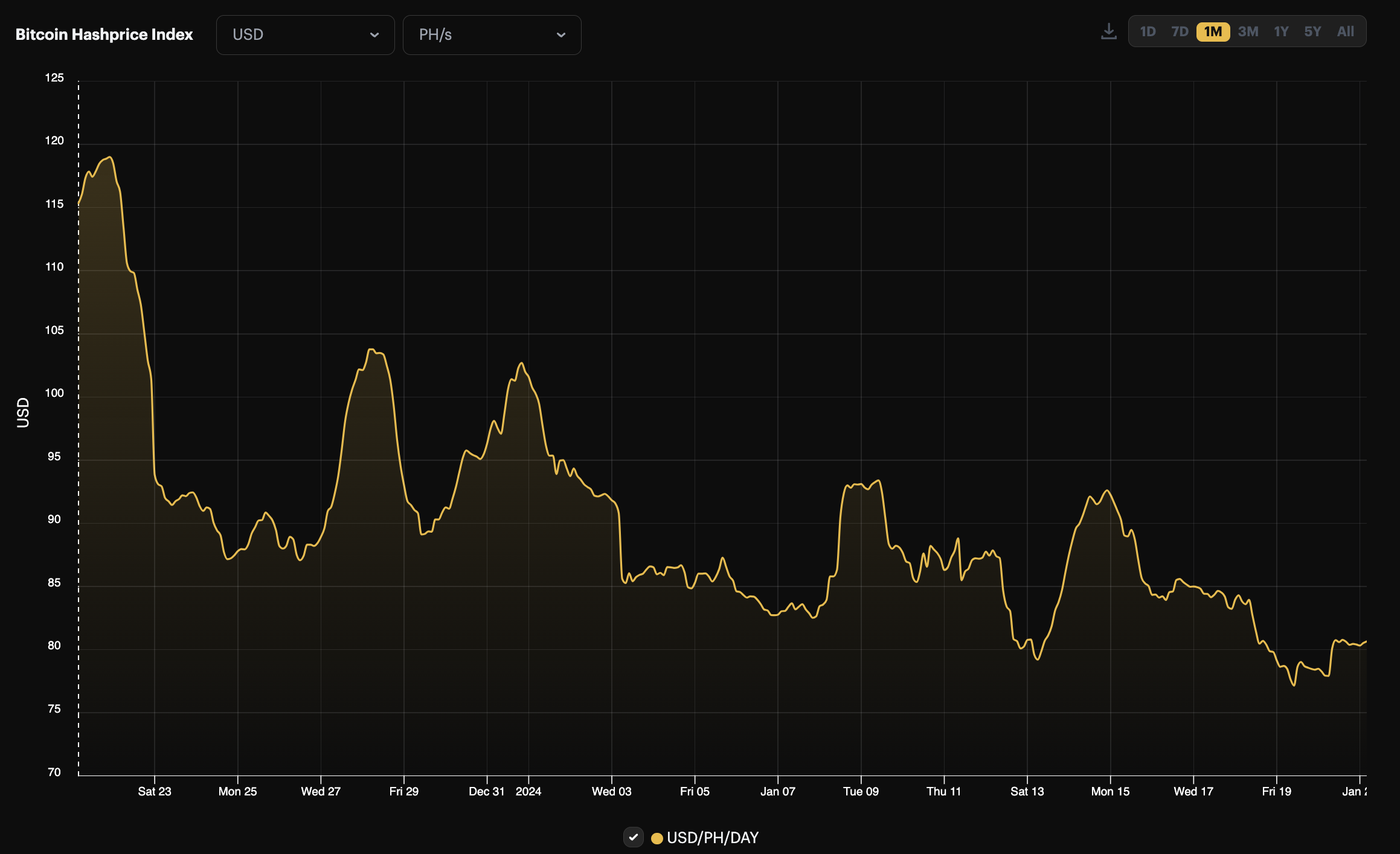

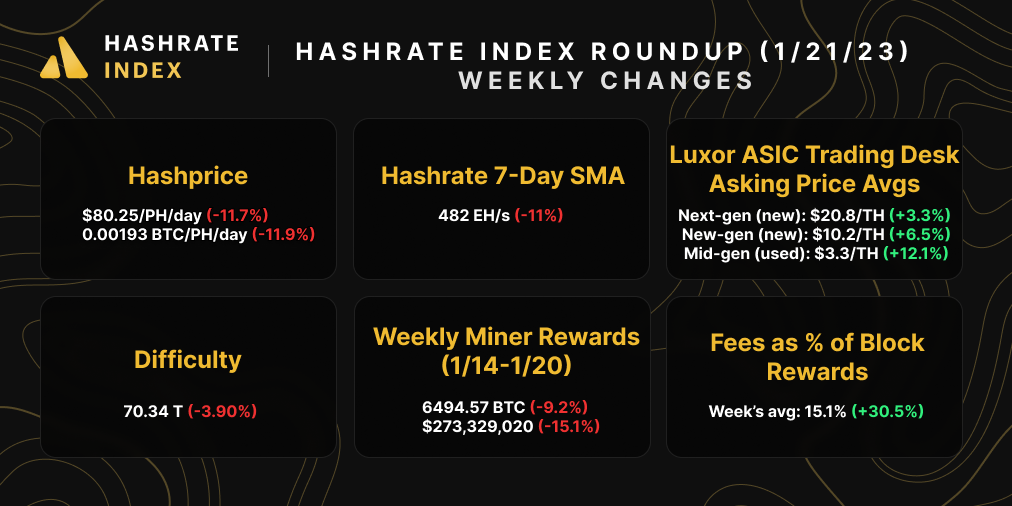

The hashprice chart looks like a roller coaster lately. Bitcoin's volatile price action and periodic spikes in transaction fees have hashprice pitching and pulling all over the place, with the last month seeing a range of prices as high as $119/PH/day and as low as $77/PH/day.

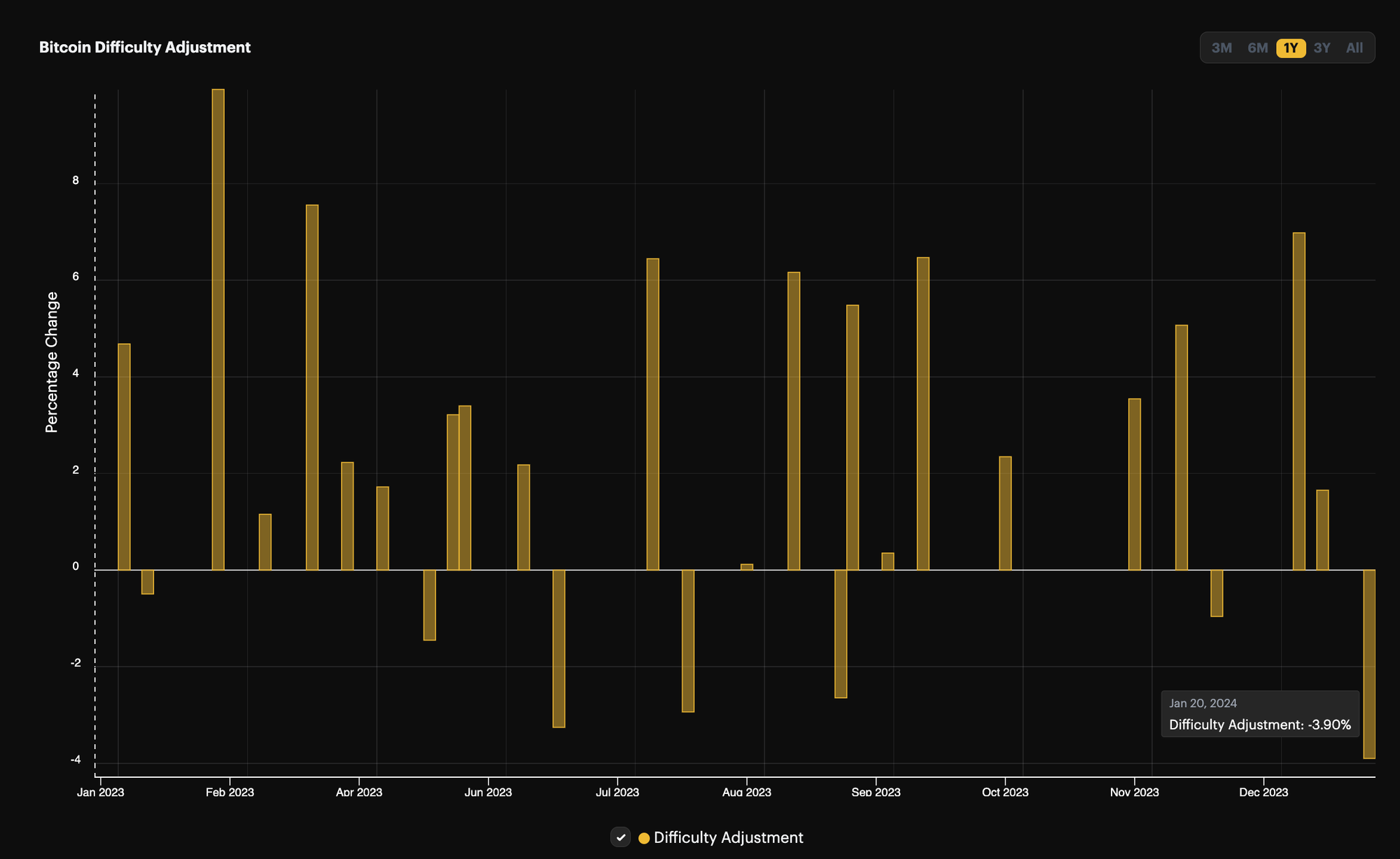

As both Bitcoin's price and transaction fees receded, Hashprice broke below $80/PH/day to a monthly low this past week. But luckily for miners, Bitcoin's difficulty adjusted downward on January 20 by -3.90% – the largest negative adjustment since December 2022.

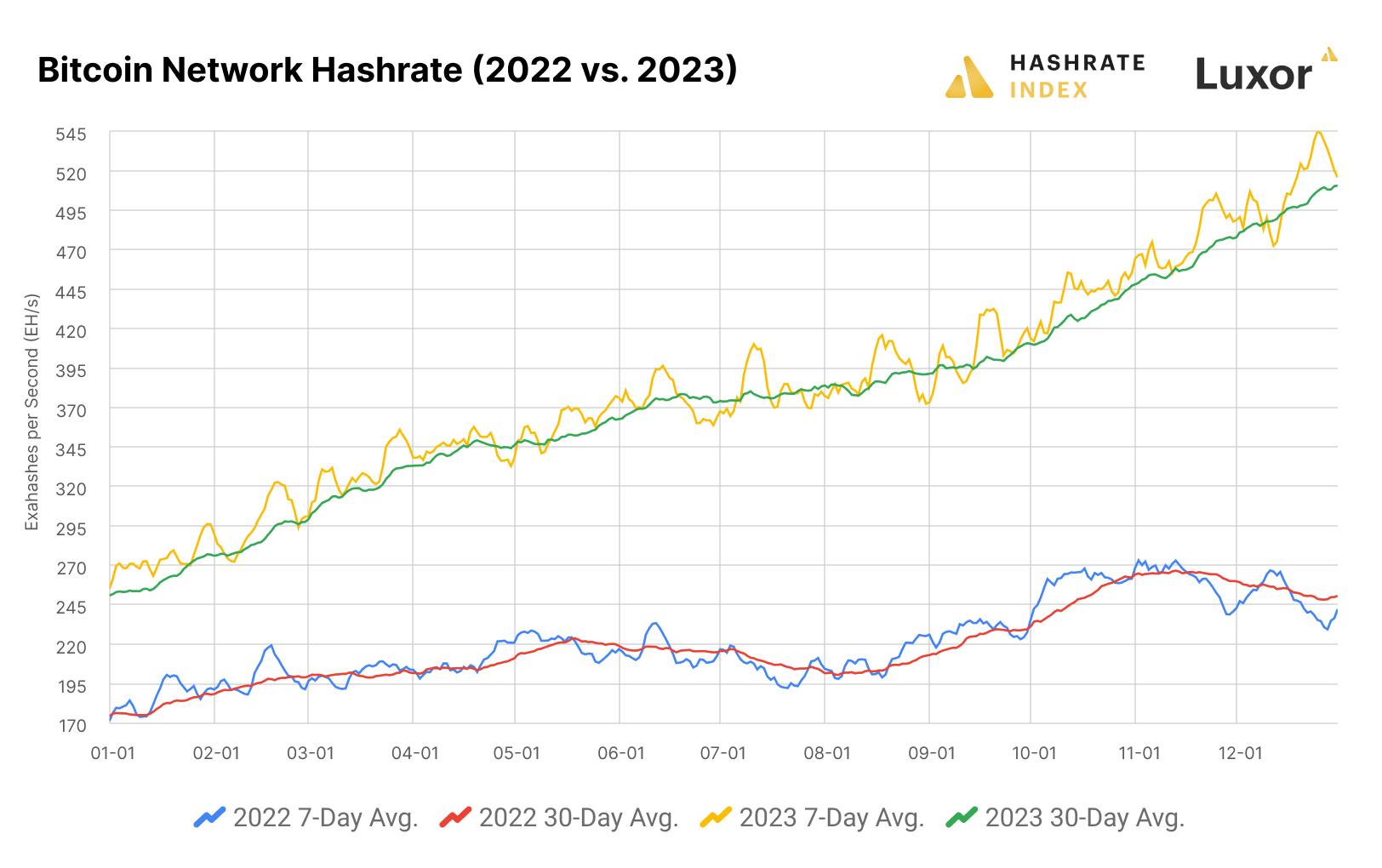

The negative adjustment comes on the heels of a cold snap in the US that brought record low temperatures across the country, including Texas. As a result of operational issues and miner curtailment/demand response, the arctic blast put Bitcoin's hashrate on the fritz; the 7-day average dropped 11% from 541 EH/s to 482 EH/s over the past week, and the 3-day average fell by nearly a quarter from 586 EH/s at the beginning of the week to 447 EH/s in the middle of the week.

Inscription activity is lulling right now compared to the action Q4-2023 delivered, so the negative difficulty adjustment came just in time for miners. But as the cold weather melts away over the next week or so in the US, we expect that Bitcoin's hashrate will rebound pretty hard, so expect a positive adjustment the next go-round.

Last week, we published our 2023 Bitcoin Mining Year in Review, an 81 page deep dive into the most historic year yet for Bitcoin Mining. Check it out below!

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting preorders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

Bitcoin Mining Market Update

Mostly red for this week's market update. Transaction fees saw a bump over the week, but they are still much lower than Q4-2023's average. Mining rewards were dampened by sluggish block times as a result of the cold snap's hashrate disruptions. In the ASIC miner market, rigs of all calibers saw significant increases in value over the last week.

Bitcoin Mining News

Here are last week's top headlines for Bitcoin mining news:

- Bitcoin mining hashrate falls by an estimated 25% amid Texas curtailment

- Investment Firm With $1B Assets Looks to Invest in Bitcoin Mining With Fabiano Consulting

- Bitcoin miner Core Scientific gets court approval for restructuring

Bitcoin Mining Stocks Update

Bitcoin mining stocks generated mouth-watering returns in 2023, and so far, 2024 has offered nothing but comedown from 2023's highs. Every miner in our update took a beating last week, and our Crypto Mining Stock Index fell 7.4%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $10.29 (-18.53%)

- HUT: $6.86 (-29.57%)

- BITF: $2.09 (-16.57%)

- HIVE: $3.18 (-19.49%)

- MARA: $16.13 (-24.94%)

- CLSK: $6.87 (-23.67%)

- IREN: $4.32 (-25.77%)

- WULF: $1.38 (-25.00%)

- CIFR: $2.68 (-20.71%)

- BTDR: $6.40 (-8.70%)

- SDIG: $5.11 (-18.37%)

New From Hashrate Index

Hashrate Index 2023 Bitcoin Mining Year in Review: In the Shadow of the Halving

2023 was a comeback year for the Bitcoin mining industry. Bitcoin’s price recovered swiftly from its post-FTX-fallout lows and gained 149% over the course of 2023. Hashprice rose 71% over 2023, a much-welcomed reverse from 2022’s 76% decline; this recovery was aided as much – if not more so – by a bull market in transaction fees from inscriptions and ordinals, a new form of Bitcoin-based NFT/digital collectibles standard that generated record levels of dollar-denominated transaction fee revenue for miners. 2023, by most markers, was a complete reversal of fortune from 2022’s market ruin.

The free version of the report is available in the blog post linked above. The premium version is available to Hashrate Index Premium subscribers.

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.