Hashrate Index Roundup (February 20, 2024)

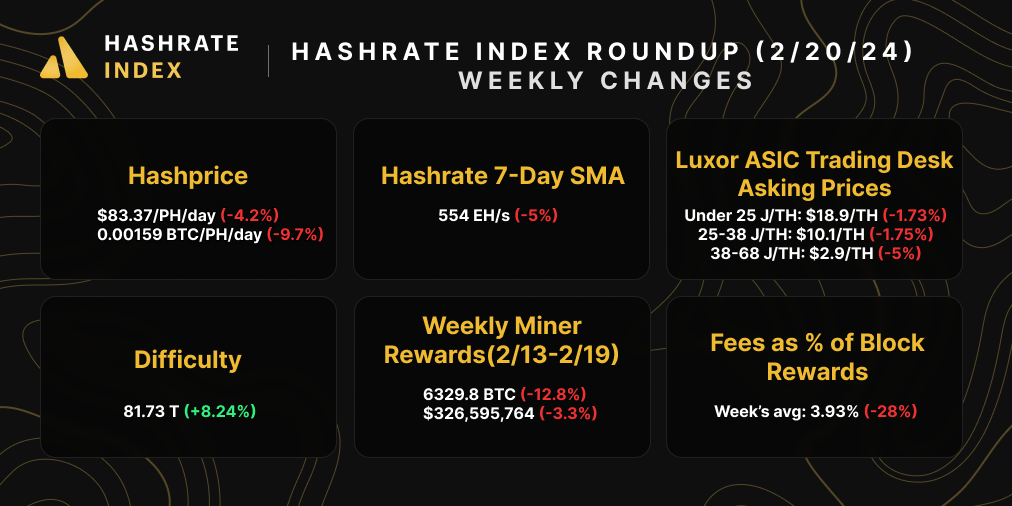

Bitcoin's mining difficulty hit yet another all-time high this past week, and hashrate is cooling off.

Happy Monday, y'all!

We're officially two months out from the 2024 Bitcoin Halving (according to our estimator on Hashrate Index). Of course, this could move up or down a day or two depending on how quickly or slowly miners propagate blocks over the next two months. But right now, Bitcoin's Fourth Halving is slated for April 20, 2024, so mark your calendars and grab yourself some bubbly to celebrate – or, if you're a miner, maybe something harder so you can cope with an event that will instantly rupture your revenue by 50%.

Now that said, hashprice is currently $83/PH/day, which is pretty good all things considered. If the Halving were to happen right now, then hashprice would be $41.50, and the breakeven power prices (in $/kWh) of popular ASIC miners would be as follows:

- S21: $0.099

- M60S: $0.093

- M50S++: $0.090

- S19 XP: $0.077

- S19k Pro: $0.075

- M50S+: $0.072

- M50S: $0.067

- S19j Pro+: $0.063

- M50: $0.060

- S19 Pro: $0.059

- S19j Pro: $0.057

- M30S+: $0.051

- S19: $0.051

- M30: $0.046

Not bad, but not exactly stellar either. Thankfully, Bitcoin's currently in a bullish trend, and in the short-term at least, our difficulty adjustment estimator is leaning toward a negative difficulty adjustment in roughly 9 days (the estimator currently projects a -5.81% adjustment, but the current difficulty epoch is only 37% complete, so this figure could change substantially between now and the next adjustment).

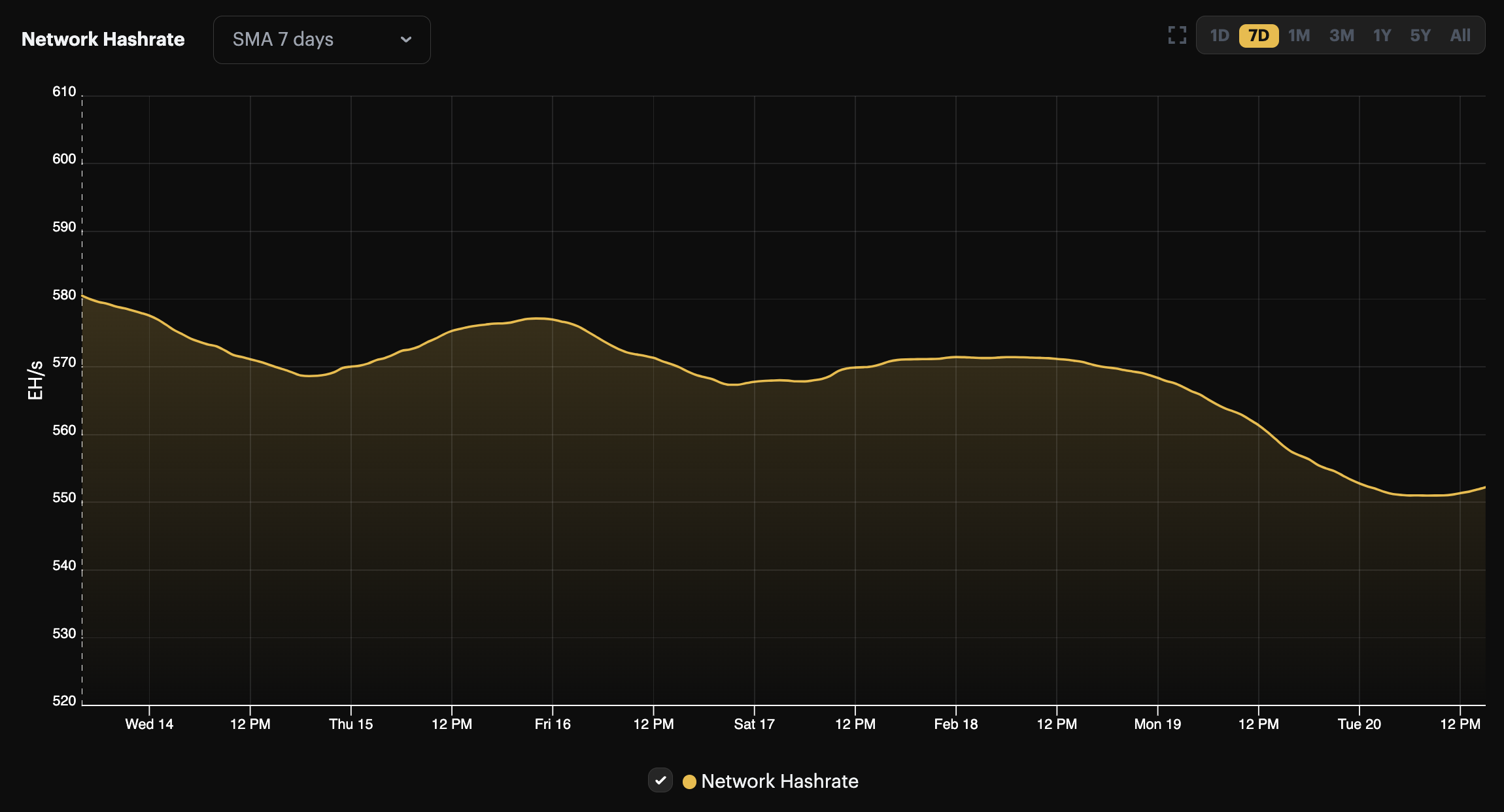

Following Bitcoin's difficulty hitting an all-time high of 81.73 trillion on February 15, Bitcoin's hashrate has fallen substantially, which is driving the possibility for a negative adjustment. Over the past week, Bitcoin's 7-day average hashrate has fallen 5% to 553 EH/s; this makes for a 9% drawdown from its 7-day average all-time high of 609 EH/s on February 8.

With hashrate tapering off, this could conjure up much needed relief for Bitcoin miners with regards to mining difficulty. Difficulty is currently up 13.5% in 2024, and the last two adjustments were 8.24% and 7.33%.

Editor's Note: The Luxor team is hiring for a Customer Support Firmware Specialist. If you think you'd be a good fit for this position, please consult the job posting – or if you know someone who would be a good fit, please point them to the post!

Sponsored by Luxor RFQ

The Antminer S21 is here, and Luxor's ASIC Trading Desk is accepting orders for this model right now! If you'd like to place a preorder for the Antminer S21, please fill out this form. Secure your order for Bitmain's most efficient and powerful ASIC miner today!

Bitcoin Mining Market Update

This week's market update is mostly green. In fact, the only green data point is Bitcoin's mining difficulty (not exactly what we like to see). Transaction fees have fallen for the second week in a row, and ASIC prices for all tiers fell as well.

Bitcoin Mining News

Here are last week's top headlines for Bitcoin mining news:

- CHINESE PARTNERSHIP TO BRING LARGE-SCALE BITCOIN MINING TO ETHIOPIA

- Growth of cryptocurrency mining operation in Virginia hindered by electricity rates

- OKLAHOMA-BASED COMPANY BUILDING CRYPTOCURRENCY MINING FACILITY IN MUSKOGEE

Bitcoin Mining Stocks Update

Bitcoin mining stocks had mixed returns over the past week, with some stocks cooling down and falling in price after an impressive multi-week rally. Our Crypto Mining Stock Index rose a tepid 4.3%.

Weekly changes to Bitcoin mining stocks:

- RIOT: $16.05 (+6.40%)

- HUT: $9.43 (+9.91%)

- BITF: $3.47 (+15.50%)

- HIVE: $4.25 (+15.49%)

- MARA: $24.53 (-2.95%)

- CLSK: $16.56 (+9.93%)

- IREN: $6.86 (+4.18%)

- CORZ: $3.55 (-5.59%)

- WULF: $2.37 (+5.11%)

- CIFR: $3.51 (+1.74%)

- BTDR: $7.13 (-17.29%)

- SDIG: $5.17 (-6.85%)

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.