Hashprice numbers go up & fed machines go brrr

T-Minus 42 days to halving. Now that days of the week don’t matter we are just measuring time in days pre and post halving.

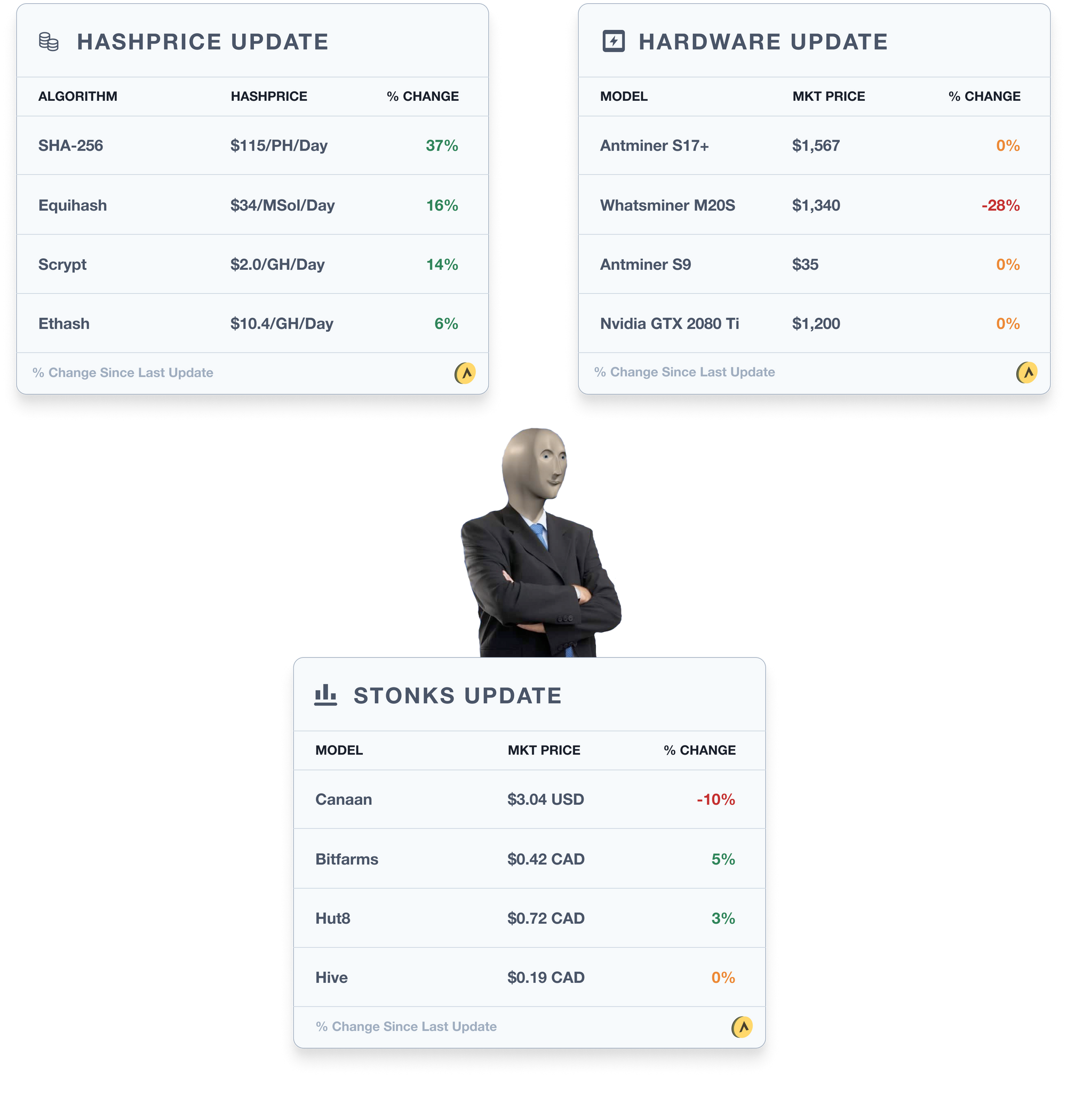

Hashprice has slightly recovered since our last update. With a 16% decrease in network difficulty level, miners can breathe again. A lot has happened in the mining world over the past two weeks so we will try to share the highlights below!

If you think your friends/colleagues would like this update you can share it here:

Luxor Product Explanation

Luxor is a Mining Pool. But what even is a mining pool? There is the original definition of pooling hashrate, but it has changed so much since that point.

As a pool we are simply a buyer of hashrate.

We pay miners (sellers) out hourly based on the expected value of their hashrate. So we are constantly valuing their hashrate and then buying it up at around 98% (depending on the coin) of what we think it’s worth.

We determine how much it is worth to us based on the network difficulty level and the emission rate (i.e. how much we could make from mining with it).

We then take that hashrate, build blocks and submit it to the network in the hopes that it is a valid block and get the block reward.

You can think of mining pools as buyers of hashrate, and miners as sellers.

Trading Update

Commentary

- SHA-256 hashprice recovered mostly because of a 16% decrease in network difficulty. The PoW Difficulty Adjustment Algorithm is truly something of beauty, acting exactly as intended. Expect more hashrate to come back online, an increase in difficulty next adjustment (~5.0%) and then another drop in hashrate. Rinse and repeat!

- Whatsminer is slashing prices for their M20s, as they have now begun sales on their M30s & M31s which are shipping in a week according to their website. S9s are still barely selling above their PSU value right now.

- Stonks have stabilized as the fed announces that the money machine does indeed go brrr. Can’t forget the odd announcement from Northern Data (ETR: NB2) that sent the stock price up 40%…. Mass demand for their compute power because of COVID? We will let you draw your own conclusions

Mining News

A few updates the past couple of weeks in the world of mining:

- HIVE Blockchain, a publicly-traded ETH mining company, is diversifying into BTC mining. They are acquiring a 30-megawatt BTC mining farm from Cryptologic for ~$3mm. Is it just me or does this seem like a steal? Good time to start investing in infrastructure. Buy the dip and start buidling! As long as it’s not for Coin Market Cap valuations….(Article).

- I got the chance to jump on the podcast with Whit and the Hashr8 team. We discussed how hashrate is valued, how to forecast the value, different instruments miners can use to hedge their risk, hashrate futures & the halving. Feel free to reply to their tweet if any thoughts! (Podcast)

- Apparently the Bitmain E3 is going to be fine to keep mining ETH. This is the second time I went back on something on Ethereum (ProgPoW last update). According to Bitmain’s announcement, the new firmware was developed to allow miners to continue using Antminer E3 “even after March 2020.” Any conspiracy theories on why Bitmain is flipping back and forth on this? (Article).

- With the decrease in hashprice we saw some miner carnage. A few miners we talked to had to shut down operations unfortunately. Digital Farms was reported to have folded and Hut8 shut off some of their machines (Article). I assume Hut8 has turned them back on after the fall in difficulty.

- Aspiring CME Director wants the exchange to mine bitcoin. "While this seems outside of our core competencies, I’d argue this is our business: we, like the miners, match and clear trades" (Article).

- Binance expected to launch a new mining pool in Q2. The exchange is following the lead of its Chinese peers, OKex and Huobi. This is good for the industry. Right now there are 10’s of thousands of hashrate sellers (miners) and only a handful of hashrate buyers, so the more buyers the better (Article).

- The team at Coindesk put forward a report on the halving. It walks through the concepts really nicely and doesn’t over-complicate the terms/analysis. It also contains some comments from Pavel, Kristy and me on the halving (Report).

- Blockware came out with an interesting report on mining. We really like the idea of tiering electricity prices and the split of equipment efficiency by each tier. This is a great way to forecast the value of hashrate. However, we don’t back the numbers shown in the report and would urge miners to do their own analysis if it is being used for anything important. No one in the industry including Coinshares, Cambridge, Blockware etc has a crystal ball into the industry (Report).

Mining Educational Content

Almost every Miner has gone through periods of bad Luck. At what point should you be concerned?

We go over the formula on calculating luck, the distribution it follows, how to do a PDF and CDF on it, how luck affects a PPS vs PPLNS pool and their miners, and blockwitholding attacks.

Check it out here:

About Luxor

Luxor is a North American mining pool which supports multiple cryptocurrencies. Luxor currently supports the following cryptocurrency networks – Bitcoin, Zcash, Monero, Horizen, Decred, Sia, LBRY, Aion, Komodo, Pirate and Sia Prime.

We also operate a product called Catalyst that allows users of altcoin mining pools to receive payments in Bitcoin.

We can be found on Twitter or Discord.

Footnotes

* SHA-256 Hashprice based on weighted average of BTC, BCH, BSV, & DGB from whattomine

* Equihash Hashprice based on weighted average of ZEC, ZEN, ARRR, & KMD from whattomine

* Scrypt Hashprice based on weighted average of Litecoin, Dogecoin, & DGB (Scrypt) from whattomine

* Ethash Hashprice based on weighted average of ETH & ETC from whattomine

* S9 Prices from Kaboom Racks, M20s from MicroBT, S17+ from Bitmain, & Nvidia prices from Nvidia

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.