Hashprice is Up 42% This Year, But How Long Will the Rally Last?

Hashprice is up big in Q1, but Bitcoin's growing hashrate could threaten the rally.

Bitcoin is enjoying a meteoric and historic Q1 so far in 2023. Its price rose more than any other Q1 in the coin's short histor, and the positive price action has revived Bitcoin miners who were previously on life support.

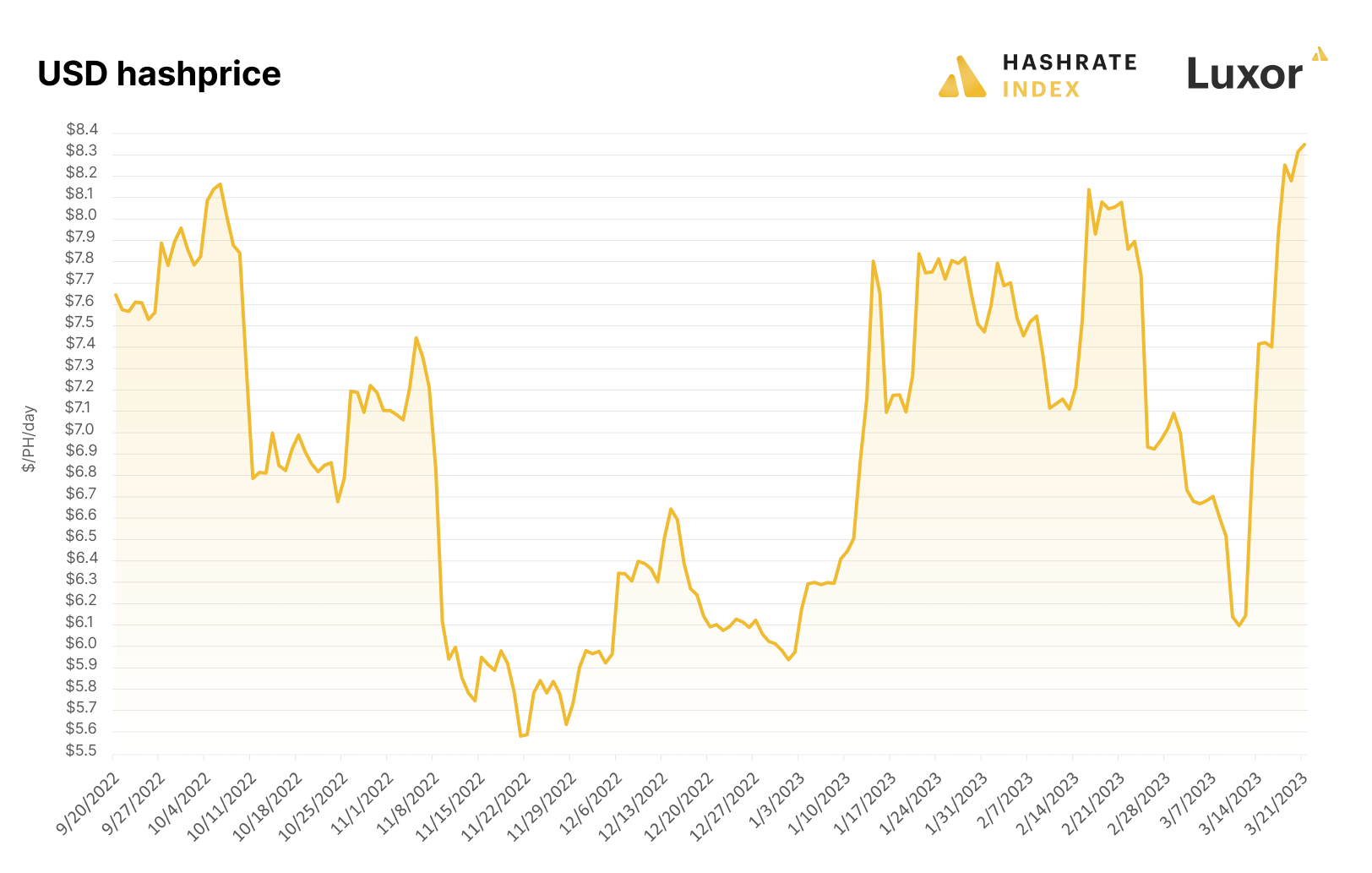

At the time of writing, Bitcoin's USD hashprice is $85/PH/day, a number which miners cringed to see last summer but which looks like a godsend now. Likewise, the hashprice average so far this quarter ($72/PH/day) might not look much better than Q4's average ($65/PH/day), it's making all the difference for some previously margin starved miners.

For sure, miners aren't exactly feasting, but they are doing better than year-end 2022. Margins were so thin back then that even miners with run-of-the-mill power rates in the US were staring down breakeven economics, but Bitcoin’s New Year rally has reversed this trend.

Hashprice refers to the total dollar or BTC rewards a miner could earn per unit of hashrate per day given current Bitcoin price, difficulty, and transaction fees. USD hashprice refers to dollar rewards and BTC hashprice refers to BTC rewards, and we express hashprice in terms of petahashes per day ($/PH/day or BTC/PH/day).

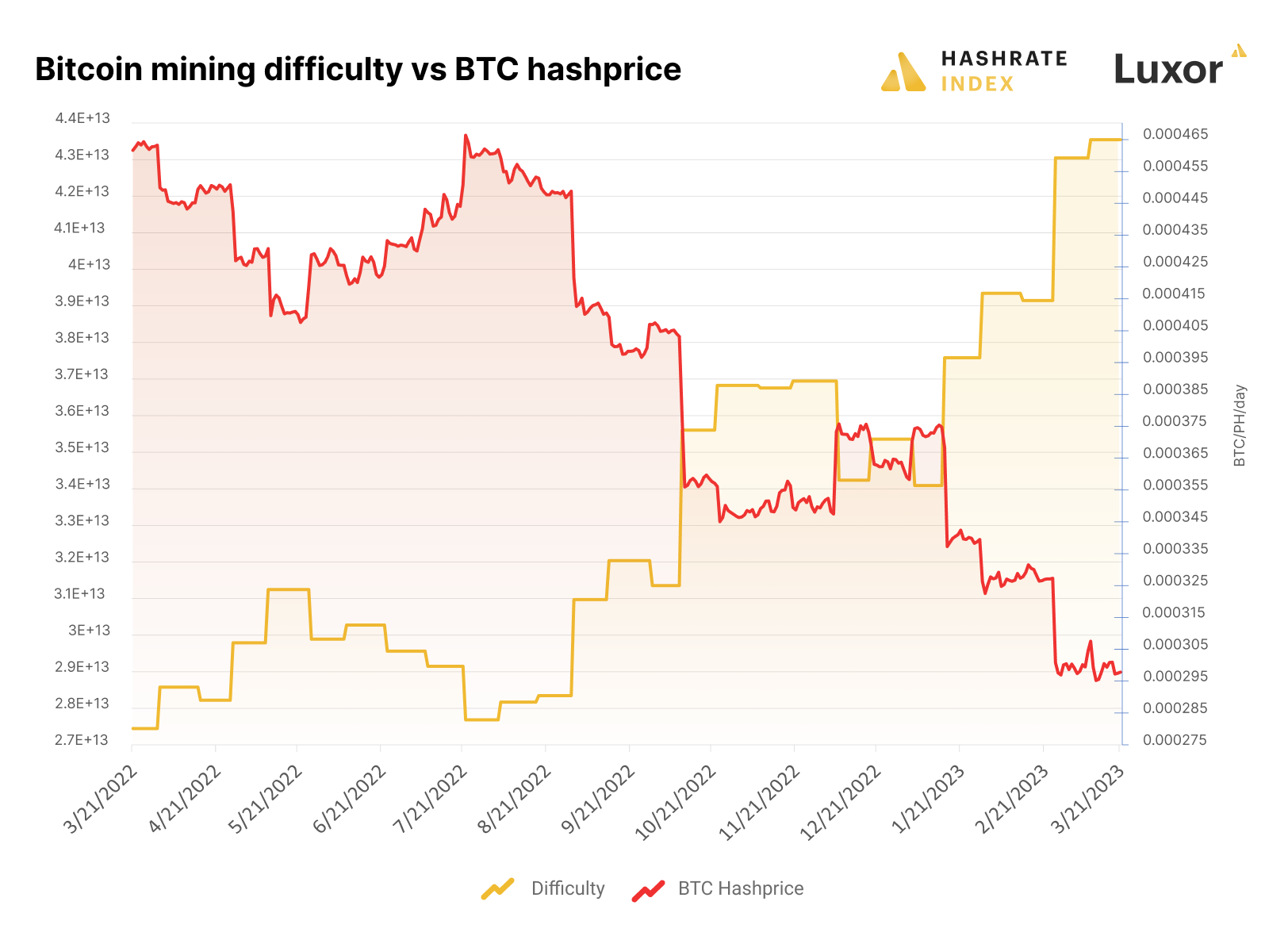

As Bitcoin's price rises, the network's hashrate has swelled too. Below are year-to-date changes of BTC price, hashprice, hashrate, and difficulty:

- Bitcoin price: $28,000 (+70%)

- Hashprice: $83.82 (+42%)

- Hashrate (7-day avg): 336 EH/s (+31%)

- Difficulty: 43.55 T (+23%)

As ever, hashprice would be higher without the year's hashrate and difficulty growth. Bitcoin’s hashrate has been growing steadily despite the bear market, so each successive difficulty all-time high continues to drive down BTC hashprice.

Bitcoin's persistent hashrate growth could stunt the current hashprice rally if Bitcoin's price doesn't keep up. Bitcoin's price itself will be highly dependent on the course the Federal Reserve's future interest rate changes, any financial system contagion from the recent bank runs, and the outlook of the general economy in the year to come.

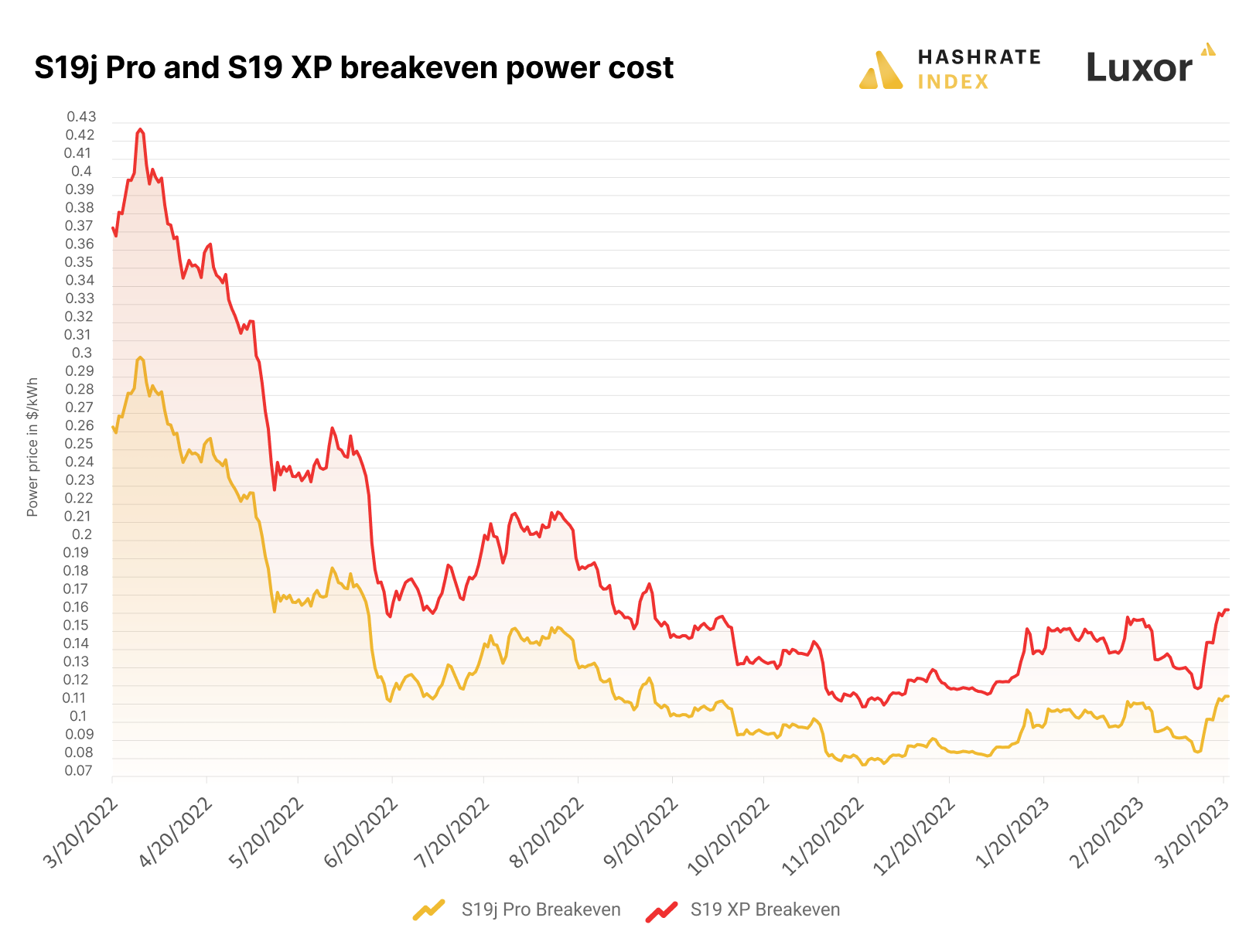

Breakevens come back from the brink

The hashprice revival has padded margins just enough to make even average-cost miners a bit more financially comfortable, but they can't relax just yet.

In 2022, energy price inflation and hashprice deflation put mining economics into a vicegrip. Elevated energy prices have unfortunately stuck around, but now miners are pulling in 41% more cashflow from their machines than they were at the turn of 2023, giving them more cushion between current operating margins and breakeven thresholds.

To visualize this further, here's the change to breakeven power costs for popular Bitcoin mining rigs from year-end 2022 to the present day (costs presented as dollars per kilowatt hour).

- S19 XP 140 TH/s ($0.115 —> $0.165)

- S19j Pro 100 TH/s ($0.081 —>$0.117)

- M50S 126 TH/s ($0.095 —> $0.137)

- M30s++ 112 TH/s ($0.08 —> 0.115)

Plenty of miners in the US were breathing down breakeven prices at the end of last year. The average industrial power rate in the US in December 2022 was $0.086/kWh, while the average in popular mining states like Texas, Georgia, and North Carolina were respectively $0.074, $0.079, and $0.077.

A miner in Texas at the end of last year with average power costs was earning $0.50 a day with an S19j Pro – a 8.5% margin. Now, that margin has grown to $36.5 with the same j Pro earning $3.10 a day.

It's not f*** money like miners made in the bull market, or even the more-modest-but-still-decent money they made in the first half of 2022. It's penthouse pauper money, but it's enough to survive for now.

We're not out of the woods yet

Not to be a downer at the end of the newsletter, but the current hahsprice surge could be just a moment's reprieve before we head back toward all-time lows.

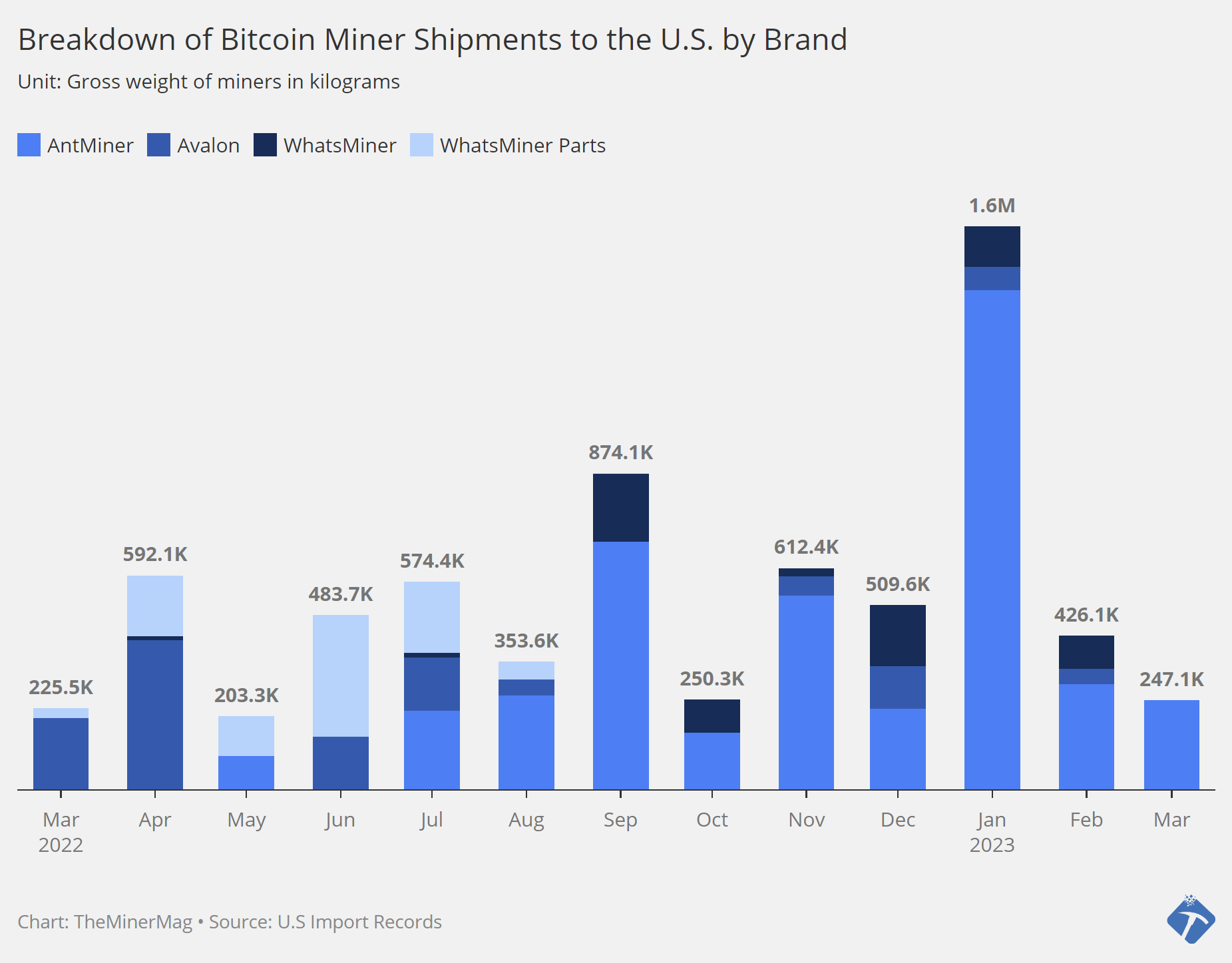

There's a lot of hashrate on order from the Big Boys in the public and private markets (per an article from TheMinerMag, public miners received 1,555 tons of machinery in Janaury, 2023). Not to mention that, despite the current bullish sentiment, we have yet to see whether or not this rally is sustainable or if it will collapse like Bitcoin's Spring rally in 2019.

All of this fretting goes out the door if Bitcoin continues running, of course. But if we only prepare for the best case, well, then we'll get more of what we got in the bull market: easy promises that spoil quickly when the market sours.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.