Don't Dance With the Dragon; Will China's "Ban" Heat Up ASIC Prices in 2022?

China's latest crypto crackdown is its most severe one yet. And it's left us with questions, like what will this mean for ASIC production and, in turn, rig prices going into 2022?

Happy Tuesday, Luxor Mining crew!

Another day, another Chinese Bitcoin ban—though this go-round, it’s looking like the CCP means more serious business than usual.

We’ll get to more of the why and how this ban is the strictest yet below, but since the CCP’s new restriction dropped last week, we’ve seen the following from China’s crypto base:

- The largest Ethereum mining pool is closing up shop

- Coingecko and CoinMarketCap now blocked by China’s internet firewall

- Exchanges move to sweep remaining Chinese users from their trading books

- USDT trading at a discount to the yuan

- Alibaba discontinuing ASIC sales on its marketplace

Folks in the west like to hand-wave these “bans” (“We’ve seen this before!”; “Not the China FUD again!”), but by all markers this crackdown is the severest yet, and judging by the initial response, China’s crypto community isn’t taking any chances to dance around the dragon this time.

We’re going to crunch some numbers first, but the rest of the newsletter will focus on dissecting this issue and what it means in light of China’s provincial mining bans from earlier this year.

Hashrate Index

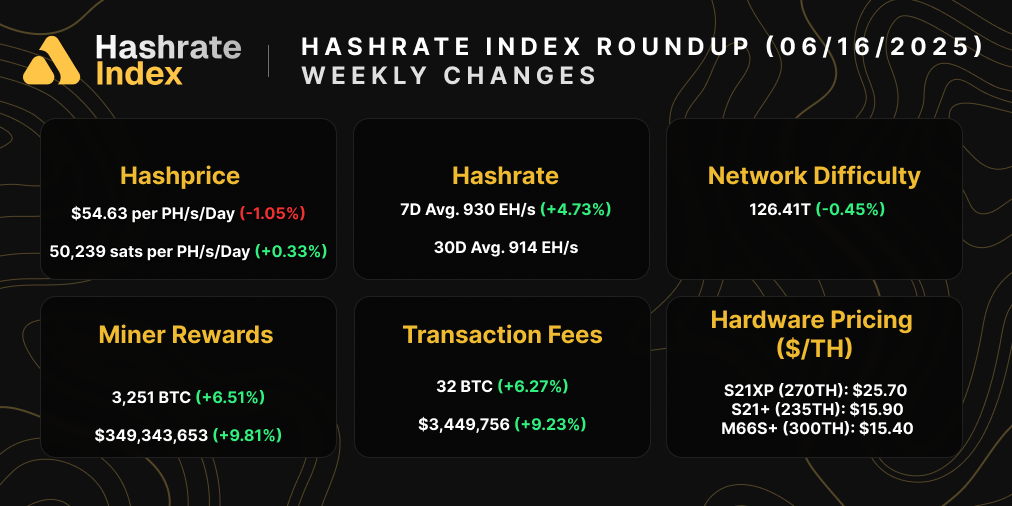

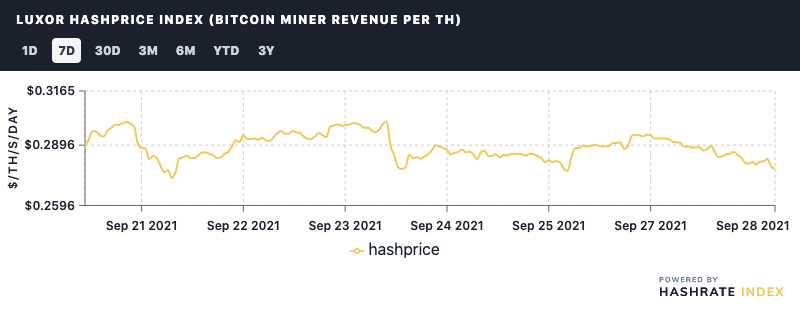

Hashprice: The news from China left an unfavorable impression on crypto markets, with bitcoin down roughly 5% since the news circulated.

And y’all know what that means! Yep, hashprice is down too, around $0.2779 at the time of writing.

Hashrate: Bitcoin’s hashrate is still sluggin’ along, with little-to-no change over the week at 137 EH on the 7 day moving average.

Rig Price: Rig prices are starting to diverge. Newer models, for example, rose a teensy bit last week, while older models fell as miners continue to seek out newer equipment and sell older rigs.

- 38 J/TH: $98.89 (+0.7%)

- 38-60 J/TH: $70.09 (+0.4%)

- 60-100 J/TH: $39.90 (-2.3%)

- 100 J/TH: $19.19 (-10%)

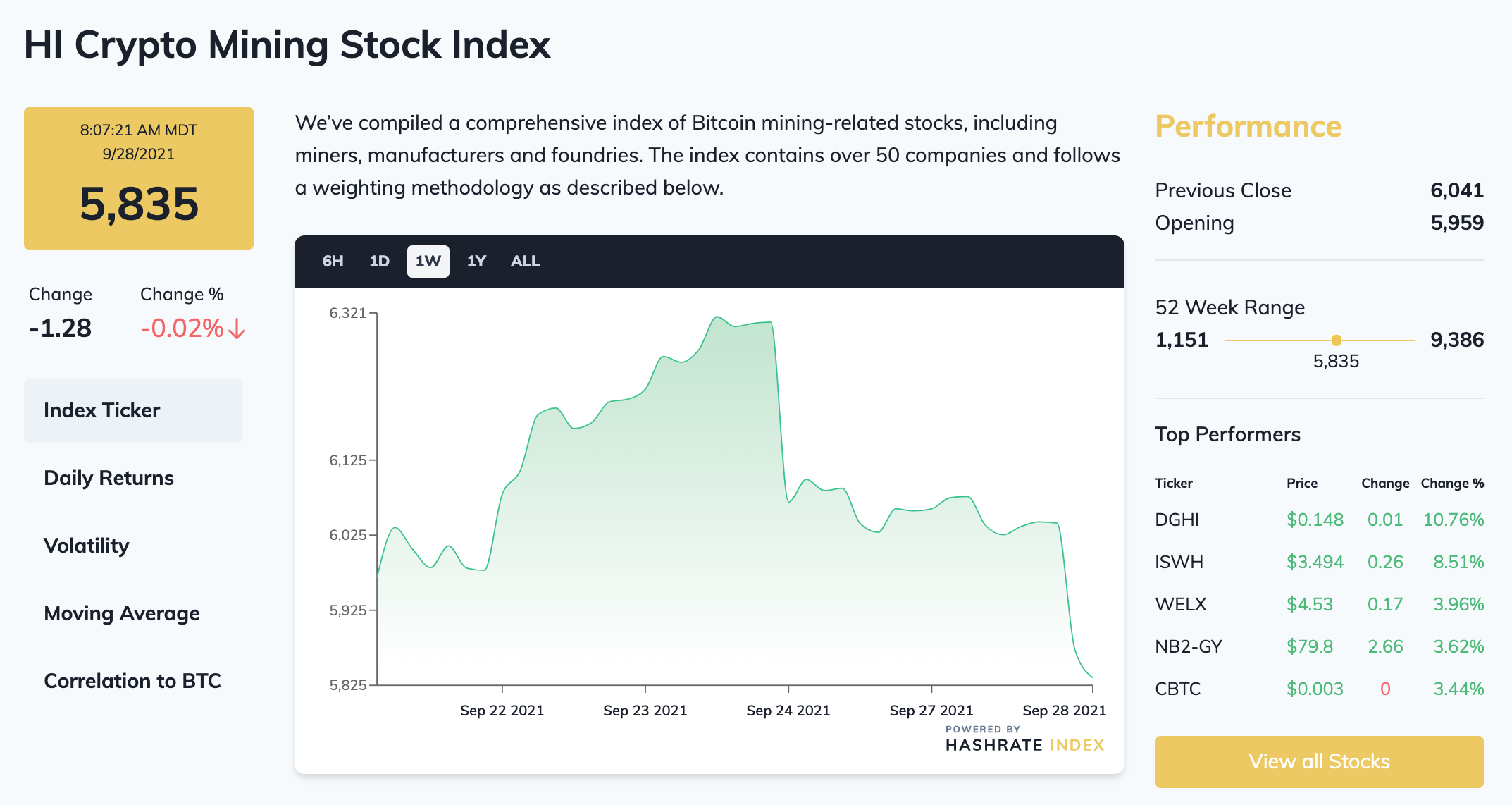

Crypto Mining Stock Index: Mining stocks are not looking too hot right now. Prices have fallen off a cliff since the recent China news (even though, in theory, this is good for North American companies), and our index is down 3% on the week.

Mining News

China Imposes Strictest Restrictions Yet on Crypto, Mining

This September, China’s central government issued new restrictions on both cryptocurrency mining and cryptocurrency use/business at large.

The first of these new crackdowns came on September 3, when the CCP reinforced the provincial bans on crypto mining that were rolled out this past summer. In a document discussing these new mandates, the menu of statutes states that it’s now illegal to provide financial services to cryptocurrency miners and that it’s also illegal for mining operations to draw power in the nation. Additionally, the CCP has added mining to its “eliminated industries” list.

The second, which was circulated internally in the Chinese government on September 15 but released to the public on September 24, levies new restrictions against cryptocurrency use in the country. In a nutshell, the new crackdown makes transacting cryptocurrencies, selling/buying cryptocurrencies, and generally any crypto-related activity (particularly for businesses) illegal.

But nothing new under the sun, right? Cryptocurrency exchanges have been blackballed by Chinese officials for years, and banks have been ordered to not service crypto-related transactions for some time as well, right?

It’s true that crypto activity in China has long skulked about in the shadow realm of finance, but the latest mandates from the CCP are now shining a light on such activities explicitly as financial crimes. The document which outlines the new rules against crypto at large, for instance, is signed by 10 Chinese governing bodies (the most ever of any anti-crypto mandate from the Chinese government), including the Chinese Supreme Court and the Supreme People’s Procuratorate and the Public Security Bureau, the latter two being China’s most powerful law enforcing bodies.

Put differently, China is bringing enforcement into the criminal realm, whereas before enforcement was left up to civil agencies. China is signaling that the buck (or satoshi, if you please) stops here, it seems.

Which Way, Crypto Man?

China’s latest restrictions mandate that financial service providers and internet providers must ramp up their scrutiny of crypto-related services and content, hence the addition of popular coin price trackers to the Great Firewall. Chinese citizens who work for off-shore crypto companies could be prosecuted under the new rules, as well.

Unsurprising as the CCP’s hardass stance may seem, we’re still left with questions, like what the new statutes mean for cryptocurrency ownership (which is protected as virtual property under Chinese law and which the current mandate did not mention).

Another question conjured by this crackdown, what does this mean for ASIC manufacturing in China? Will Bitmain stop producing in country? From where we’re standing, this seems inevitable. It’s likely that Bitmian will have to shift manufacturing capacity to its Malaysian and Indonesian facilities (Whatsminer, who produces machines in Thailand, will be largely unaffected here).

If this happens, then it will send bigger wrinkles through the already severely ruffled ASIC supply chain, disrupted as it has been by chip shortages and constipated shipping logistics.

Think ASICs are expensive now? Next year is looking like a “hold my beer”moment for higher prices still if this comes to pass…

And on that pleasant note, have a great week, and Happy Hashing!

-Luxor Team

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.