Bitmain Drama > Tiger King

The power struggle continues at the world's leading ASIC manufacturer

Happy 34-days A.H. (After-Halving) everyone.

While the founders of Bitmain battle it out, miners that haven’t ordered new Bitmain machines celebrate. With expected delays in shipping, some miners may get a couple more months of higher profitability.

This update we also cover Hut8, SMIC, Kyrgyzstan, ETH 2.0 and more

If you like this newsletter we would be grateful for you to share it with your friends & colleagues.

Trading Update

Commentary

- With difficulty dropping ~9%, SHA-256 Hashprice saw a moderate two-week gain even with transaction fees coming down. But the gain will be short-lived, with difficulty expected to increase by 15% tomorrow.

- Equihash Hashprice increased by 19% during the period. Coinbase announced that they would be listing ZEN, which increased the value of mining. Some hashrate then switched over from ZEC to ZEN, making ZEC more profitable. This highlights why it’s important to look at hashprice on an algorithm basis, not per-chain. There are events that occur outside of the main chain that affects the value of hashrate for miners.

- Q3 2020 Difficulty Futures traded down on FTX, as the Bitmain news raised concerns that new machines will be delayed. The market seems to think it will be temporary given that Q4 2020 & Q1 2021 futures held strong.

- Hut8 dropped 20% over the period. It was on pace for over 25% however the market reacted well to their announced equity raise on the 11th.

Mining News

A few updates from the past couple of weeks in the mining industry:

- The power struggle at Bitmain continues. Bitmain’s operations in Shenzhen are reportedly being disrupted as Micree Zhan (ousted CEO) forbade shipment of new ASICs following his recent takeover of the Beijing office. Zhan and co-founder Jihan Wu have been at odds for some time battling for control over the company. It sounds like machines out of Shenzhen (such as the Bitmain Z15) will be delayed but machines such as the S19 that ship out of Malaysia may be okay. For miners who purchased Bitmain machines, this is troubling news. But for others, it is a blessing as they may be able to get a couple more months of extra profitability before Bitmain starts fully shipping again. (article)

- There were a few equity financings last week including from VBit & Hut8. Even with a growing amount of debt financing options available for miners, some mining firms are still leveraging equity to fund capital expenditure.

- SMIC, the chip supplier for Canaan has announced its going public. The new source of funding may help them (and Canaan) catch up with competing groups. SMIC’s chip-making capabilities still lag behind Bitmain’s major chip supplier, Taiwan Semiconductor Manufacturing Company (TSMC), as well as Samsung, which works closely with Whatsminer and MicroBT.

FTX’s Difficulty Futures have been trading for over a month. I had the chance to jump on a podcast with Sam from FTX and some others to talk about everything related to mining derivatives. (podcast)

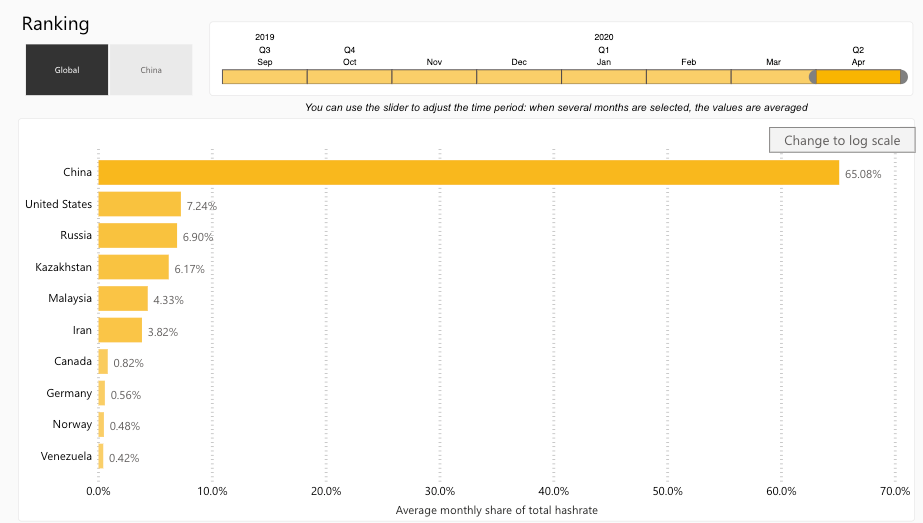

Following Kazakhstan’s lead a few weeks ago, neighboring-country Kyrgyzstan is also looking to legalize crypto mining. Kyrgyzstan’s government ceased supplying electricity to 45 mining companies last September (~136 MW), due to concerns on their electricity usage (article). This is interesting as it implies that 2-3EH of hashrate was turned off last September and likely moved to Kazakhstan or other regions. Currently, Cambridge reports no hashrate produced in Kyrgyzstan, so we may see them return to being a global player in the near term.

- As Ethereum 2.0 moves to reality so too does the transition from PoW to PoS. Many are skeptical that ETH will ever move off of PoW given the uncertainty of PoS as a secure consensus algorithm. However, if the move did happen it would leave many ETH miners worse off with either useless equipment (ASICs) or less profitable (GPUs). Don’t expect many ETH miners to turn over to staking. As my friend Nick Foster so eloquently put “I can’t imagine how much of a dork I would be if I found a five-year lease with $0.04 power, and I was mining ETH and I decided to sell everything and just keep paying my lease so I could stake ETH as a replacement.” (article)

Mining Educational Content

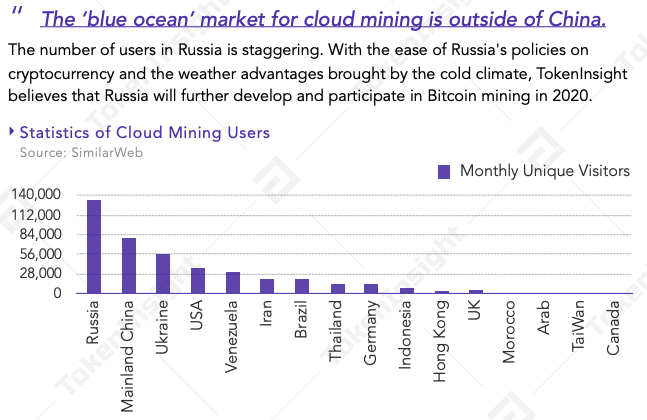

Last week we did a deep dive on Cloud Mining. The main concepts, the concerns & historical troubles, major players, how to evaluate them and much more.

Check it out here:

About Luxor

Luxor is a Seattle-based mining company.

Luxor currently runs mining pools for the following cryptocurrency networks – Dash, Bitcoin, Zcash, Monero, Horizen, Decred, Sia, LBRY, Komodo, Pirate and Sia Prime.

We launched a new Equihash Profit Switching Algorithm called Luxor Switch and Catalyst which allows altcoin miners to receive payments for their hashrate in Bitcoin.

We can be found on Twitter or Discord.

Footnotes

* SHA-256 Hashprice based on weighted average of BTC, BCH, BSV, & DGB.

* Equihash Hashprice based on weighted average of ZEC, ZEN, ARRR, & KMD.

* X11 Hashprice based on weighted average of DASH & AXE.

* Ethash Hashprice based on weighted average of ETH & ETC.

* M20s & M30s from MicroBT, S17+ & S19 from Bitmain. Used machine price from Kaboom Racks.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.