Bitcoin Mining ETF and a Peek Through the Looking Glass

The Viridi Cleaner Energy Crypto-Mining & Semiconductor ETF is now listed on the New York Stock Exchange, and Cambridge's new mining map gives a unique glimpse into Bitcoin's global hashrate share.

Happy Tuesday Luxor Mining Fam!

It’s not a Bitcoin ETF, but…

The Viridi Cleaner Energy Crypto-Mining & Semiconductor ETF (Ticker: RIGZ) is now listed for trading on the New York Stock Exchange.

RIGZ is an actively-managed exchange-traded fund which is focused on investments within the cryptocurrency mining and mining infrastructure industries. The ETF will hold shares of popular public Bitcoin mining companies, as well as stock in semiconductor manufacturers.

Additionally, we now have something of a benchmark for what Bitcoin’s country-by-country hashrate share looked like before China’s crackdown thanks to new data from the University of Cambridge’s Centre for Alternative Finance.

But more on that farther down. First, some data and posts from Hashrate Index.

Hashrate Index

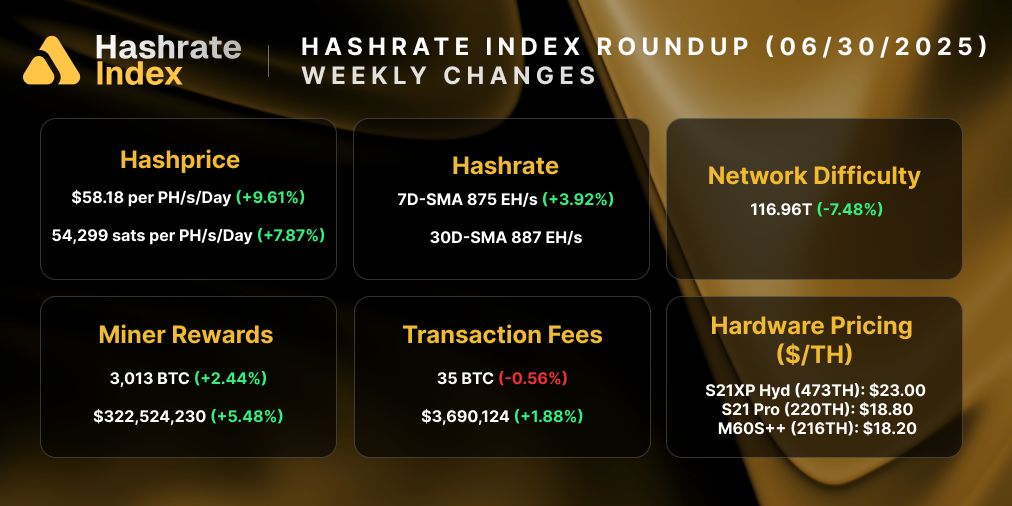

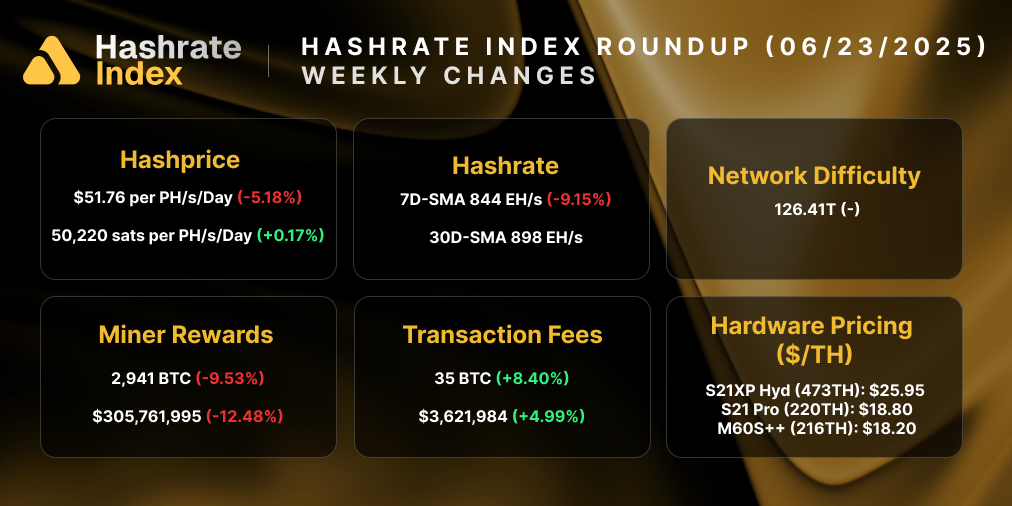

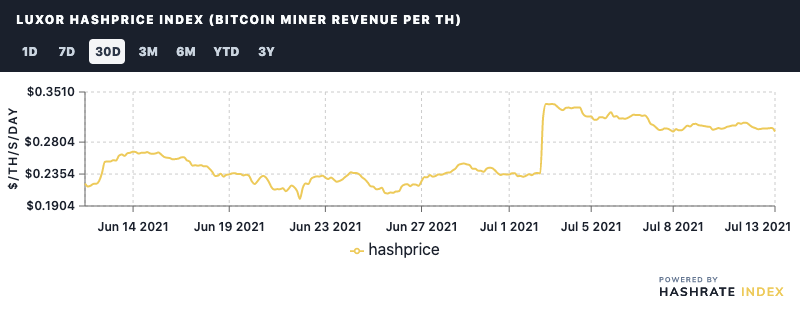

Hashprice: The latest adjustment gave miner profitability a nudge, but not much of one. Hashprice is currently $0.28, as selling pressure continues to weighs down Bitcoin’s price.

Hashrate: Bitcoin’s hashrate is bouncing back after China’s mining crackdown. With the great mining migration in its early stages, hashrate continues to come on line at a steady pace, with the 7-day SMA currently at 104 EH.

Even as hashrate is booting back up, Bitcoin’s difficulty still adjusted downward this weekend to 13.93 T, the fourth negative adjustment in a row. It’s too early to tell by what degree, but the next adjustment will likely be upward as more China miners come online around the world and hashrate continues to recover post-exodus.

What is a Carbon Negative Block, Anyway?: One miner is taking Bitcoin’s ESG narrative a step further, blazoning their blocks with a message that claims the miner’s operations are “carbon negative.” What does that even mean? We look into the logistics in our latest post for Hashrate Index.

Mining News

RIGZ Listed on the New York Stock Exchange

The Viridi Cleaner Energy Crypto-Mining & Semiconductor ETF (Ticker: RIGZ) is now listed for trading on the New York Stock Exchange.

RIGZ is an actively-managed exchange-traded fund which is focused on investments within the cryptocurrency mining and mining infrastructure industries.

“Based on recent developments within the Chinese mining sector, North American miners that have access to sustainable and cheap power, large fleets of new-generation rigs, and access to capital are well positioned to generate higher returns during the months and years ahead. We are excited to be launching RIGZ at such a pivotal point within the evolution of this market sector, and to be prioritizing investment into sustainable crypto mining practices through Viridi’s clean energy focus,” Wes Fulford, Chief Executive Officer of Viridi Funds, said.

RIGZ holdings consist of crypto mining companies (Bitfarms, Hut 8 Mining, Riot Blockchain, CleanSpark, HIVE Blockchain Technologies, and Marathon Digital Holdings), as well as semiconductor companies (Samsung Electronics Co, Nvidia Corporation, Advanced Micro Devices, and Taiwan Semiconductor Manufacturing Co).

Three Other Provinces Join China’s Crackdown

State-owned power companies in the Anhui, Gansu and Henan regions have begun conducting inspections to sniff out any miners still active in these regions, according to Chinese media sources.

The actions come after the State Grid Corporation of China, a CCP-owned power entity which owns and oversees the country’s grid system, recently sent renewed notices to each of its provincial branches reminding them to kick miners off their grids.

Check Out Cambridge’s Cool New Global Hashrate Map

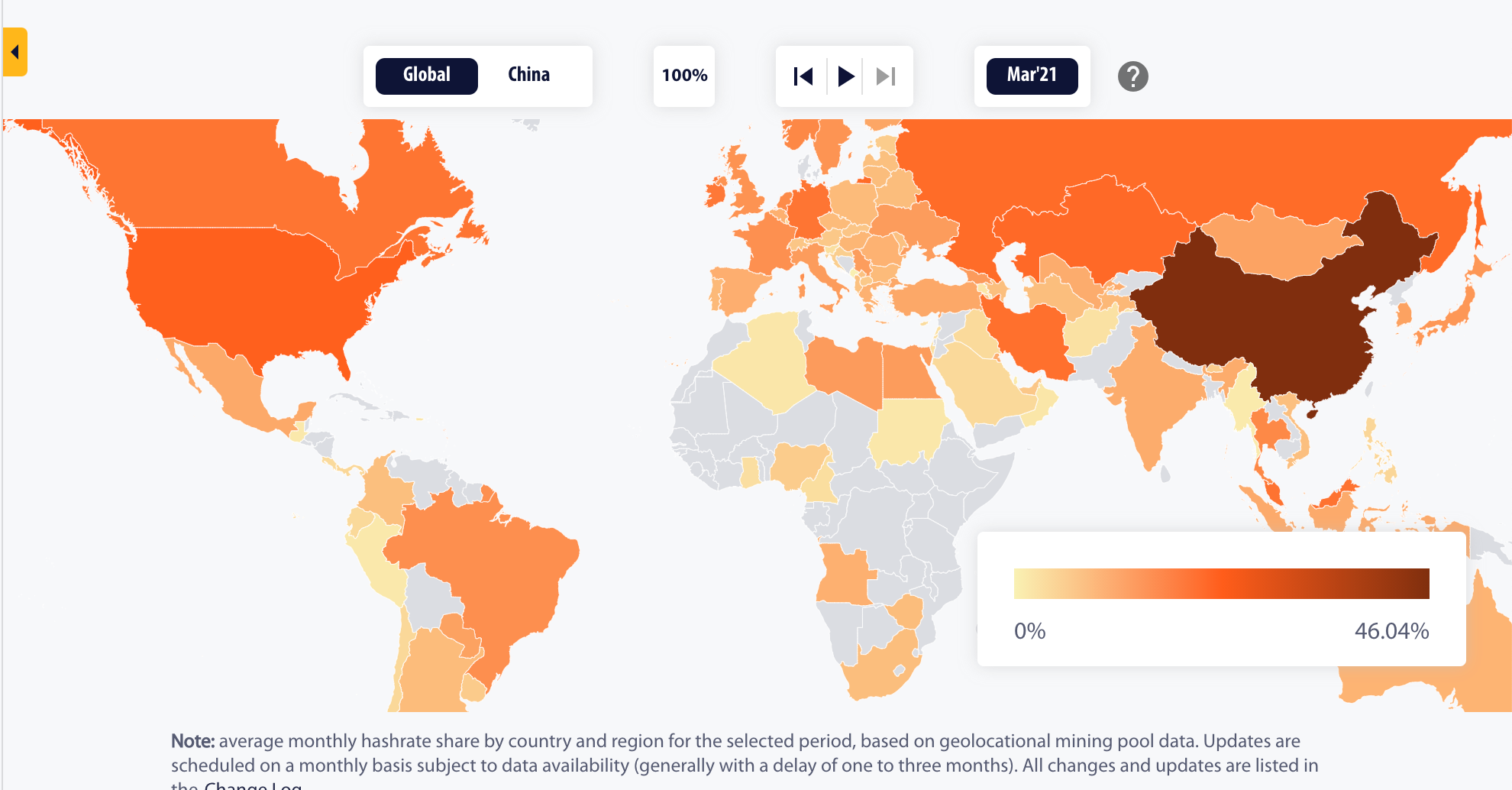

The University of Cambridge Judge School of Business’s Centre for Alternative Finance has been conducting Bitcoin mining research for years now, but the hashrate map they released last week might be their best work yet.

The world map presents each country’s share of hashrate from August 2019 until March 2021, allowing you to track the flow of hashrate between regions (and even within China itself) month-by-month within this timeframe.

The data isn’t perfect and the per country percentage is likely to be skewed due to privacy tech like VPNs, but it’s the most comprehensive topographical view we’ve ever had of the Bitcoin’s mining industry’s hashrate distribution.

What’s more, the maps gives us a snapshot of global hashrate right before the migration from China, so we’ll have it to refer back to when looking at where hashrate settles post-ban.

Hashing Like Beckham? Ukraine “Miners” Were Mining Fifa Virtual Goods, Not Crypto

News circulated recently that Ukrainian police had raided an underground crypto farm that was stealing power from its neighbors -- but that news is only half true.

Turns out, the farm wasn’t mining crypto (or running mining hardware at all); the farm was mining Fifa Ultimate Team cards using 3,800 PS4s. The reality came to light after an internet commentator noted that pictures from the raid displayed playstations, not the barebones GPU setups that would be much more efficient for mining altcoins.

Apparently, there’s a billion dollar market in EA collectibles, enough to incentivize this type of bot farming, but we doubt this will make the news for “boiling oceans” anytime soon…

Mining Disrupt Is this Week, So Come Say Hi!

We’re back in Miami this week for Mining Disrupt and we will have a booth in the expo center, so come say hi and talk mining with us!

Happy Hashing, and have a good week!

-Luxor Team

RIGZ ETF DISCLOSURE

Investors should consider the investment objectives, risk, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the RIGZ ETF please call (215) 882-9983 or visit the web site at viridifunds.com/rigz-etf. Read the prospectus or summary prospectus carefully before investing.

Investments involve risks. Principal loss is possible. ETFs may trade at a premium or discount to their net asset value. Redemptions are limited and often brokerage commissions are charged on each trade which may reduce returns.

The Fund will not invest directly in cryptocurrencies however it invests in companies involved in the cryptocurrency industry such as mining and manufacturers which can be very volatile. There is no assurance that the cryptocurrency network or service providers will continue in existence or grow. Technology companies may have limited product lines, financial resources and could face intense competition and rapid product obsolescence. Cryptocurrency functionality relies on the Internet and a significant disruption of connectivity could impede functionality and the risk of fraud or cyber-attack which could have adverse effect on the Fund’s investments.

Cryptocurrencies are subject to supply and demand so it is unclear how it will be impacted by geopolitical events. Nevertheless, political, health or economic crises may motivate large-scale acquisitions or sales of cryptocurrency either globally or locally. Large movements in the price of cryptocurrencies could create volatility and negatively impact the value of the Fund.

Cryptocurrencies exchanges are new and largely unregulated without any central authority or backing by any government or banks. Cryptocurrency is not legal tender and may experience very high volatility or be more exposed to fraud, glitches or stop operating.

Cryptocurrencies currently face an uncertain regulatory landscape and are rapidly evolving in not only the United States but also in many foreign jurisdictions. The adoption of laws and regulations that affect the industry could ultimately have a negative impact or impede the growth of the companies the fund invests in.

Investments in foreign securities and depositary receipts are subject to special risks including the risk of a foreign jurisdiction imposing restrictions on the ability to repatriate or transfer currency or other assets; political, regulatory risks; and foreign market and trading risks. Depositary receipts represent shares of foreign based corporations and may be less liquid than the underlying shares in their primary trading market.

The Fund may invest in companies that have recently completed an IPO (initial public offering), are derived from a SPAC (Special Purpose Acquisition Company) or result from a Reverse Merger. These companies may be unseasoned and lack a trading history and track record. IPOs and stocks derived from SPACS or Reverse Mergers are thus often subject to extreme price volatility and speculative trading.

The fund invests in micro-, small-, and mid-capitalization sized companies which could have less liquidity and lower-trading volumes which tend to make their market price fall more in response to selling pressures and may have limited markets, product lines, or financial resources and lack management experience.

The Fund’s crypto mining investments will be screened with clean energy criteria. Given the high energy usage of the crypto mining industry, the Sub-Adviser will evaluate crypto mining companies by focusing on their actions that will reduce the negative environmental impacts of mining. The Sub-Adviser will also consider purchased carbon offsets and other actions promoting environmental sustainability. There can be no assurance that this strategy will be successful for the Fund.

The Fund is non-diversified, which means that it may invest more of its assets in the securities of a single or smaller number of issuers than if it were a diversified fund. The Fund was recently organized with limited operating history and track record on which to base an investment decision.

The Funds are distributed by Quasar Distributors, LLC. The Sub-Adviser (Viridi Funds) provides clean energy screening.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.