Bitcoin Bear Market Clamps Down On Q2 Public Miner Financials

Q2-2022 was one of the toughest quarters yet for these public mining stocks.

Public Bitcoin miners wrapped up their Q2 financial reporting recently, and the numbers tell us a bit more about what we already knew – the bear market has been brutal for the big boys.

Q2 produced the perfect macro cocktail to intoxicate mining operators: Bitcoin’s price plummeted, Bitcoin’s mining difficulty increase, energy prices soared, and interest rates rose. So at a time when mining was become less profitable (both because of Bitcoin’s price decline and the rise in difficulty), power became more expensive (for those miners without long term PPAs, at least) and the cost to acquire capital went up.

On paper, every Bitcoin miner in our analysis printed a substantial loss, because their primary operating assets (bitcoin mining ASICs) declined by 47% over the quarter, while Bitcoin itself (their primary cash equivalent) fell 58%. Additionally, many experienced degraded performance over the quarter for a variety of reasons.

We won’t be covering quarterly losses in-depth here; given the volatility in Bitcoin’s price and ASIC prices, the figures muddy the water and obscure actual operational health.

Instead, we’ll take a look at bitcoin production, hashrate, and Q2 BTC liquidations. After that, we’ll look at enterprise value (EV) / revenue ratios using up-to-date EVs based on most recent marketcaps and Q2 revenue numbers. We’ll also wrap up the article with up-to-date EV / Active ASIC ratios and the latest operational updates from some of the miners in our analysis

Editor’s note: Some miners were left out of certain analysis for lack of reporting on specific data points, or because the data skewed the rest of the data set.

Public Miner BTC Production and Operational Efficiencies

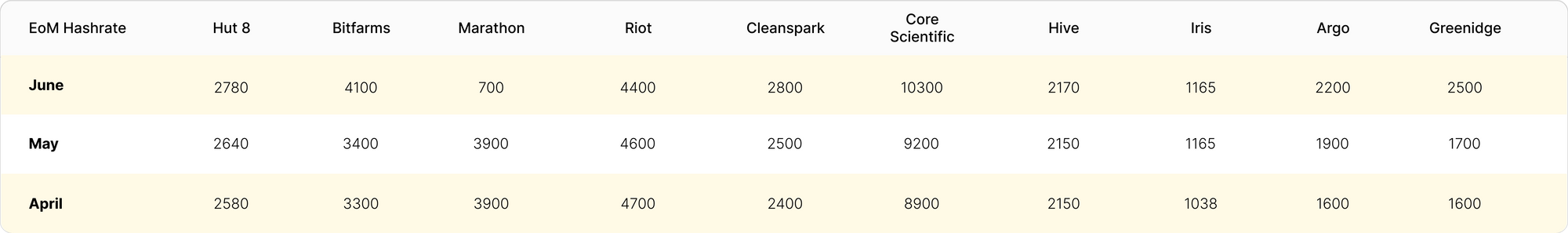

To start, we’ll take a gander at operating hashrate, bitcoin production, and operational efficiency (BTC mined per unit of hashrate).

Most miners expanded their fleets as the quarter wore on, with the notable exceptions of Riot and Marathon, two of the largest Bitcoin miners by marketcap. For Riot, the shrinkage came from its exit from Coinmint and subsequent migration of machines to its Whinstone facility. Marathon claims that severe storms in Montana disrupted its facilities at Hardin, adding that the energization of Compute North’s Texas facility was taking longer than expected.

In terms of BTC production, only Marathon, Riot, Core Scientific, and Hive mined fewer BTC in June than they did in April.

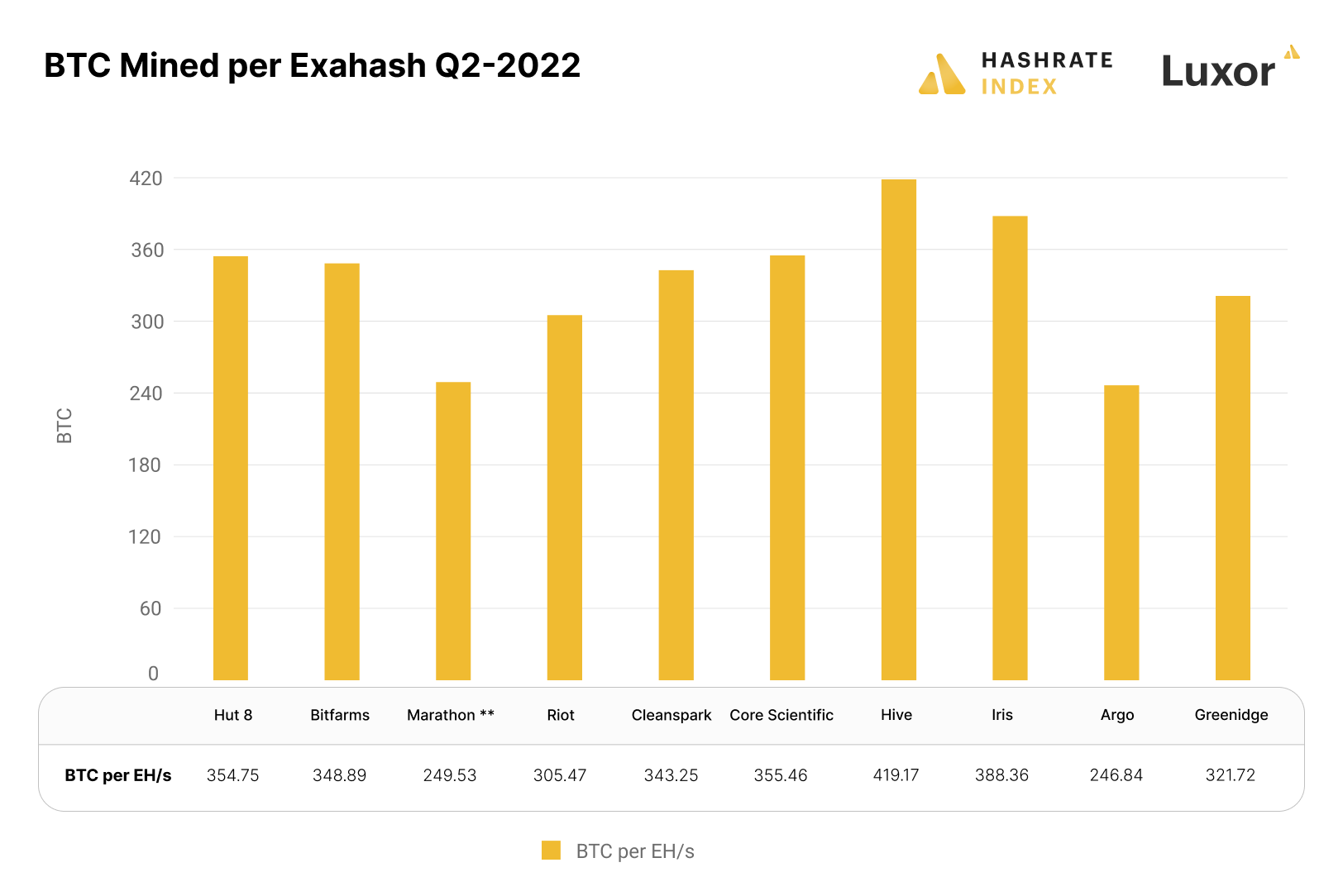

Taking hashrate and bitcoin production in tandem, we can analyze operational efficiency. The following analysis takes the sum of all BTC rewards over Q2 and divides this by each miner’s average hashrate for the quarter.

Hive, Hut 8, Iris Energy, and Core Scientific led the pack here. It’s worth noting that part of Hive and Hut 8’s efficiency comes from their ETH mining operations; Hut 8 converts all of these rewards into BTC, while Hive includes ETH holdings as a BTC equivalent in its production numbers.

The laggards for this ratio are Marathon, Argo, Riot and Greenidge. For Riot’s part, in addition to migrating its fleet, the miner curtailed power to the tune of $5.7 million in power credits. This income supplants the Bitcoin mining revenue they would have earned during the curtailment downtime, but obviously, it won’t show up in BTC production numbers. As for Marathon, the miner claims storm damage in Montana and behind-schedule energizing of Compute North’s Texas facility impeded its Q2 production.

Bitcoin Miners Sell BTC to Pay Down Debt, Fund Operations

Q2 was a record quarter for public bitcoin miner liquidations.

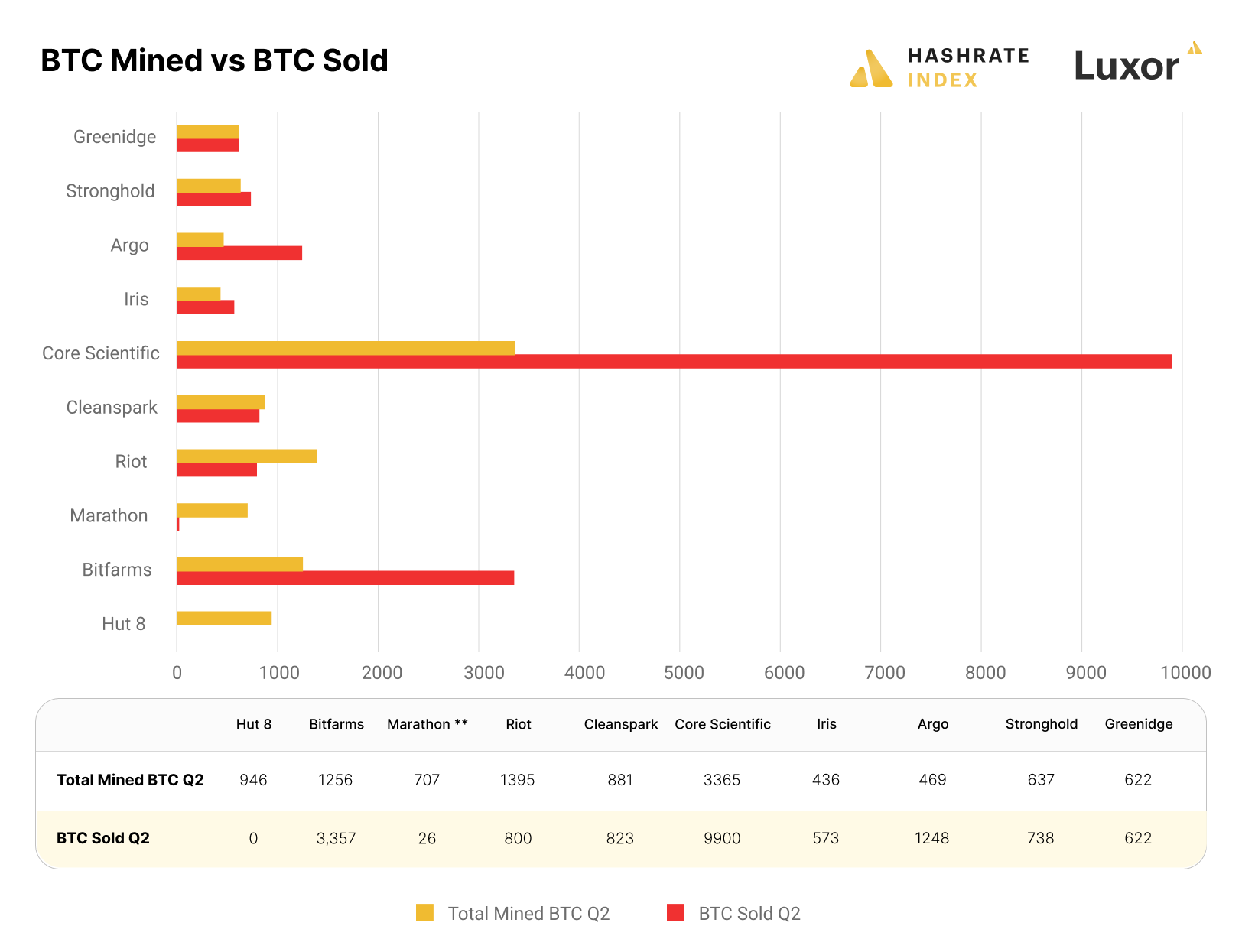

The miners in the following chart collectively mined 10,714 BTC in Q2, but they also sold 18,087 BTC over the same period. Plenty of other miners that we left out of this analysis sold, as well, and to our knowledge, the only public miner who didn’t sell any BTC last quarter was Hut 8.

These miners sold BTC to cover their mountains of liabilities. Beyond electricity costs, these miners have debt for equipment financing and real estate, not to mention payroll and other expenses. Bitcoin is the most liquid asset these miners keep on their balance sheet, so it’s always the first to go. As demonstrated by the above chart, many miners couldn’t cover these cost by selling their Q2 production, so they dipped their hands into their treasuries to make up the rest.

Below is a table that depicts the total value of the bitcoin treasuries of the public miners in our analysis, as well as the Price / Hodl ratio of each.

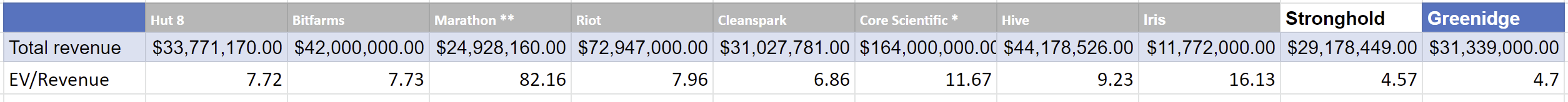

Enterprise Value / Revenue Ratios for Public Bitcoin Miners

Public mining stock prices are down, which means marketcaps are down, which also means that the enterprise values are also down, even as some many miners moved to pare down debt last quarter.

For our enterprise values, we include BTC holdings as well as cash holdings. These public miners treat BTC balances as a cash asset, so it makes sense to include in overall enterprise value, especially considering how many of them liquidated holdings to cover expenses recently.

We opted to use revenue instead of EBITDA because too many miners posted negative earnings in Q2, skewing the dataset.

For EV/revenue, a lower ratio is more favorable. A higher ratio means that a company’s enterprise value is trading at a higher multiple relative to revenue.

Enterprise Value / Total ASIC Value for Public Bitcoin Miners

The EV / Total ASIC Value ratio is a multiple we pioneered on Hashrate Index to show how much larger a company’s enterprise value is relative to its productive assets (bitcoin mining ASICs).

As with other similar multiples, a larger ratio is less favorable than a smaller ratio.

We left Marathon Digital out of the above chart because its ratio was so high (86.18) that it muddied the rest of the chart. Hive has the second highest ratio, but it’s important to note that this company earns a large portion of its BTC from Ethereum mining (Hive automatically converts its mined ETH to BTC); as such, Hive has a smaller ASIC fleet for its size relative to its peers.

Below is a table that outlines more data on each public Bitcoin miner’s ASIC portfolio, including the total value of their active ASIC fleets.

Latest News and Operational Updates From Public Bitcoin Miners

Cleanspark recently announced the acquisition of assets from Waha Technologies. The newly acquired datacenter has an existing capacity of 36 MW, with room to expand to 86MW. Existing power was acquired for about $450,000 per MW. The new site located in Georgia will add 2.6 EH/s of capacity, and is expected to be fully scaled by 2023. Some key assets with the acquisition include in-place S19 mining rigs. Cleanspark paid $8.9 million for the S19 rigs with 340 ph/s of capacity at $26 per terahash.

Hut 8 released news of their continued growth and diamond hands with a full Bitcoin treasury. During the most recent BTC selloff, the company was able to keep their full Bitcoin stack, while the vast majority of miners needed to sell bitcoin to pay off debt and equipment loans. Recently, Hut 8 announced an at-the-market equity offering for $200 million. This allows the company to raise capital at prevailing market prices. Executives have stated money will be used to expand their operations, and for general work capital needs. Benefit of capital raise, the company can continue growing and hodling their stack through the bear market.

Stronghold did not fare well with the bear market. The company recently announced they had to return 26,000 S19 mining rigs to their lenders. Of those 26,000 mining machines, 18,000 were actively mining bitcoin at an annual revenue run rate of $70 million. Whitehawk lending increased the tenor of term loan from 14 months to 36 months. By changing the terms of principal repayment, Stronghold will have access to capital of up to $20 million dollars. It is unclear if NYDIG will have a hosting agreement with Stronghold or simply sell the mining rigs into the secondary market.

Iris Energy continues to consistently build and expand their operations. Miner deliveries during 2022 increased from 4.3 EH/s to 6.0 EH/s. Recently, they energized their Mackenzie site earlier than anticipated, adding 1.5 EH/s of capacity. Company benefited from the recent Bitmain pricing adjustments on their S19J pro mining orders. Based on company comments, Iris Energy will take on more hashrate from Bitmain with their price protection credits.

Core Scientific continues to be hard hit with a down market in Bitcoin. The company has sold most of its Bitcoin stack to fund operations, and pay off equipment loans. Additionally, the company shares slide down with the recent $200 MM equity raise announcement. Core Scientific has self-hosting capacity of 10.9 EH/s and 8.4 EH/s hosting mining. They continue to lead all public Bitcoin miners with the largest deployed capacity.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.