How BRC-20 inscriptions sent BTC transaction fees to 5-year highs

BRC-20 inscriptions drove Bitcoin transaction fees to their highest level since 2017. Here's how.

Every time you think Bitcoin gets boring, or that you have it figured out, the market proves you wrong. The market for inscriptions did the proving last weekend. Or more rightly, a new inscription token standard, BRC-20, did when it drove Bitcoin transaction fees to their highest levels since 2017.

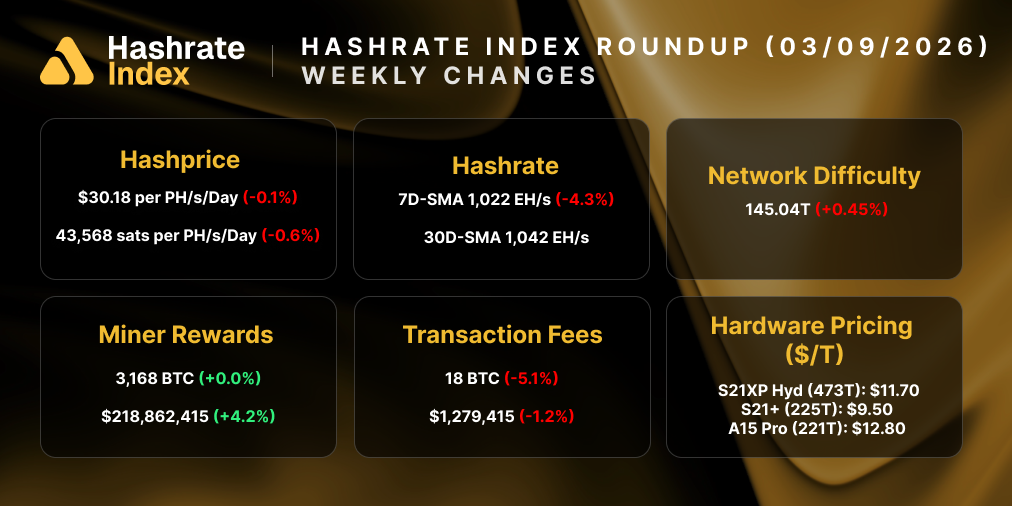

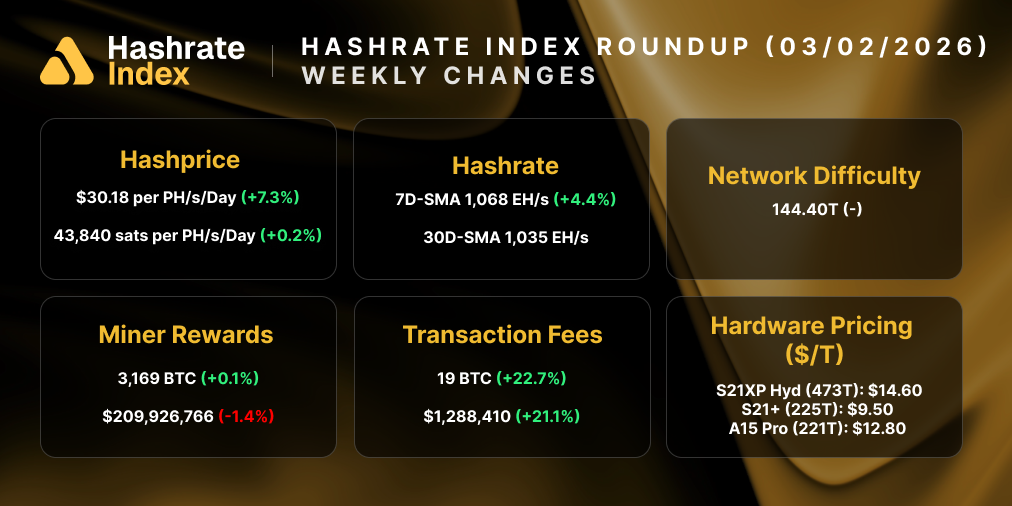

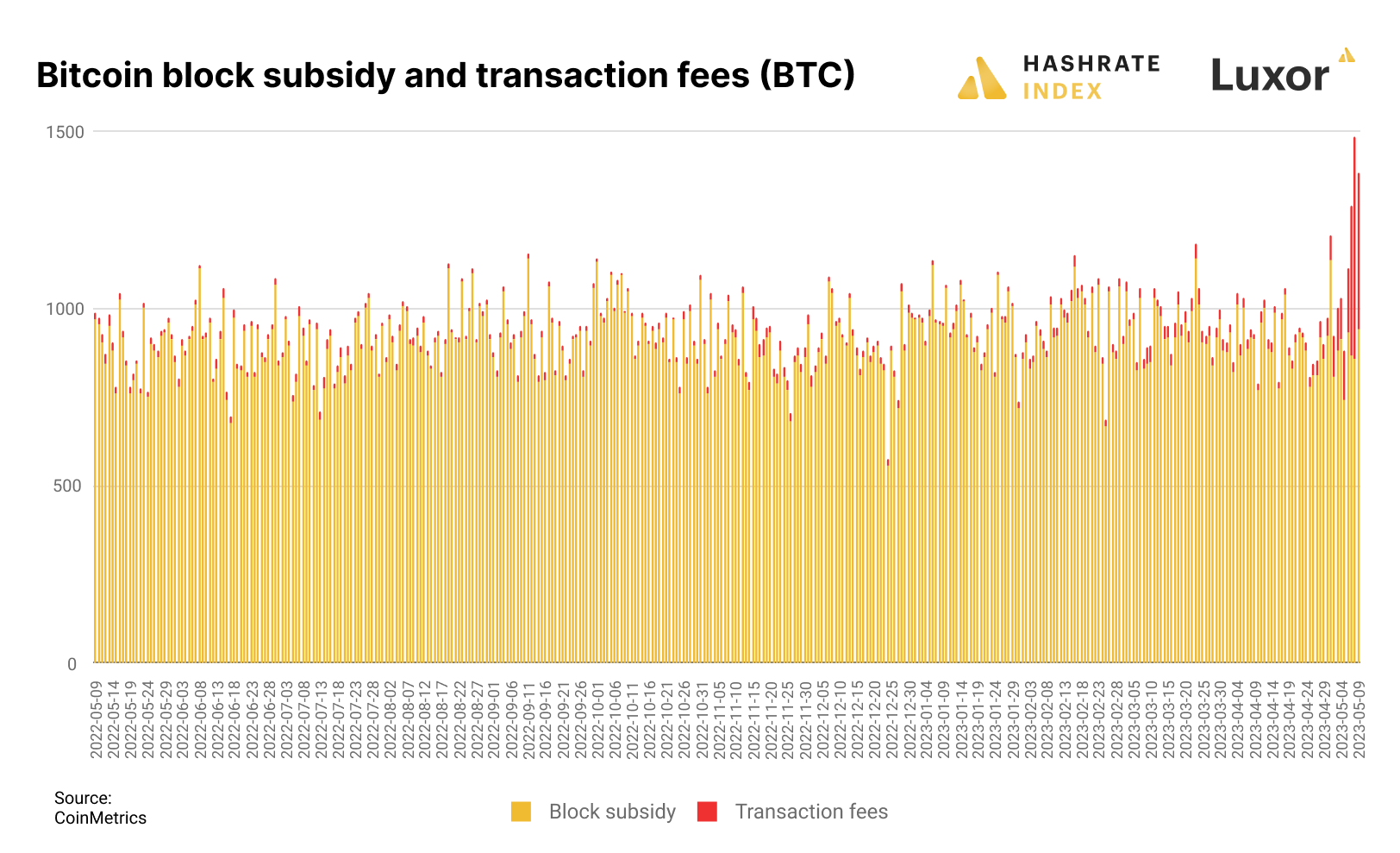

The BRC-20 bonanza started bubbling up on Sunday and peaked on Monday. Bidding wars were so intense that some block rewards were over 12.5 BTC – last halving epoch’s block subsidy. It was the first time we saw transaction fee rewards eclipse the block subsidy this halving epoch, and hashprice topped out at $129/PH/day on Monday from the fee action, a 72% increase from the prior week.

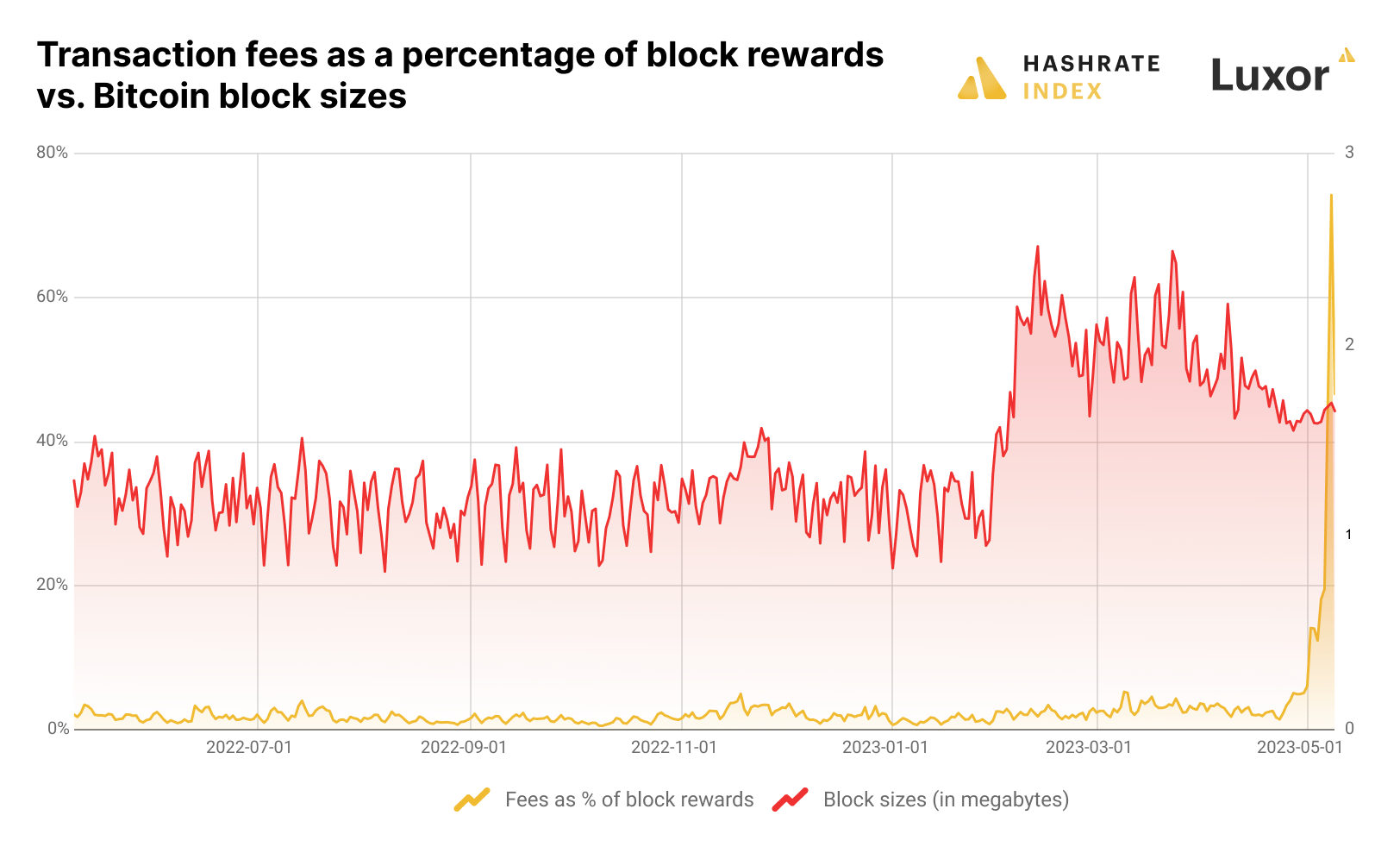

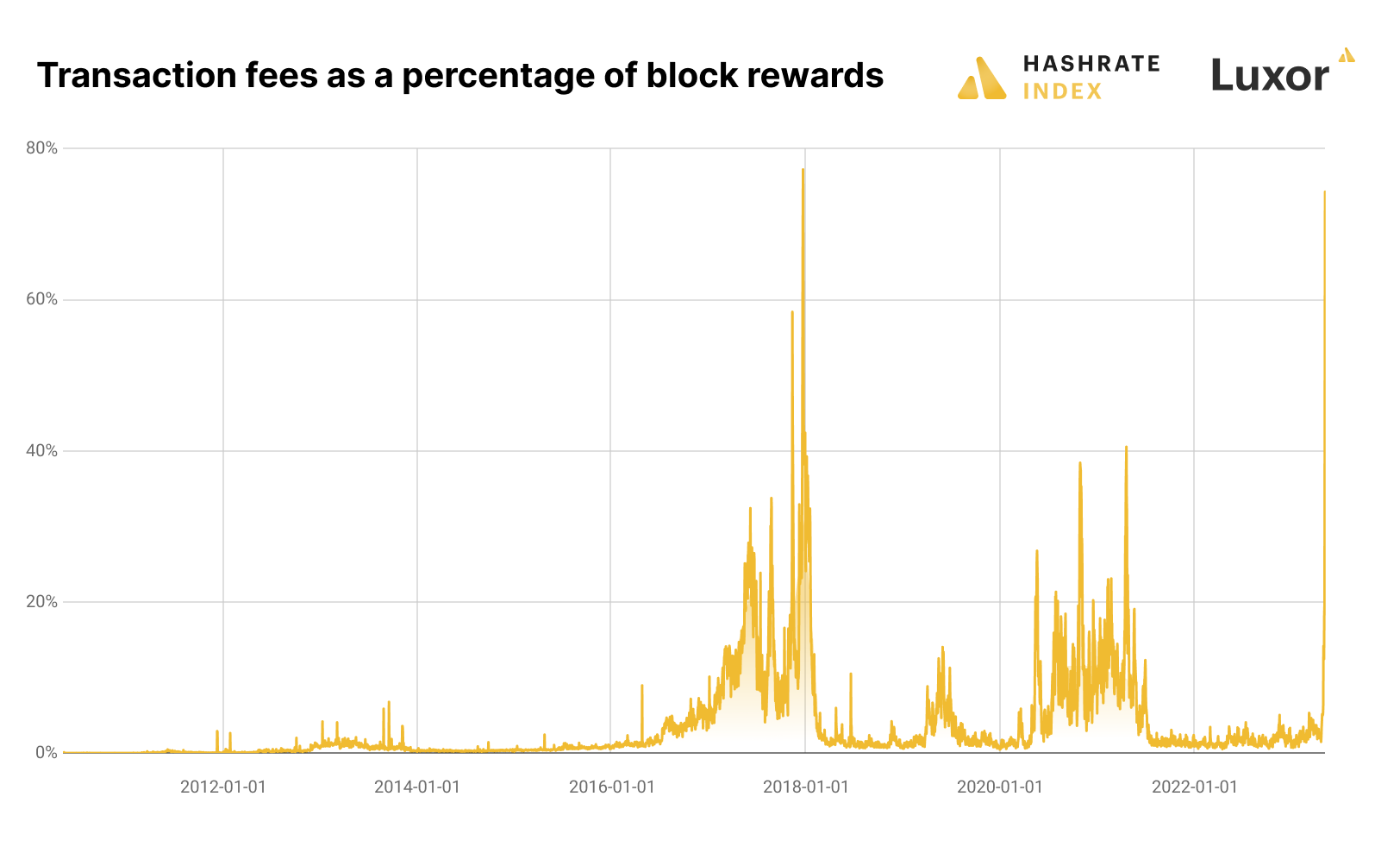

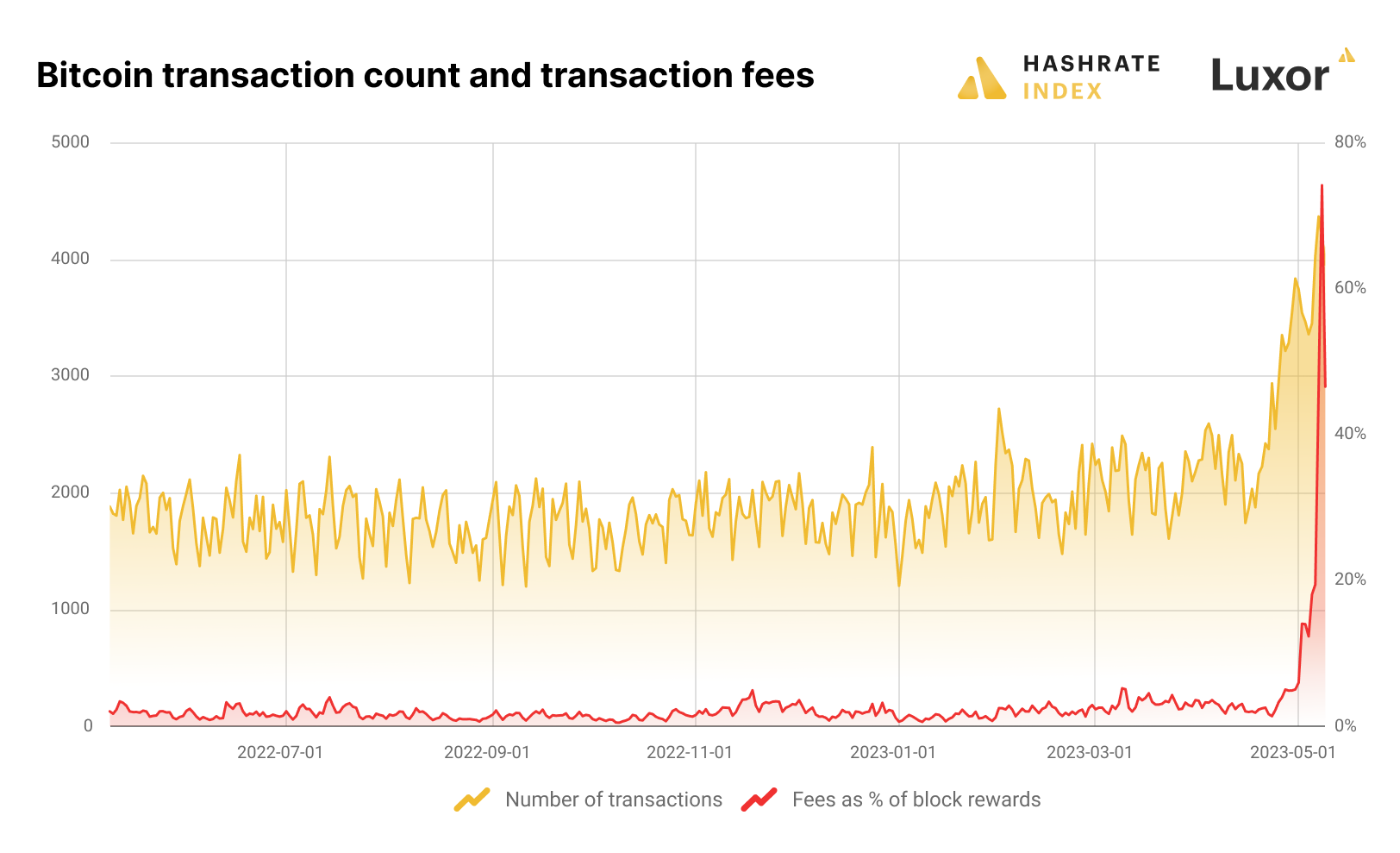

The whole thing meant a FAT payday for Bitcoin miners. I mean, look at this chart. The transactions as a percentage of block rewards datapoint looks like an X-Games Mega Ramp. Absolutely parabolic. So it’s no surprise that yesterday, transaction fees made up their second largest share of block rewards ever. (The largest fee-to-subsidy ratio was 77% on December 22, 2017).

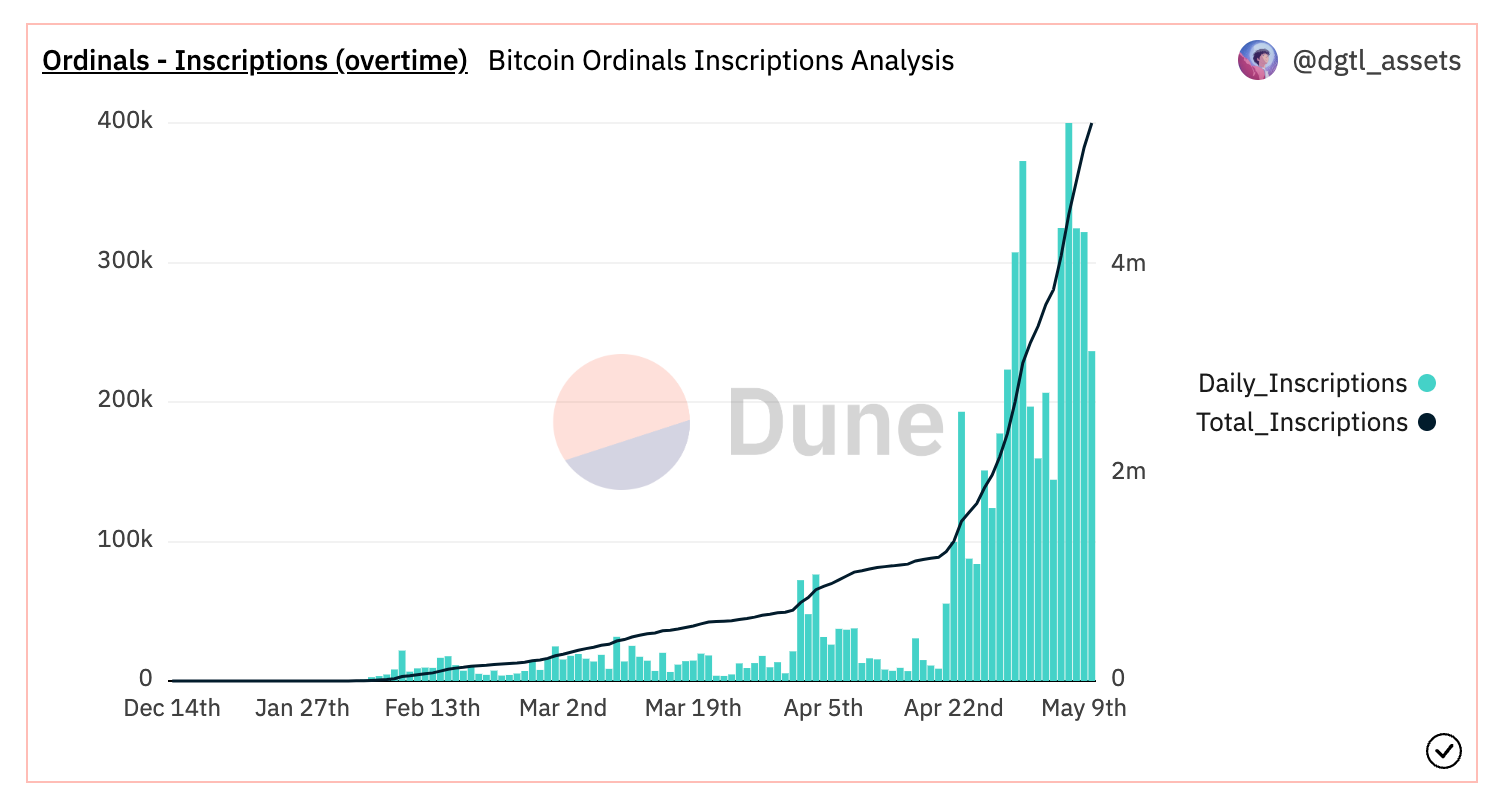

You may notice in the first chart that despite the high fees, BRC-20s did not lead to all-time high block sizes. In fact, blocks were fuller in February and March, the inception of the inscriptions mania.

We’ll be unpacking this dynamic in today’s newsletter. But before we do, here’s a little more data to chew over to show just how profitable the BRC-20 ord-rush has been for Bitcoin miners.

- The average fee-to-block-subsidy ratio over the last week was 33.09%, versus 6.37% the week prior. Compared to the first week of November, when that ratio was 1.9%, last week’s average looks damn good, and this week’s average looks ungodly good.

- The average transaction count per block on Sunday May 7 hit an all-time high of 4373.26 transactions, while Monday May 8 witnessed the second highest at 4197.17.

- Miners reaped 2749.95 BTC ($63,212,552) in transaction fees in May alone, versus 2233.14 BTC ($69,264,805) in the first four months of 2023.

- Year-to-date, the average of total daily transactions has been 38.63 ($1,026,956), versus 16.50 ($329,795) for the last six months of 2022.

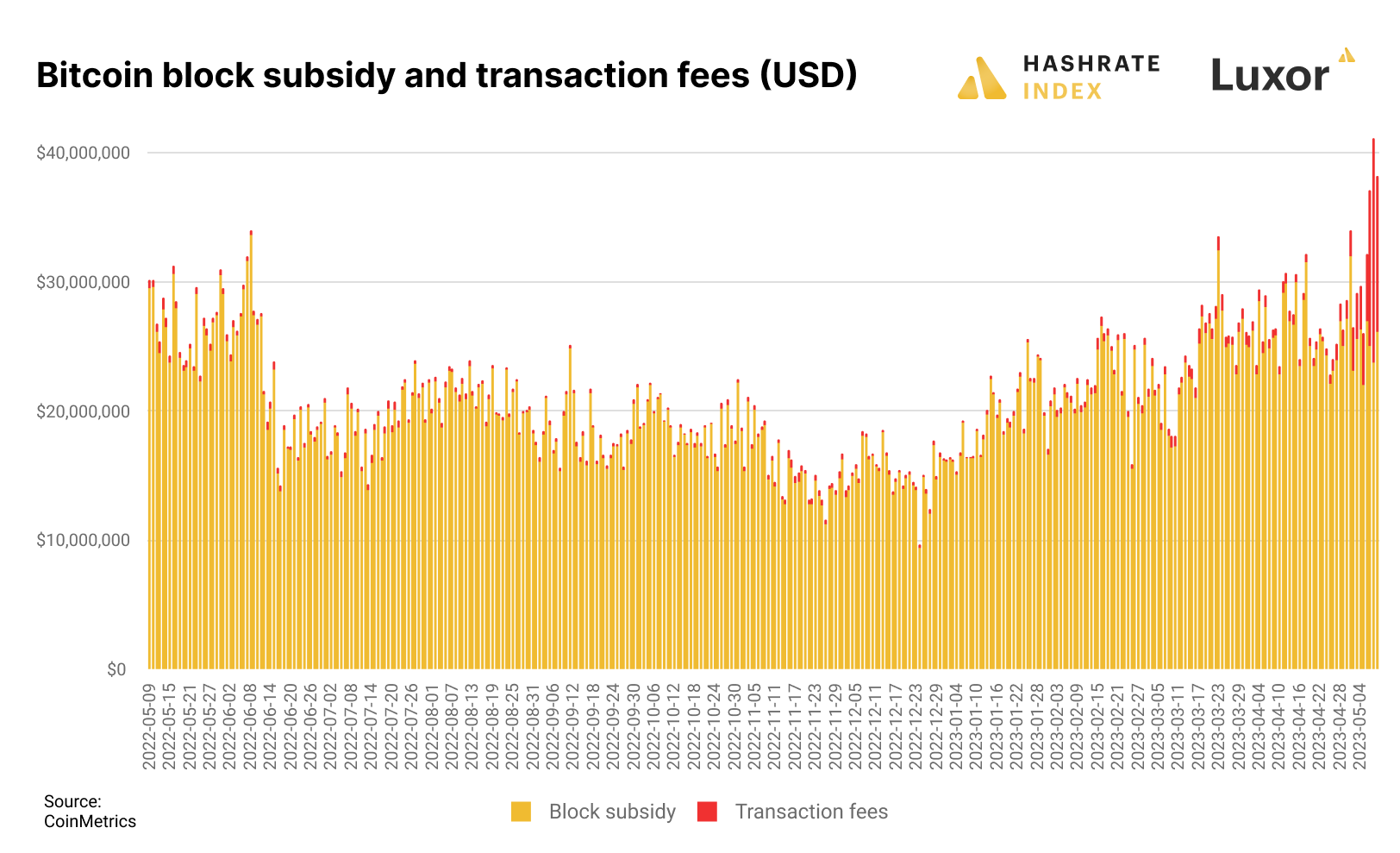

The chart above gives a clear picture of the positive impact on BTC denominated rewards, but to really show how this has been a revenue lifeline for miners, we need to look at USD denominated rewards.

In the USD denominated chart above, we can see daily rewards decrease throughout 2022, bottoming out to a low of under $10 million in daily revenue on Christmas Eve. Revenues have slowly trended upward since. And now, adding to the inertia of Bitcoin's 2023 recovery, the recent transaction fee mania has slung mining revenue back to the levels we saw in May and early June of last year – the final days before Bitcoin’s price shit the bed and dropped below $30,000.

Back then, hashprice was roughly $120/PH/day. Now, it’s ~$103/PH/day, so the recent fee and BTC price action hasn’t put profitability back on par with May 2022. But a 14% decrease ain’t bad when you consider that hashrate grew 54% over the same period and difficulty along with it.

Like we said, Bitcoin’s price drove a lot of this year's hashprice recovery. But so far in May, BRC-20 tokens are carrying those gains forward still – or more specifically, the token standard's minting incentives AND design are fueling the transaction fee boom.

In the first section, we cover what the BRC-20 standard is and how it works. If you’re just here for the data, you can skip to the second section.

BRC-20 brings Ethereum-like minting incentives to Bitcoin inscriptions

Before we break down how the BRC-20 standard is responsible for the meteoric rise in transaction fees, a quick BRC-20 primer.

If you haven’t read up on what the hell an ordinal / inscription is, check out this primer on inscriptions, ordinals, and digital artifacts.

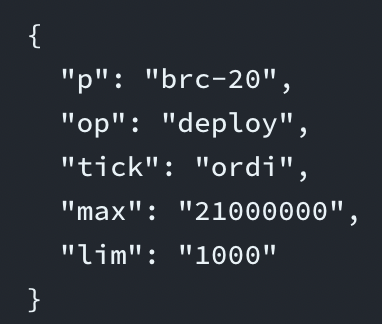

The standard is a memetic reference to ERC-20, the popular Ethereum smart contract standard that incubated the ICO outbreak in 2017’s bull market. Like the ERC-20 contracts which dictated ICO token distributions, the BRC-20 standard provides a template for users to mint tokens that conform to certain parameters. The BRC-20 token creator sets these parameters with a deploy contract using Bitcoin’s OP_CODE function.

Once a BRC-20 token template is publicized, anyone can build transactions to mint tokens in that series so long as the transaction they broadcast conforms to the original deploy contract’s standards.

Here’s an example of a BRC-20 deploy contract and its parameters. It contains a four letter ticker, a maximum supply, and a limit on how many tokens a user can mint at one time. Once someone deploys a template and publicizes it, other Bitcoin users can use it to mint tokens in the series. Ordinal theory serializes these tokens with the same numeric system that keeps track of other inscriptions, so BRC-20 tokens are fully trackable and indexable.

The BRC-20 minting mechanism has given way to a “first come, first mint” mentality for inscriptions series where inscribers are gunning to mint as many inscriptions in a series before everyone else. As inscribers rush to mint, they are paying astronomical fees to beat out the competition.

We’re seeing the same transaction bidding wars that clogged up Ethereum in 2021/2022, and we're also seeing profitable hybrid mining-trading strategies called maximal/miner extractable value (MEV) begin to pop up on Bitcoin from the minting frenzy.

If you’d like to read more about BRC-20 tokens and the minting incentives, I recommend these articles on OrdinalHub:

BRC-20 tokens send Bitcoin transaction fees to multi-year highs

The first-come, first-mint incentives are the primary catalyst for the explosion in transaction fees. But the BRC-20 token standard's design is also leading to greater blockspace congestion than other inscriptions because these tokens are “heavier” than other inscription transactions, and this is contributing to fee pressure as well.

BRC-20 contracts are stored in JSON format, a somewhat clunky and inefficient format for data storage which has ramifications for blockspace (more on that in a second).

Going further, BRC-20 tokens use more traditional transaction data and less witness data than other inscriptions (like images, for example). A BRC-20 token transaction may have 55 bytes of data in the witness section of the block, while it has 300 bytes of data in the transaction section, for example, while the largest-ever-block had 3.96 megabytes in the witness section and only 300 bytes in the transaction section.

Simply put, the ratio of transaction data to witness data is MUCH HIGHER for BRC-20 tokens than traditional inscriptions.

Editor’s note: Bitcoin’s 2017 SegWit upgrade changed the design of transaction and signature data in Bitcoin blocks, wherein the witness data that is used to verify the signatures on a transaction was moved out of the transaction data section of a block and moved to a different section (hence segregated witness, or SegWit for short). This data is discounted by the Bitcoin protocol, making it cheaper to transact on a fee-per-byte-of-data basis.

So BRC-20 utilizes more transaction section data and less SegWit data, making them more expensive to transact on a per-byte basis. This is why, as fees have gone parabolic, we’ve seen transaction counts increase while block sizes have remained lower relative to other periods of high ordinal activity.

The first wave of ordinals took up more blockspace because of the SegWit discount. But since BRC-20s use more transaction data than witness data, blocks are filling up with more transaction data than witness data, so their overall data footprint is lower.

There's plenty of room for improvement for the BRC-20 token format. In fact, BRC-20s could be stored as binary code instead of as JSON files, which could reduce bandwidth by as much as 80%.

BRC-20: Casting shadows of MEV on Bitcoin?

So far with the BRC-20 brouhaha, we haven’t seen any front running or sandwich trading like in Ethereum's NFT market– not yet, at least. All it would take is a script / program that scans the mempool, and this is just a matter of time. Once these scripts exist, traders will be able to front run and snipe BRC-20 mints – and if demand were sufficient, the resulting MEV shenanigans would make Sunday and Monday's fee surge look like a warmup.

We have seen traders and miners seize arbitraging opportunities between ordinal markets, another form of MEV. If BRC-20 tokens continue to garner popularity we expect to see more sophisticated MEV strategies, which could involve out-of-band payments to miners for priority inclusion in blocks.

Outside of MEV, though, the big takeaway from BRC-20 tokens and inscriptions at large is that they provide miners with a revenue stream that a) miners either didn't know existed or b) thought would never exist.

In 2022, many miners grew complacent with 1-3% transaction fees as a percentage of block rewards, so much so that to many, a 5-10% fee-to-subsidy ratio (let alone 25%, 50%, or 100%!) was inconceivable.

Naturally, the most recent action has ignited discussion above events that decouple hashprice from Bitcoin price (like the China Mining Ban), particularly with Bitcoin’s fourth halving less than a year a way.

Now the burning question is: will inscriptions actually last long enough to make a meaningful difference when that difference is needed most? I personally doubt that BRC-20 inscriptions in their current form will be the thing to keep transaction fees afloat 50 years from now when miners really need it.

But the current fee mania at least shows that ample block space demand exists, wherever it may come from. And for miners dreading April 2024's halving, that's a godsend.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.