The Bitcoin Halving is Behind Us: How Did Luxor’s Predictions Hold Up?

In March, we made some predictions about the halving's impact. Here's how they held up.

In March, we published a pre-halving report with predictions for how the event would shake up Bitcoin’s hashrate and other network metrics. With the Bitcoin halving now two months behind us, it's time to look back and see how our predictions held up.

Luxor’s Pre-Halving Predictions

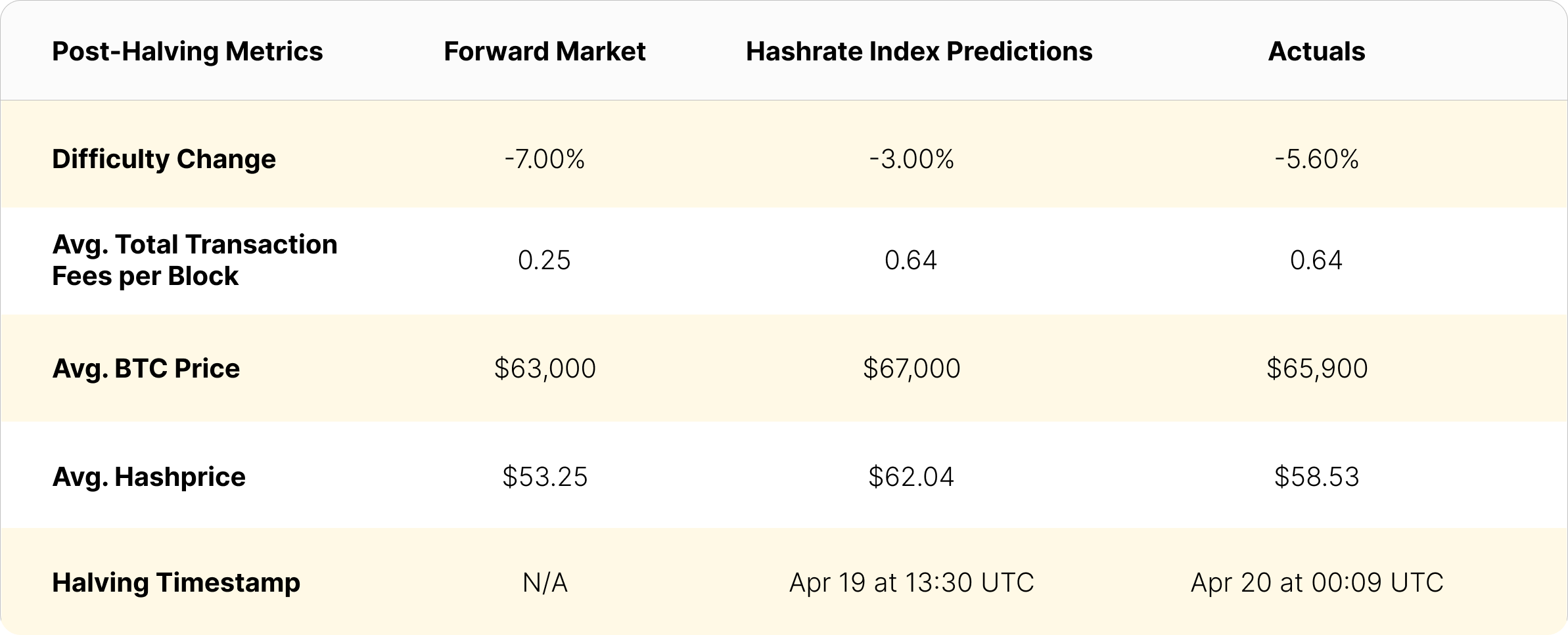

In our March 22, 2024 report, we made predictions about Bitcoin’s difficulty, hashrate, transaction fees, and hashprice after the halving, basing them on our forward market prices, historical data, third party estimates, and internal modeling and forecasting. In addition, the trades made by market participants in Luxor’s Hashrate Forward Market provided their own expectations for Bitcoin’s hashrate and hashprice. In the table below, we compare the market’s expectations, our own, and the actual changes to these metrics.

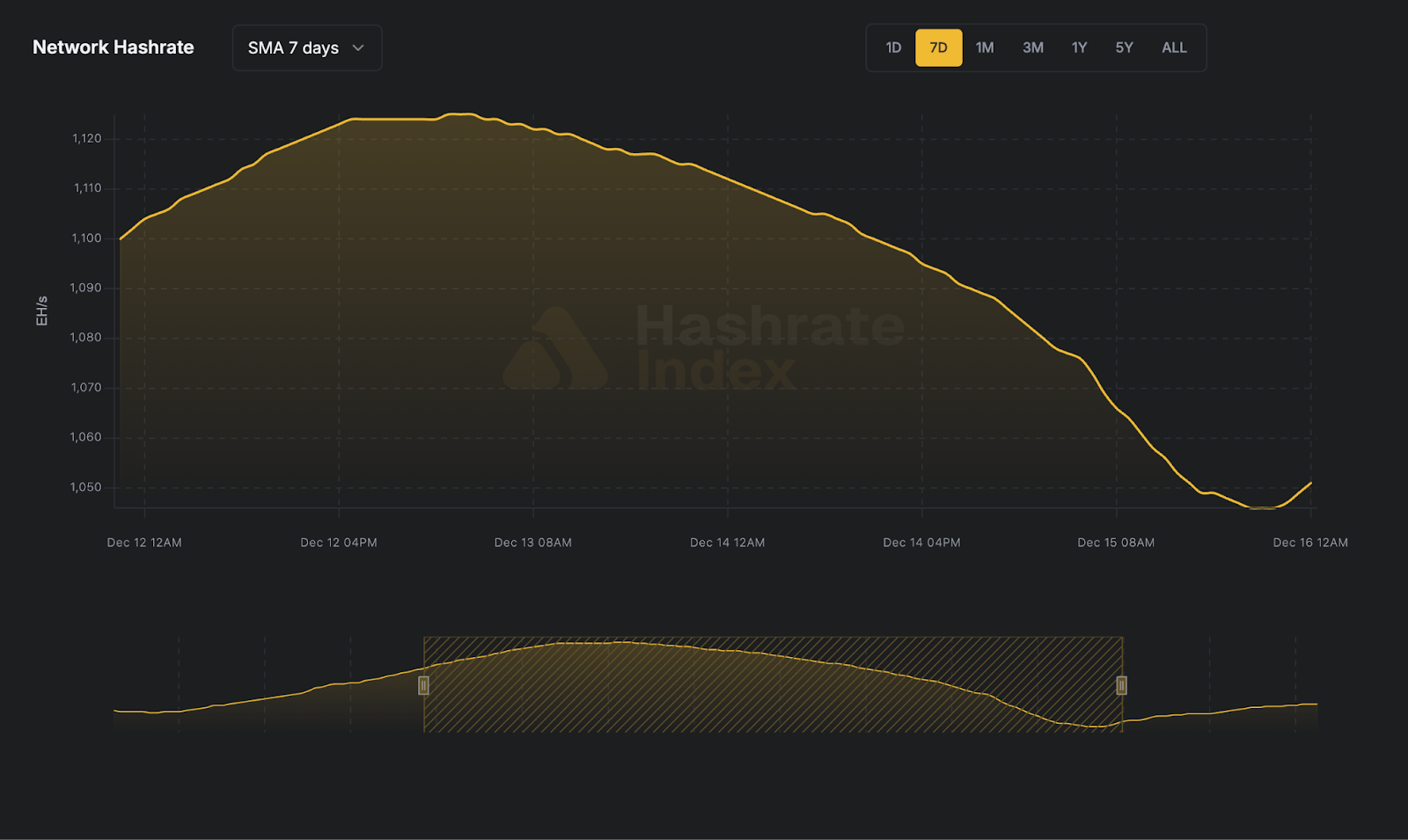

Network Difficulty After the Halving

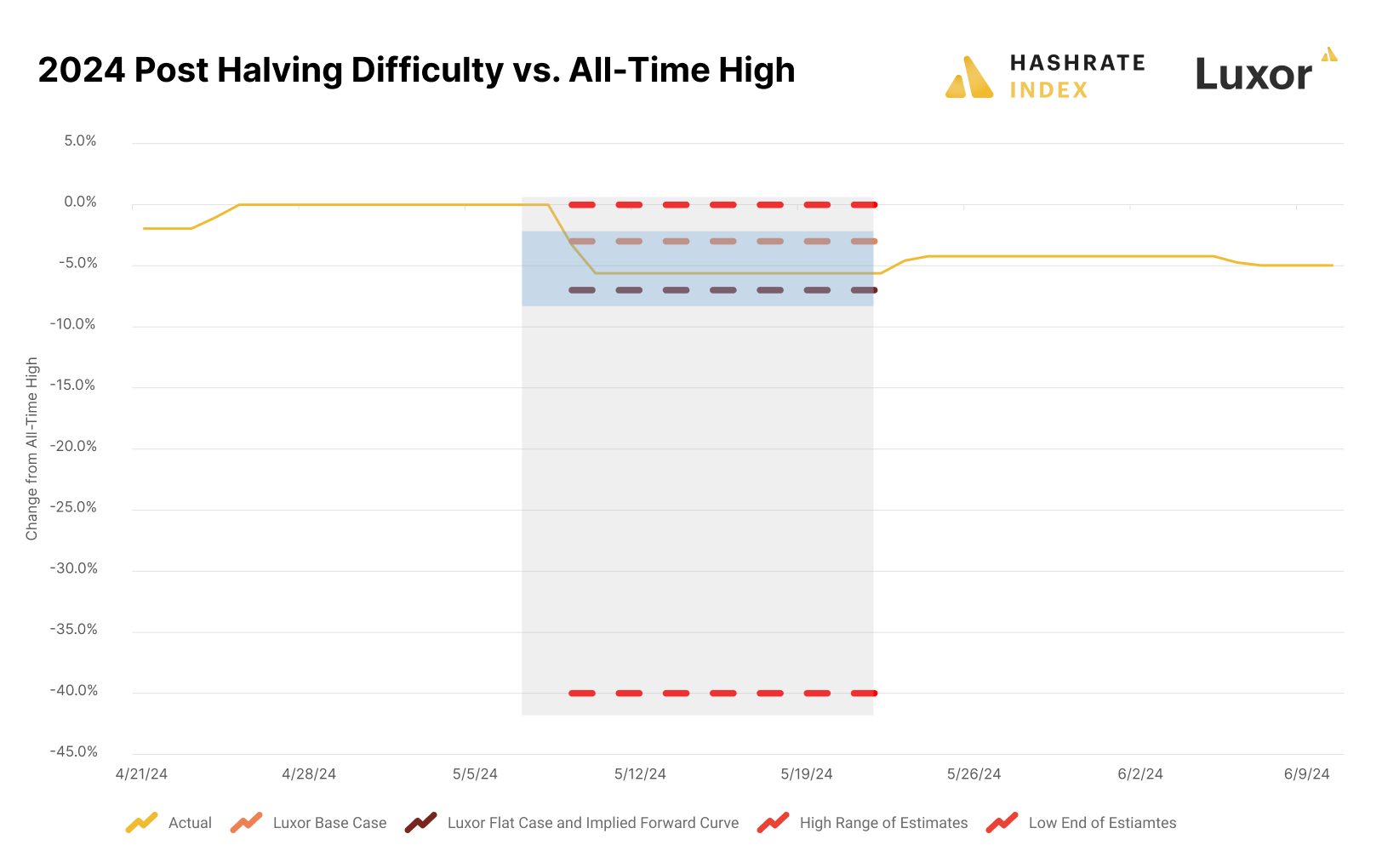

Perhaps the most debated aspect of the halving was the expectation for a drop in Bitcoin’s difficulty (and hashrate) as unprofitable miners turned off their machines. A wide range of estimates were put forward, with commentators anticipating anywhere from 0-40% of the entire network hashrate coming offline after the halving.

Based on our analysis, we anticipated a small drop in difficulty – between 3-7%, with two difficulty adjustments post-halving – and we nailed the call. The actual peak to trough drop in difficulty post-halving was 5.5% – after two difficulty adjustments.

Rising Transaction Fees After the Halving

In March, we also nailed guidance on transaction fees up-to and after the halving. Based on our transaction fee forecasts, we projected a moderate rise in fees per block, from 0.25 BTC in March to 0.64 BTC after the halving. As of June 14, 2024, the actual transaction fee average per block has been 0.64 BTC per block since the halving – spot on with our prediction.

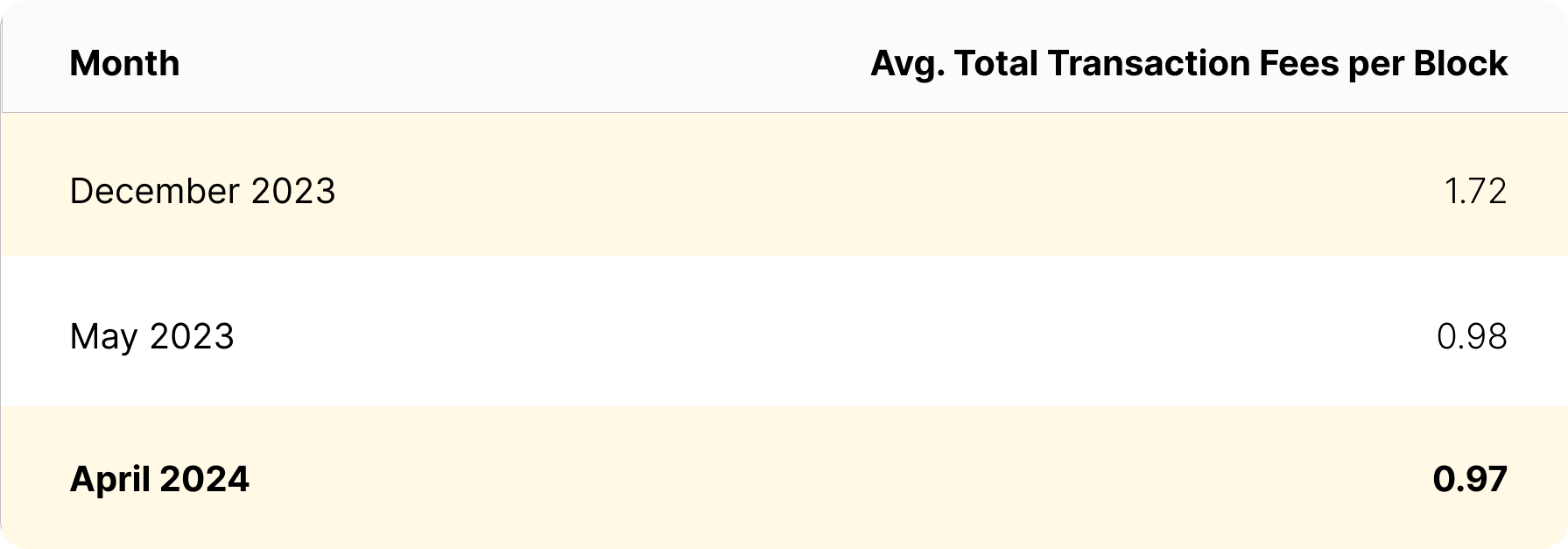

A new fungible token standard launched on the halving block, Runes, were the wild card for transaction fees heading into the halving. But even so, our qualitative guidance accurately gauged the magnitude of the event. In the report, we mentioned that Runes could have a similar impact as BRC-20 tokens, and they did; in April 2024, miners reaped comparable transaction fees to the three peak months for BRC-20 activity last year.

The Bitcoin Halving’s Effect on Hashprice

Luxor’s Hashrate Forward market and Hashrate Index Premium’s projections provided market participants with a reasonable range of plausible scenarios and likely outcomes for hashprice. As of June 14, 2024, actual post-halving hashprice has averaged $58.53/PH/Day, compared to a forward curve of $53.25/PH/Day for Luxor Hashrate Forward market from April 20 to June 14, 2024 and our $62.04/PH/Day base case projection in Hashrate Index’s pre-halving report.

Staying Up To Date on Hashrate Markets

If you follow Bitcoin Mining, you need to follow Luxor’s forward and futures hashrate markets, as well as Hashrate Index’s projections. Otherwise, you are missing out on analysis of the most important dimension of hashprice – time.

Forward prices, far more than spot prices (i.e., the price right now, at this instant), tell you a lot about the economics of a commodity business. What could a newly-purchased ASIC earn over the next 12 months? How much profit would a miner lock in right now by hedging hashrate production? How much lower are financing rates for companies that hedge their hashrate production? These are questions that can only be answered by considering future hashrate markets.

Luckily –- we got the tools to help you out.

- Reach out to the Luxor Team to get started using hashrate markets.

- Subscribe to Hashrate Index’s Quarterly Hashrate, Difficulty and Hashprice Projections Report.

- Follow Luxor’s OTC Hashrate Forward markets in our app or on telegram.

- Follow Luxor’s Hashrate Futures on Bitnomial Exchange.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.