2024 Bitcoin Home Mining Guide

Discover how to start mining bitcoins at home profitably in 2024. Learn about ASIC miners, costs, profitability, and choosing the best mining pool.

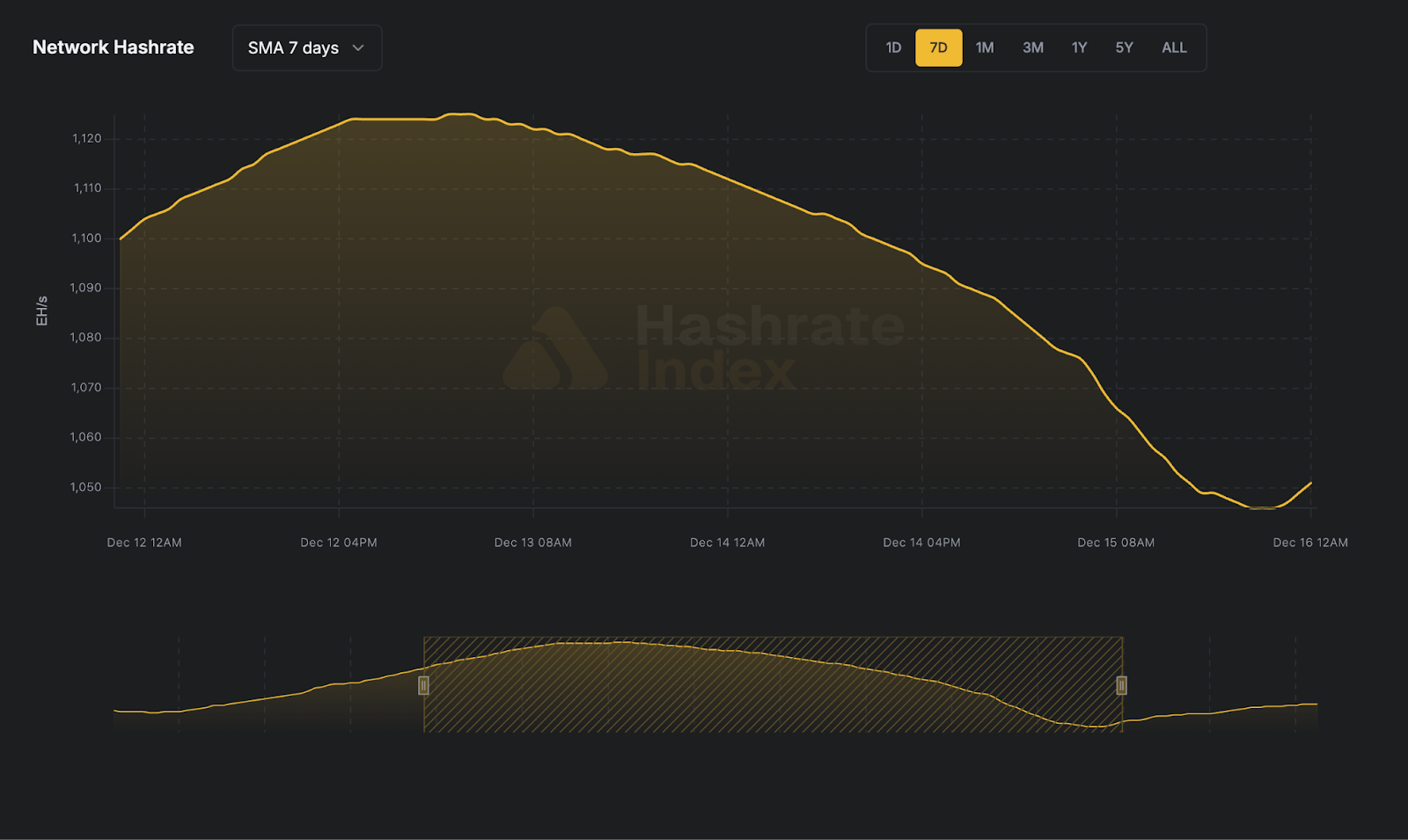

It’s been a while since our last Bitcoin Home Mining Guide back in 2021, and a lot has changed in the Bitcoin mining industry since then. The price of Bitcoin has seen its fair share of ups and downs, culminating in a new all time high in 2024. New ASIC miner models such as the Antminer S21 have come to market, providing excellent efficiency gains while pushing Bitcoin’s hashrate to its own all-time high. Most importantly, we have gone through Bitcoin’s fourth halving, which reduced the Bitcoin block subsidy to 3.125 BTC. Given these significant evolutions to the mining ecosystem, we feel it’s a great time to provide an updated Bitcoin Home Mining Guide for 2024.

Home mining can still be a profitable venture in the current landscape, but there are several important factors to keep in mind to be successful. In this guide, we will walk you through the whole process, from buying your first ASIC to reaping the rewards of your hashrate. We will also highlight crucial variables to look at when first getting into home mining.

Calculating Costs and Profitability of Mining Bitcoins at Home

Before diving into mining, it's important for miners to calculate or estimate the costs involved to ensure that their operation will be profitable (or at least break even). The top questions every miner should ask themselves when calculating costs are, “how much will this ASIC cost me up front?” and “how much does it cost to run?”.

The cost of the ASIC is pretty straight forward, but how do you know if you’re getting the best price? The cost of your electricity when operating the ASIC miner has several more variables to it, including the cost of power at on-peak and off-peak hours, as well as the cost of power in your specific region. We will expand on these factors in greater detail. If you know these numbers already, you can use our Bitcoin Mining Profitability Calculator to start getting an idea of your returns and profit margins.

How to Buy a Bitcoin ASIC Miner

There are several different brands manufacturing ASICs in today’s market, but the two biggest companies are Bitmain and MicroBT with their Antminer and Whatsminer series respectively. Models like the Antminer S21 and Whatsminer M60S are the latest models, sporting great efficiency ratings. These models also come with some higher price tags, ranging from $3,000 - $5,000 as of June 2024. Older models like the Antminer S19 or Whatsminer 50 series can be found for much cheaper, but are less energy efficient, produce less hashrate, and are therefore less profitable in the long run.

When purchasing an ASIC, it's crucial to choose a reputable retailer to ensure you’re getting an authentic product, competitive price, and reliable customer service. Buying from the manufacturer’s website is a good starting point, but the company might not have the newest models in stock. ASIC resellers and marketplaces such as Luxor's ASIC Trading Desk offer a variety of mining hardware from multiple manufacturers, with detailed specifications, price comparisons, and user reviews.

Unboxing and Getting to Know Your ASIC Miner

So you purchased and received your first ASIC miner, congratulations! The first thing you likely will notice is the weight – that sucker is heavy! Most ASIC miners weigh around 12-15kg (25-35lbs).

Remove it from the box carefully and take off any packaging. Take note of any extras that come in the box, like power cables and owner’s manual, which we suggest reading through.

The miner primarily consists of 3 parts: the control board, the power supply unit (PSU), and the hashboards. The control board is the ASIC miner’s logic center – kind of like its brain. This is on the top side of the miner, and it’s where the ethernet cord connects to the device. The PSU is the power supply, which requires two 240 volt inputs on cables that are rated for that voltage. A key mistake people make is assuming that the power cables come with the miner, but in a lot of cases, they do not. You will need to purchase the correct cable for the miner type you purchased.

The hashboards are the circuit boards located within the body of the miner and they run the mining process itself. Under most circumstances, you will not need to ever interact with any of the internal components of the miner. If you remain curious, here is a great video where the Luxor team dissects an S19K Pro.

Look around the machine and identify where its ports and status LEDs are located, including the ethernet port. ASICs don’t use WiFi, so you will need a good quality ethernet cable to hook it up to your home router/modem. Ensure that the cable is not a tripping hazard or receiving interference from nearby cables; you want to make sure your miner has a stable internet connection to maximize miner efficiency.

ASIC Miner Electricity Costs and Technical Requirements

Mining Bitcoins at home with one or two Bitmain miners requires significant electricity. Depending on the model, an ASIC miner can consume from 3,000 to 3,700 watts, translating to about 72-84 kWh daily. Using our Mining Profitability Calculator, you can enter your local electricity rates to see how much an ASIC would cost to run (for newer models, this can be anywhere from $5 to $10 per day per miner, which is roughly $150 to $300 monthly). It's important to investigate different electrical rates for different demand times in your area. The easiest way to do this is to call your electrical provider and ask for details on your electrical schedule.

For each miner, you will need to install one 20 AMP 240V circuit and breaker. In the U.S., most homes only include 240V outlets and breakers for the dryer and central heating. You should ensure that you have adequate physical and electrical space in your breaker box for the miners you wish to use. We strongly advise consulting a licensed electrician for any electrical work.

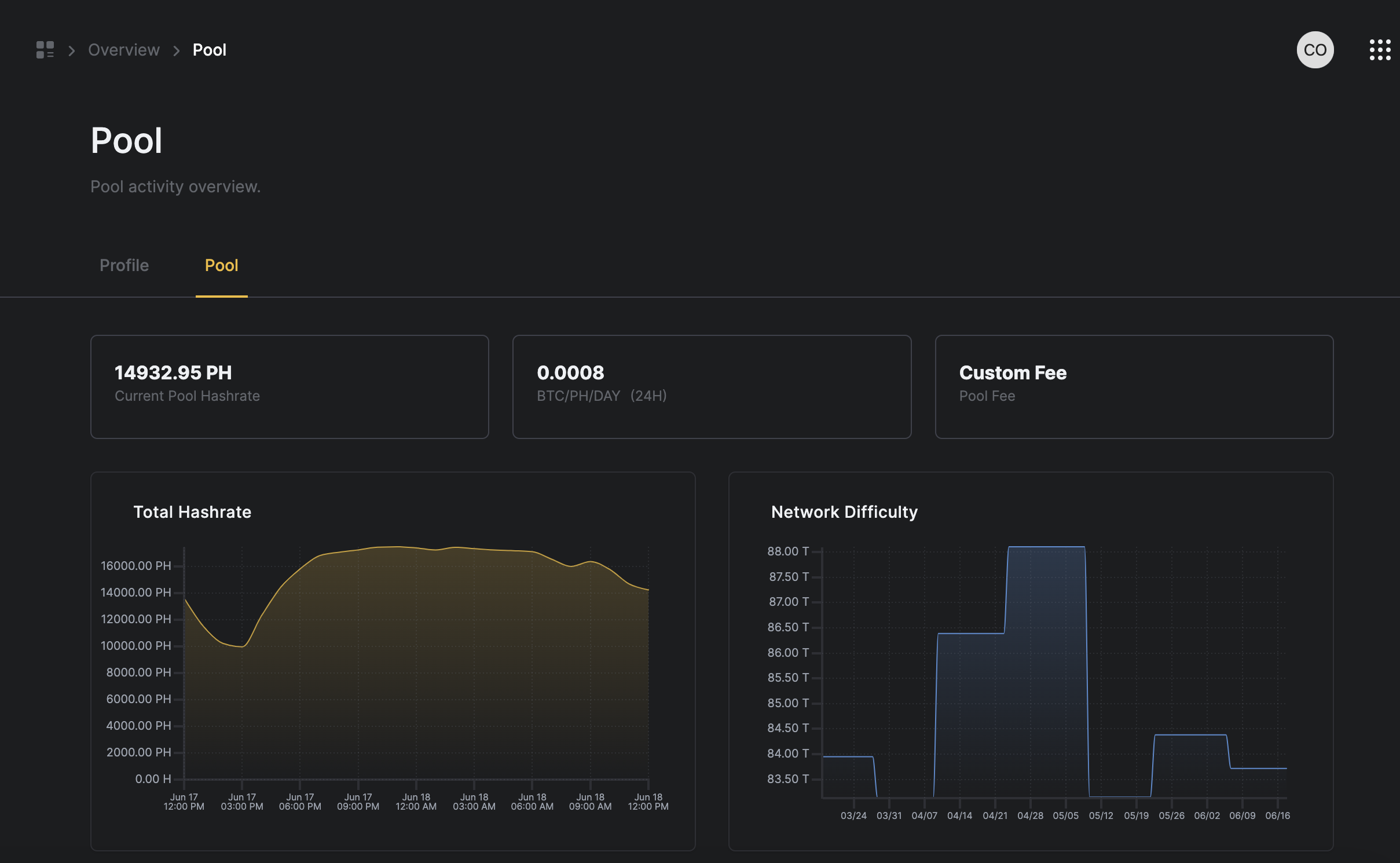

Choosing a Bitcoin Mining Pool or Crypto Mining Pool

Now that your ASIC miner is set up, it’s time to start earning bitcoin!

Selecting the right mining pool is vital for maximizing your mining returns. Different mining pools offer various payout methods, each with its own advantages. Common methods include Pay-Per-Share (PPS), Full Pay-Per-Share (FPPS), and Pay-Per-Last-N-Shares (PPLNS). FPPS and PPS provide stable, predictable payouts based on the number of shares submitted, while PPLNS can be more profitable over time but with higher variance. If you would like to learn more, we made a Bitcoin Mining Pool Payout Guide that describes these concepts and key terms more in depth.

Understanding the payout method of the pool is paramount to determining which pool to use as each has its own pros and cons. Luxor Mining Pool is an excellent choice, offering competitive fees, reliable payouts, and robust security features.

Connecting to a Bitcoin Mining Pool and Managing Your Wallet

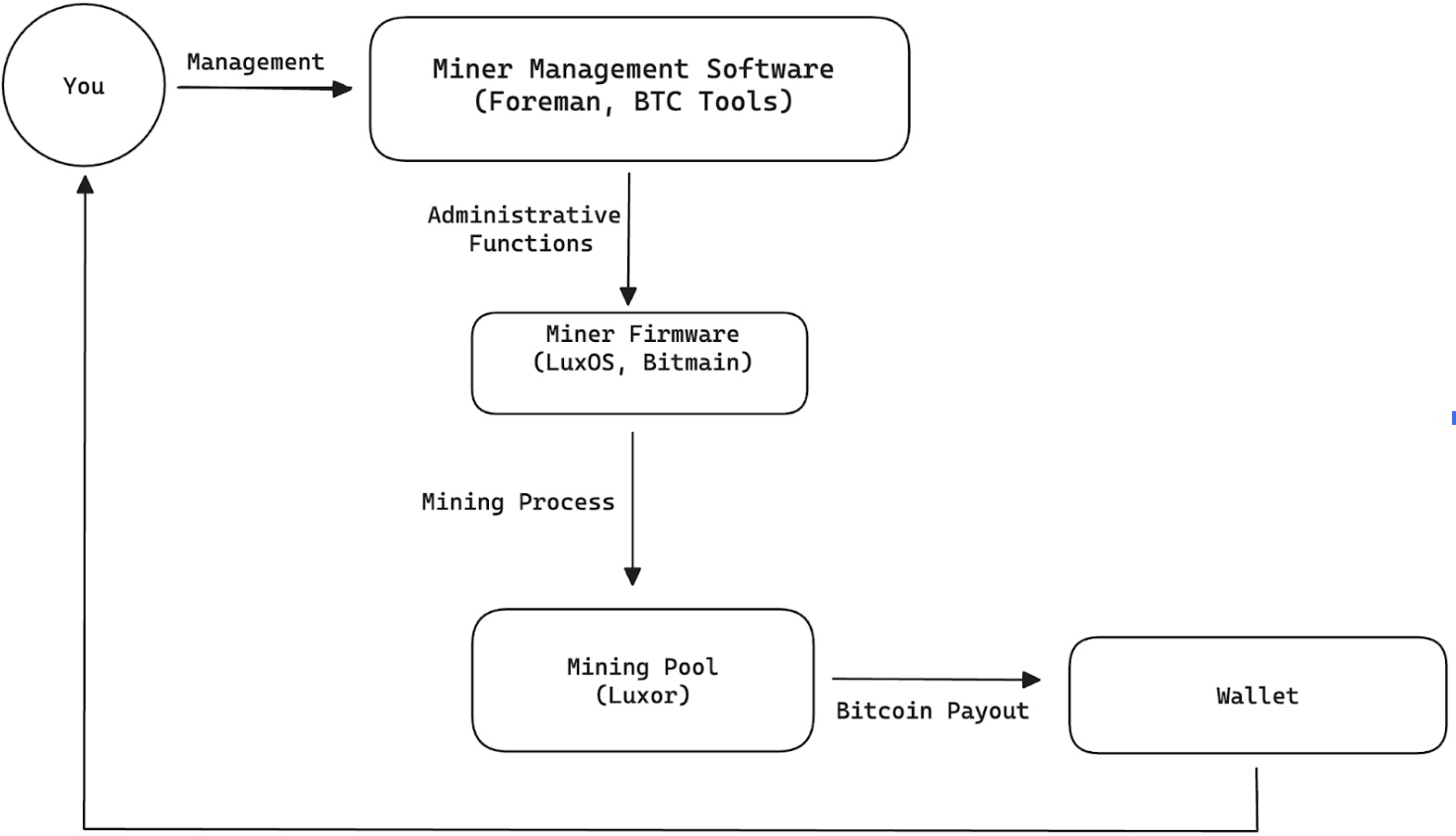

To connect your miner to a pool, configure the miner's settings with the pool's server address, your worker name, and password. For Luxor, create a subaccount on our platform, then enter the pool address and credentials into your miner's configuration page. Ensure your wallet address is correctly set up to receive payouts. Detailed setup instructions for Luxor pool and wallet configurations can be found in our documentation and in video form, making the process straightforward and efficient.

ASIC Miner Heat and Noise Management

Running one or two Bitcoin miners at home generates substantial heat and noise. Miners like Bitmain’s Antminer series can produce noise levels around 75 decibels, comparable to a vacuum cleaner, which can be disruptive. Soundproofing measures, such as enclosures or noise-canceling materials, can help reduce the impact of the noise.

Additionally, effective cooling solutions, such as placing miners in well-ventilated areas or using dedicated cooling systems, are essential to prevent overheating. Some Bitcoin miners use the excess heat to warm their homes, which can offset heating costs during colder months.

ASIC Firmware Considerations

ASIC miners come manufacture-equipped with firmware installed for power and setting management. By default, these operations are limited to basic functionality: typically, modes for low, normal, and high power settings. Aftermarket firmware provides enhanced capabilities in the form of power and temperature management; alerts, documentation, and logging; and enhanced energy efficiency. Choosing which firmware to use will ultimately come down to each miner’s needs and technical aptitude. Luxor offers a firmware package for most Bitmain miners, so check out the firmware documentation or watch the features highlight video here.

Bitcoin Mining Farm Management Software

Mine management software can be a helpful tool for optimizing the performance and efficiency of your mining operation. Such software provides comprehensive monitoring and control over multiple miners, allowing you to track real-time performance metrics such as hashrate, power consumption, and temperature. It can also automate various tasks such as rebooting malfunctioning machines, adjusting power settings, and managing firmware updates. You can find our guide on some of the best mine management software here.

By offering detailed analytics and reporting features, applications like Foreman or BTC tools can help identify inefficiencies and potential issues before they escalate, ensuring continuous and effective mining operations. Furthermore, it enhances scalability, enabling miners to manage large-scale operations across multiple locations from a single interface, thereby maximizing profitability and reducing operational overhead.

Luxor provides a tool called Commander which serves as a mass configuration tool for LuxOS firmware. For instance, while Foreman and others offer automated processes and monitoring, Commander offers LuxOS installs and configuration of settings that may not be available in some of the management tools. You can download Commander and get started with LuxOS firmware in our download section.

ASIC Miner Operational Considerations and Maintenance

Once your miner is running, regular monitoring and maintenance are essential. The miner will intake and exhaust air from the ambient environment, meaning that scheduled downtime is needed to physically clean the miner and remove any dust or debris. Routinely check all cables for signs of damage or wear. Ensure that the area the miner operates in is clean and well-ventilated. Consistent monitoring helps identify potential issues early, allowing for prompt resolution should an issue arise.

Some of the most common failures include hashboards overheating, which causes hardware damage to the chips. Similarly, a PSU can also overheat, leading to failure. Keeping your temperatures in check and doing regular cleaning for dust can help to prevent this. Typical spare parts for ASICs include fans, power supply cables, and even control boards. You can purchase these parts online from Luxor's ASIC Trading Desk. But check around, you might also find a local shop that carries these parts depending on your location.

Bitcoin Storage and Wallets

There are generally two types of cryptocurrency wallets: cold wallets (the most prominent of which are known as hardware wallets) and hot wallets. Cold / hardware wallets store your private key offline, normally in a separate device that you connect to a computer to sign transactions when needed. The important thing about hardware wallets is that they are more secure from cyberthreats. The device itself contains the 12-24 word key phrase used to access and send funds from a particular Bitcoin wallet. Since the device has to be connected to a computer to function, keeping it disconnected and physically secure keeps your bitcoin safe.

A hot wallet is a wallet that runs on a device like a computer or mobile device and the private keys for the wallet are stored on the same device. This means that if the computer can access the internet, you can send bitcoin to other addresses. The private key is what allows a user to unlock and send coins, so if the device containing the private key is connected to the internet, the private keys are more vulnerable to being compromised. Hot wallets should be used as a temporary location of your Bitcoin and never used as a long term storage solution. Use hot wallets like a checking account and hardware (cold) wallets as your savings account.

Bitcoin Exchanges

An exchange is exactly what it sounds like: a place to exchange things like bitcoin and USD. Exchanges serve as a place to store Bitcoin over any period of time, but this is not recommended as exchanges can be compromised and any funds on the exchange can be stolen. It’s best to use an exchange as a place to purchase or sell bitcoin but not for long term storage. Once purchased from an exchange, it’s generally advisable to transfer bitcoin to a hardware wallet. Some examples of popular exchanges include Coinbase.com and Kraken.com.

Selling BTC involves converting Bitcoin into fiat currency through various platforms such as the exchanges we mentioned or peer-to-peer (P2P) marketplaces. P2P platforms allow users to sell directly to other individuals, often with more flexible payment methods. It's important for sellers to choose reputable platforms and understand the associated fees and transaction times.

What is a UTXO?

UTXOs are important to Bitcoin users and miners alike. Every time you receive Bitcoin, the amount of Bitcoin received is contained within a single transaction. Each transaction consists of a certain amount of Bitcoin and just like coins to the dollar, you cannot send more than is contained in the UTXO without including other UTXOs in the transaction. In short, you want to keep your UTXOs as large as possible by ensuring your transactions are of adequate size. An example of this would be allowing your mining rewards to remain on the pool until they reach a threshold that is acceptable to you. River Financial has an article that describes how UTXOs work and is worth reviewing for a better understanding.

Bitcoin Blockchain Explorers

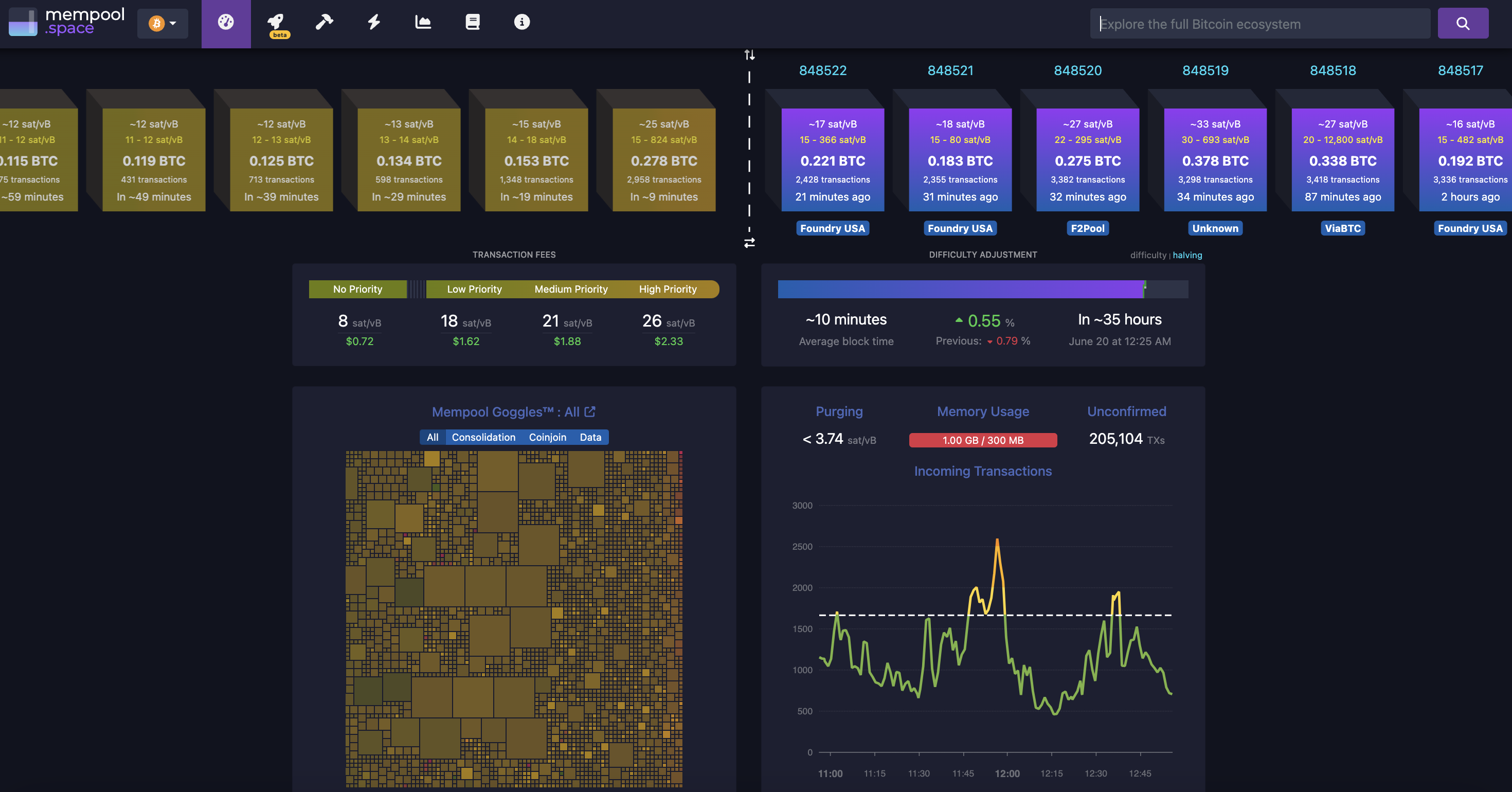

Blockchain explorers are online tools that allow users to view and verify Bitcoin transactions. Sites like Blockchain.com and mempool.space are excellent blockexplorers. They provide a transparent and comprehensive view of the blockchain, enabling users to track transaction history, view block confirmations, verify the status of specific transactions, and estimate fees. This transparency is essential for users to ensure the accuracy and validity of their Bitcoin transactions, as well as to investigate any potential issues or irregularities in the blockchain.

Bitcoin Mining Taxes

Taxes on bitcoin sales and purchases are an important consideration for compliance with legal and financial regulations. Depending on the jurisdiction, Bitcoin transactions, including buying, selling, and trading, may be subject to capital gains tax, income tax, or other tax obligations. Proper record-keeping of all transactions is essential for accurately calculating tax liabilities. Consulting with a tax professional knowledgeable about cryptocurrency can help ensure compliance and help you avoid potential legal issues. Alternatively, Luxor makes it easy to report your crypto mining taxes thanks to our partnerships with leading crypto tax management companies. Learn more on our tax page here.

General Tips and Tricks

- Firmware Updates: Updating your firmware can significantly improve your mining efficiency and performance. Make sure that, regardless of the firmware vendor, you keep your firmware updated.

- Offset Heating Costs: Consider the placement of your mining rig to make use of the heat it generates. Strategically placing the rig in colder areas of your home can help offset heating costs during winter months.

- Gradual Scaling: Scale your mining operation gradually to manage costs and risks effectively. Starting small allows you to understand the nuances of mining and adjust your strategy as you gain more experience.

- Peak/Off-Peak Hours: If your utility provider offers different rates for peak and off-peak hours, take advantage of these to lower your electricity costs. Running your miners during off-peak hours can lead to significant savings.

- Stay Updated: Keep tabs on Bitcoin's price volatility and significant events like halvings, which can impact mining profitability. Staying informed helps you make timely decisions about your mining operations.

This concludes our 2024 home mining guide! We have gone over everything a home miner needs to understand the current landscape and start mining: from buying your first miner and calculating operating costs, to tweaking firmware settings and maximizing efficiency in any environment. Mining is an ever changing field, so it is important to keep up to date with all of the variables at play. By following the steps and advice in this guide, we are confident you will start off your mining career strong.

Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.