An overview of the debt burdens of the public bitcoin miners

Some public bitcoin miners are being eaten alive by the bear market, with a common trait among them being that they all have high levels of debt. This article reveals who has taken on the most debt relative to equity and who has been the most prudent in avoiding debt.

The bear market has now swept over the bitcoin mining industry with full force for several months. Public bitcoin mining companies have done their best to withstand the pressure, but now we see some of them starting to give in.

Core Scientific recently announced it’s unable to make debt payments in November and will likely run out of cash before the end of the year. Other miners, like Argo and Iris Energy, soon followed suit with similar announcements, while Stronghold has been restructuring debt for several months.

It’s not a coincidence that these companies are struggling. They all have one thing in common, and that is high debt burdens, particularly equipment financing. Bitcoin miners with a lot of debt have encountered difficulties servicing this debt as their operating cash flows have evaporated due to a lethal combination of a falling bitcoin price, growing mining difficulty, and rising energy prices.

Another disadvantage of having a high debt is that it can prevent a company from taking on additional debt financing. Lenders are reluctant to give loans to a company that already has a lot of debt since it increases the insolvency risk of the company.

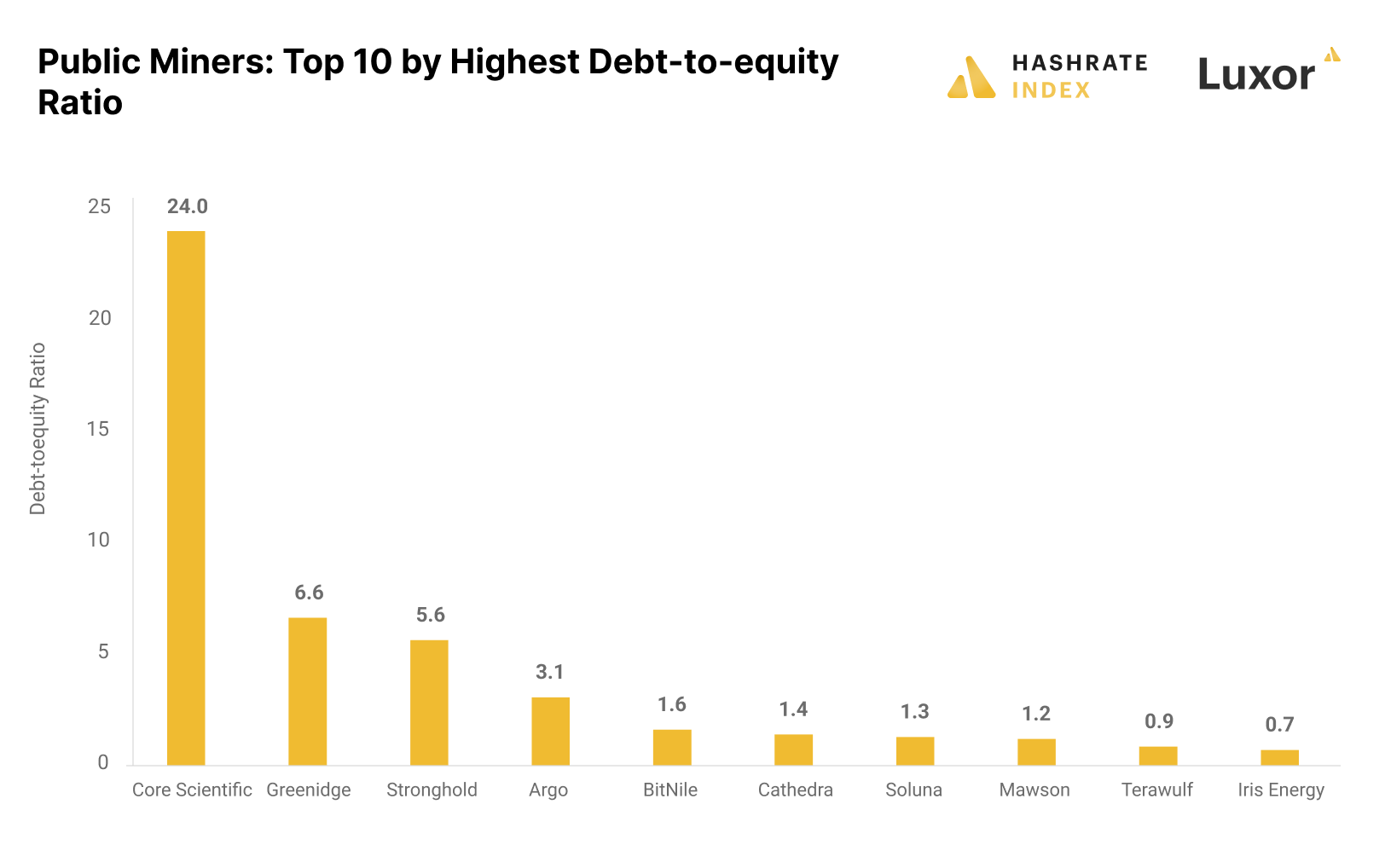

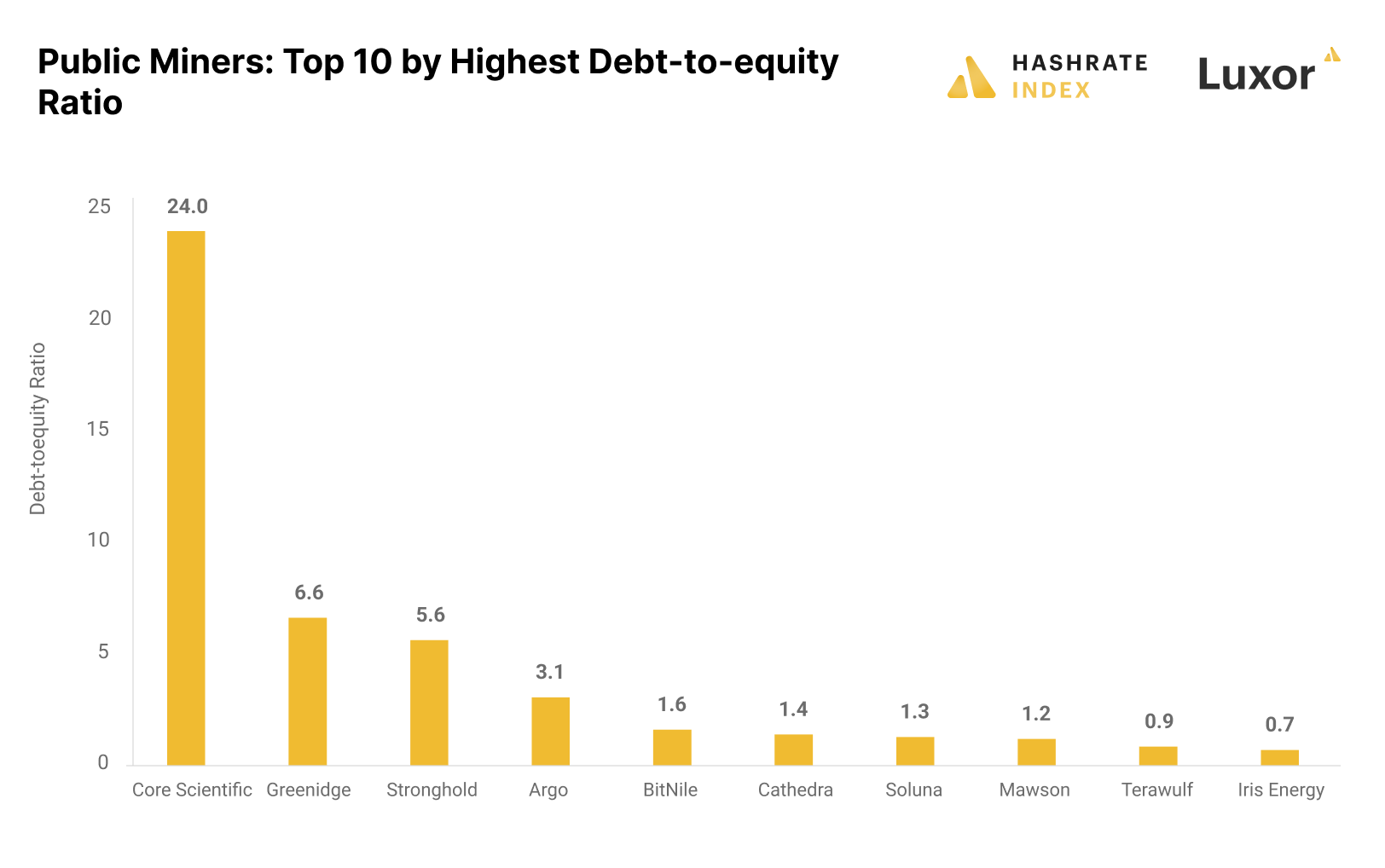

Having little debt relative to equity is the most critical factor for a bitcoin miner to survive this bear market. This article starts by showing the ten public bitcoin miners with the most debt relative to equity before revealing who has the least debt.

Which public bitcoin miners have the most debt?

I got to start with some bad news. A handful of bitcoin mining companies are buried under so much debt that it’s hard to understand how they can get through this bear market alive. These companies are Core Scientific, Greenidge, Stronghold, and Argo.

Everyone already knows about Core Scientific’s problems, as they announced last week that they will be unable to make upcoming debt payments and will likely run out of cash before the end of the year. I wrote an article analyzing Core Scientific’s current situation, which you can find here.

Argo made a similar announcement a few days later, stating that because they failed to raise much-needed equity from a strategic investor, they might be unable to continue operations. The company’s stock plummeted by 70% following the announcement, and if it weren’t already problematic for the company to raise equity, it will become even more complicated with a 70% lower valuation. Argo’s debt primarily consists of equipment financing from NYDIG.

With a debt-to-equity ratio of 6.6, Greenidge seems to be in an even worse financial state than Argo. Like many others on this list, the New York-based natural-gas plant operator turned bitcoin miner has also been an avid user of equipment financing. As of June 30th, Greenidge had a total equipment financing balance of $88.6 million with NYDIG.

Stronghold also has a very weak balance sheet with a debt-to-equity ratio of 5.6. The Pennsylvania-based power plant operator turning coal refuse to bitcoin has been struggling financially for many months. The company just completed a debt restructuring, in which it returned 26,200 machines to NYDIG in exchange for the extinguishment of $67.4 million of debt.

Still, even after delivering back all these machines, Stronghold has a very high debt burden that will be hard to pay back. Particularly now that the company’s bitcoin production capabilities have been severely reduced due to it delivering machines back to its lender. Still, as the company owns a power plant, it can now sell energy to the grid at relatively high prices due to the high energy price inflation.

Companies further down on the list are BitNile, Cathedra, Soluna, Mawson, Terawulf, and Iris Energy. Like most struggling miners, Iris Energy has taken on considerable equipment financing. The company recently announced that it is not producing enough cash to meet these financing obligations and is in talks with the lender. Still, with a debt-to-equity ratio of 0.7, Iris Energy is not in nearly as big trouble as Core Scientific, Greenidge, Stronghold, and Argo.

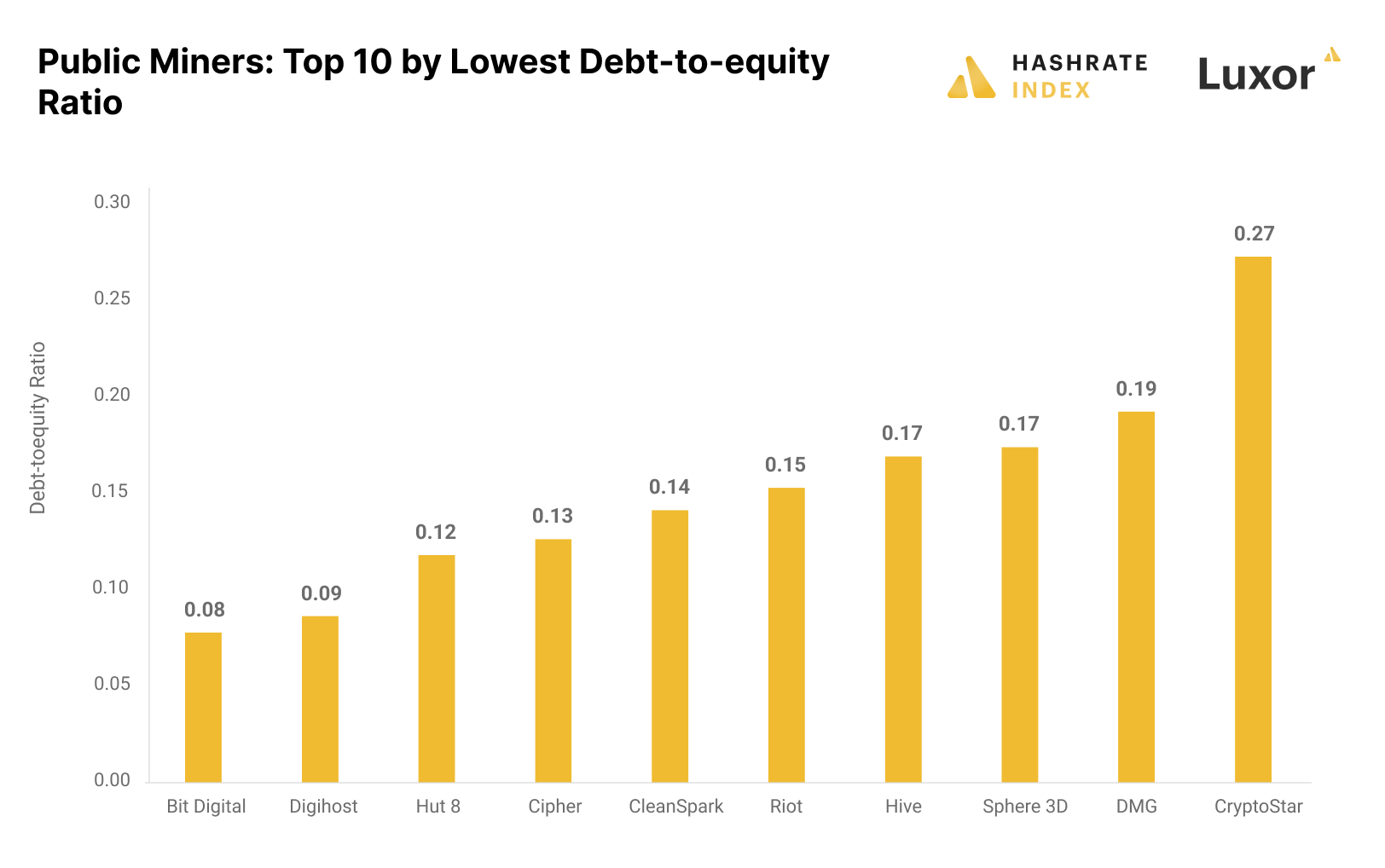

Which public bitcoin miners have the least debt?

I hope the previous section was not too depressing to read. To cheer you up a bit, I now have some good news for you: Not all public bitcoin miners are drowning in debt. In fact, a lot of them barely have any debt.

With debt-to-equity ratios of 0.08 and 0.09, Bit Digital and Digihost have the least debt relative to equity. Other prudent operators include Hut 8, Cipher, CleanSpark, and Riot.

Riot is one of the biggest public miners, but unlike Core Scientific, it has mostly financed its operations with equity. In 2022 alone, the company has raised $272 million and has an additional $228 million of at-the-market offerings available.

Equity is a safer form of capital than debt, but that advantage comes with a price: dilution. Riot has diluted shareholders by 43% in 2022, but I suspect its shareholders will accept this dilution if the worst-case alternative is going bankrupt.

Thanks to their strong balance sheets, these companies are now well-positioned to not only survive the bear market but to exploit weaker competitors and expand heavily.

CleanSpark, for example, has been expanding like never before during this bear market, buying 26,500 mining rigs for cents on the dollar from amongst others Argo, as well as purchasing Mawson’s bitcoin mining facility in Georgia. As you can see on the first chart, both Argo and Mawson are on the list of the public miners with the most debt relative to equity.

Conclusion

This bear market has proved to be tougher than anyone except the most prudent pessimist could expect a few months ago. Bitcoin mining margins have been hammered since June as the bitcoin price has hovered around $20k while energy prices have soared. Miners are now raking in very little cash flow, and several of the most indebted miners are now falling short of producing the necessary cash flow to service their debt.

As cash flows have evaporated, the most important factor for the public miners is the strength of their balance sheets. The simplest way to measure balance sheet strength is to look at the debt-to-equity level. As this article showed, some bitcoin miners have tremendously high levels of debt while others barely have any.

The companies with the least debt relative to equity will be better positioned to take advantage of strategic opportunities during the bear market. They have much lower debt payments to make than their debt-burdened competitors and could also improve liquidity with new debt positions if needed. Those with the most debt, on the other hand, are going to have to fight tooth and nail to get through this bear market alive.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.