Which Public Bitcoin Miners Owe the Most Money?

The public bitcoin mining companies collectively owe more than $4 billion, and the biggest of them has already declared bankruptcy due to its unsustainable debt burden.

Core Scientific, the biggest public bitcoin miner by hashrate, just announced bankruptcy after struggling under a mountain of debt for months. Several other public miners might soon join Core Scientific in declaring bankruptcy, as many owe enormous amounts of money to their creditors and find it increasingly difficult to service debt. This article discusses their debt loads and reveals who owes the most money.

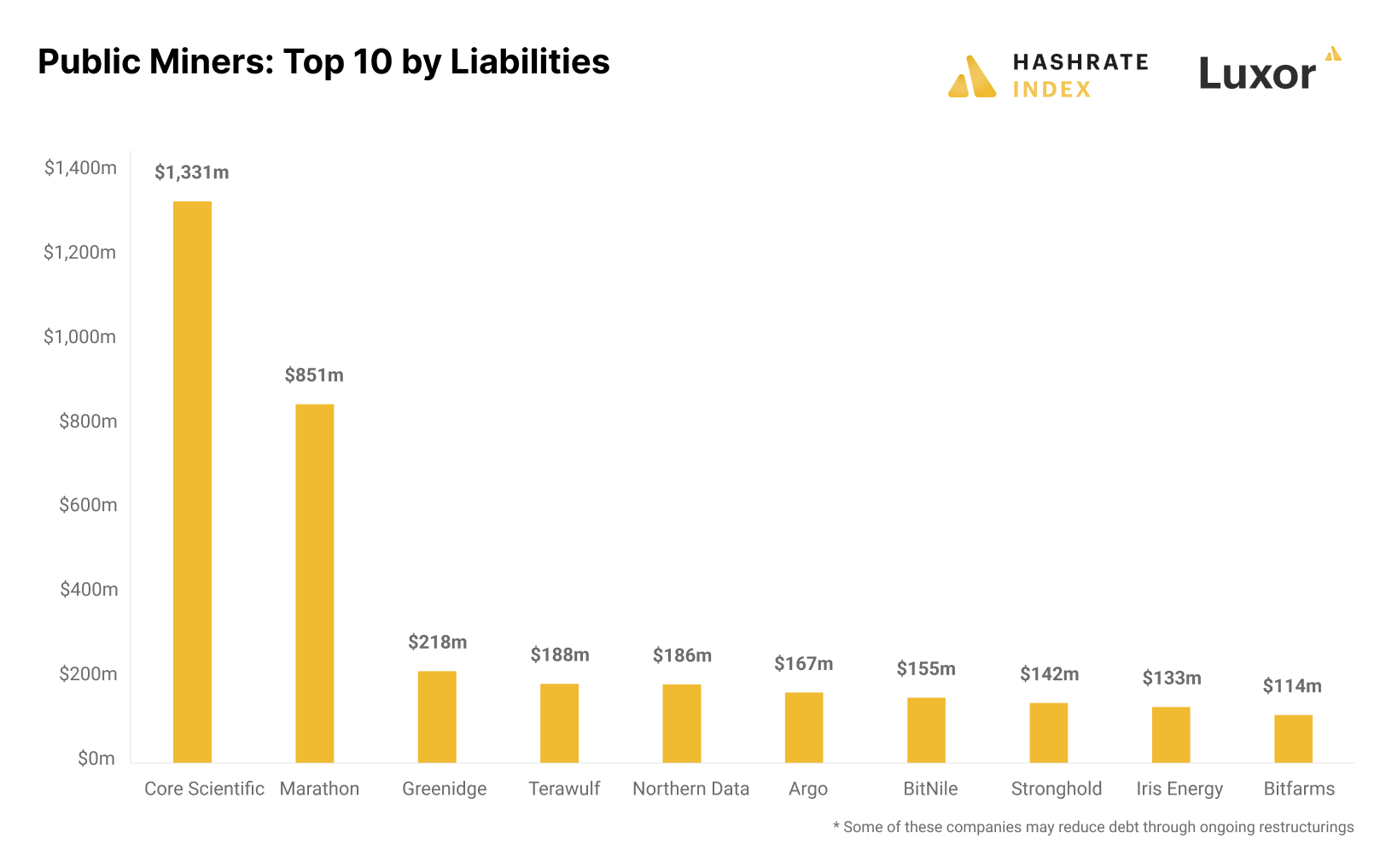

Core Scientific and Marathon owe the most money

Unsurprisingly, Core Scientific owes the most money, with $1.3 billion in liabilities on its balance sheet as of September 30th. Such an enormous debt load requires tens of millions in monthly debt service payments that the company has been unable to pay in recent months as its cash flows have evaporated in tandem with the falling bitcoin price and rising electricity prices. As a result, the company declared bankruptcy recently.

Marathon is the second-biggest debtor, with $851 million in liabilities. Most of this debt is convertible notes, which come with no monthly debt service payments but instead give the holders the option to convert them to stock. Therefore, Marathon’s debt is relatively easy to service, and the company is not at immediate risk of going bankrupt.

The third-biggest debtor is Greenidge. The company owes $218 million but is undergoing a restructuring process that might substantially reduce its debt. I explain this restructuring process later in the article.

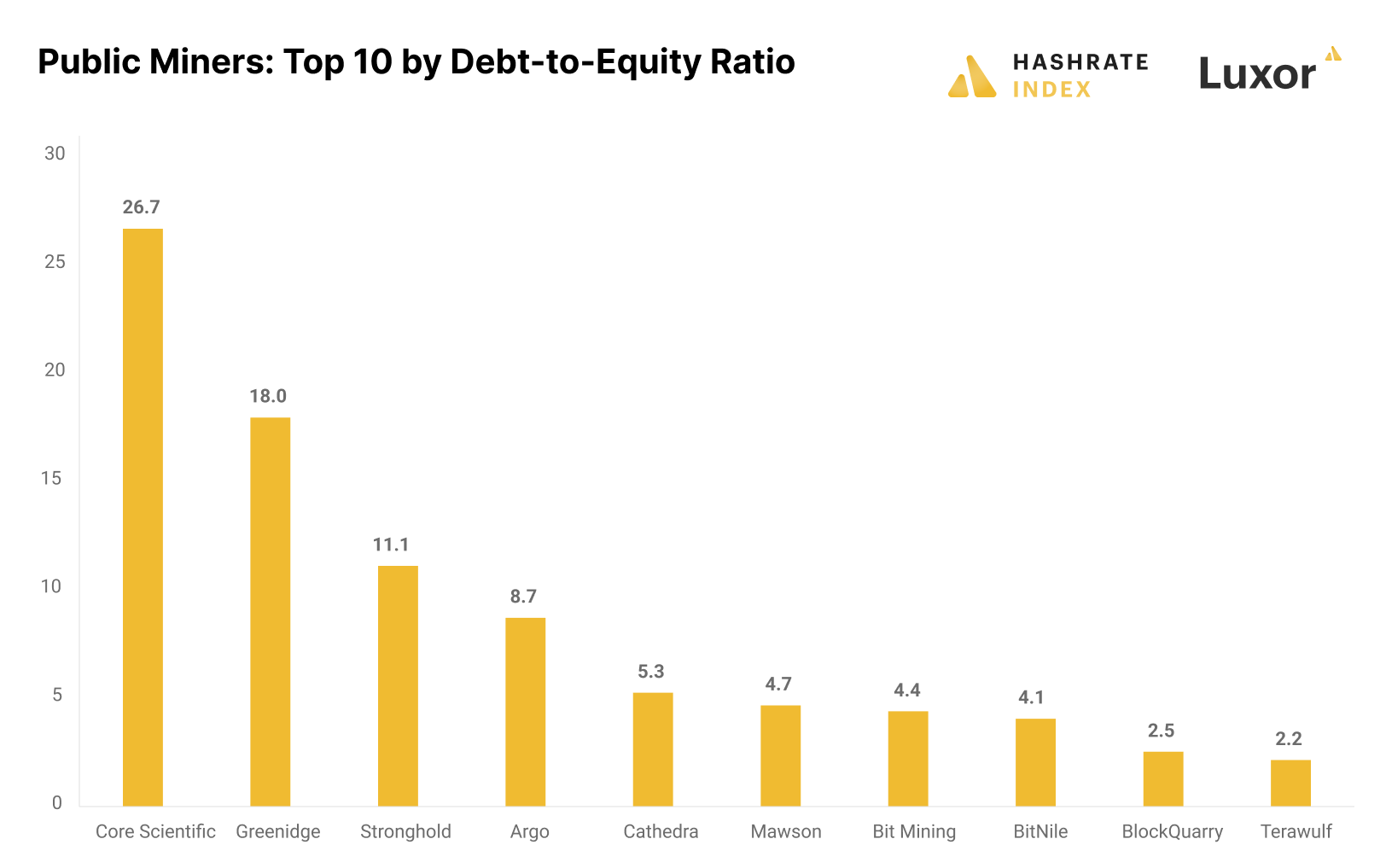

Many public miners have dangerously high debt relative to equity

The previous section showed the public miners’ absolute debt levels. However, the most relevant information is how high liabilities these companies have relative to their equity since companies with high equity valuations have more room for taking on debt than their lower-valued peers. Therefore, I like to look at the debt-to-equity ratio.

In most industries, a debt-to-equity ratio of 2 or higher is considered risky, but it should ideally be substantially lower in the notoriously volatile bitcoin mining industry. In the chart below, we can see that there are many public miners with extremely high debt-to-equity ratios.

With its monstrous liabilities, it’s no surprise that Core Scientific has the highest debt-to-equity ratio of 26.7. The two power plant operators turned bitcoin miners, Greenidge and Stronghold, follow behind with debt-to-equity ratios of 18 and 11.1. Argo also has a dangerously high debt-to-equity ratio of 8.7.

There are around 25 public bitcoin miners. Almost half of them have debt-to-equity ratios higher than 2 – a level considered risky even in much more stable industries like consumer staples or agriculture. The entire bitcoin mining sector has total liabilities of $4 billion and equity of $2.2 billion, giving it a debt-to-equity ratio of 1.8, which is relatively high compared to most other industries. Due to the leverage in the industry, we will likely see many restructurings and potential bankruptcies going forward.

Several public miners are restructuring their debts

The massive debt levels of some of the bitcoin mining firms are not sustainable, and some of them are going through efforts to restructure debts. These debt restructurings usually work by turning debt into equity but can also imply selling off assets to pay down debts. In this section, I briefly explain some of the debt restructurings currently taking place in the bitcoin mining industry.

Let’s start with Core Scientific. Due to its unsustainable debt burden, the company declared bankruptcy on December 21st. This bankruptcy is only of a formal nature, as the company will only restructure its debt and not liquidate its possessions. Under the new company structure, the convertible noteholders will likely own 97% of the company’s equity. This transformation of debt to equity will substantially reduce debt and allow the company to continue operating.

Greenidge is also working on a debt restructuring but has so far managed to avoid bankruptcy. On December 20th, the company signed a non-binding agreement with its machine lender NYDIG, to restructure approximately $74 million worth of debt. By this agreement, NYDIG will extinguish Greenidge’s outstanding debt on 2.8 EH/s of machines by taking ownership of them. NYDIG will host these machines at Greenidge’s facilities, meaning Greenidge is essentially transforming itself from a self-miner to a hosting company to improve its financial condition.

Argo, who accidentally published a bankruptcy announcement recently, stated it’s negotiating to sell some of its assets and carry out an equipment financing transaction to reduce its debt and improve liquidity.

Conclusion

The massive debts some public miners took on when times were better have now returned to haunt them. As mining cash flows have deteriorated, these companies have found it increasingly difficult to service their debt, and many are forced to restructure. These restructurings typically turn debt into almost worthless equity, meaning both equity and debt holders suffer massive losses.

Due to the unsustainably high debt levels in the industry, we will likely continue to see more restructurings and potentially some bankruptcies. We have started to enter the part of the cycle where the weak players are flushed out.

However, some public miners barely have any debt. These companies will thrive as they have the financial muscles to pick up distressed mining assets for cents on the dollar. With both ASICs and mining facilities being sold off by struggling companies, there are tremendous expansion opportunities for the financially strong players.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.