The Evolution of Bitcoin Mining Pool Rewards: Fixed & Upfront Payouts

Understand the past, present, and future of mining pool payouts.

Since the early days of Bitcoin, pools have played a central role in distributing and smoothing rewards for miners. Payout structures evolved over time, from luck-based systems like solo mining and Pay-Per-Last-N-Shares (PPLNS) to predictable models like Pay-Per-Share (PPS) and Full-Pay-Per-Share (FPPS). But one risk remained: hashprice volatility. Even with regular payouts, miners were still exposed to fluctuations driven by Bitcoin price, network difficulty, and transaction fees — making revenue forecasting difficult and limiting access to financing.

Luxor Pool's Fixed and Upfront Payouts change that. Here’s how.

History 101: Mining Pools & Payouts From PPLNS to FPPS

When Bitcoin first began, mining was a solo endeavor. Individuals ran software on home computers equipped with CPUs to compete for blocks and earn newly minted coins. With only ~144 blocks available per day, every miner was essentially playing a lottery, and success largely hinged on luck.

As Bitcoin’s price rose and more participants joined the network, competition intensified, rendering solo mining increasingly impractical. Despite contributing valid work, most miners received no rewards simply because they didn’t find a block. To overcome this hurdle, miners began forming pools.

Bitcoin mining pools first emerged in late 2010 as a way to reduce variance in earning mining rewards, allowing miners to combine computational power and share the risk and rewards. This innovation made mining more predictable and accessible, catalyzing a shift toward industrial-scale operations.

As mining pools evolved, new reward distribution models emerged to address different preferences around payout frequency and risk. Over the years, pools experimented with a variety of alternative payout models, each designed to address challenges like pool-hopping, payout variance, or decentralization. While these models offered interesting solutions, there was limited adoption, and as the industry matured, a handful of widely used and commercially relevant payout methods eventually emerged.

The Pay-Per-Last-N-Shares (PPLNS) model was one of the earliest methods used to distribute mining rewards, first introduced circa 2011. In this structure, miners are only paid when the pool successfully discovers a block, and the reward is distributed among the most recent contributors (the “last N” shares). While PPLNS fairly compensates miners proportional to their actual work, it exposes them to significant risk: if the pool is unlucky and doesn't find a block, miners receive nothing during that time.

Around 2012, to reduce variance and offer miners more predictable income, pools began introducing the Pay-Per-Share (PPS) model. PPS pays miners a fixed amount for every valid share submitted, based on the block subsidy, regardless of whether the pool finds a block. This smooths out income for miners and eliminates luck risk, transferring that variance to the pool operator instead. PPS was the first step toward making mining rewards more predictable and commercial, especially for small-to-mid-sized operators who were unable to absorb long dry spells.

While this brought more predictability to mining income, it overlooked one critical piece of the puzzle: PPS only accounted for block subsidies and excluded transaction fees, which, as Bitcoin matured, became too valuable to ignore.

Transaction fees eventually became a more meaningful part of block rewards over time, and popular pools evolved PPS into Full-Pay-Per-Share (FPPS) around 2014-2015. FPPS retains the predictable, per-share payout model of PPS but includes a pro-rata share of transaction fees in addition to the block subsidy, reflecting the total revenue earned by miners.

Luck-independent pool payout methods, like PPS and FPPS, were an improvement for miners. However, they still left a fundamental risk: spot hashprice volatility, i.e., the combined effects of BTC price, network difficulty (i.e., network hashrate), and transaction fees on mining revenue.

The Next Payout Innovation: Fixed and Upfront Payouts

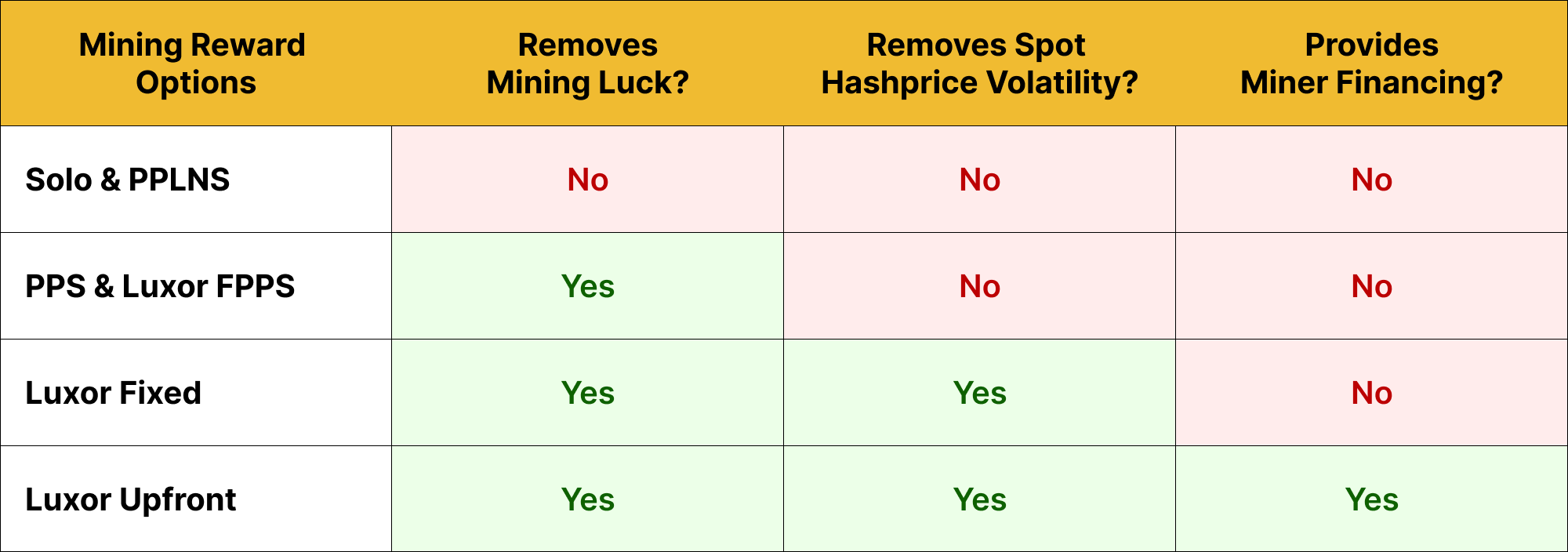

Luxor’s Fixed & Upfront Payout structures remove spot hashprice risk and/or provide financing. The table below compares common payout models against three key miner needs:

Since 2023, Luxor’s Fixed Payouts have allowed miners to lock in a future BTC-denominated hashprice, regardless of spot market conditions. This eliminates the operational uncertainty introduced by hashprice variance and enables miners to model future cash flows with greater confidence.

Upfront Payouts took this one step further in 2024 by providing miners with immediate, non-dilutive capital in exchange for a fixed commitment to deliver hashrate over time.

Both payout structures extend out to twelve months, allowing miners to hedge network difficulty and transaction fee volatility, by selling their future hashrate at a guaranteed hashprice. Settlement occurs through daily mining activity on Luxor Pool.

With several hundred million dollars of notional volume in sight this year, the trend is clear: Fixed and Upfront payouts are the next evolutionary step for modern mining operations seeking revenue stability and access to capital.

Case Study: Post-Halving 2024-2025 Hashprice Market

The 2024 halving slashed block subsidies and set off a period of sustained margin compression for miners. BTC price action was overwhelmed by growth in network difficulty and a transaction fee bear market. In this environment, hashprice declined, a major problem for financing, fleet expansion, and treasury planning.

However, not all miners were impacted equally. Those who hedged their exposure to network difficulty and transaction fees outperformed their peers. How? By locking in Fixed Payouts.

If a miner were to enter into a series of Fixed Payout contracts — i.e., sell hashrate forward for a fixed BTC amount (at prevailing market rates) — they effectively lock in consistent revenue for that duration. Over the past 12 months post-halving, these “lock-in” strategies delivered measurable outperformance, with some operators earning up to 20% more Bitcoin versus traditional FPPS pools.

Why This Matters: Risk Management and Growth

The implications for miners are significant. Let’s break it down:

Revenue Stability

Fixed payouts allow miners to model future cash flows, and reduce sensitivity to short-term fluctuations in network difficulty or blockspace demand.

Treasury Optimization

Instead of selling BTC from treasury at inopportune times, miners can raise capital by selling future hashrate at a locked-in hashprice, while still HODLing.

Access to Capital

Upfront payouts give miners access to non-dilutive financing, enabling hardware purchases or infrastructure investments.

Case Study: Bitmine tripled its deployed ASIC capacity and locked in a fixed hashprice for a 12-month term, achieving a risk-mitigated turnkey mining solution.

Competitive Advantage

Luxor Pool is the only mining pool in the world offering these novel payouts, turning the pool itself into a growth platform for its miners.

Conclusion

The evolution of mining pool payouts mirrors the maturation of Bitcoin mining itself, from a hobbyist hustle into a professionalized industry. By integrating fixed & upfront payouts, Luxor continues to innovate in building financial services on hashrate in the same way energy and agriculture markets evolved. Power producers hedge megawatt output, farmers lock in crop prices months in advance. Bitcoin miners can do the same with their SHA-256 compute.

If you’d like to learn more about Luxor’s Bitcoin mining services, please reach out to [email protected] or visit https://luxor.tech/mining.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.