How Will the Ethereum Merge to Proof-of-Stake Impact the GPU Market?

GPUs are starting to flood the resale market, but how much will this bring down prices?

Ethereum’s merge to proof-of-stake is complete, which leaves billions of dollars of GPU mining hardware in want of new use cases. As we covered in the last article in this 3 part series, some of this hardware – roughly 16% of it over the long-term – could migrate to GPU-mineable alternatives.

The rest will either be scrapped or sold. And this raises an obvious question: how will this hardware impact the wider GPU market?

After all, gamers, news pundits, and other commentators were quick to cast blame on GPU miners for jacking up prices over the last two years, so it stands to reason that folks are anticipating a price drawdown now that hardware will be flushed back onto the market.

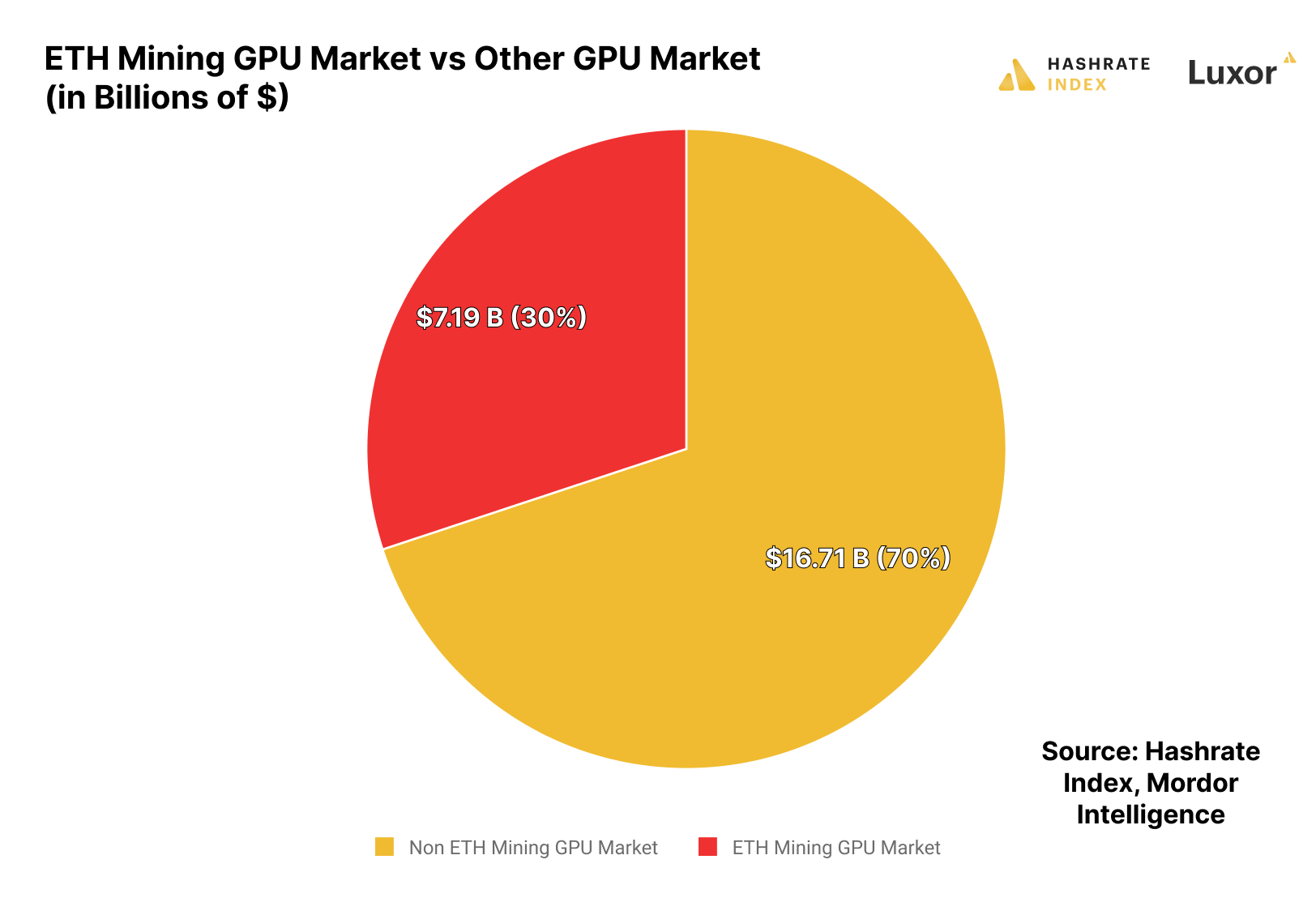

Based on our research, we expect prices to drop. But given the fact that GPU mining equipment is just over 1/4th of the total GPU market – and that many miners started selling equipment ahead of the merge – we don’t expect prices to fall too drastically.

Ethereum Hashprice and GPU Price Correlations

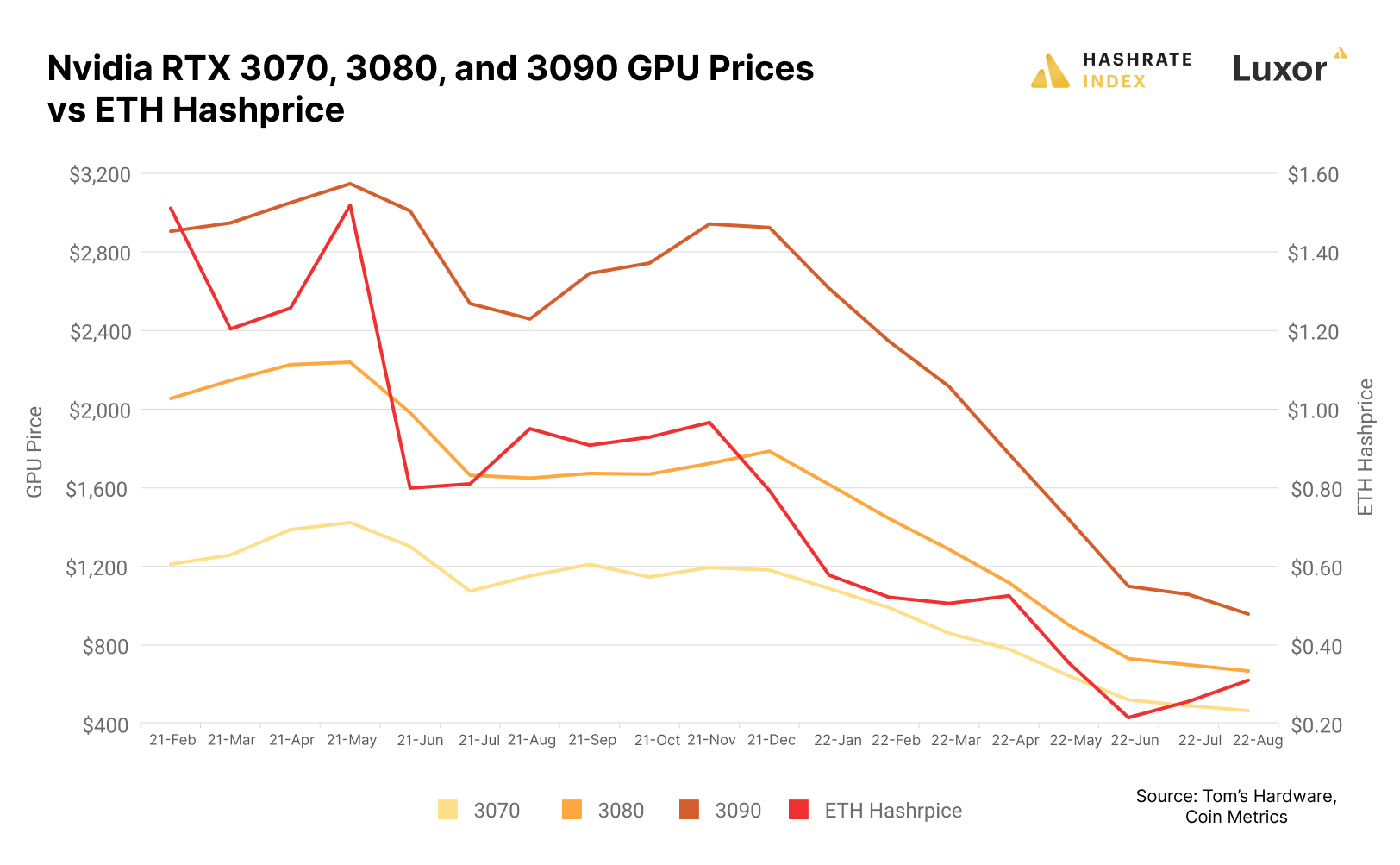

As with the Bitcoin mining ASIC market, GPU prices have been correlated to Ethereum mining reward potential (hashprice).

A shortage of silicon chips during the COVID pandemic complicated this correlation somewhat. As industries shut down and supply chains seized up in 2020 and for part of 2021, the computing chip market faced shortages, affecting manufacturing for everything from cars, to refrigerators, and of course GPUs.

The chip shortage no doubt exacerbated price inflation for mining equipment, GPUs included, but we’ll never know by how much. As evidenced by the following graph, though, we do know that volatility for Ethereum’s hashprice meant volatility in GPU prices across the board.

The most drastic decline in our analysis came in the aftermath of the Chinese mining ban in 2021, where the monthly average of Ethereum’s hashprice fell 47% from May to June. In response, prices for Nvidia’s RTX 3070 fell 9% in June and 18% in July, the RTX 3080 fell 11% in June and 16% in July, and the RTX 3090 fell 4% in June and 16% in July.

Reacting to bear market mining dynamics, prices for these models have been in a downtrend since the new year. The August 2021 to August 2022 changes are:

- RTX 3070 (-60%)

- RTX 3080 (-60%)

- RTX 3090 (-61%)

GPU Prices in a Post-Merge World

So now that Ethereum is no longer proof-of-work, we can expect GPU prices to fall, right?

Short answer, yes, but just how much is a more complicated question to answer.

If you read the last article in this series, you already know that the GPU-mineable alternatives for ETH miners can only take on so much of Ethereum’s now-obsolete hashrate. Based on our most recent estimate, ETH mining GPUs account for $7.19 billion of the global GPU market; based on 2021 data from Mordor Intelligence, this is 30% of the GPU industry’s total addressable market (TAM) of $23.9 billion.

Per our prior analysis, roughly 16% of the mining equipment previously used to mine ETH will migrate to other chains. As for the rest, industrial miners may repurpose the graphics cards for high performance computing, but the retail miners who do not migrate to another chain will sell or scrap their GPUs.

We expect that plenty of selling has already occurred (in the chart that displays GPU price and hashprice correlations, for instance, GPU prices declined all summer even as ETH hashprice rebounded; we know anecdotally of many Ethereum miners who sold their rigs over the summer to get ahead of the game).

Now that said, this does not mean that prices will not continue to fall. We expect them to decline throughout the rest of the year, with a 15% drawdown as the best case scenario, a 25% drawdown as a base case, and a 50% drawdown as the worst case.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.