Hashrate Markets Lookback Series - November 2024

November 2024’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

Luxor’s Monthly Lookback Series is a deep dive into Bitcoin hashrate market activity. In this post, we cover November 2024’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

Summary

- Bitcoin’s Record High: November 2024 saw Bitcoin price surge to nearly $100,000 post-election.

- Lagging Mining Economics: Despite the increase in hashprice, record-high network difficulty and historically low transaction fees post-halving continue to weigh on mining economics. This has resulted in a divergence between Bitcoin's price action and the Bitcoin mining markets. Zooming out, as of November 25, Bitcoin’s price is up 47% since its 2021 peak and mining stocks, as measured by Hashrate Index's Crypto Mining Index, are down 34%.

- Diverging Hashrate Markets: USD-denominated contracts favored long positions, while BTC-denominated contracts benefited hedgers. The best strategy for miners in November was to hedge network difficulty and transaction fees and maintain long exposure to Bitcoin.

- Evolving Miner Strategies: Miners are leveraging Luxor’s forward market to hedge risks, secure funds, and expand. Hashrate markets are emerging as key tools for Bitcoin miners to differentiate and grow.

November 2024 Hashprice & Its Constituents

In November, Bitcoin's price hit an all-time high. However, despite the increase in hashprice, record-high network difficulty and historically low transaction fees post-halving continue to weigh on mining economics. This has resulted in a divergence between Bitcoin's price action and the Bitcoin mining markets.

In November, Bitcoin's price nearly hit $100,000 on spot markets in a run after the U.S. election. The Bitcoin price component of monthly hashprice increased 32% — the largest since March 2024 and August 2021 before that. The average daily Bitcoin price rose 38% over the month, climbing from $69,689 at the start to $96,748 by month's end.

Spot Bitcoin miners saw their Bitcoin price gains partially eroded by a 10% month-over-month increase in average network difficulty, which was largely priced into Luxor’s hashrate markets in October. Difficulty began November at a record 95.67T, then set new highs of 101.65T and 102.29T following increases of 6.24% on November 4 and 0.63% on November 18.

Transaction fees continue to disappoint following the halving, averaging just 0.10 BTC per block in November — 70% below Bitcoin’s lifetime average of 0.34 BTC. Month-over-month, fees fell 34% after a brief resurgence in October. The only notable fee event was the $BITCAT rune mint on November 15–16.

In USD terms, Bitcoin transaction fees totaled $37 million in November, down from $45 million in October but higher than the $20 million monthly average from July to September. In the seven months since the halving, fees amounted to $304 million, a sharp drop from $1.08 billion in the seven months prior, despite Bitcoin’s price increase.

Record-high network difficulty and historically low transaction fees drove BTC-denominated hashprice lower in November. Starting at 0.00067 BTC per PH/s/day, hashprice dipped below 0.00063 BTC after the November 4 difficulty adjustment, briefly rose on mid-month fee increases, and ended the month back at 0.00063 BTC per PH/s/day.

USD-denominated hashprice rose steadily in November, driven by Bitcoin's price action. After bottoming at $43.27 per PH/s/day following the difficulty adjustment and prior to the U.S. election, daily hashprice peaked at $63.20 and ended the month at $61.03.

Zooming out reveals a clear divergence between Bitcoin's price and Bitcoin mining markets. As of November 25, compared to their 2021 peaks, Bitcoin's price is up 47%, while Luxor’s Hashprice Index is down 85% and mining stocks, as measured by Hashrate Index's Crypto Mining Index, are down 34%. While other factors like interest rates, energy prices and high-performance computing (HPC) opportunities undoubtedly impact company valuations, this demonstrates that Bitcoin miners have a different exposure mix than pure play Bitcoin holders. While Bitcoin markets are at all-time highs, mining markets have yet to catch up.

Note: figure is accurate as of November 25, 2024

November 2024 Hashrate Market Activity

Our analysis of the November hashrate market focuses on two key points: how the November 2024 hashrate contract traded in previous months and how the forward curve shifted in November based on trades for forward hashrate during the month.

The two tables below show the evolution of USD and BTC-denominated Bitcoin hashrate forward markets throughout June - November 2024. Rows represent specific monthly contracts, while columns represent each trading month. Cell values indicate the average monthly mid-market price, except for the bold highlighted main diagonal, which shows actual hashprice settlement in each month. This table summarizes both the trading history of the November 2024 contract (colored row) and the forward curve in November (colored column).

Note: all values shown in figures represent the midpoint of the best bid and ask on Luxor's Non-Deliverable Hashprice Forward market.

The set of participants trading the November contract and trading forward contracts in November, was more diverse than in October. Private miners were on all sides of the deliverable (DF) and non-deliverable forward (NDF) market, while prop traders opted for the buy-side of the non-deliverable forward market. Public miners re-entered the market in November to sell forward, receive financing, and expand their fleet.

Lenders continued to buy the DF and sell the NDF. We see the discount of DF’s relative to NDF’s as the interest rate in hashrate-based lending markets. Buyers and sellers of the DF with upfront payment can use the NDF to lock-in a fixed yield or cost of capital instead of having exposure to the uncertain and variable returns of hashprice. In November 2024, that yield or cost of capital was in the 10-13% annualized range.

How November 2024 Hashrate Traded

The contrast between Bitcoin price on the upside and network difficulty and transaction fees on the downside played out in the forward market, leading to diverging outcomes in the USD and BTC-denominated hashrate markets.

In USD hashrate markets, November hashrate settled higher than traded in the prior five months: meaning long positions earned a return and hedgers saw a loss in USD terms. In BTC hashrate markets, however, November hashrate settled lower than traded in the prior five months: meaning hedgers earned a return and long positions saw a loss in BTC terms.

Recent USD contract buyers saw the highest returns, while early sellers, hedging in June or July, incurred the smallest losses. During the hashprice rebound, early hedgers earned 7–11% less than spot Bitcoin miners, compared to 19–25% less for those hedging later.

The table below summarizes how a 1 EH mining operation’s USD revenues would have performed, had it sold November 2024 hashrate forward versus mining spot during the month.

In BTC production terms, outcomes based on hedge timing were less varied, with a positive production delta across the board. If a miner had fully hedged at the average mid-market price in June or July, they could have mined 9% and 14% more Bitcoin than those miners which mined at spot prices through November. Those who fully hedged in August, September, and October produced 10%, 6%, and 5% more Bitcoin versus spot miners. In other words, it was best to sell early, or conversely, buy late.

The table below summarizes how a 1 EH mining operation’s total Bitcoin production would have performed, had it sold November 2024 hashrate forward versus mining spot during the month.

The best strategy for miners in November was to hedge network difficulty and transaction fees by selling in the BTC-denominated hashrate market and maintaining their long exposure to Bitcoin. For those who employed this strategy, it proved successful.

Unfortunately, most public mining companies remained unhedged in November 2024. The figure below illustrates a hypothetical scenario of how public miners' November Bitcoin production would have differed if they had fully hedged their November production back in June.

Note: this figure is strictly for demonstration purposes and based on the simplifying assumption of multiplying actual production figures by the percentage difference between hashrate forward contracts’ locked-in hashprice versus spot hashprice; it excludes fees and bid/ask spreads associated with entering into hashrate forward contracts.

A second caveat: although selling forward proved to be favorable in this instance, it is critical to recognize that hedging is typically a cost of business rather than a revenue generation method. Hedgers willingly pay a price to buy certainty and obtain more predictable cash flows, which increases valuation, reduces cost of capital, and ultimately attracts investments.

How Future Hashrate Traded in November 2024

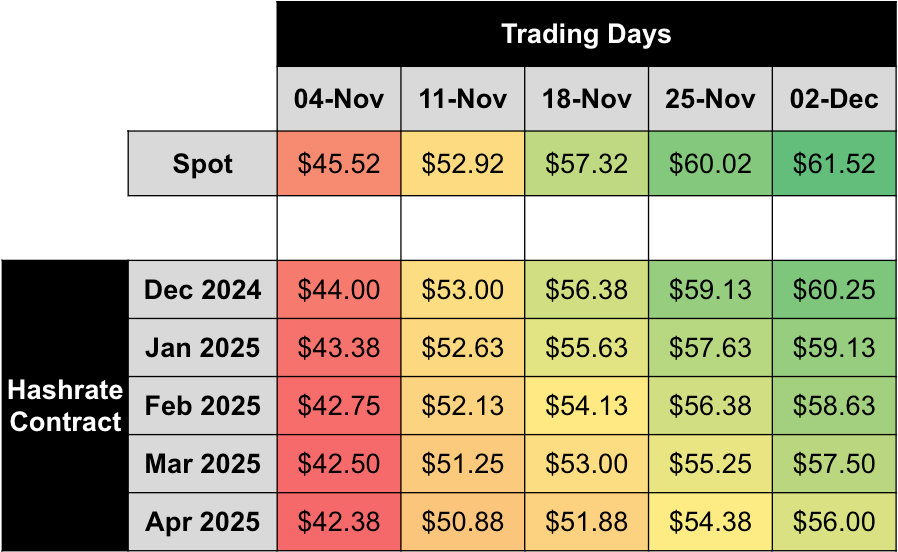

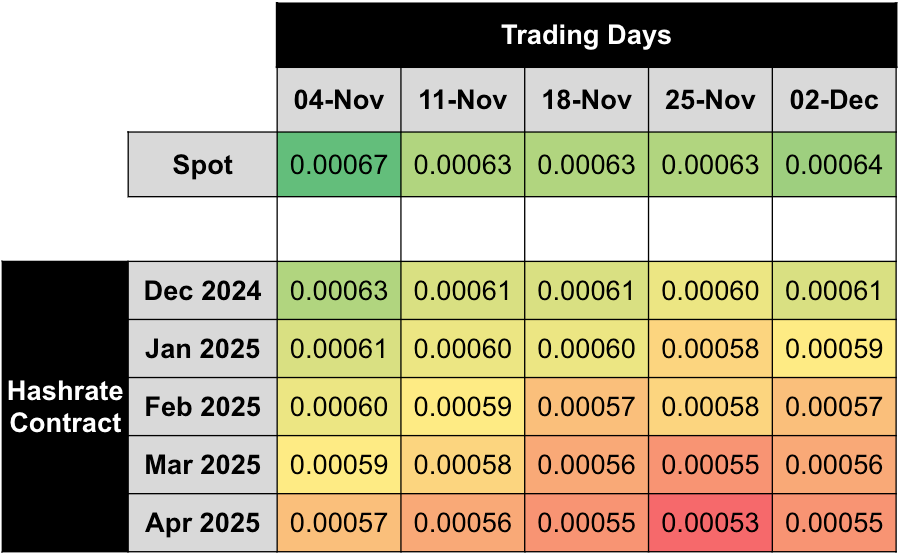

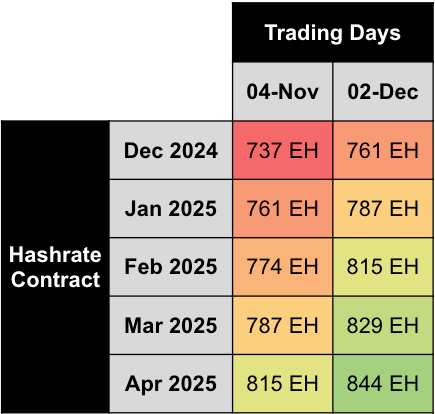

The two tables below summarize the evolution of Bitcoin hashrate forward markets during November 2024, for the subsequent five months from December 2024 through April 2025. Rows represent specific monthly hashrate contracts, while columns represent specific trading days. Cell values indicate the average daily mid-market price, except for spot prices.

During November trading, both USD and BTC curves traded in backwardation throughout the month. USD contracts rose across the board in value, whereas BTC contracts fell. Given this information, we can use the two contracts (by dividing USD contract values with BTC contract values) to back out implied Bitcoin price expectations expressed by the market:

Throughout November, implied Bitcoin prices were in contango. Combining this information with USD-denominated hashrate contracts being in backwardation allows us to infer the market’s expectation around network difficulty and hashrate: namely that both will grow faster than Bitcoin price and transaction fees.

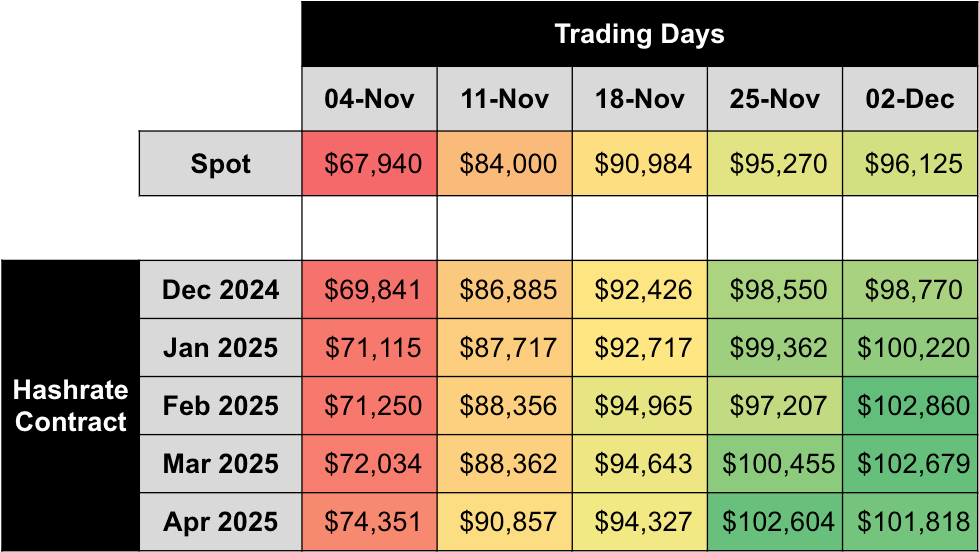

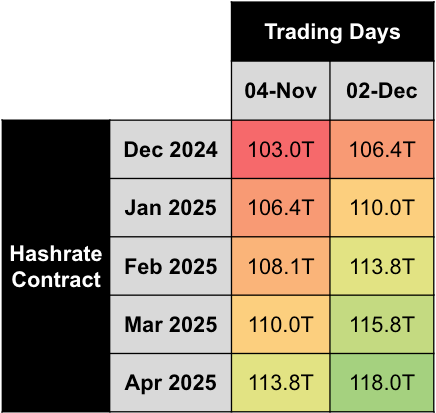

If we make an assumption around transaction fees, we can calculate the changes in implied difficulty and network hashrate expectations in the forwards market. In the tables below, we assume a 0.15 BTC per block transaction fee assumption on November 4th and 0.10 BTC per block on December 2nd:

Note: figures assume 0.15 BTC per block transaction fee assumption on November 4th and 0.10 BTC per block on December 2nd, 2024.

Based on this simplified analysis, we estimate that during November trading, end of year hashrate expectations rose ~25 EH and end of Q1-2025 expectations rose ~42 EH. This is a significant increase in hashrate expectations and a headwind for unhedged operators (especially those with older-generation ASICs).

Notably, Luxor’s hashrate forward marketplace enabled a handful of 12-month trades throughout November. These transactions enable a 12-month revenue hedge, protecting sellers from any downside in hashprice caused by changes in Bitcoin price, network difficulty and transaction fees, and giving buyers exposure to Bitcoin mining long term without the need to purchase and operate physical hardware.

12-month BTC-denominated hashrate forward contracts were executed mid-month, locking in a hashprice of ~0.00055 BTC. Using the November 14th forward curve as a reference, extrapolating back month hashprice, assuming transaction fees of 0.15-0.35 BTC per block, we can back out market expectation for network hashrate. This simplified analysis suggests the global network hashrate is expected to reach 1 Zetahash (ZH/s) between September and December 2025.

Looking Ahead and Concluding Thoughts

Bitcoin’s latest difficulty adjustment occurred earlier this week on December 2, increasing by 1.59% and marking a new all-time high of 103.92T. On December 4, Bitcoin’s price surged by over 7% and broke the $100,000 milestone. The key question going forward is: what does this mean for hashprice? Will Bitcoin price action outpace increasing difficulty, or will hashrate growth and low transaction fees continue to restrain mining revenue?

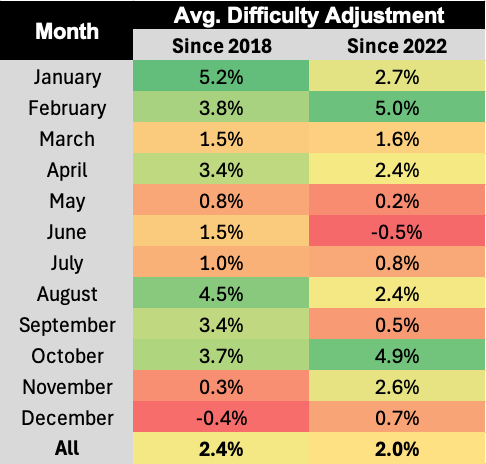

Over the last several years, December has been a slower month on average for difficulty growth, perhaps due to colder weather and increased power prices in the northern hemisphere. The chart below shows the average difficulty adjustment by month since 2018 and 2022.

As reported by Blockspace media, another factor that may contribute to slowing difficulty growth is officials halting Bitmain units at U.S. ports. As we progress through December, it will be interesting to see if the seasonal pattern holds, hardware shipment stall and difficulty growth slows, or if the Bitcoin price bull market encourages enough miners to plug in and buck all the obstacles.

Speaking of looking forward, in a recent Hashrate Index analysis, we found that hashrate forward markets were 80% more predictive of future hashprice than spot markets. For miners seeking to stay ahead, understanding, monitoring and participating in hashrate markets isn’t just a smart move — it’s essential. In Luxor’s Hashrate Forward Market, sellers can currently secure a hashprice of ~$61.44, while buyers have the opportunity to lock in the same hashcost through May 2025.

With the bull market in full swing, miners are scrambling to capitalize on the upside. Across the industry, miners are racing to procure ASICs, secure rack space, and bring machines online. In this environment, we see miners deploying two key strategies in hashrate markets.

The first is to buy hashrate directly from Luxor’s hashrate market. This direct approach offers several advantages over operating ASICs. Physical mining operations entail challenges: delivery delays, electrical issues, power costs, and infrastructure bottlenecks can stall production while leaving operating capital idle. By contrast, hashrate forwards enable miners to deploy capital and generate BTC instantly — without the typical complexities associated with ownership and operation of hardware.

With Bitcoin transaction fees still near historical lows, hashrate offers an upside not available through spot BTC purchases. Exposure to transaction fees — especially in a rising fee environment — adds another layer of potential upside in a bull market. Mining companies looking to add Bitcoin to their balance sheet should consider adding hashrate for the additional upside from mining economics.

For well-capitalized public Bitcoin mining companies this creates a unique opportunity. As a complement to a treasury strategy of acquiring Bitcoin from spot markets, those funds can also be invested in Bitcoin hashrate contracts. This approach would immediately boost managed hashrate, increase monthly Bitcoin production, and set their investment offering apart from MicroStrategy and other public mining companies.

The second approach being deployed by miners is to sell hashrate forward, receive non-dilutive financing, and expand their ASIC fleet. As the only Bitcoin mining pool with forward market functionality, and durations now extending up to 12 months, Luxor miners can sell forward a portion of their hashrate for upfront funds and expand immediately. Our desk is currently seeing financing deals at a 10-13% (annualized) discount to the hashrate forward curve.

By pairing a hashrate forward sale with a power hedge, miners can now lock in returns on their Bitcoin mining investments. Enter the hashspark spread — a clever nod to the spark spread (the difference between the wholesale electricity price and its production cost with natural gas). This concept is a game-changer for the mining industry. Bitcoin mining companies can now hedge away key market price risks and pivot into a more predictable electricity arbitrage business.

If you’d like to learn more about Luxor’s Bitcoin mining derivatives, please reach out to [email protected] or visit https://www.luxor.tech/derivatives.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.