Hashrate Markets Lookback Series - December 2024

Luxor’s Monthly Lookback Series is a deep dive into Bitcoin hashrate market activity. In this post, we cover December 2024’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

Tune in to our X Spaces session discussing these results here.

Summary

Bitcoin Continues to Boom: December 2024 saw Bitcoin price hit another new all-time high, driving an 8% increase in hashprice despite other challenges to mining economics.

Constituents Hold Hashprice Back: Record-high network difficulty and historically low transaction fees post-halving continued to pressure miners, with BTC-denominated hashprice dipping and USD-denominated hashprice ending the month at $54.29 per PH/s/day.

A Fork in Hashrate Markets: USD-denominated contracts benefited long positions, while BTC-denominated contracts favored hedgers. Strategic hedging in BTC markets enabled miners to outperform spot mining in Bitcoin production.

Hashrate Markets Go Mainstream: Volumes on Luxor's hashrate market are growing rapidly, with December 2024 recording the highest trading volumes yet.

December 2024 Hashprice & Its Constituents

Bitcoin's price hit a new all-time high in December. However — despite an increase in hashprice — network difficulty is relentlessly marking all-time highs as well, and historically low transaction fees post-halving continue to weigh down on mining economics.

In December, Bitcoin continued to break new ground on spot markets. The Bitcoin price component of monthly hashprice increased by 14% overall — starting at $96,924, peaking at a new all-time high of $106,739, and trailing back down to $93,606 by month's end.

Spot Bitcoin miners saw their Bitcoin price gains partially eroded by a 5% month-over-month increase in average network difficulty. Difficulty began December at 102.29T, eventually setting a new all-time high of 109.78T following three consecutive increases of 1.59%, 4.43%, and 1.16% on December 2, 16, and 29 respectively.

Transaction fees continue to disappoint following the halving, averaging just 0.088 BTC per block in December — 74% below Bitcoin’s lifetime average of 0.34 BTC. Fees fell 12% month-over-month and constituted 2.7% of the overall block reward throughout December, on average. Over the last quarter, transaction fees only constituted 3.5% of the overall block reward on average.

It is unusual for transaction fees to remain this low during a bull market. Historically, rising Bitcoin price has driven increased transaction activity and competition for block space, elevating fees. We believe that protocol changes at the software-level may have a role to play.

On the one hand, Bitcoin Improvement Proposals (BIPs) like SegWit and Taproot reduce block weight for certain transactions in an effort to improve privacy, efficiency, and scalability for multi-signature and complex financial transactions. This effectively increases block capacity and lowers fees.

On the other hand, alternative use cases for blockspace like BRC-20 tokens and Inscriptions cause episodic fee-generating events. This disconnect highlights the uncertain nature of block space demand. We can’t measure demand for blockspace until that demand materializes, but we can devise methods for projecting transaction fees into the future for better anticipating transaction fee volatility.

Record-high network difficulty coupled with historically low transaction fees drove BTC-denominated hashprice lower in December. Starting at 0.00063 BTC per PH/s/day, hashprice gradually dipped towards 0.00058 BTC, following a brief spike to 0.00065 BTC in early December.

USD-denominated hashprice also fell in December, despite Bitcoin's month-over-month price action. Daily hashprice started the month at $60.77 per PH/s/day, peaked at $63.81 and ended the month at $54.29.

In 2024 as a whole, Bitcoin delivered a solid 119% gain, signaling robust market sentiment. However, mining stocks underperformed: the HI Crypto Mining Index rose by just 35%, reflecting a disconnect between BTC and mining equities. Hashprice, the key revenue metric for miners, fell sharply by 45%, making it a challenging year for operational margins. While 2023 was significantly better for miners, with mining stocks surging 227% and hashprice up 65%, 2024 was still an improvement compared to the lows of 2022, when the sector experienced severe declines.

December 2024 Hashrate Market Activity

Our analysis of the December hashrate market focuses on two key points: how the December 2024 hashrate contract traded in previous months and how the forward curve shifted in December based on pricing for forward hashrate during the month.

The two tables below show the evolution of USD and BTC-denominated Bitcoin hashrate forward markets throughout July - December 2024. Rows represent specific monthly contracts, while columns represent each trading month. Cell values indicate the average monthly mid-market price — except for the bold highlighted main diagonal — which shows actual hashprice settlement in each month. This table summarizes both the trading history of the December 2024 contract (colored row) and the forward curve in December (colored column).

Note: all values shown in figures represent the midpoint of the best bid and ask on Luxor's Non-Deliverable Hashprice Forward market.

The table below shows the type of market participants on the buy and sell side of Luxor’s deliverable (DF) and non-deliverable hashrate forward (NDF) market. Most notably, in December lenders were active on the buy side of the DF market, while public and private miners used the contract to sell forward, receive financing, and expand their fleet.

Since the DF involves upfront payment, it tends to trade at a discount to the NDF to compensate the buyer for the inherent credit risk. We see the discount of DF’s relative to NDF’s as the interest rate in hashrate-based lending markets. Buyers and sellers of the DF with upfront payment can use the NDF to lock-in a fixed yield or cost of capital instead of having exposure to the uncertain and variable returns of hashprice. This strategy was used by lenders (buy the DF and sell the NDF) to earn a return and miners (sell the DF and buy the NDF) to obtain financing. In December 2024, that yield or cost of capital was in the 9-13% annualized range.

How December 2024 Hashrate Traded

The contrast between Bitcoin price on the upside and network difficulty alongside transaction fees on the downside continued to play out in the forward market, leading to a second month of divergent outcomes between USD and BTC-denominated hashrate markets.

In USD hashrate markets, December hashrate settled higher than traded in the prior five months: long positions earned a return and hedgers saw a loss in USD terms. In BTC hashrate markets however, December hashrate settled lower than traded in the prior five months: hedgers earned a return and long positions saw a loss in BTC terms.

Buyers of the December 2024 USD contract in September saw the highest returns, while early and late sellers, hedging in July or November, incurred the smallest losses. Overall, hedgers earned between 10-31% less than spot Bitcoin miners. As a miner, in USD terms, it was best not to be hedged in December and/or buy hashrate from the forward market.

The table below summarizes how a 1 EH mining operation’s USD revenues would have performed, had it sold December 2024 hashrate forward versus mining spot during the month.

In BTC production terms, hedging was the best strategy for Bitcoin miners. If a miner had fully hedged at the average mid-market price in July or August, they could have mined 19% and 13% more Bitcoin than those miners which mined at spot prices through December. Those who fully hedged in September, October and November, produced 10%, 8%, and 1% more Bitcoin versus spot miners. In other words, it was best to sell early, or conversely, buy late.

The table below summarizes how a 1 EH mining operation’s total Bitcoin production would have performed, had it sold December 2024 hashrate forward versus mining spot during the month.

The best strategy for miners in December was to hedge network difficulty and transaction fees by selling in the BTC-denominated hashrate market and maintaining their long exposure to Bitcoin. For those who employed this strategy, it proved successful.

Unfortunately, most public mining companies did not hedge network difficulty and transaction fees in December 2024. The figure below illustrates a hypothetical scenario of how public miners' December Bitcoin production would have differed if they had fully hedged their December production back in July.

Note: this figure is strictly for demonstration purposes and based on the simplifying assumption of multiplying actual production figures by the percentage difference between hashrate forward contracts’ locked-in hashprice versus spot hashprice; it excludes fees and bid/ask spreads associated with entering into hashrate forward contracts.

A second caveat: although selling forward proved to be favorable in this instance, it is critical to recognize that hedging is typically a cost of business rather than a revenue generation method. Hedgers willingly pay a price to buy certainty and obtain more predictable cash flows, which increases valuation, reduces cost of capital, and ultimately attracts investments.

How Future Hashrate Traded in December 2024

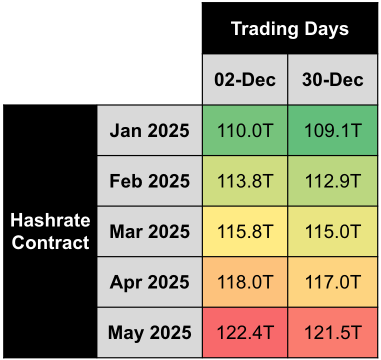

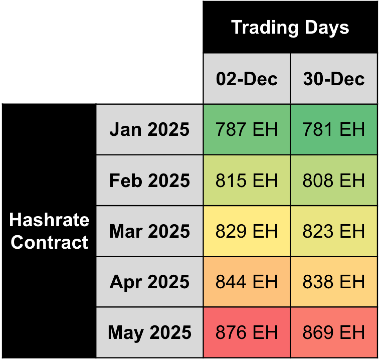

The two tables below summarize the evolution of Bitcoin hashrate forward markets during December 2024, for the subsequent five months from January 2025 through May 2025. Rows represent specific monthly hashrate contracts, while columns represent specific trading days. Cell values indicate the average daily mid-market price, except for spot prices.

During December trading, both USD and BTC curves traded mostly in backwardation. USD-denominated contracts rose for the first half of the month, but fell for the second half. In contrast, BTC-denominated forward hashrate contract pricing was essentially flat.

Given this information, we can use the two contracts (by dividing USD contract values with BTC contract values) to back out implied Bitcoin price expectations expressed by the market:

Like USD hashprice, implied future Bitcoin price expectations rose during the first half of the month, but fell during the second half. But, implied future Bitcoin prices were mostly in contango. Combining this information with USD-denominated hashrate contracts being in backwardation allows us to infer the market’s expectation around network difficulty and hashrate: namely that both are expected to grow faster than Bitcoin price and transaction fees.

If we make an assumption around transaction fees, we can calculate the changes in implied difficulty and network hashrate expectations in the forwards market. In the tables below, we assume a 0.10 BTC per block transaction fee assumption on December 2nd and 0.075 BTC per block on December 30th:

Note: figures assume 0.10 BTC per block transaction fee assumption on December 2nd and 0.075 BTC per block on December 30th, 2024.

Based on this simplified analysis, we estimate that future hashrate expectations were fairly stable during the month of December.

Looking Ahead and Concluding Thoughts

Looking forward, Luxor’s Hashrate Market, is pricing in an average hashprice of $53.11 or 0.00055 BTC per PH/s/Day over the next six months. Sellers can currently secure this hashprice while buyers have the opportunity to lock in the same hashcost through to June 2025.

In recent days, block times have slowed and the difficulty adjustment expected on January 12 is now projected to be -0.62%. The slower block times appear related to the winter storms in Texas, where approximately 17% of global hashrate is located. As a result, January contracts are priced in slight contango.

We are keeping our eye on three key trends in 2025. The first is the race between Bitcoin price and network difficulty. If Bitcoin price continues to outpace network difficulty, like it has the last few months, then 2025 could be a very lucrative year for Bitcoin miners. However, if Bitcoin price falls, then higher network difficulty will mean hashprice is significantly lower for any given previous Bitcoin price. This is a key risk miners should consider hedging against in 2025.

The second key trend is low transaction fees, which will be the wild card for hashprice in the coming year. Since the April 2024 halving, fees have been historically and unexpectedly low. But as we know volatility in blockspace markets can pick-up at any time and provide a much welcomed production boost for miners.

The final key trend is hashrate markets going mainstream in 2025. With volumes at an all time high, we see miners deploying two key strategies in hashrate markets.

The first is to buy hashrate directly from Luxor’s hashrate market. This direct approach offers several advantages over operating ASICs. Physical mining operations entail challenges: delivery delays, electrical issues, power costs, and infrastructure bottlenecks can stall production while leaving operating capital idle. By contrast, hashrate forwards enable miners to deploy capital and generate BTC instantly — without the typical complexities associated with ownership and operation of hardware.

With Bitcoin transaction fees still near historical lows, hashrate offers an upside not available through spot BTC purchases. Exposure to transaction fees — especially in a rising fee environment — adds another layer of potential upside in a bull market. Mining companies looking to add Bitcoin to their balance sheet should consider adding hashrate for the additional upside from mining economics.

For well-capitalized public Bitcoin mining companies this creates a unique opportunity. As a complement to a treasury strategy of acquiring Bitcoin from spot markets, those funds can also be invested in Bitcoin hashrate contracts. This approach would immediately boost managed hashrate, increase monthly Bitcoin production, and set their investment offering apart from MicroStrategy and other public mining companies.

The second approach being deployed by miners is to sell hashrate forward, receive non-dilutive financing, and expand their ASIC fleet. As the only Bitcoin mining pool with forward market functionality, and durations now extending up to 12 months, Luxor miners can sell forward a portion of their hashrate for upfront funds and expand immediately. Our desk is currently seeing financing deals at a 9-13% (annualized) discount to the hashrate forward curve.

By pairing a hashrate forward sale with a power hedge, miners can now also lock in returns on their Bitcoin mining investments. Enter the hashspark spread — a clever nod to the spark spread (the difference between the wholesale electricity price and its production cost with natural gas). This concept is a game-changer for the mining industry. Bitcoin mining companies can now hedge away key market price risks and pivot into a more predictable electricity arbitrage business.

By looking at the recently released energy-adjusted hashprice metric on Hashrate Index, we can determine what different generation miners are earning per unit of electricity. New generation miners are earning upwards of $135 per MWh, while mid and old generation miners earn approximately $105 and $72 per MWh respectively.

Volumes on Luxor's hashrate forward market are growing rapidly, with December 2024 recording the highest trading volumes yet. Public companies are increasingly trading and showing interest in hashrate forwards, which we expect to become standard by 2025. Firms that develop and clearly communicate their hashrate forward strategies will gain a competitive edge in de-risking operations, securing financing, and expanding their hashrate.

If you’d like to learn more about Luxor’s Bitcoin mining derivatives, please reach out to [email protected] or visit https://www.luxor.tech/derivatives.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.