Hashrate Index Roundup (September 25, 2022)

Hashprice is approaching all-time lows as the bear market claims a new victim.

Happy Sunday, y'all!

Bitcoin had some eye-popping sell-offs this week, dipping to as low as $18,200 on Wednesday. The volatility had Bitcoin see-sawing in a range of low $18,000s to low $19,000s throughout the entire week.

As the bear market wears on, the downturn is claiming new victims. Most recently, Bitcoin mining hosting provider Compute North has filed for Chapter 11 bankruptcy to restructure its business (more on this in the news section below).

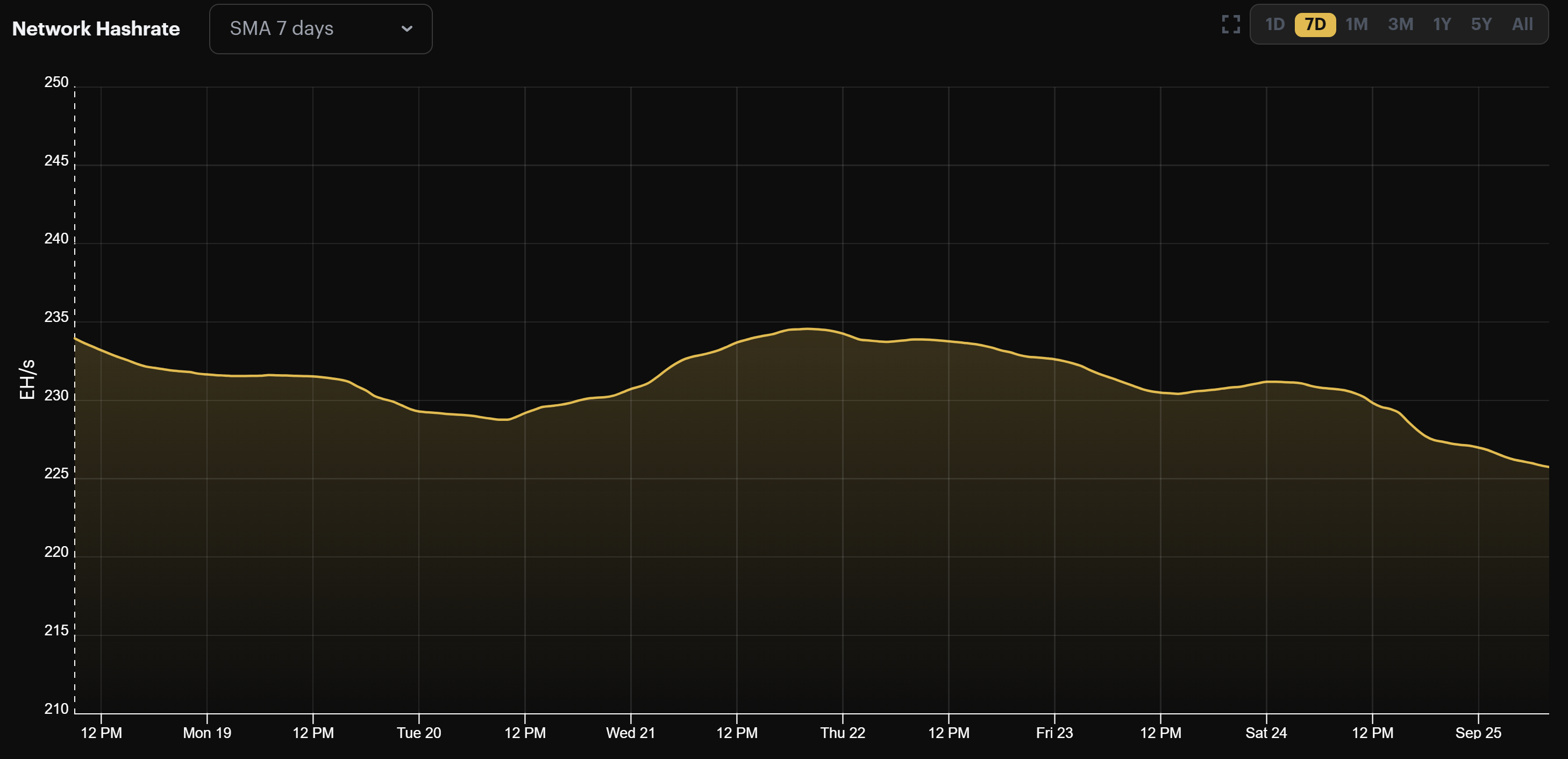

With Bitcoin's price in the toilet, the bad news is that this price action is punishing hashprice (obviously). The good news: Bitcoin's hashrate is dropping as a result, falling 3.8% to 225 EH/s. Blocks are coming in slower as a result – 10 minutes and 10 seconds slower, to be exact. So it's becoming increasingly likely that the next difficulty adjustment will be to the downside.

Maybe that's cold comfort given the fact that hashprice is down 70% year-to-date, but it's a bear market baby, so you gotta take every crumb of positivity you can get.

Bitcoin Mining News

- Compute North files for Chapter 11 bankruptcy – Compute North, one of the largest Bitcoin mining hosting providers in the US, filed for Chapter 11 bankruptcy last week. In anticipation of the restructuring, CEO David Perrill stepped down, and one of Compute North's clients, The9, is suing the firm. Compute North provides hosting for some of the biggest players in the public and private Bitcoin mining sector, including Marathon Digital, Compass Mining, and many others.

- Riot Sues Northern Data over Whinstone acquisition

- Bitfarms powers up Argentina mining site

- Digihost acquires New York power plant Fortistar

- Bitmain discounts bulk S19 J Pro orders to $19/TH

Mining Market TLDR

Sponsored by Luxor

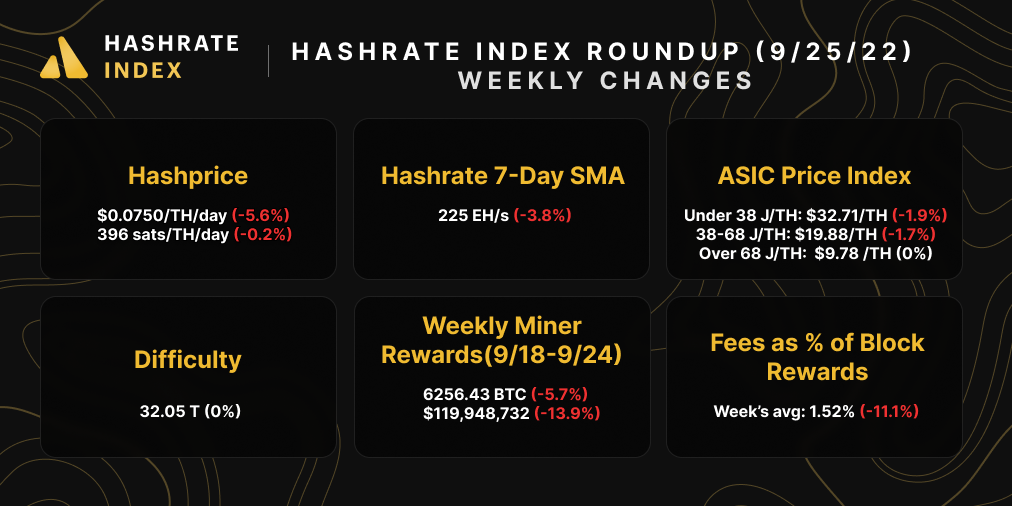

Hashprice Index (September 25, 2022)

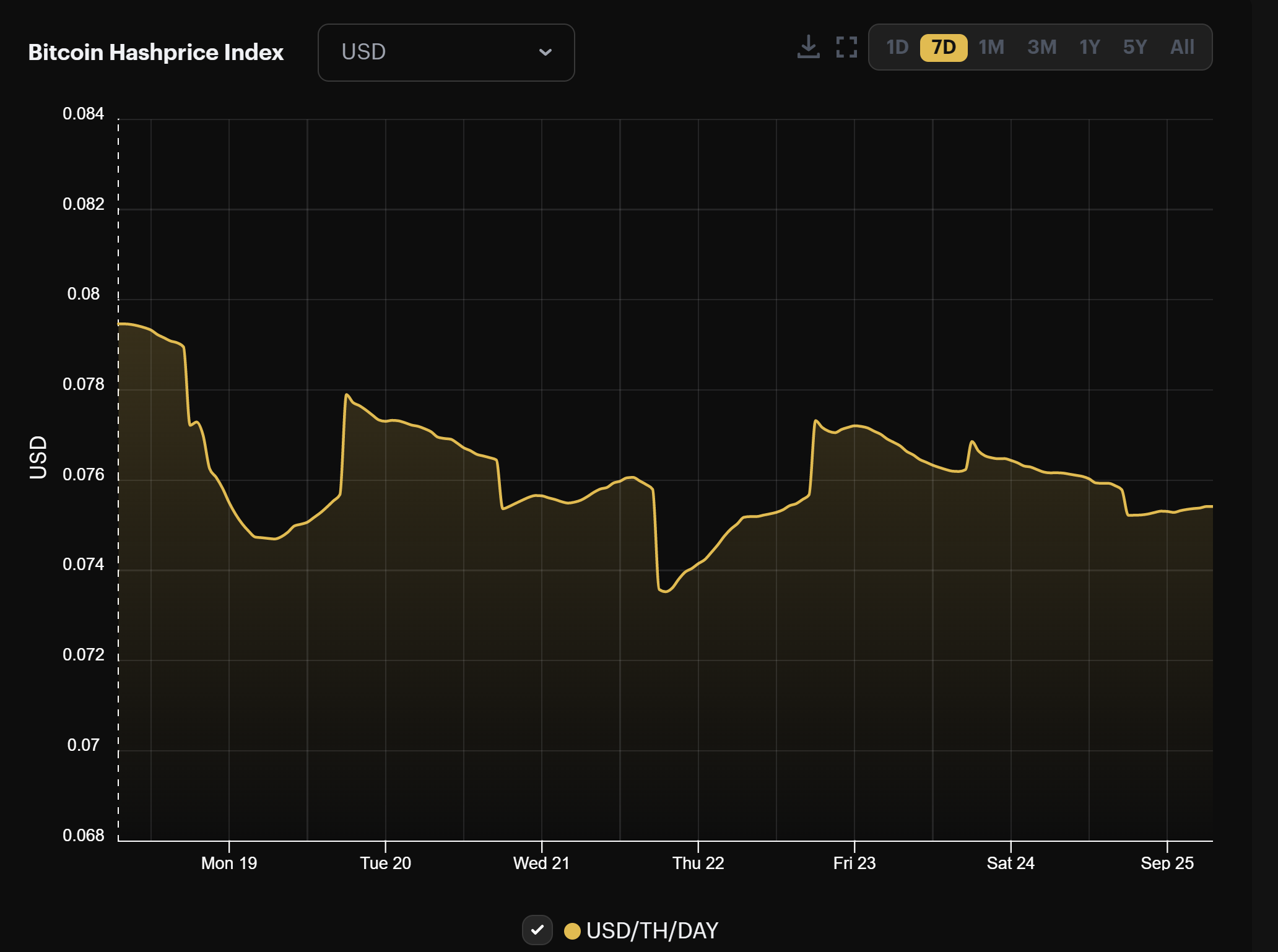

During last week's sell-off, Bitcoin's hashprice got as low as $0.0735/TH/day. That's only 3.6% away from Bitcoin's hashprice daily average all-time low of $0.0709.

With every week, we inch ever closer to that all-time low. Next week's difficulty adjustment (likely to be negative) will stay hashprice from this fate for a little while longer, but it's only a matter of time until the bear market grinds hashprice down to its low and below.

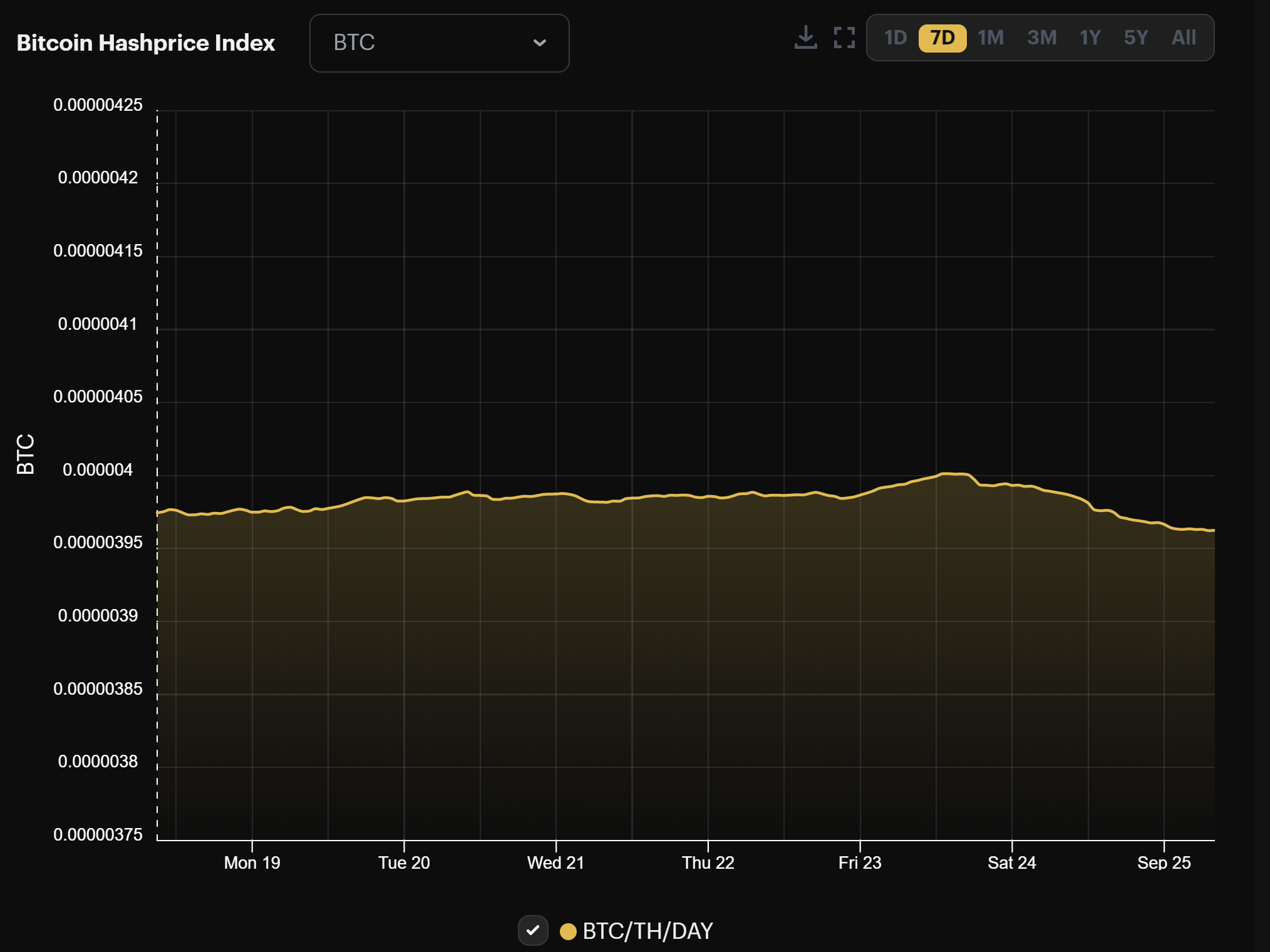

But that's for USD denominated hashprice. As for BTC denominated hashprice, we set yet another new all-time low last week at 396 sats/TH/day.

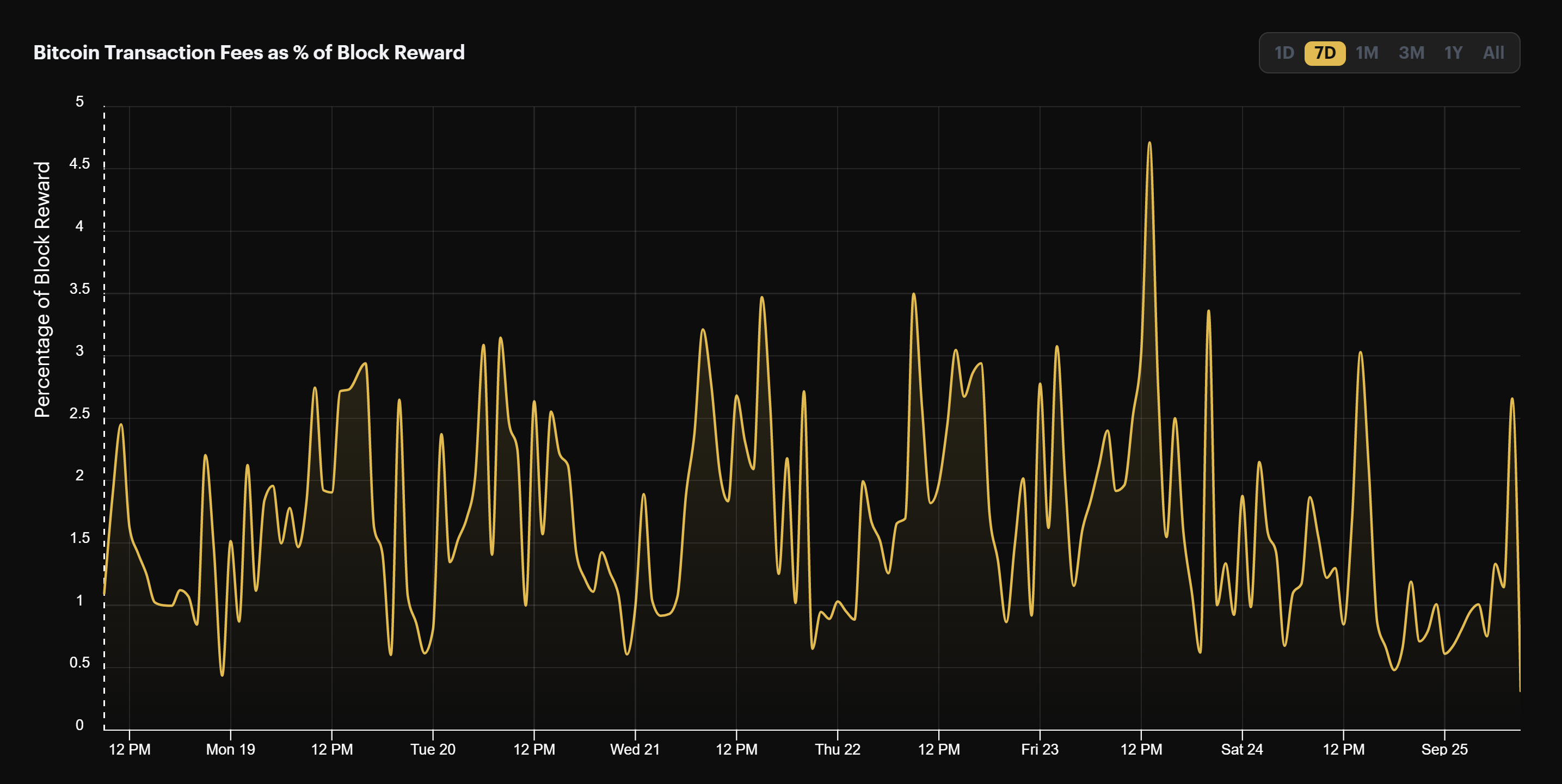

Bitcoin's transaction fees continue to dwindle.

Last week's average transaction fee share of block rewards was 1.53%, which is just a blip above the 30-day average of 1.50%.

Bitcoin Mining ASIC Price Index (September 25, 2022)

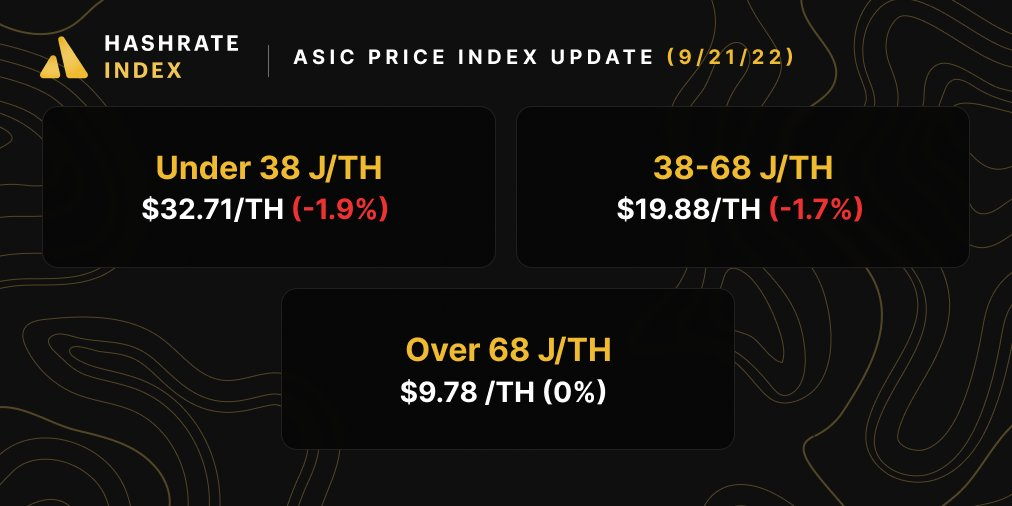

Surprise, surprise – our ASIC Price Index continues to decline.

New and mid-gen machines fell, while old-gen machines stayed stagnant (this is the result of fewer datapoints for these rigs, as these older models are not changing hands nearly as much now as they were in the bull market).

As we stated in the news section, Bitmain continues to discount bulk orders of their S19 series, this time with a 30% markdown of S19 J Pros to $19/TH. All of that to say, the secondary market still has a ways to go before it sees the bottom of this current cycle.

When hashing at $0.06/kWh power cost, here is the current bitcoin mining profitability for popular mining rigs:

- Antminer S19 XP (140 TH/s): $6.20

- Whatsminer M50 (114 TH/s): $3.80

- Whatsminer M30s++ (112 TH/s): $3.40

- Antminer S19j Pro (104 TH/s): $3.40

- Antminer S19 (95 TH/s): $2.50

- Whatsminer M30s (86 TH/s): $1.80

- Antminer S17 (56 TH/s): $0.60

- Whatsminer M20s (68 TH/S): $0.20

Bitcoin Mining Stocks (September 25, 2022)

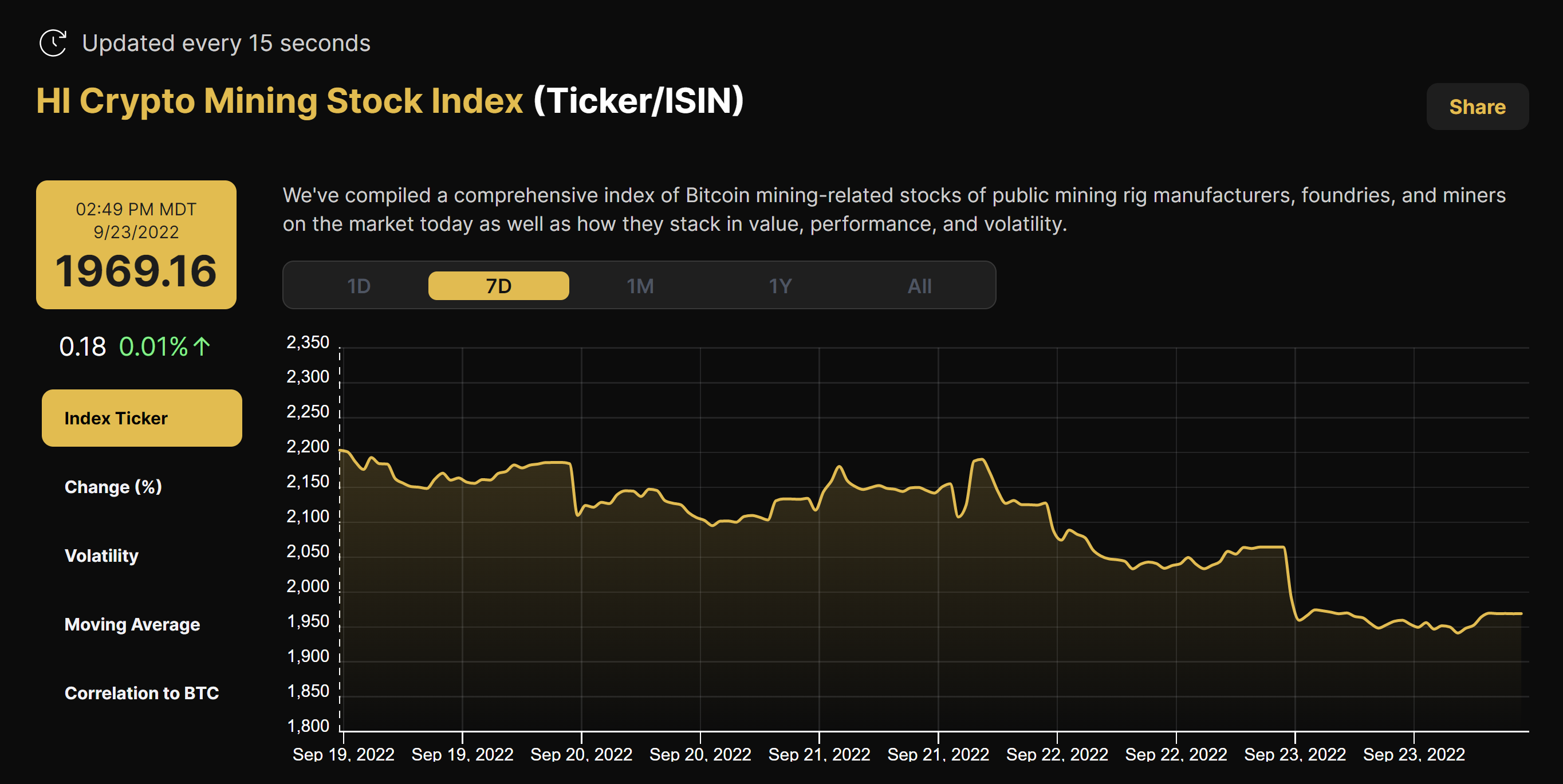

Bitcoin mining stocks continue to feel the weight of the down market.

Over the course of last week, Bitcoin's price decline hit these stocks hard, so our Crypto Mining Stock Index fell by a whopping 10.6%.

New From Hashrate Index

How Will Ethereum's Merge to Proof-of-Stake Impact the GPU Market?

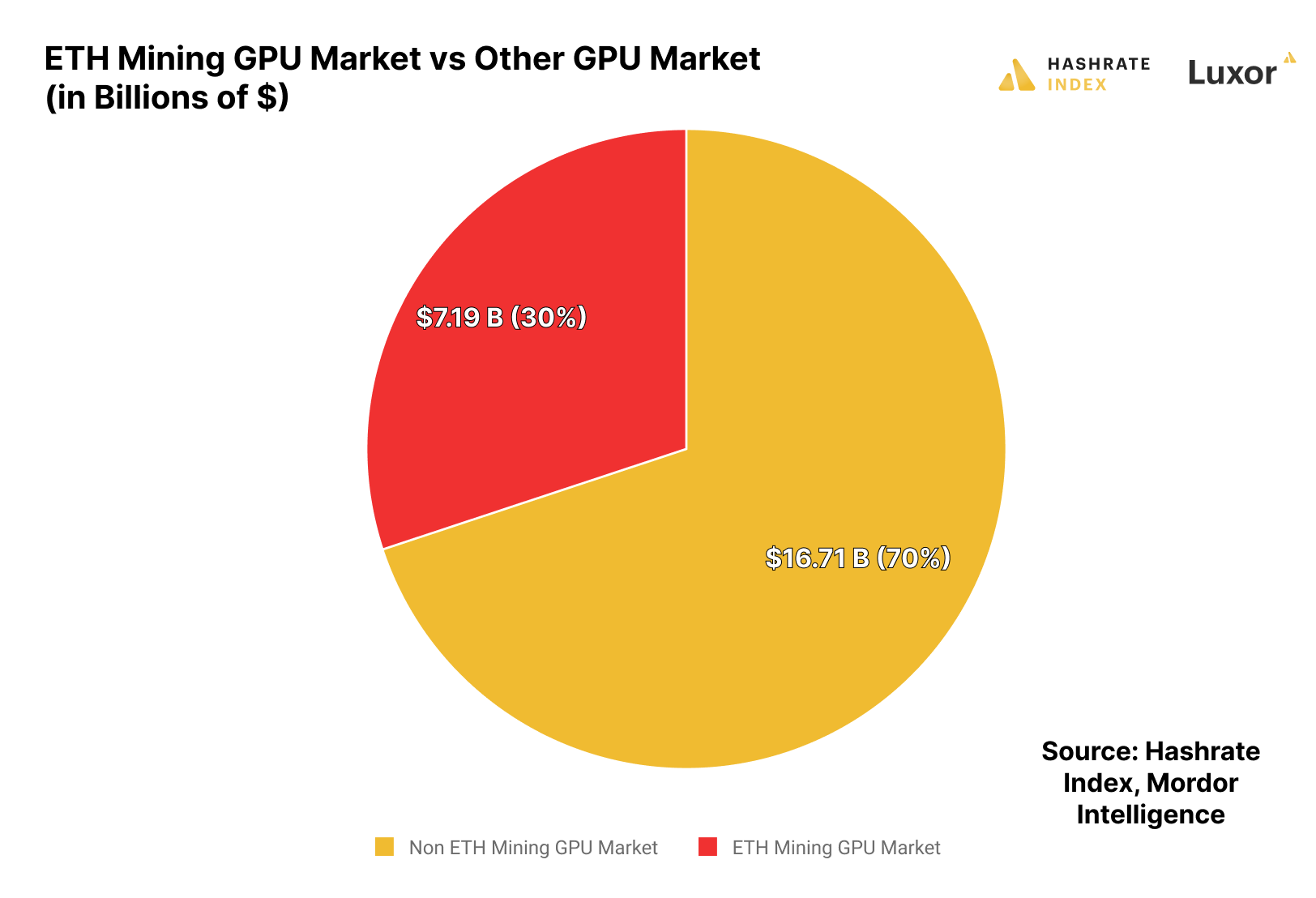

Ethereum’s merge to proof-of-stake is complete, which leaves billions of dollars of GPU mining hardware in want of new use cases. As we covered in the last article in this 3 part series, some of this hardware – roughly 16% of it over the long-term – could migrate to GPU-mineable alternatives.

The rest will either be scrapped or sold. And this raises an obvious question: how will this hardware impact the wider GPU market?

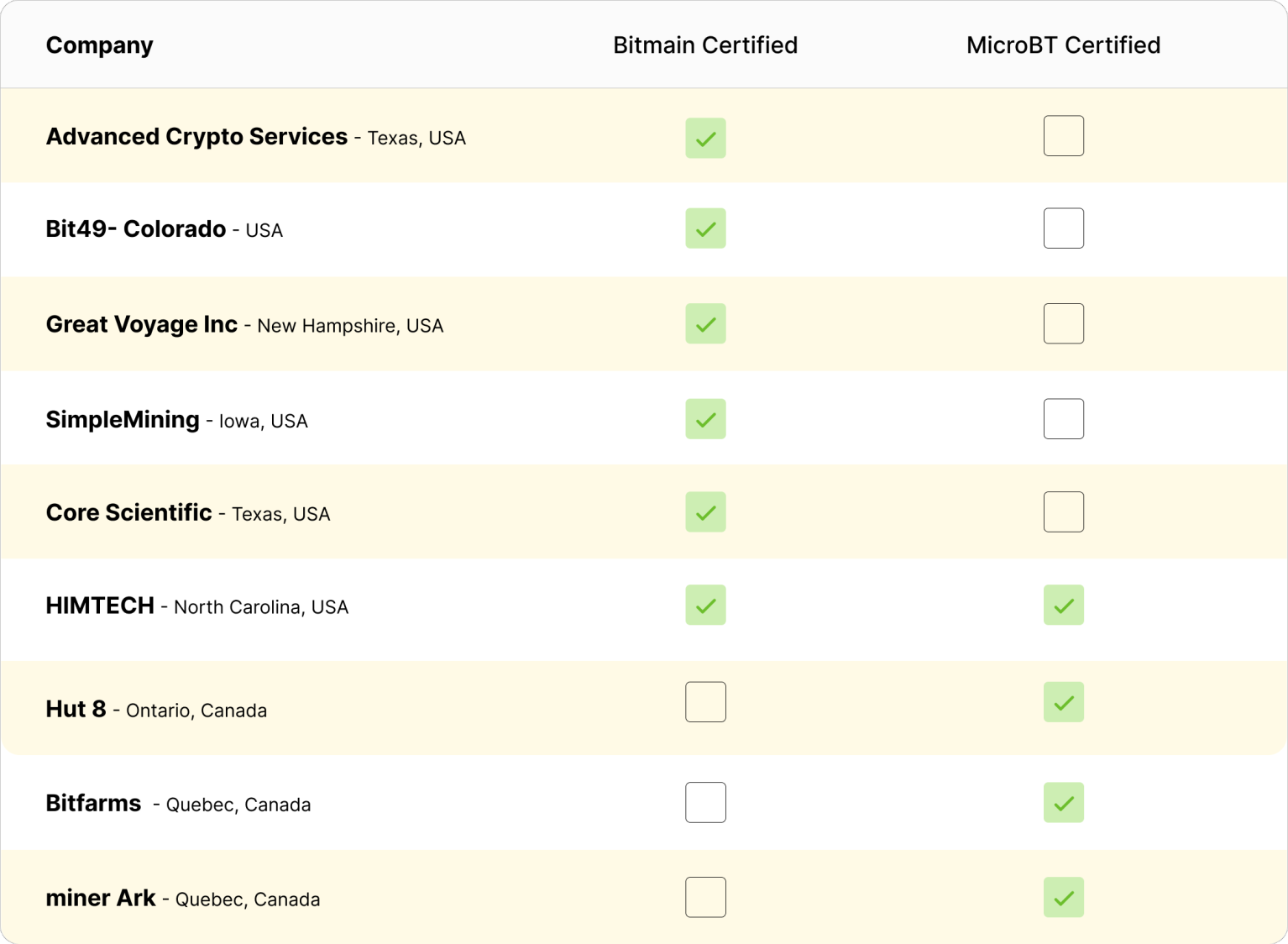

Certified Bitmain and MicroBT Bitcoin Mining ASIC Repair Centers: A Guide

In one of our latest Bitcoin Mining guide articles, we consolidated a list of certified Bitmain and MicroBT repair centers that North American Bitcoin miners can use when their equipment needs some tender love and care.

Have a great week, and Happy Hashing!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.