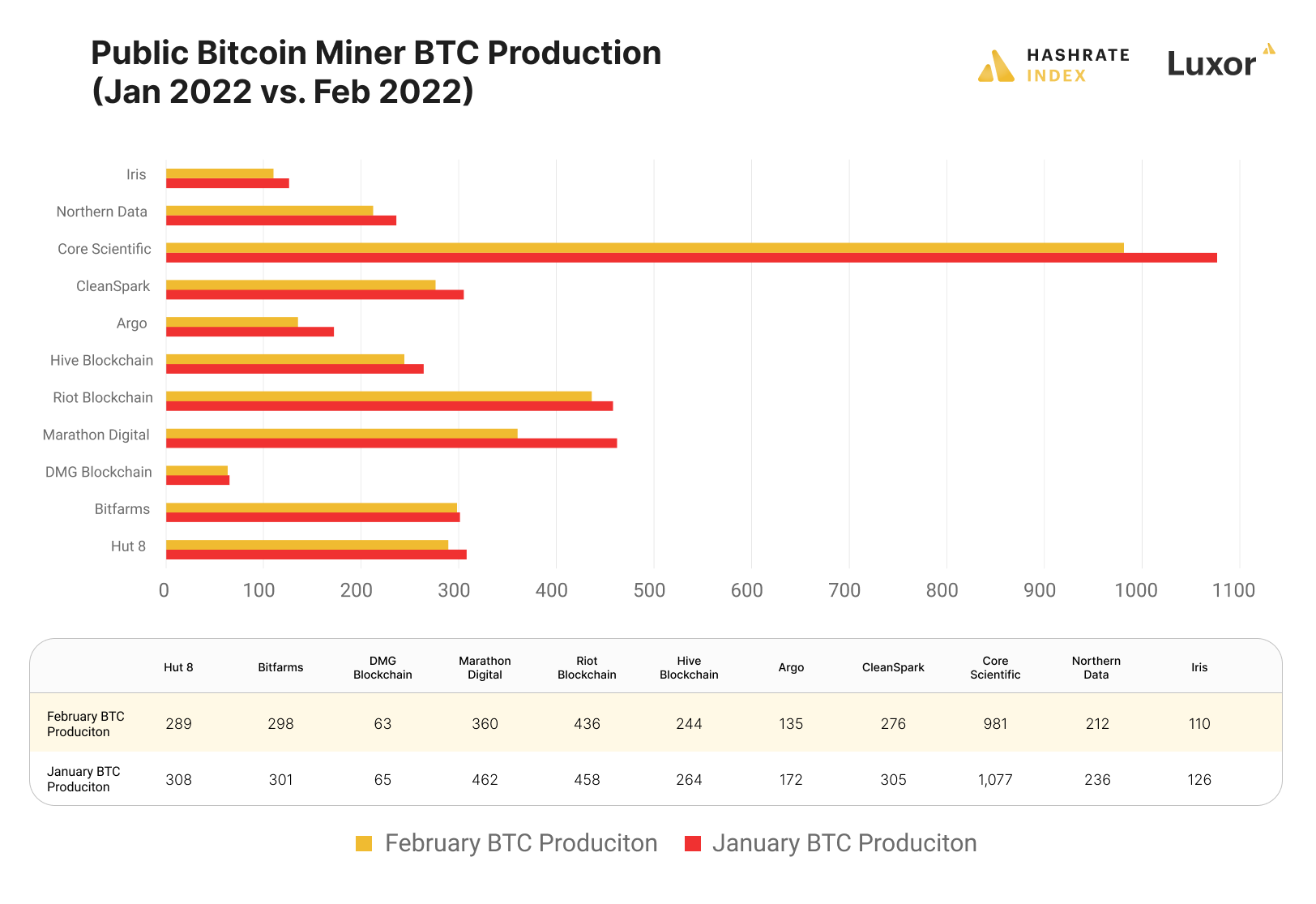

Public Bitcoin Miners Mined Fewer BTC in February 2022 Than January

Public Bitcoin miners earned fewer bitcoin rewards in February 2022 than they did in January. Bitcoin's difficulty all-time high and miner power curtailment explain the reduction in productivity.

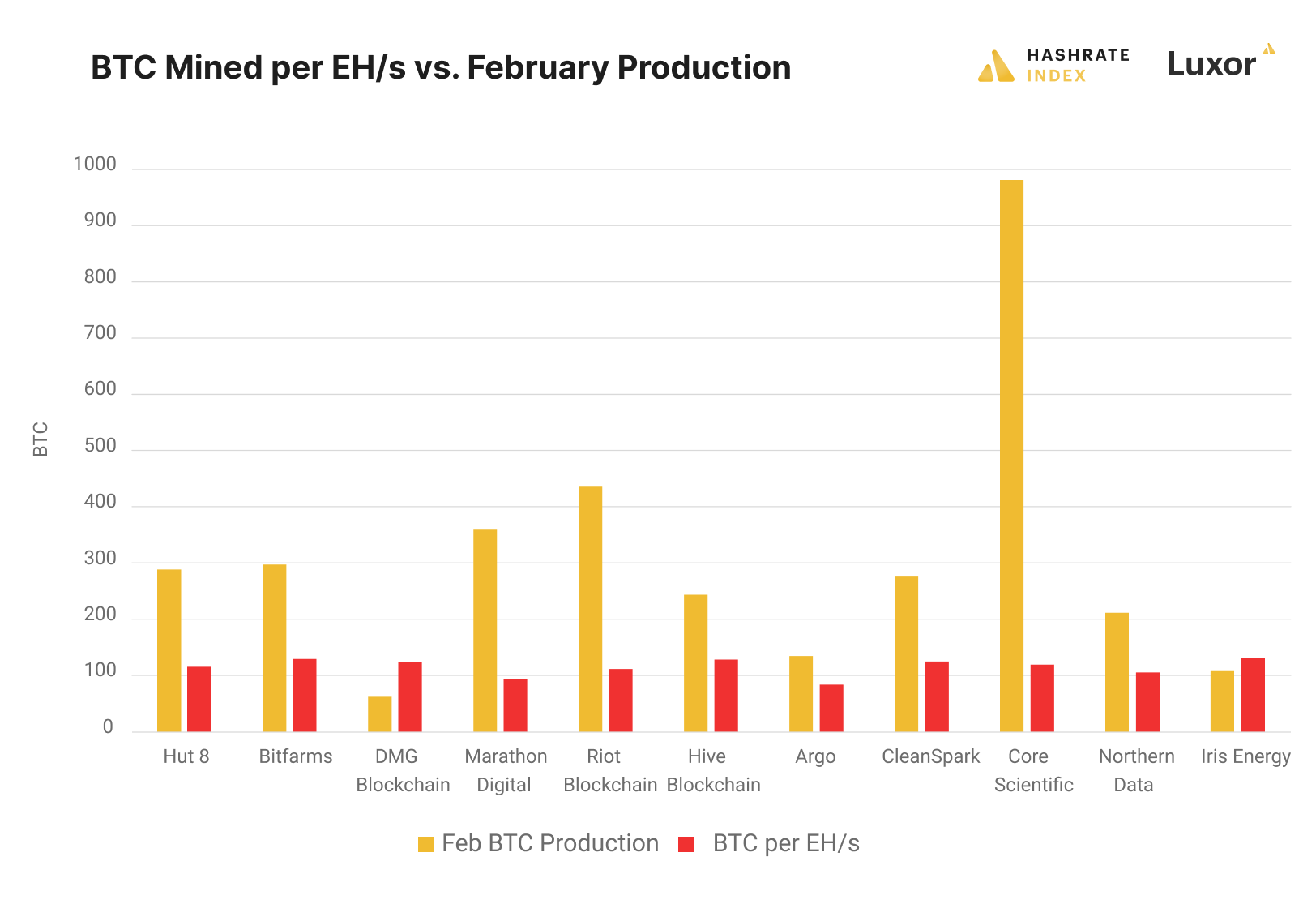

The February production updates for major Bitcoin mining stocks are out, and the numbers indicate that some companies could be having trouble keeping their hashrates apace with the Bitcoin network’s growth.

Update: A previous version of this newsletter included an improperly labelled graph. This version has been updated to correct the error.

Even though most of these miners plugged in additional hashrate throughout the month, they all earned fewer bitcoin rewards in February than they did in January. In addition to combatting rising hashrate and difficulty, many of these miners had to curtail their operations in February in response to winter storms that threatened to snarl up energy infrastructure in the Western United States and Canada.

Marathon Digital and Argo Blockchain's bitcoin production were the most notably impacted in February, respectively experiencing declines of -28%, and -27% from their January production numbers.

Explaining its downgraded performance, Argo partook in the load shedding that is common during the cold winter months in Quebec. For Marathon, electrical snafus at its Montana facility and curtailment of its Texas operations impacted productivity.

Relative to the prior months of January and December, our February production was impacted by increasing network difficulty, continued fluctuations at the power station in Montana, and voluntary curtailment of our miners in Texas to support the grid during a recent storm. We expect our monthly production reliability to improve as we diversify deployments across new locations.

Another thing to bear in mind, both Marathon and Argo use PPLNS mining pools (via Marapool and Terrapool, respectively). PPLNS payout schemes expose miners to block variance and luck risks, so an unlucky month could hamper productivity, as well.

Sponsored by BlockFi

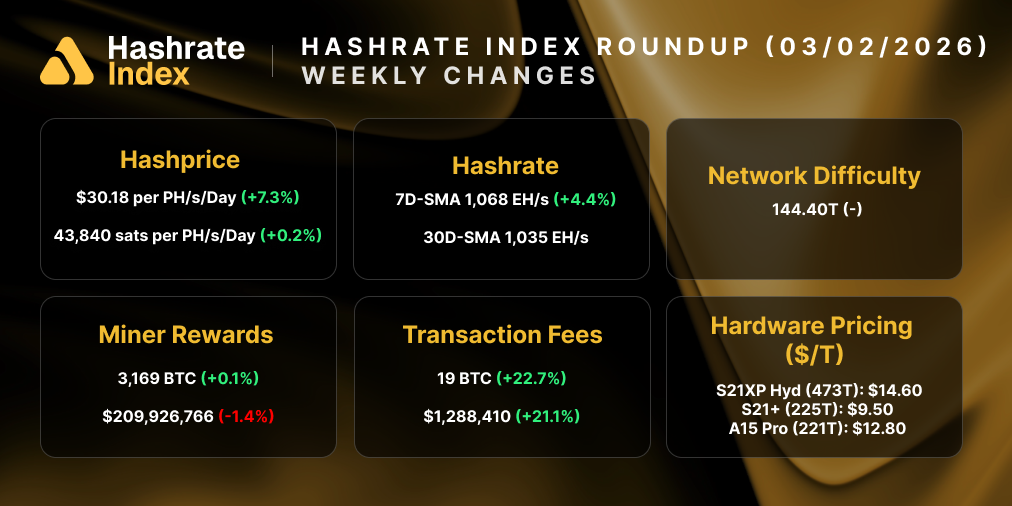

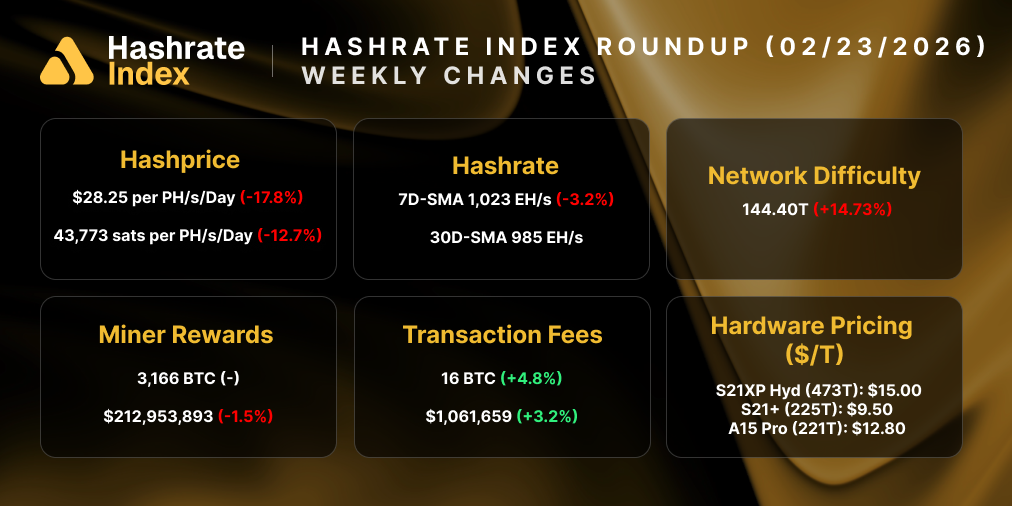

Bitcoin Hashrate, Difficulty Ramped Up in February 2022

Outside of Marathon and Argo, other miners also earned fewer block rewards because they curtailed their energy draw. Riot and Core Scientific, for instance, shutdown portions of their respective operations in anticipation of last month’s winter storms in the western United States.

But curtailment didn’t account for the reduction of rewards across the board; Bitcoin’s surging hashrate did.

On February 1, Bitcoin’s 7-day average hashrate was 191 EH/s. By February 17, this would leap to 220 EH/s, a 15% increase which precipitated a 4.78% upward difficulty adjustment. Bitcoin miners were hashing under an all-time high difficulty for roughly half of the month, so they were earning fewer bitcoins per unit of hashrate.

As evidenced by February’s reduced production numbers, these public bitcoin miners did not expand their individual hashrate capacities enough to keep up with the wider network's growth.

By March 1, Bitcoin’s 7-day average hashrate was 198 EH/s, only a 3.6% increase from the beginning of February. The network also experienced a rare downward adjustment on March 3, and it’s possible that the next adjustment will provide us with an even rarer back-to-back downward adjustment. It’s a little too early to tell whether or not the next adjustment will go negative, but if it does, it’s likely that these miners will earn more BTC in March than they did in January or February.

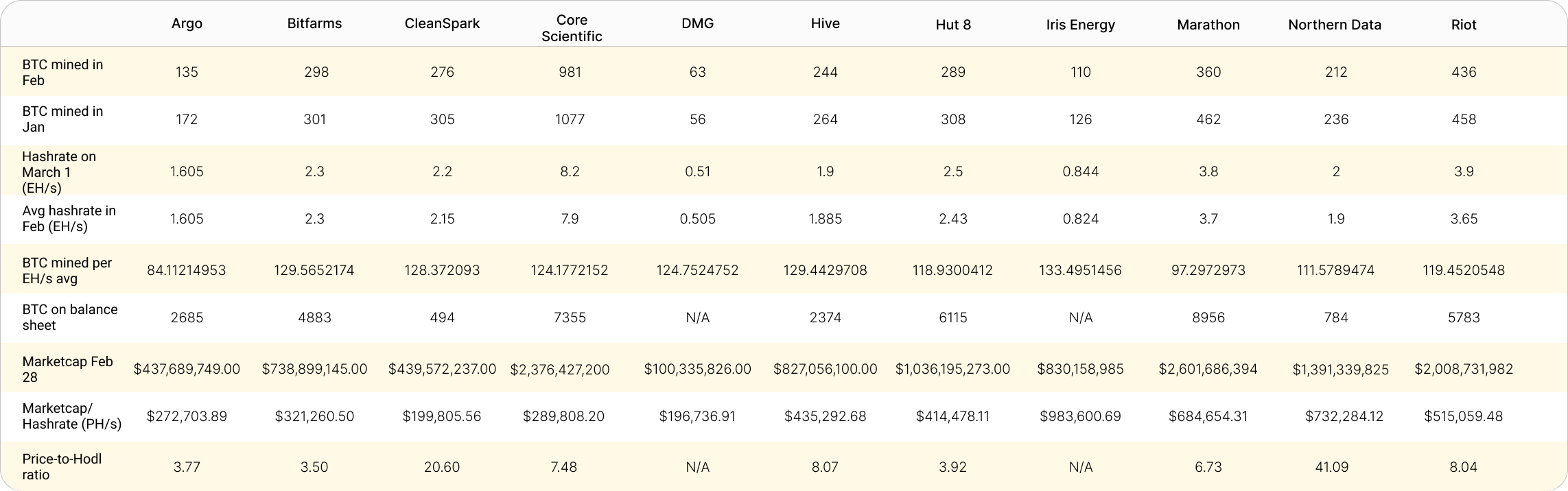

Public Bitcoin Miner Price to Hodl-Ratio, Marketcap / Hashrate Ratio for February 2022

Most public Bitcoin miners hold the Bitcoin they mine, opting to pay down expenses through other means like stock offerings, collateralized bitcoin loans or financing. The bitcoin these miners hold on their balance sheets acts as a fund of sorts which gives investors proxy exposure to holding bitcoin outright, instead of just exposure to the production of the asset.

The price-to-hodl ratio is a metric investors can use to evaluate how much they will pay for exposure to a miner’s bitcoin treasury. Generally speaking, the lower the ratio, the better the value, because investors are paying fewer dollars per share per unit of bitcoin a company holds. If the ratio is higher, investors are paying more per share per unit of bitcoin a company holds.

A higher ratio may mean investors are willing to pay more to own a fast-paced, high growth bitcoin miner; for example, Riot and Marathon have some of the highest ratios among their peers, which could indicate that investors are willing to pay a premium for exposure to these companies because of the heaps of hashrate they have on pre-order.

Similarly, the marketcap-to-hashrate ratio shows investors how much they are paying for exposure to a company’s active hashrate capacity. A low ratio means an investor is paying a low price per share for a company's current hashrate, whereas a higher ratio means an investor is paying much higher cost per share to own an equivalent amount of hashrate. (Additionally, certain miners may have a higher marketcap/hashrate ratio because they own infrastructure, like a mining facility itself or an energy source, which investors bake into overall valuation).

For example, bitcoin miner ABC's marketcap is $350,000 per petahash, and bitcoin miner DEF's marketcap is $750,000 per petahash. The lower dollar value per current petahash has the best potential value near-term. If investors are paying a large premium for current hashrate, it could mean they expect large future expansions of hashrate, or the miner owns valuable infrastructure.

With recent supply chain constraints and new power expansion delays among many of the public miners, though, there are no guarantees these companies will be able to achieve their promised hashrate expansion targets in 2022.

Have a great week, and Happy Hashing!

-Luxor Team

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.