Culprits or Scapegoats: Do Bitcoin Miners Influence Bitcoin's Price?

Do bitcoin miners selling bitcoin overly affect Bitcoin's price?

Miners are net sellers of bitcoin and always provide a certain selling pressure on the market. The strength of this selling pressure varies through bitcoin's market cycle, as miners tend to sell the most during bear markets. This perverse inverse correlation between the bitcoin price and the amount of bitcoin sold by miners is a paradoxical outcome of their "hodl-at-any-cost" treasury strategy. By refusing to sell bitcoin voluntarily during the bull market, the bear market inevitably forces the precious orange coin out of the miners' hands at depressed prices.

Many observers assume the increased selling pressure from miners during bear markets to have a significant negative impact on the bitcoin price. This discussion appears in each bear market, and analysts haven't yet reached a consensus on how big of an effect the selling pressure from miners could have on the bitcoin price. That is why I wrote this blog post.

Miners hold a tiny share of the circulating bitcoin supply

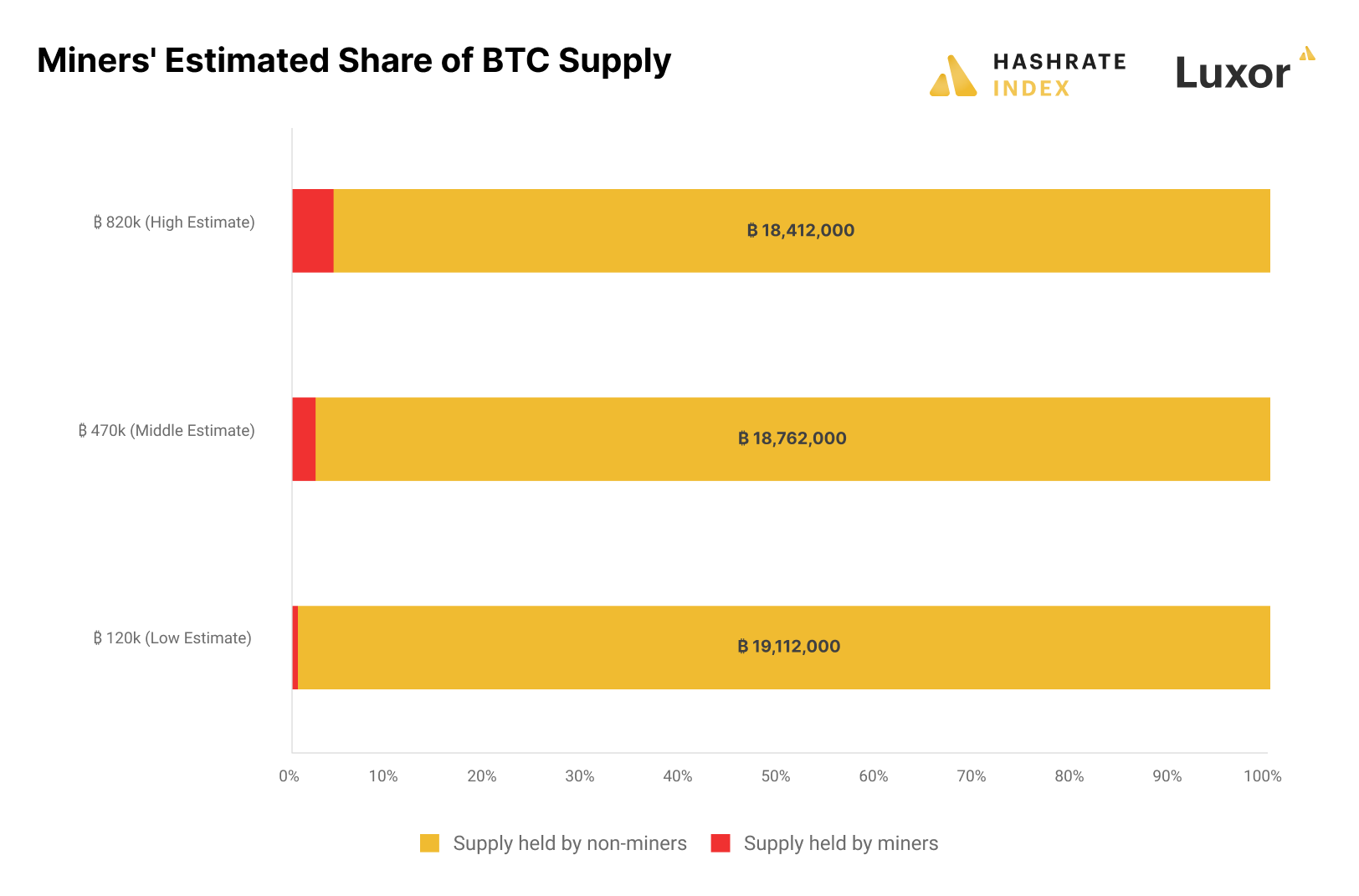

Many believe bitcoin miners are enormous bitcoin holders that can move markets on a whim. For miners to be able to impact the bitcoin market to a significant degree, they must collectively own a sizeable portion of bitcoin's circulating supply. Let's estimate the miners' total bitcoin holdings to determine if they live up to their monstrous reputation.

Before we get going, it is essential to understand that nobody actually knows how much bitcoin the miners own. The best we can do is make approximations with relatively large error margins. On-chain data providers like CoinMetrics and Glassnode provide the most popular estimates. These firms group wallet addresses by their closeness to the coinbase transaction – the transaction in each block that sends the block reward to the block's miner. You can read more about the methodology in this article, but the essential thing to be aware of is that it likely significantly overestimates the miners' bitcoin holdings. Therefore, I use CoinMetrics' estimate of 820,000 as a high estimate.

Another way to estimate miners' bitcoin holdings is to derive it from the public miners' holdings. As of December 1st, they held approximately 30,000 bitcoin. Since they currently generate around 25% of bitcoin's hashrate, a rough estimate for the total bitcoin holdings of all miners could be 120,000 bitcoin. I use this as a low estimate. We can then create a middle estimate of 470,000 bitcoin.

Bitcoin's circulating supply is 19.2 million. As we can see in the chart above, even our high estimate for miners' holdings at 820,000 is only 4% of the circulating bitcoin supply. Our middle estimate of 470,000 is only 2%, while our low estimate of 120,000 makes up less than 1% of the bitcoin supply.

The public's image of miners as enormous bitcoin holders and influential market participants might have been accurate ten years ago when the block reward was 50 and miners held a significantly higher portion of bitcoin's circulating supply. Times have changed, and miners no longer hold a meaningful share of the bitcoin supply.

Even if miners sold more than their entire bitcoin production, it wouldn't significantly impact the spot market

In the previous section, I showed how bitcoin miners don't hold as much share of the bitcoin supply as most think. Still, the most important thing to find out is how well bitcoin's spot market can absorb the selling pressure from the miners, as they tend to sell more aggressively in bear markets than most market participants.

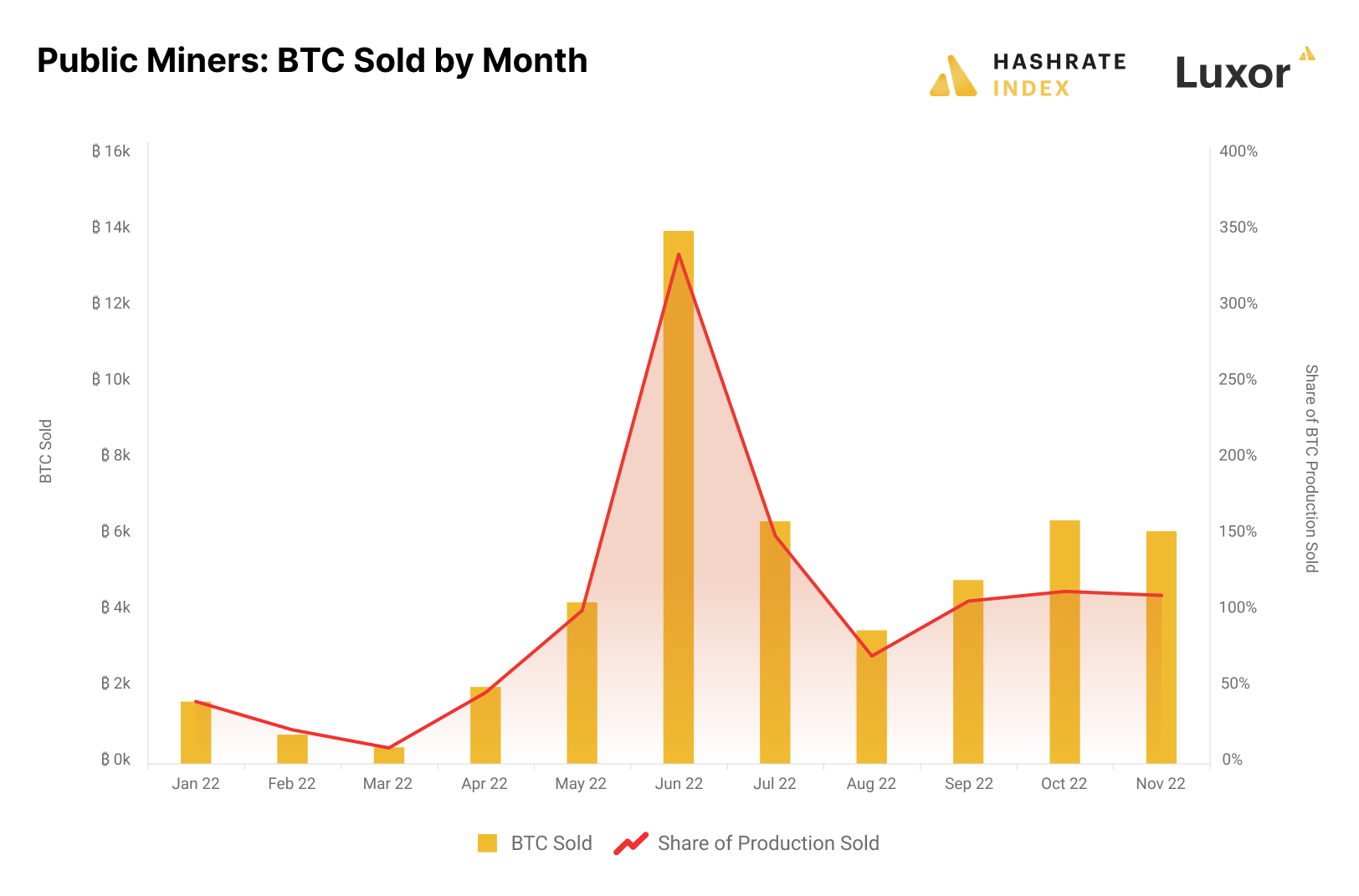

The best way to estimate miners' absolute selling pressure is by looking at how much bitcoin they receive daily. Every day about 900 freshly minted bitcoin flow into miners' wallets. If miners sell less than 100% of their production, they accumulate bitcoin; if they sell more than 100%, they reduce their holdings.

During the first four months of 2022, public miners in accumulation mode sold less than 100% of their production. As market conditions worsened in April, they started liquidating their precious hodl and sold more than 100% of their output for the first time this year. Their bitcoin sales peaked in June when they dumped 350% of their production. In the following months, they slowly but steadily depleted their holdings, selling between 100% and 150% of production.

The critical takeaway is that at the most this year, the public miners sold 350% of their output, and it is implausible that they will sell more than that again.

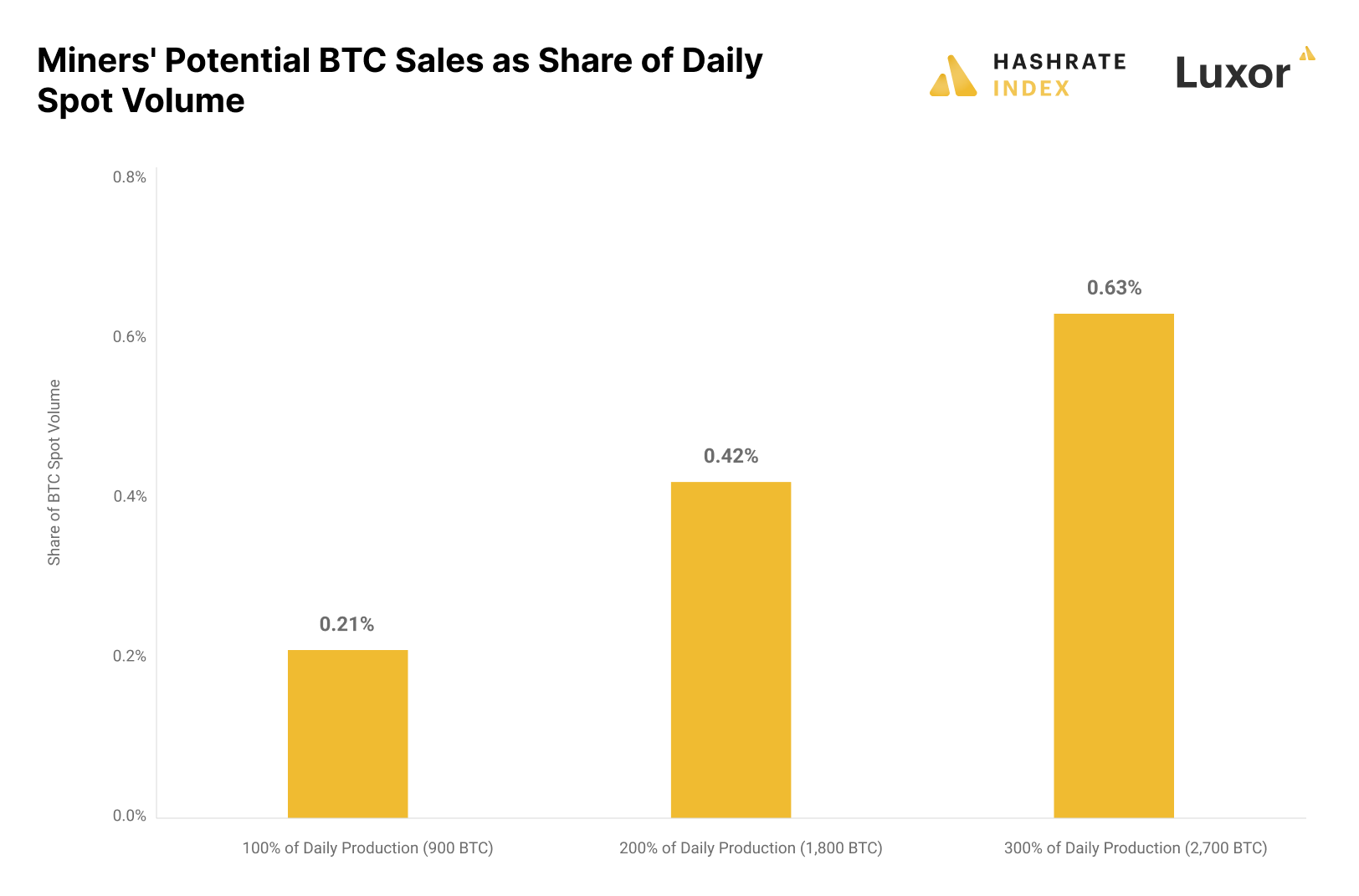

Let's calculate how big of an impact different shares of production sold could have on bitcoin's spot market. The average daily bitcoin spot volume on Binance, which has 80% of the spot volume, has since November 1st been 430,000 bitcoin.

A selling pressure of 100% of miners' production only makes up 0.2% of bitcoin's spot volume. If miners ramp up sales to 200% of production, it only makes up 0.4% of the spot volume. Even if miners dumped holdings at an extreme rate of 300% of production, the resulting selling pressure would only make up 0.6% of bitcoin's volume.

Due to the small share of bitcoin miners' hypothetical volume compared to bitcoin's total spot volume, we see that bitcoin should have more than enough liquidity in its spot market to accommodate the selling pressure from miners.

Only an implausible worst-case scenario of miners dumping their entire holdings at once could impact the spot market

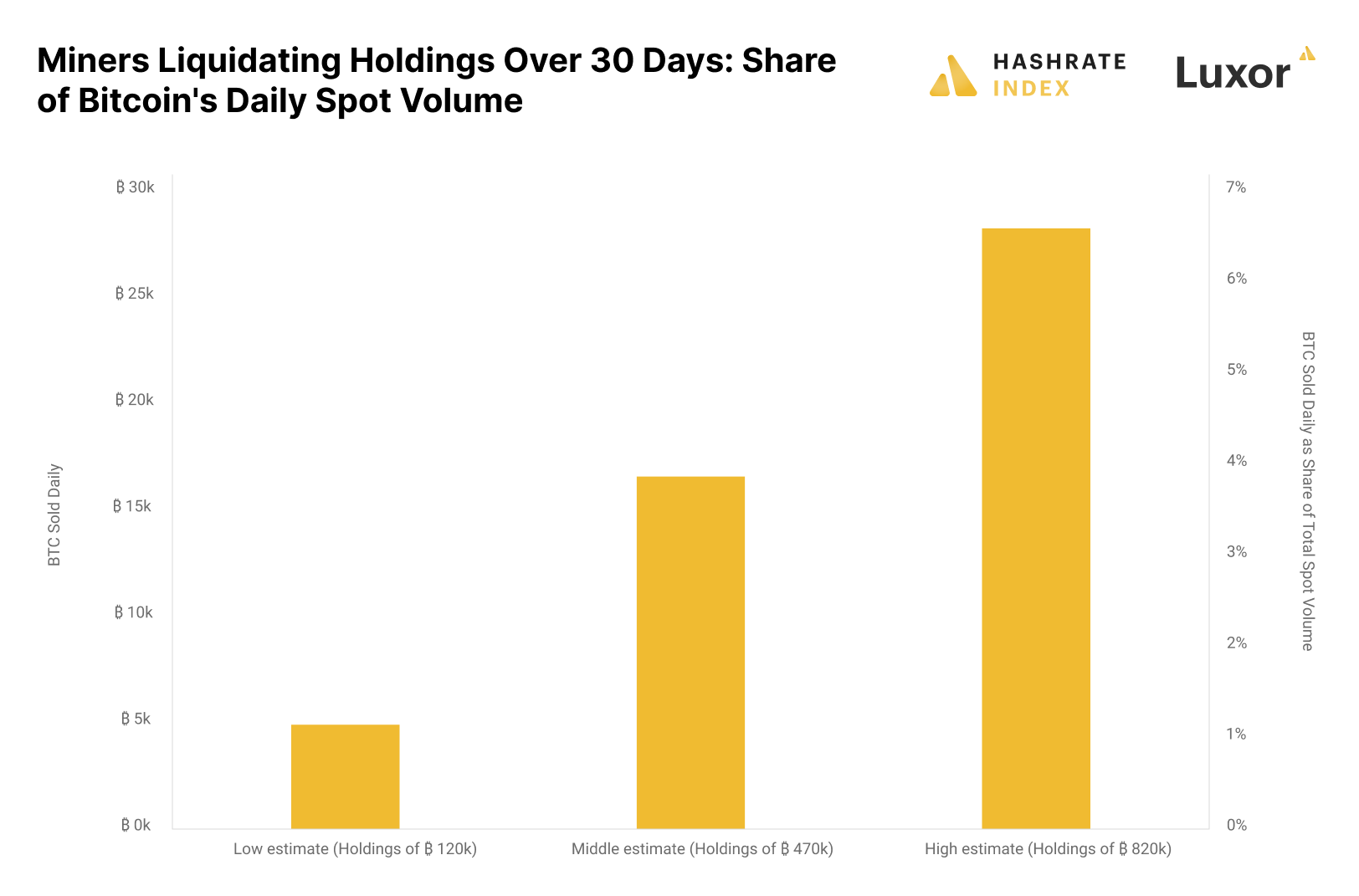

In the previous section, I showed how bitcoin's spot markets have more than sufficient volume to handle periods of abnormally large miner selling pressure. To take this analysis one step further, I want to show a more extreme, hypothetical scenario: How would spot markets react if miners completely drained their bitcoin holdings over 30 days?

In our low estimate, the miners hold 120,000 bitcoin. Dumping this amount over 30 days, plus the 900 produced daily, equals a daily selling pressure of 4,900 bitcoin. With an average of 430,000 bitcoin trading on Binance daily, this selling pressure would only make up 1% of the total spot volume, meaning it would not impact the price significantly.

Our middle estimate of 470,000 bitcoin starts to look more meaningful. Dumping such an amount over 30 days would equal 4% of bitcoin's spot volume, which definitely would move the price downwards. In our high estimate of 820,000 bitcoin, the daily liquidation over 30 days would be almost 7% of bitcoin's spot volume. The spot market would lack sufficient liquidity to accommodate such large sales, and the bitcoin price would likely plummet.

Still, it's implausible that miners would drain their entire holdings at such a rapid speed. This scenario was merely a worst-case showing the maximum potential effect miners could have on the market.

Conclusion

Miners are among the least understood participants in the bitcoin market. They used to have an outsized impact on the market during the first years of Bitcoin due to the initial size of the block reward. As the block reward has shrunk and miners' bitcoin holdings have become more distributed to other network participants, their impact on the market has weakened.

The total bitcoin holdings of miners are not as significant as most think, as they only hold between 1% and 4% of Bitcoin's circulating supply. Still, miners have tended to sell aggressively during bear markets, meaning their impact on the market should be slightly higher than their small share of supply ownership indicates.

Bitcoin's spot market has strong liquidity and should be able to accommodate the selling pressure from miners. This year, miners have sold a maximum of 350% of their daily production. This maximum selling pressure didn't make up more than 1% of bitcoin's total spot volume. Only if miners drained their entire holdings over a few weeks would it significantly impact the bitcoin price, but such a scenario is implausible.

The selling pressure from miners is overrated and will gradually weaken as the block reward gets smaller.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.