Examining Crypto Mining Stock Trends vs. Bitcoin Price in Different Market Environments

Over the long-term, crypto mining stocks underperform bitcoin, but shorter time frames tell a different story.

Bitcoin Mining, an industry which was once tucked away in the depths of Sichuan, Inner Mongolia, and Xinjiang, is now largely concentrated in North America. The Chinese government’s mining ban in May 2021 started the race for a rapid hashrate migration to the West, quickly transitioning the relatively closed-off industry to an era where large players (particularly public miners) are increasingly scrutinized under the eye of North American regulators.

We can clearly see the sector’s staggering growth in North America through public listings; in January 2021, Riot Blockchain (RIOT) and Marathon Digital Holdings (MARA) were the only publicly traded bitcoin miners on the NASDAQ. There are now 16 publicly traded bitcoin mining companies currently listed on the NASDAQ according to Galaxy Digital’s 2021 Year-End Report, a dramatic jump as institutional capital continues to flow into public mining companies.

With mining companies taking advantage of the Bitcoin bull market to go public, it’s prudent to zoom out as an investor to compare the performance of these publicly traded equities to the underlying commodity they are attempting to produce through proof of work.

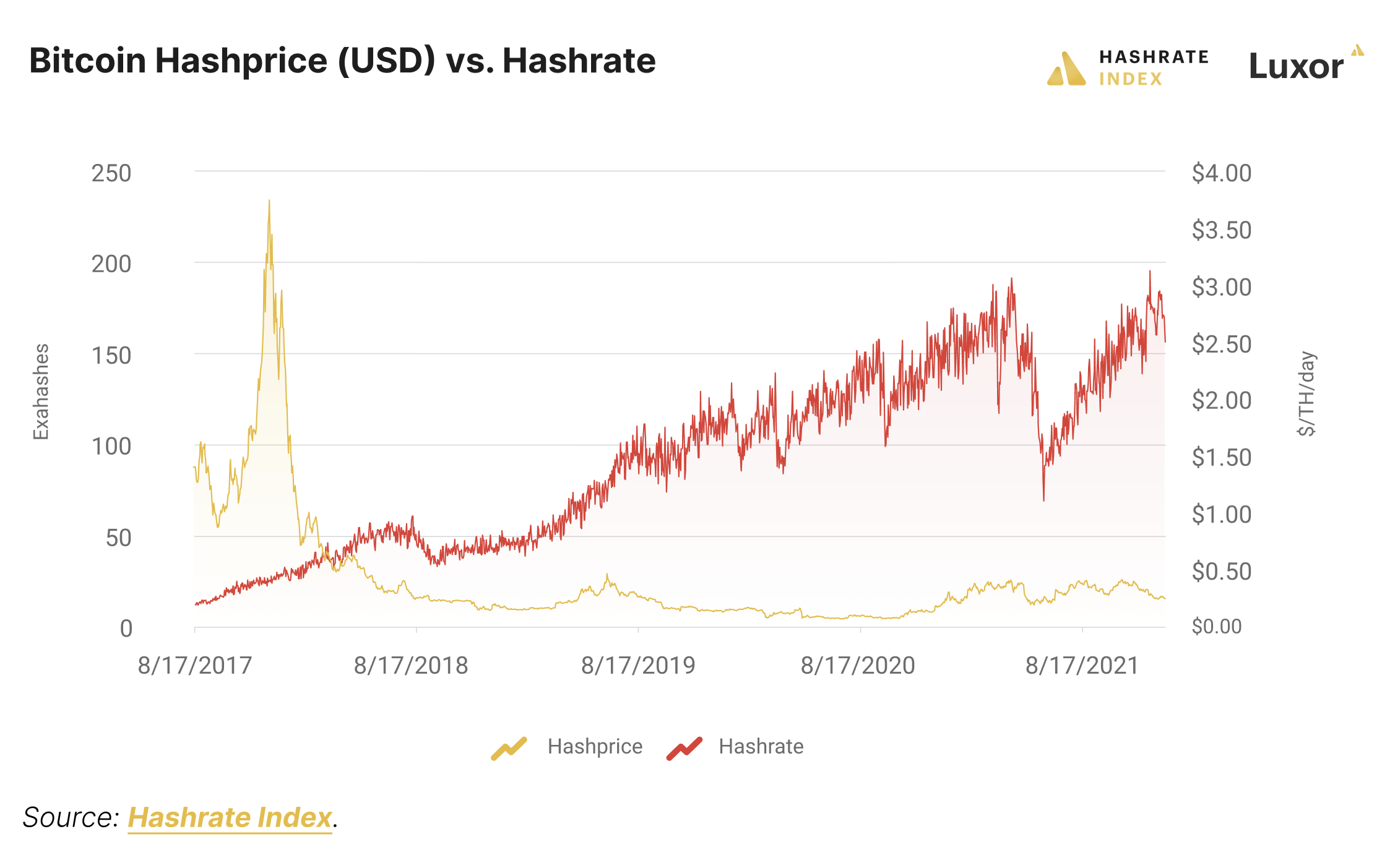

Once we zoom out, we can observe that there are certain short-term bullish periods where an increase in mining profitability (hashprice) lead to crypto mining stocks outperforming bitcoin. But over the long-term, it’s becoming increasingly difficult for crypto mining stocks to beat bitcoin’s returns.

What is Bitcoin Mining Hashprice?

As mining has entered into a new paradigm where publicly traded miners contribute an ever-increasing amount of hashrate, the volatility of both the bitcoin price and hashprice have influenced public miner equity valuations.

Hashprice, measured in dollars per terahash per second per day ($/TH/s/day), is the market value of a unit of hashing power on the bitcoin network. Changes to Bitcoin’s mining difficulty, block subsidy halvings, and Bitcoin’s price all affect hashprice.

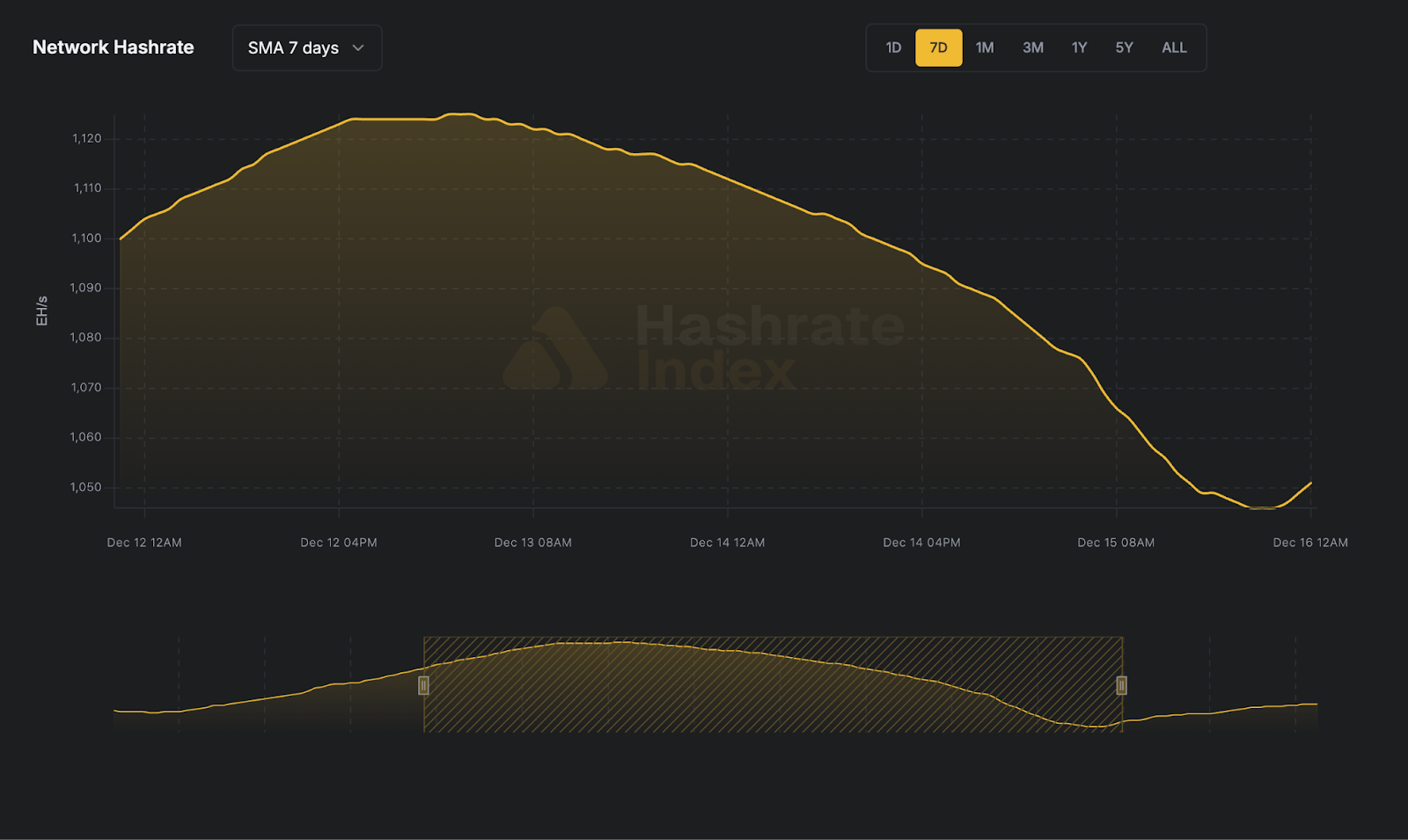

Going further, hashprice is negatively correlated to Bitcoin’s mining difficulty. Mining difficulty adjusts every 2016 blocks (~2 weeks) according to changes in network hashrate over the prior difficulty period (also called a difficulty epoch).

An increase in difficulty from growth in hashrate reduces hashprice whereas a decrease in difficulty increases hashprice because less hash power is required to mine the same reward. This correlation is always true for BTC-denominated hashprice, but the correlation is more complicated when we examine Bitcoin’s USD-denominated hashprice.

Indeed, USD hashprice is positively correlated to bitcoin’s fiat denominated market value. Fluctuations in USD hashprice are based on bitcoin’s fiat market value between difficulty adjustments. As bitcoin’s fiat price increases or decreases, hashprice follows.

Crypto Mining Stock Performance on Recent Hashprice Downturn

Prior to the May 2020 halving, hashprice increased to a local top of $0.467 on June

26th, 2019 before steadily falling 84.6% over the course of 15 months to a bottom of $0.072 on September 27th, 2020.

As seen in the graph below, public mining stocks suffered over this period as bitcoin’s price declined 16.56% and a surging hashrate pushed hashprice lower. The low hashprice levels put downward pressure on miner profitability over this period, partially contributing to a substantial drop in valuations. Bitfarms ($BITF), Hut 8 ($HUT), and Marathon Digital ($MARA) suffered significant losses declining 72.32%, 62.06%, and 32.38% respectively.

Crypto Mining Stock Performance Since Hashprice Bottom

Since hashprice bottomed in late September 2020, crypto mining stocks have greatly outperformed bitcoin.

The increase in bitcoin’s price preceded a ~60% drop in hashrate in the aftermath of China’s mining ban, a drop which elevated hashprice to above $0.40. As hashprice temporarily exploded to the upside, miners significantly outperformed BTC throughout this duration. This is a salient example of crypto mining stocks trading as a proxy to both BTC and hashprice.

Crypto Mining Stocks vs. BTC Since IPO Tell a Different Story

Though miners may outperform bitcoin in short-term windows during hashprice bull markets, over the long term, miners typically underperform bitcoin.

It is important to keep in mind that, over time, BTC-denominated hashprice will programmatically trend towards zero as Bitcoin’s block subsidy continues its halving schedule down to 0 while hashrate increases. Paired with this, almost all current valuations in the current near-zero interest rate environment have inflated P/E ratios.

New metrics will continue to evolve for miner analysts on the sell-side such as the price-to-hodl ratio, which examines the ratio between miner’s market cap and bitcoin held on balance sheets, and price-to-mined-revenue ratio, which examines bitcoin’s marketcap vs. miner revenue. Over time (assuming an exponentially increasing BTC price), it will become increasingly difficult for public miners to continue to outperform bitcoin as hash rate and difficulty continue to significantly increase as bitcoin continues its monetization phase.Photo by Gilly on Unsplash

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.