Bitcoin Mining Stocks: February 2023 Production Updates

The public miners used an operationally slow February to restructure their finances.

Marathon and Terawulf added the most hashrate in February

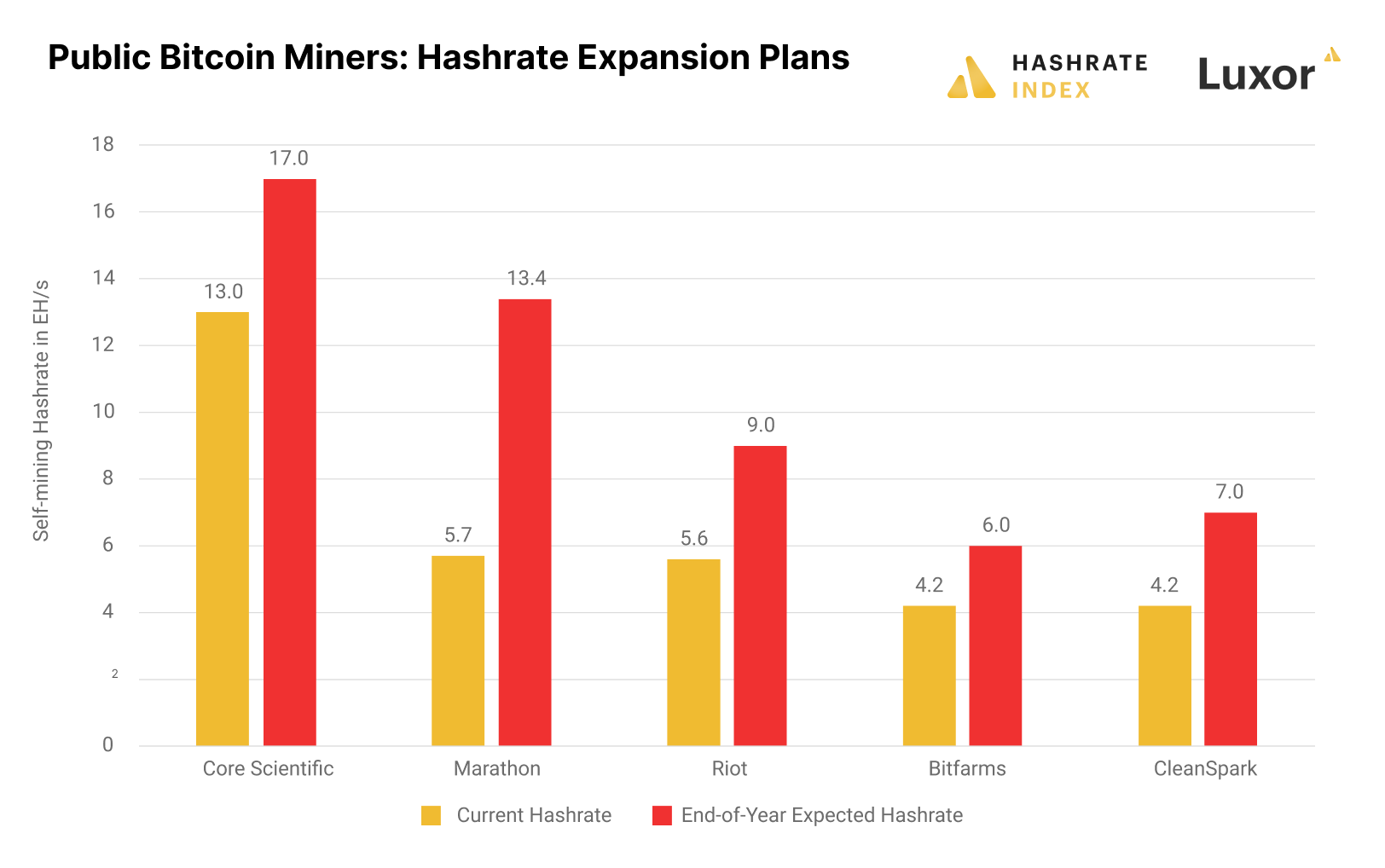

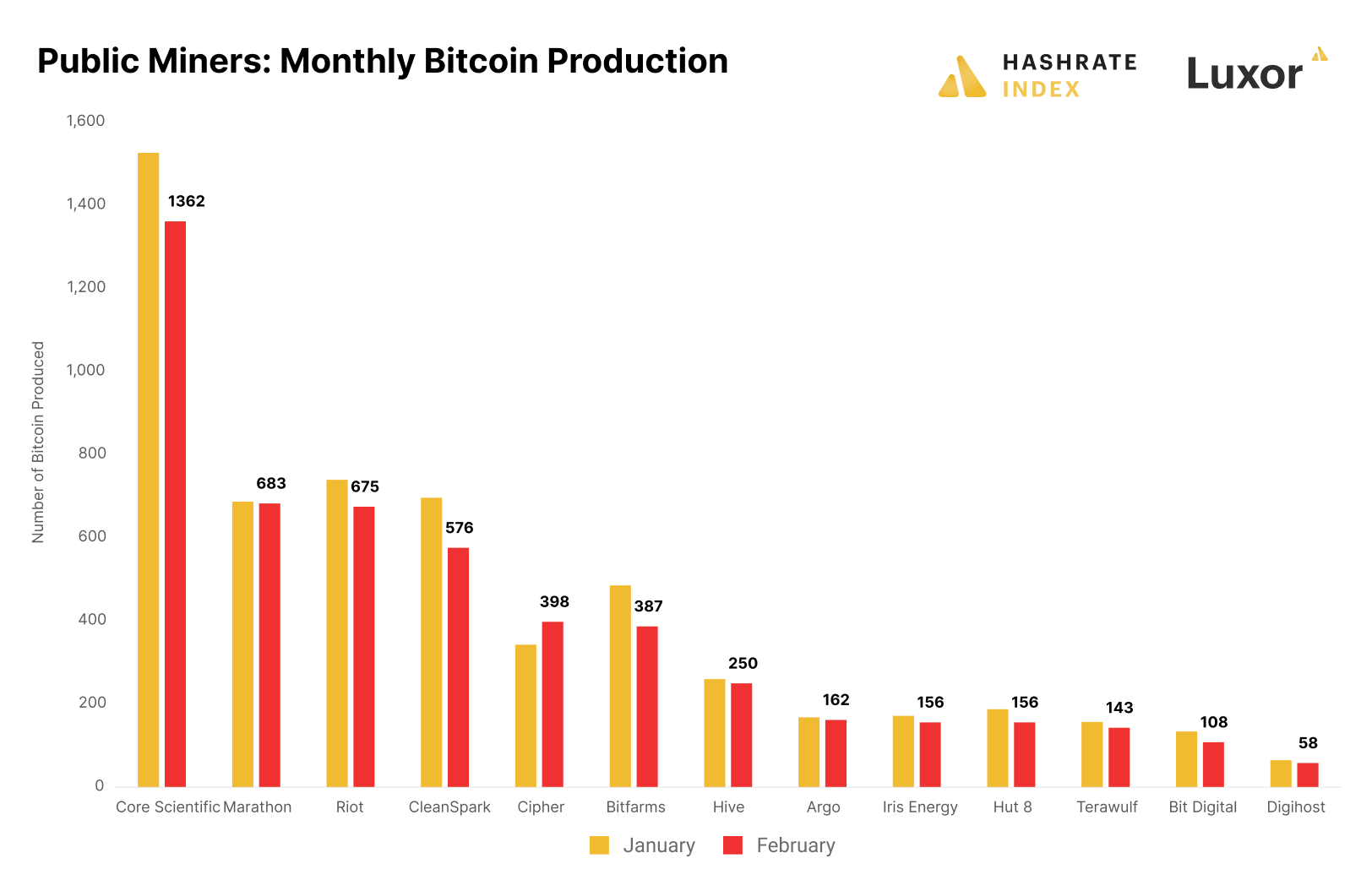

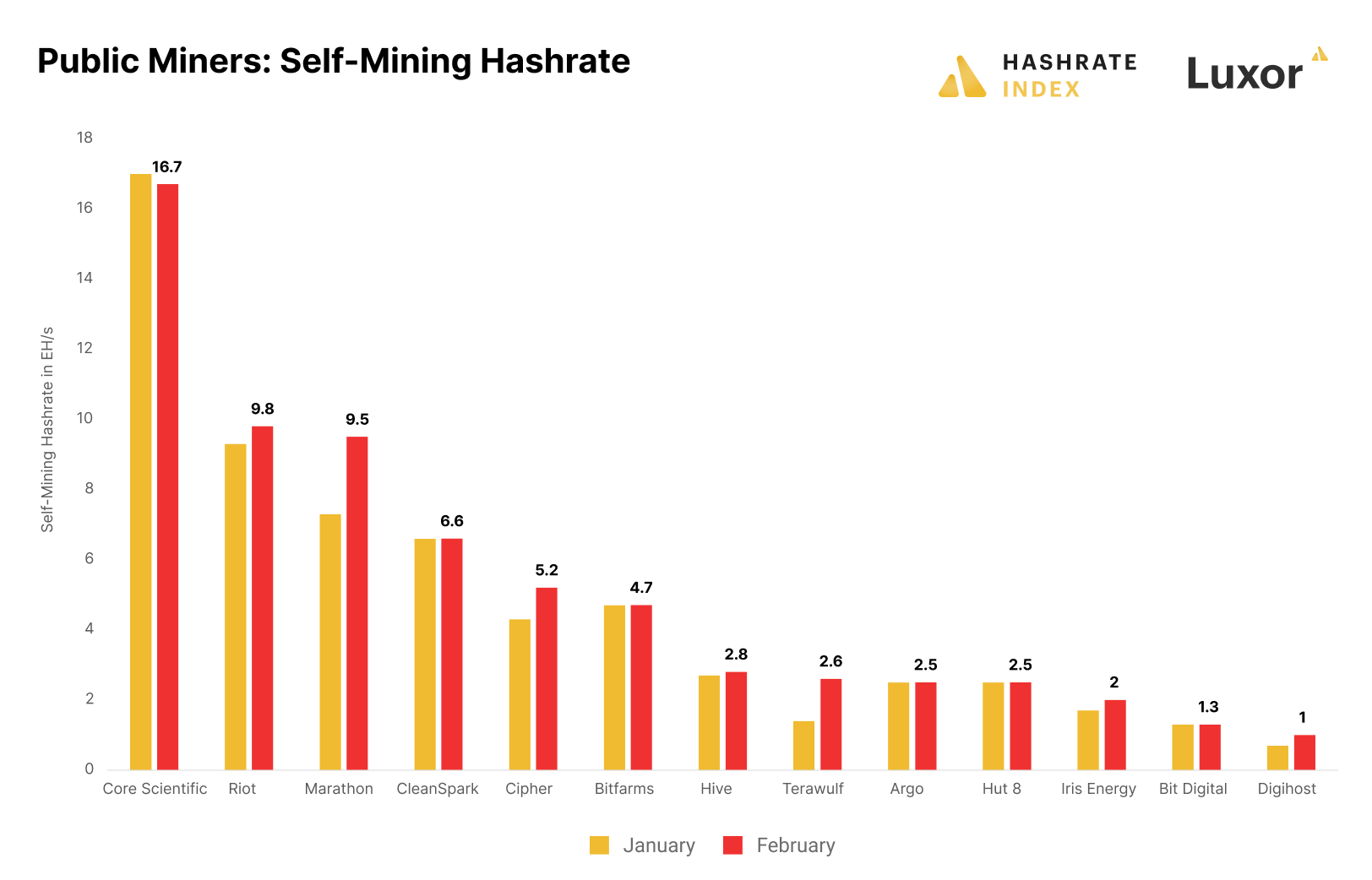

Bitcoin’s hashrate keeps surging, as the bitcoin price’s 30% increase has pushed many marginal miners into positive cash flow territory. For the public miners, February was a relatively slow month for expansion, with most of these companies ending the month with similar hashrate capacities as they started with. Virtually all the public miners' hashrate growth in February came from only three companies: Marathon, Terawulf, and Cipher.

Marathon grew its hashrate the most in February, one of its fastest expansion months ever. With 9.5 EH/s plugged in, Marathon is closing in on Riot and will likely soon take its place as the second-largest public miner by hashrate. The company’s goal is to have 23.3 EH/s energized by the middle of 2023, and it has to keep growing at this pace if it is to reach this lofty goal.

Terawulf grew its self-mining hashrate by a whopping 85% in February and now has 2.6 EH/s plugged in. It energized its machines at the Nautilus Cryptomine, the first behind-the-meter nuclear-powered bitcoin mining facility in the US. The facility will provide Terawulf with an industry-leading PPA at a fixed $0.02 per kWh over five years. The once cute little pup is turning into a big bad nuclear-powered wolf.

Cipher also grew considerably in February, increasing its hashrate by 20% to 5.2 EH/s. The Texas mega-miner continues its consistent, rapid growth and is now fortifying its position as the fifth-largest public miner by hashrate. Cipher has now beaten its hashrate target of 4.8 EH/s by February, which it announced in October. Refreshing to see one public miner beating expectations for once.

Riot only marginally grew its hashrate in February. One of the company’s buildings containing 1.9 EH/s is still offline after being knocked out by a winter storm in December. Riot appears to be struggling with repairing this building, as the company doesn’t expect it to return online before the second half of 2023. Due to this setback, Riot has, in a typical public miner fashion, pushed its 12.5 EH/s hashrate goal to the second half of 2023.

Core Scientific saw negative hashrate growth month-over-month for the first time in the company’s history. The bankrupt bitcoin mining giant reduced its self-mining inventory by 5,000 machines in February, likely selling them as part of its restructuring process. At the same time, it ramped up its hosting capacity by 30% and now hosts 52,000 machines for its clients.

Bitfarms didn’t grow its hashrate in February. The pan-American miner has not managed to meaningfully grow its hashrate during the past few months, as its Argentine plans have ground to a halt. Most of the company’s hashrate growth was supposed to come from a new facility in Argentina, but it struggles to obtain the necessary licenses to import machines into the country.

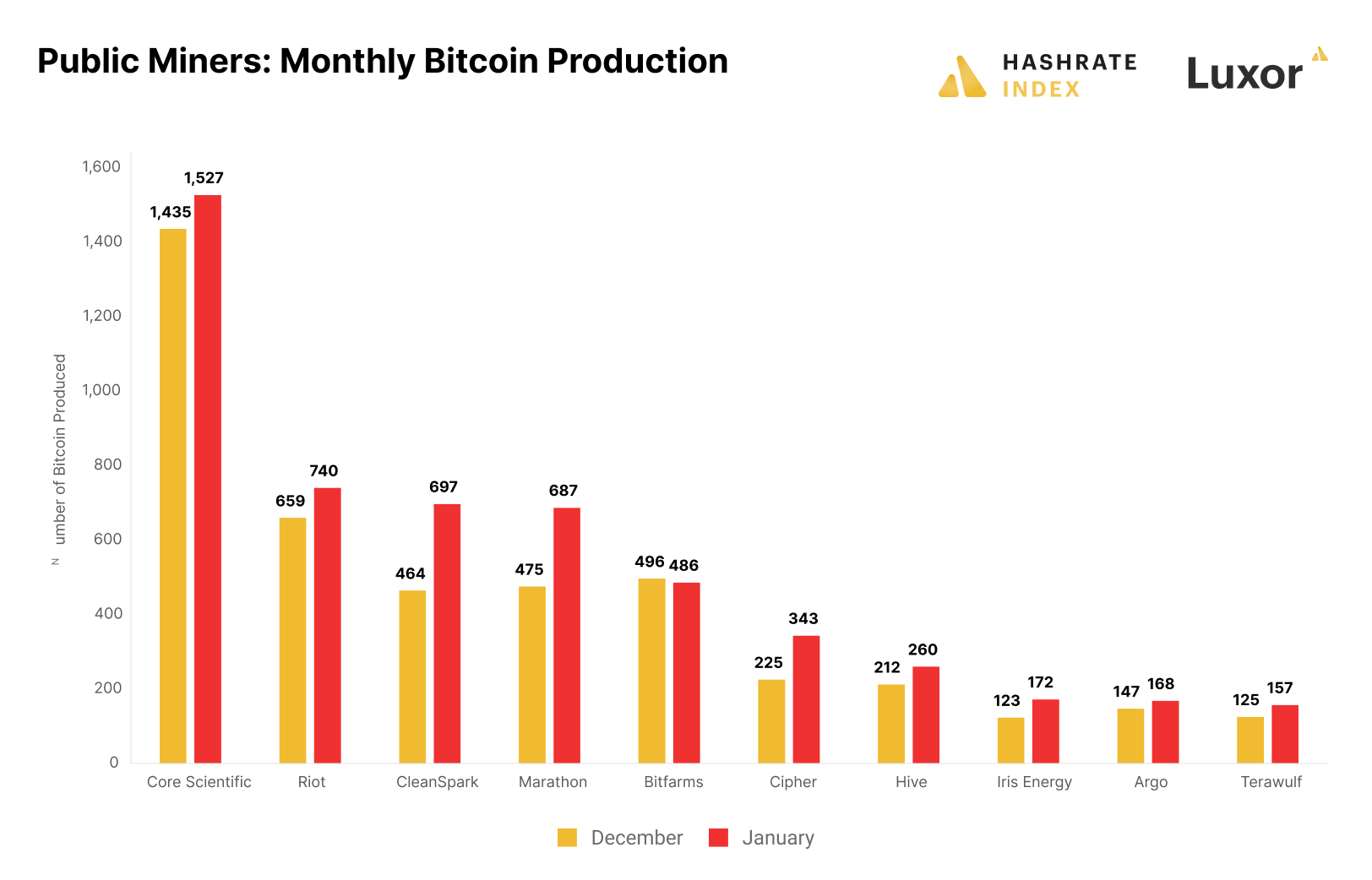

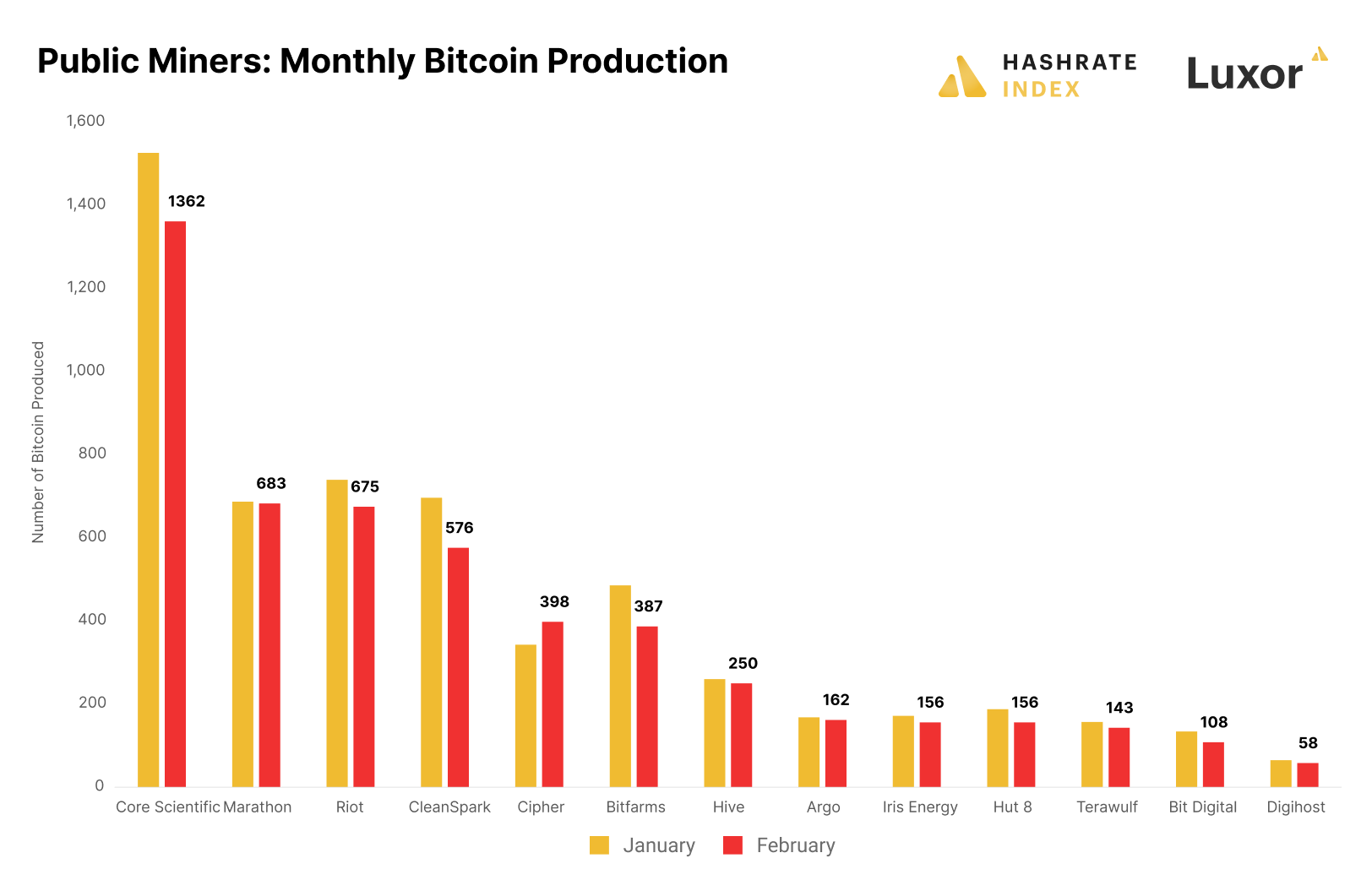

Only Cipher grew its bitcoin production in February

February contains 10% fewer days than January and is the shortest month of the year. In addition, the average difficulty during the month was 10% higher than in January. Therefore, it is no surprise that most public miners saw declines in bitcoin production from January to February.

Cipher was the only public miner increasing its bitcoin production in February, producing 16% more than during the previous month. This production growth is a substantial feat given the shortness of the month and the soaring difficulty of bitcoin mining.

Marathon produced nearly the same number of bitcoin in February as in January. The company grew its hashrate substantially in February, giving it the possibility to keep up with Bitcoin’s ever-increasing difficulty.

Interestingly, Terawulf’s bitcoin production slightly declined in February compared to January. This decrease is unexpected given the company’s 85% hashrate growth over the month. The most likely explanation is that most of the hashrate growth came late in the month.

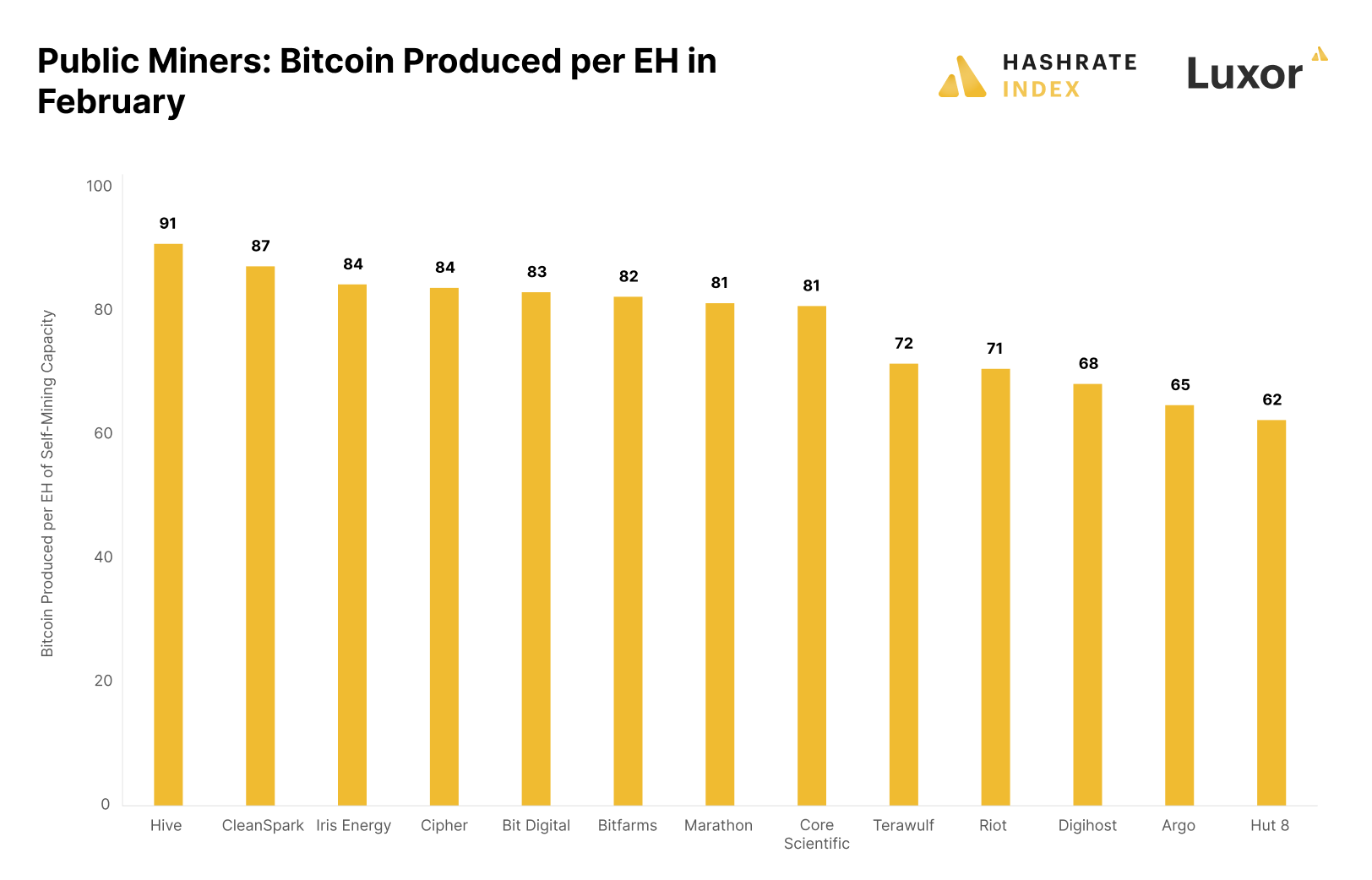

Hive achieved the highest hashrate utilization in February

In the excel spreadsheets, bitcoin mining looks much simpler than it is in reality. Most analysts assume bitcoin miners operate with 100% up-time and will produce exactly the amount of expected bitcoin given their machines’ nameplate hashrate. The harsh truth is that achieving even 95% up-time is a substantial feat, as machines periodically go offline or underperform due to energy curtailment, periodic repairs, heat, or simply mismanagement.

Due to these factors, we see substantial differences in the historic hashrate utilization among different public miners, with some generating vastly more bitcoin per unit of nameplate hashrate than others.

We can measure hashrate utilization with the bitcoin produced per EH, which is an important metric for several reasons. Firstly, by comparing the public miners’ actual bitcoin production to their stated hashrate, you will quickly expose who is overstating their hashrate. Secondly, the metric indicates who utilizes their hashrate the most efficiently and achieves a high up-time.

By revealing inefficiencies and poor investor information, this metric gives the public miners nowhere to hide. It is, therefore, my favorite bitcoin mining metric.

Generating 91 bitcoin per exahash, Hive achieved the highest hashrate utilization rate in February. The company has fortified its position as one of the most efficient miners, usually among the top three. Hive operates in energy markets with stranded hydropower. The price of this energy source tends to be more stable than fuel-based sources like natural gas, meaning Hive is less often forced to curtail operations compared to for example Texas-based miners like Riot. Hive also operates in cold environments, which could allow them to overclock machines more efficiently.

CleanSpark was among the most efficient operators in February, producing 87 bitcoin per exahash. Like Hive, this company is usually close to the top of this list.

Hut 8 only produced 62 bitcoin per EH in February, making it the least efficient operator. It spent the month investigating electrical issues at its Drumheller site which have reduced production levels. In addition, the company removed machines and electrical equipment from the facility in North Bay, Ontario, where it has an ongoing dispute over a PPA with Validus.

Financial updates

The public miners increased their bitcoin sales in February, using the mini bull run as an opportunity to convert bitcoin to some desperately needed fiat. Even miners that previously seemed firmly determined never to sell bitcoin have started offloading, most notably Hut 8, which sold its entire January production of 188 bitcoin in February. Other big hodlers, like Marathon and Riot, sold 650 and 600 bitcoin in February.

In February, we also saw a continuation of the trend of miners restructuring their debts. Heavily indebted Stronghold amended its credit agreement with Whitehawk Finance, allowing the waste-coal miner to delay principal amortization payments of $29 million until June 2024. This is the latest in a series of efforts by Stronghold’s management to strengthen the company’s balance sheet, and the company looks much more likely to survive the bear market now than just a few months ago. Stronghold also signed a long-term hosting agreement with Foundry in February.

Cathedra also restructured debt by settling it into shares. Dilution has proven to be a constant threat to investors in public mining companies, but we can all agree that it is a lesser evil than bankruptcy. The bitcoin mining featherweight will now have C$2.5 million less debt to worry about.

Marathon has a massive liquidity balance of $220 million of unrestricted cash and 8,260 unrestricted bitcoin. In February, it spent $50 million of its precious fiat to pay down its Silvergate debt. Silvergate, one of the leading crypto lenders, recently announced its plans to liquidate its operation and Marathon seems to desire to cut ties with the bank.

Bitfarms might have seen slow hashrate growth over the past few months, but at least it has reduced its debt by 86% since June 2022, from $165 million to $23 million. In February, the company negotiated a restructuring of one of its loans, allowing it to pay down the loan with significantly less capital than initially required. Bitfarms have quickly gone from a bankruptcy candidate to a relatively solid player.

Iris Energy utilized $67 million of remaining Bitmain prepayments to acquire 4.4 EH/s of new S19j Pro miners without any additional cash outlay. By giving up machines as collateral and now buying machines back at depressed prices, Iris has considerably reduced its debt.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.