ASIC Liquidity Premium

A primer on ASIC price correlation with bitcoin price and hashrate token liquidity premiums.

Market Overview

ASIC Market

So far 2021 has seen a huge demand for ASICs faced with a short supply. According to the two largest ASIC manufacturers — Bitmain and MicroBT, the current demand has already backed up their orders till this August (6 months away).

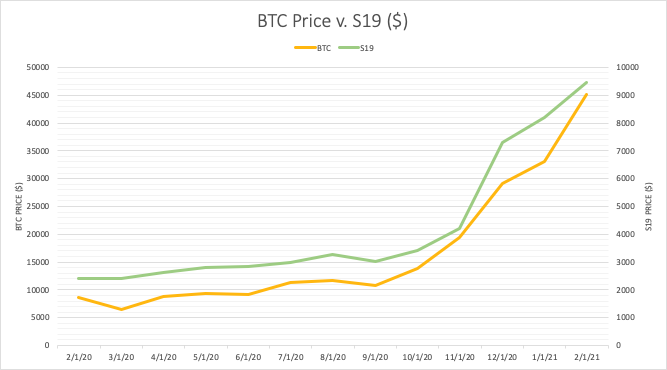

The demand-supply imbalance is leading to a significant increase in ASIC prices in the secondary market. By comparing the price changes in Bitcoin with Bitmain's Antminer S19 and S9's prices in the past year, we can infer that the rise of both newer and older ASICs' prices has a strong correlation with bitcoin's skyrocketing price, particularly the newer machine, the S19.

Correlation coefficient = 0.99 (the closer to 1, the stronger the correlation)

Correlation coefficient = 0.97 (the closer to 1, the stronger the correlation)

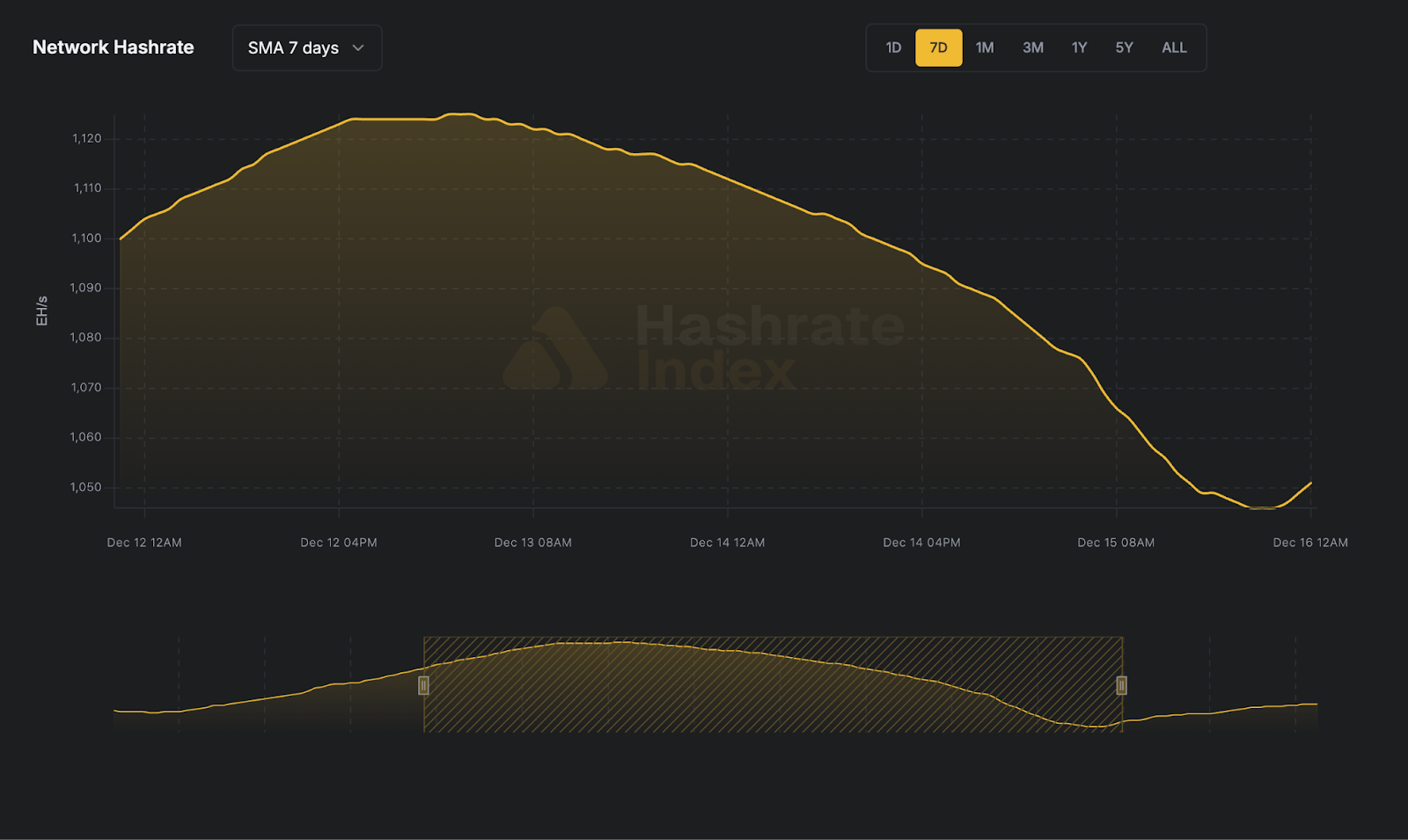

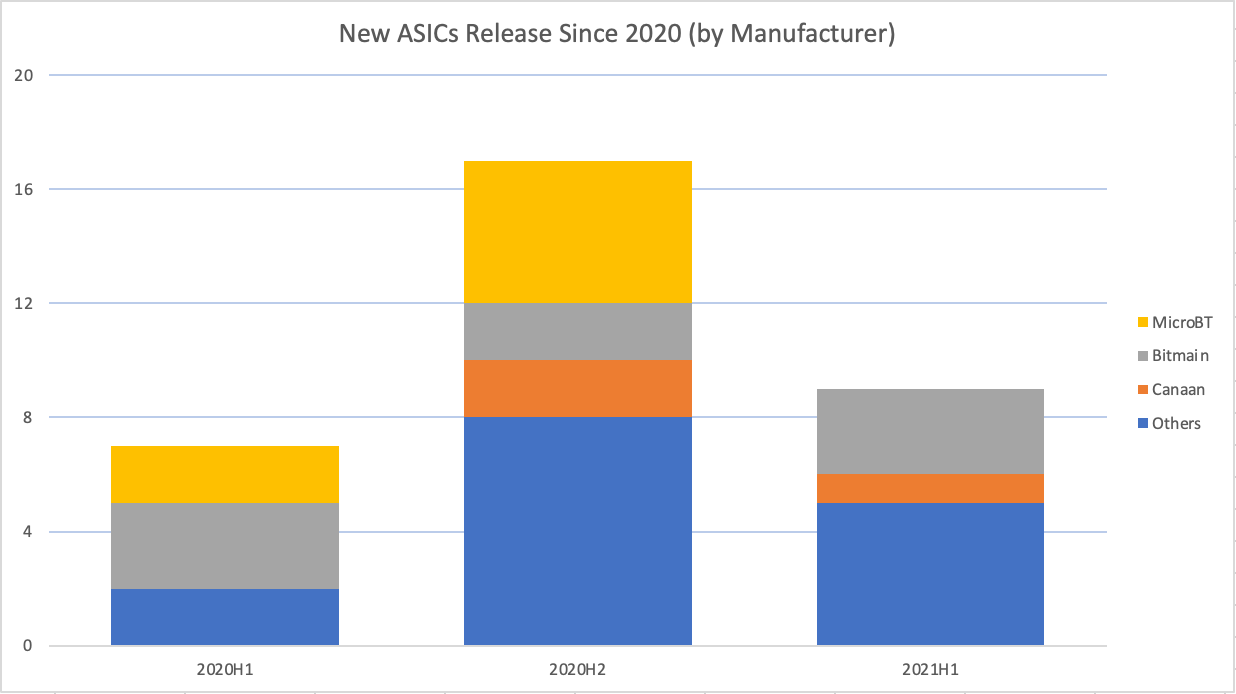

According to Hashrate Index, there are 206 ASIC products on the market and 46.12% of them support SHA-256. After 2018, the number of new machines released has been gradually decreasing. From 2018 to 2020, the percentage of new ASIC releases to the total amount of ASIC types decreased from 47.57% to 12.14%. However, the average hash rate of an ASIC has greatly increased with similar advancements in technology. The highest hash rate an ASIC can generate is now 110 Th/s (by Antminer S19 Pro).

The ASIC market has been steadily dominated by Bitmain and MicroBT, Bitmain has the biggest market share of around 45%, while MicroBT is catching up with a market share of ~35%. In the recent mid-high hashrate (≥ 60Th/s) ASIC market, Bitmain's S19 series and MicroBT's M30 series have accounted for 27% of the total hashrate. In the lower hashrate (< 60Th/s) bucket, Bitmain's S9 series has generated approximately 20% of the total network's hashrate. If bitcoin's price continues to rise, this percentage is expected to increase as well.

Cloud Mining

Cloud mining allows people to mine cryptocurrency without being directly involved with purchasing, installing, and maintaining mining rigs. Via a cloud mining platform, people can open an account, rent cloud computing power in part or in entirety, and start mining remotely with lower costs, which makes crypto mining more accessible to a wider miner base across the globe.

There are more than 50 cloud mining platforms worldwide, but less than 10 major platforms (such as Genesis Mining, BitDeer, RHY, etc.) have taken 80% of the market share. In February, BitFuFu announced a strategic partnership with the largest crypto mining company, which gives BitFuFu a great advantage in obtaining the latest Bitmain ASICs and uniting resources to offer high-quality mining services.

Hashrate Tokens

In early 2021, Binance and Poolin launched their hashrate tokens BTCST and pBTC35A. Each BTCST represents 0.1 Th/s of Bitcoin mining power whereas each pBTC35A is collateralized by 1 Th/s of hashpower. By purchasing and staking hashrate tokens, the holders receives daily Bitcoin rewards that correspond to the number of staked tokens. The emergence of hashrate tokens have offered a standardized hashrate product to the market which provided a higher degree of liquidity and lowered barriers of entry for the token holders.

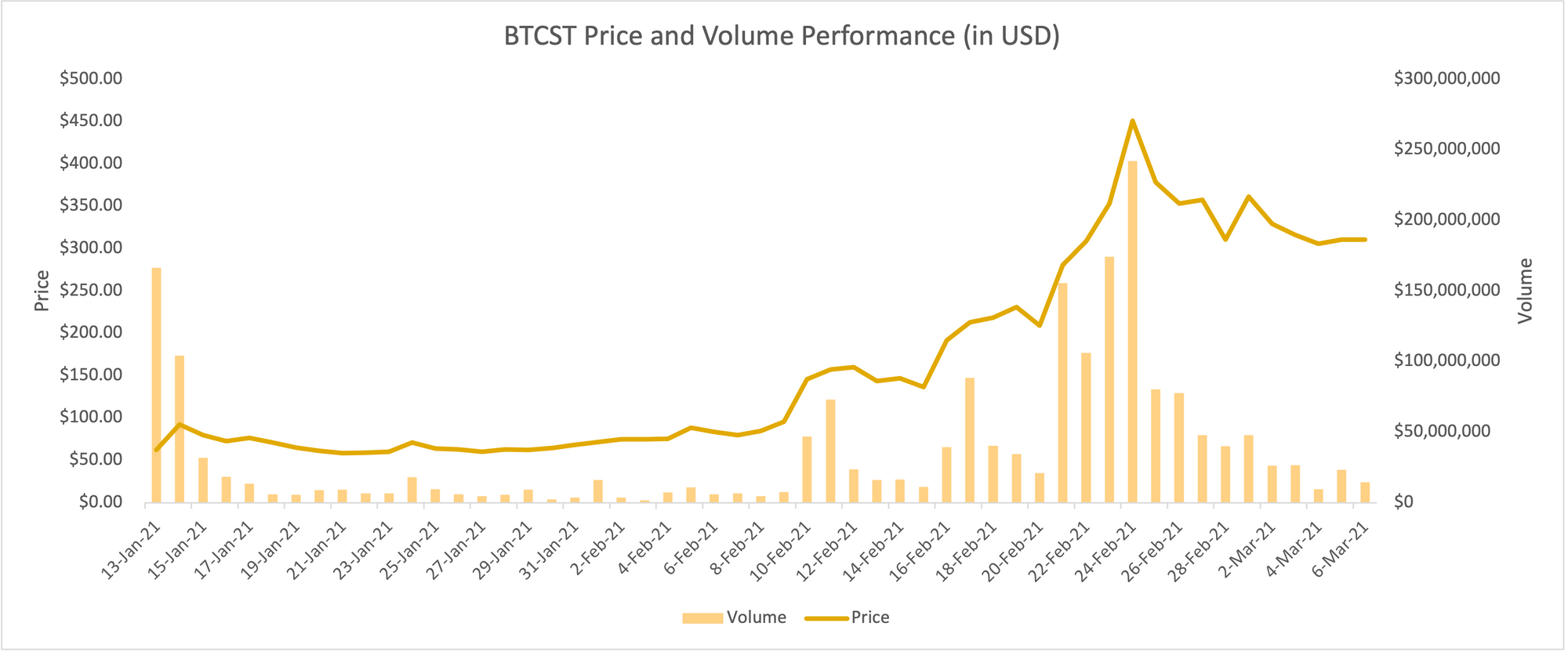

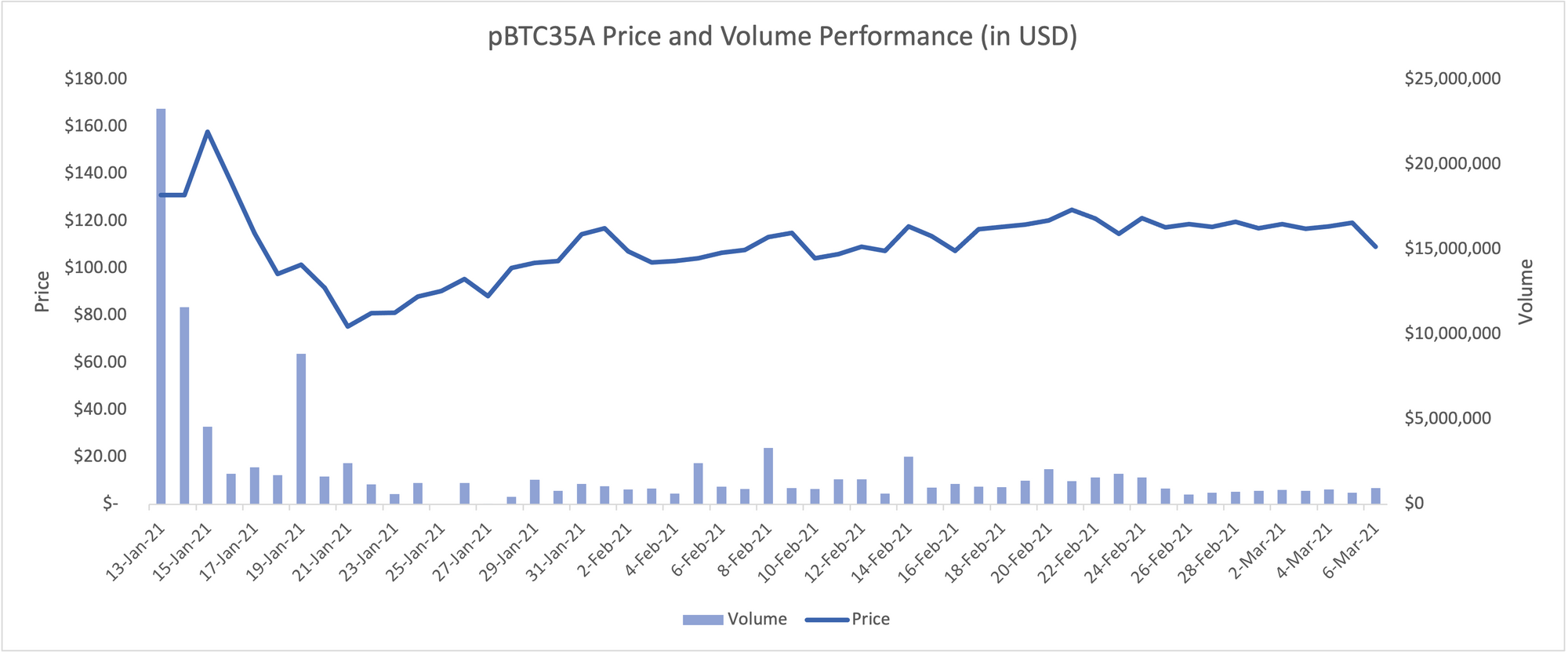

In the past month, BTCST has seen a notable increase in both token price and volume, whereas pBTC35A's performance is relatively flat due to a much smaller investor community. Currently, BTCST now has a 39.7% circulation rate and a 5.4% turnover rate, while pBTC35A has a 34.9% circulation rate, which means these two tokens have a fairly good adoption rate but still have potential avenues for growth and adoption.

Comparisons

Differences in Liquidity

ASICs

Among the three markets mentioned above, ASICs have the lowest liquidity. Both purchasing and reselling ASICs require a lot of resources and time investment.

Time spent selecting the machine and model, engaging with brokers or with another miner, de-racking miners, packing miners for shipping, shipping delays, import considerations, cleaning and checking new miners, and re-racking are just some of the tedious steps in the process that make it incredibly time-consuming. From a cost perspective, you will need to pay various fees before getting/selling the machines, for example, shipping costs and a ~5% fee (if purchased from brokers). At the same time, there are many risks associated with this stage, such as the inherent risks in breaches of contract, lack of transparency in prices and machine conditions, and illiquidity caused by high percentage advance payments. Both buyers and sellers take on high risks resulting from information asymmetry and need to conduct additional due diligence efforts which make ASICs the least liquid.

Cloud Mining

Cloud mining provides a more flexible solution for both institutional and individual miners (buyers) in terms of buy-side liquidity. It bypasses the miner's difficulty purchasing rigs, and selecting hosting services. Cloud mining allows miners to have a lower barrier of entry. Although cloud mining offers better liquidity than self-mined ASICs, it often comes at the expense of higher operational costs and counter-party risks.

Cloud mining still has a lower level of liquidity compared to Hashrate tokens since the cloud mining platforms don't have a built-in mechanism for miners to sell their contract once they buy in. The first mover in this area, ViaBTC, has launched "Contract Trading" for Bitcoin and Ethereum allowing miners to trade their mining contracts, which brings more liquidity to its cloud mining platform.

Hashrate Tokens

Hashrate tokens have the highest liquidity compared to both ASICs and cloud mining. They provide miners exchange-level liquidity to mining power. Since hash power is standardized and listed for exchange trading, miners can enter and exit the market without too much slippage or cost.

However, hashrate tokens also have their own risks. For instance, there is cancellation risk if the economics become unprofitable at one point. If the mining rigs suffer from power outage, damages, or losses, it will lead to the loss or inaccessibility of mining rewards. There is also counter-party risk.

Currently, the top exchanges for trading in BTCST are currently Binance, VCC Exchange, WBF Exchange, and PancakeSwap. For pBTC35A, the top exchanges for trading are currently Uniswap (V2), Gate.io, MXC.COM, Bilaxy, and Poloniex.

Liquidity premium: ASIC v. Hashrate Token

Comparing on Efficiency (USD per Th)

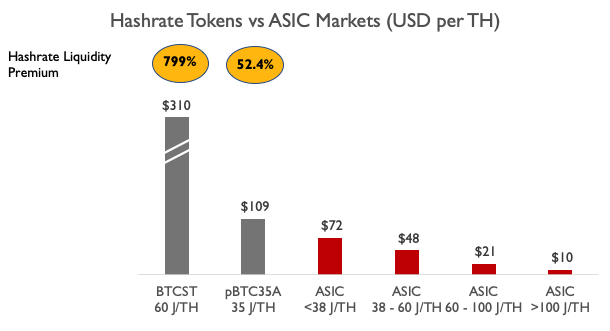

BTCST is equivalent to an efficiency of 60J/Th, and pBTC35A is equivalent to an efficiency of 35J/Th. When comparing ASICs with different efficiencies to the two hashrate tokens' current prices, BTCST has an almost 800% liquidity premium to the average of the 38 - 60 J/Th and 60 - 100 J/Th efficiency bucket, whereas pBTC35A has a 52.4% liquidity premium to the closest <38 J/Th bucket.

Comparing with Antminer S19

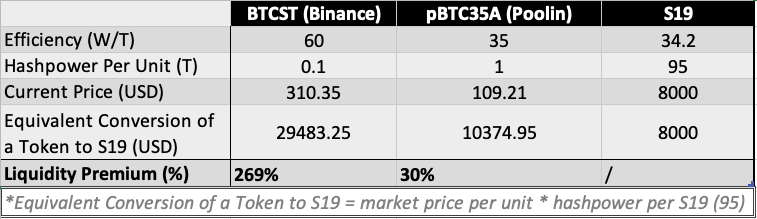

If we compare hashrate tokens to Antminer S19 using their current market prices:

The equivalent conversion of BTCST to S19: $310.35 x 0.1T x 10 x 95T = $29,483.25, which means the current BTCST has a 269% premium to S19.

The equivalent conversion of pBTC35A to S19: $109.21 x 1T x 95T = $10,374.95, which means the current pBTC35A has a 30% premium to S19.

Conclusion

Compared to cloud mining and hashrate tokens, ASICs currently have the lowest level of liquidity due to their intrinsic physical nature. Between the two hashrate tokens mentioned above, BTCST has a greater liquidity premium to ASICs with similar efficiency given its liquidity and exposure at-scale.

We can expect more online ASIC online markets to emerge in order to enhance the ASIC market's transparency and liquidity by utilizing industry expertise as well as standardized processes in the future.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.