The Past, Present, and Future of Bitcoin Mining Competitive Structures

What will the future of Bitcoin mining look like?

Bitcoin mining is one of the most fragmented industries in the world, consisting of thousands of players worldwide ruthlessly competing for scarce block rewards. Still, a recent consolidation trend has led some to wonder whether bitcoin mining will remain decentralized or follow the destiny of many other industries consolidating into oligopolies or monopolies.

This article analyzes the competitive structure of bitcoin mining and tries to foresee how it could develop as the industry matures. Will the industry become so competitive that it becomes nearly impossible for miners to profit? Or will mining become so consolidated that Bitcoin risks being exposed to 51% attacks? Let’s find out.

Some industries are more competitive than others

The level of competition varies between different industries. While established players in specific sectors thrive in a relaxed environment of little competition, companies in the most competitive industries must fight tooth and nail just to survive.

An industry’s level of competition primarily has two implications. Firstly, the higher the competition in an industry, the lower the average profitability, as competition forces companies to lower prices or provide higher-quality products that are more costly to produce.

Secondly, industries characterized by high competition tend to be fragmented. This implication is particularly important for mining, as the decentralization of Bitcoin depends on the mining layer staying sufficiently fragmented.

A simple way to estimate the level of competition within an industry is to calculate the four-firm concentration ratio, which shows the aggregated market share of the four largest players. We usually consider industries with a four-firm concentration ratio lower than 40% competitive. Competitive market forms include monopsony, perfect competition, and monopolistic competition.

When the four largest firms in an industry control more than 40% of the market, the market starts to resemble an oligopoly. Due to their high market shares, oligopolists possess much market power and could, in some instances, collectively capture the market by joining forces in a cartel.

The most well-known cartel is OPEC, an organization of 13 of the biggest petroleum-producing nations, controlling 82% of the world’s proven oil reserves. By cooperating in a cartel, these nations can influence oil production and thereby manipulate prices in their favor.

Some are worried that the bitcoin mining industry could consolidate into an oligopoly as the sector matures, allowing the biggest players to collaborate in a cartel and perform a 51% attack. Later in the article, I will explain why that is highly unlikely.

Bitcoin mining is one of the most fragmented industries in the world

The high fragmentation of the bitcoin mining industry becomes evident when comparing its four-firm concentration ratio with other sectors. As you can see on the chart below, many well-known industries are consolidated to such an extent that we consider them oligopolies.

For example, the four biggest players in the ASIC manufacturing industry control approximately 95% of the market. Other oligopolies or monopolies include the cigarette, search engine, breweries, and ammunition industries.

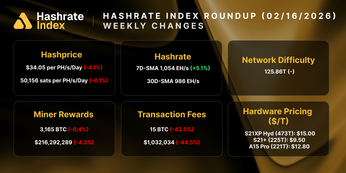

On the other hand, the bitcoin mining industry is unusually fragmented, with the four largest public miners only generating 13% of Bitcoin’s hashrate. The gold mining and electricity generation industries are similarly fragmented, with four-firm concentration ratios of 15% and 16%.

Core Scientific is the biggest public miner by hashrate, generating approximately 5.6% of Bitcoin’s hashrate. Riot follows behind with 3.1%. These are extremely low market shares for being the biggest companies in an industry. So far, no players have successfully consolidated a significant percentage of Bitcoin’s hashrate, and mining remains as decentralized as ever.

Analyzing the competition of bitcoin mining with Porter’s Five Forces

We established that bitcoin mining is one of the world's most competitive and fragmented industries. But mining is far from mature, and we have seen many previously fragmented industries consolidate into oligopolies or even monopolies over time. Let’s analyze some features of the mining industry to predict how the industry structure could develop over the coming years.

Porter's Five Forces is a helpful framework for analyzing the competitive nature of industries. According to Porter, five forces determine an industry's ultimate level of competition and fragmentation: the threat of new entrants, the bargaining power of suppliers, the bargaining power of buyers, the threat of substitution, and competitive rivalry. I will now analyze bitcoin mining based on this framework.

Threat of new entrants

The threat of new entrants describes how easily new players can enter an industry. In industries with low barriers to entry, incumbents always face the threat of growing competition from new competitors entering the game. Industries with low barriers to entry are generally fragmented and competitive.

Taxi drivers worldwide complain about low earnings, but what do they expect when all you need to get started is a car and a driving license? I have experienced this myself. I was the first in my high school to get a driver’s license, so I decided to run an unlicenced taxi operation on the weekends, driving drunk students home from parties. The super profits only lasted a few months, as competition gradually pushed down rates when more of my fellow students got their driving licenses.

Similar to the unlicensed taxi industry, barriers to entry are exceptionally low in bitcoin mining. The two most important input factors are ASICs and cheap electricity. You can easily procure ASICs almost in any country, and affordable electricity is available in many locations. And most importantly, there are no gatekeepers in bitcoin mining - the Bitcoin network doesn’t require you to apply for a license to get started.

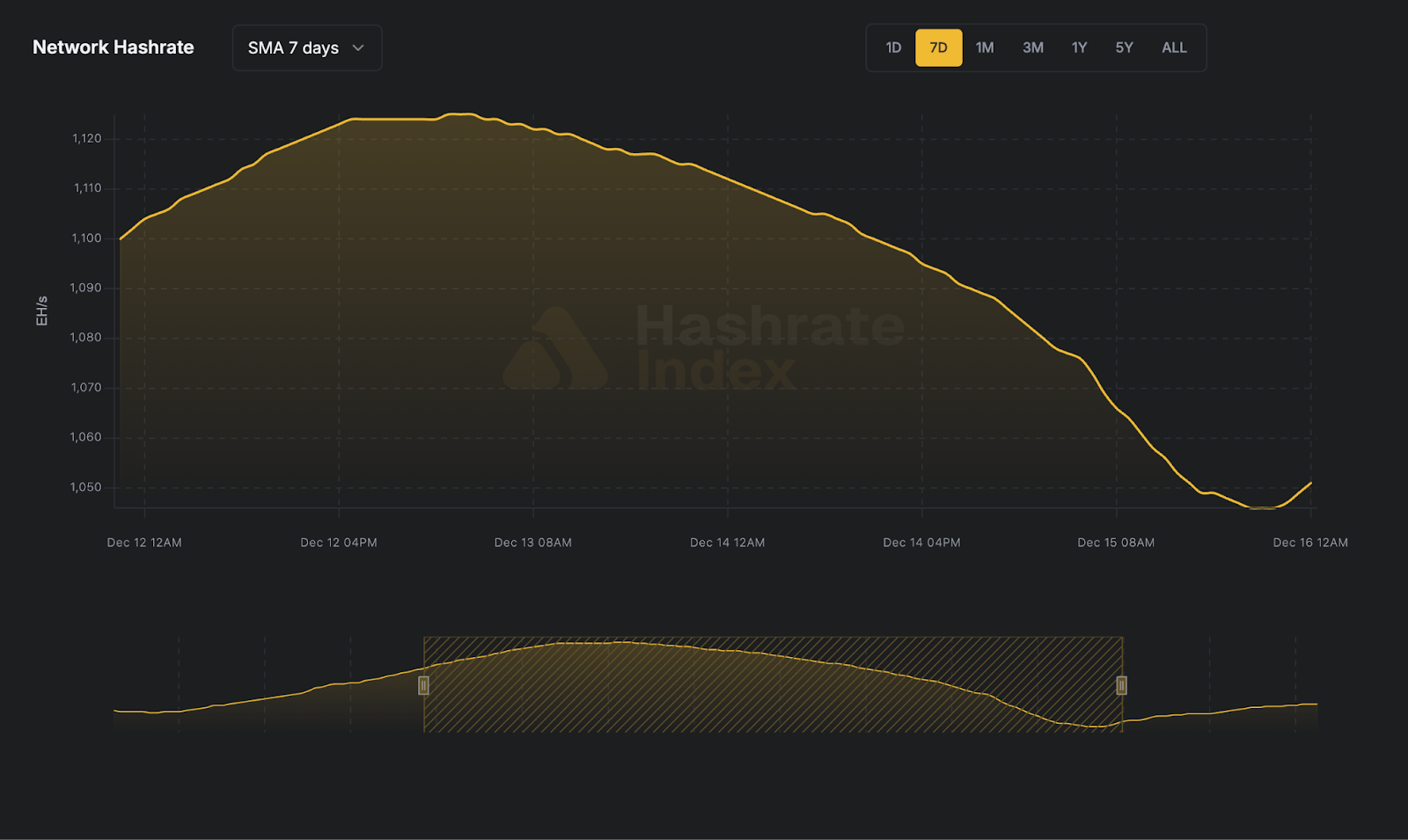

Due to the minimal barriers to entry, we have historically seen that every time the bitcoin price increases, the hashrate surges in the following months as the super profits attract an army of new entrants. The result is a decline in mining profitability and a constant inflow of new players. Good for decentralization but not for bitcoin mining profits.

Bargaining power of buyers

Buyers and sellers of goods constantly bargain, if not explicitly, then implicitly. The price the seller achieves for goods is determined by its bargaining power relative to the buyer. If the seller’s negotiating power is substantially lower than the buyer's, the seller will struggle to sell its product for more than the cost of producing it.

The market structure of bitcoin mining resembles a monopsony, where many producers compete to serve only one customer. This one customer yields tremendous market power, allowing it to set prices and squeeze its suppliers. Monopsony is the most competitive market form that exists.

Monopsonies are rare. I can only think of a couple, one of which I saw when I lived in a small town in Eastern Ukraine. The town’s big fish in a small pond oligarch had cornered the local vegetable market, owning the only food company purchasing vegetables from the many local farmers. This monopsony resulted in super profits for the local oligarch and an unprofitable existence for the farmers.

Like the Ukrainian farmers getting squeezed by their local oligarch vegetable buyer, bitcoin miners can only sell their hashrate to one possible buyer - the Bitcoin network.

Unfortunately for the miners, the Bitcoin network wields its market power even more mercilessly than our Ukrainian oligarch. A miner can’t negotiate the price it receives for its hashrate - it has to accept the offer from the Bitcoin network. If the miner thinks his work is not sufficiently appreciated and threatens to leave the network - tough luck; thousands of other miners are waiting in line, ready to take his place.

Satoshi appears to have intentionally designed Bitcoin as a monopsony in its mining layer. The value derived from the existence of a commodity is captured by two entities: the producers or the holders. Benefitting the holders over the producers is what makes bitcoin a great store of value.

Thanks to the difficulty adjustment, the supply issuance of bitcoin stay completely firm at a fixed number per block no matter how much hashrate the miners supply to the network. Thus, miners have no market power, and the hodlers can benefit from a verifiable, predictable, and low stock-to-flow ratio.

The extreme bargaining power of the Bitcoin network relative to the miners also has critical implications for the decentralization of mining. In most industries, the biggest incentive to consolidate is the companies’ opportunity to gain market power and increase prices. This consolidation incentive doesn’t exist in bitcoin mining.

Bargaining power of suppliers

The bitcoin mining industry booked revenues of around $10 billion in 2022. This industry revenue is split between the miners and their suppliers, which includes ASIC manufacturers, energy suppliers, software providers, employees, and other infrastructure providers. What is left after all these suppliers have gotten paid is bitcoin miners’ cash flow from operations.

The ASIC manufacturing industry is an oligopoly, giving these companies a very high bargaining power. Bitcoin miners can rarely negotiate the offered ASIC prices. Anyone involved in the bitcoin mining industry knows the grip Bitmain and other suppliers have on the ASIC market.

Electricity is the most significant input in a bitcoin mining operation. These suppliers also have high bargaining power, as bitcoin miners compete for electricity allocations with other industries and residential users. Still, miners can often negotiate lower all-in prices than other consumers since they provide demand flexibility to the market.

The government supplies protection to bitcoin miners and demands taxes in return. Bitcoin mining’s physical infrastructure makes it an easy target for this racket, and we have recently seen various governments target miners with arbitrary tax increases. I fear the prevalence of these miner-specific taxes will keep increasing over the next few years, as the governments have high bargaining power relative to bitcoin miners.

Threat of substitution

Threat of substitution also affects the competitive dynamics of an industry. If consumers can easily substitute a product or service with another, the negotiating power of the producers gets very low.

Luckily bitcoin miners cannot be replaced. There is a broad consensus within Bitcoin that it will never move to proof-of-stake, and due to the decentralized nature of Bitcoin, even if some group within Bitcoin wanted to move to proof-of-stake, it would be impossible.

Conclusion: The bitcoin mining industry will stay fragmented and ultra-competitive

Bitcoin mining is currently one of the most competitive and fragmented industries in the world. Our Porter’s Five Forces analysis indicates that the bitcoin mining industry will remain ultra-competitive and fragmented.

The industry has exceptionally low barriers to entry, meaning there will be a constant flow of new entrants into the sector. The low barriers to entry are great for decentralization but put pressure on the profit potential of existing players.

There is only one ultimate buyer of bitcoin miners’ hashrate - the Bitcoin network. It is a merciless buyer that refuses to negotiate. Even if bitcoin miners consolidated, they couldn’t negotiate higher hashrate prices with the Bitcoin network, as it is all set in stone by the Bitcoin protocol. Achieving a higher bargaining power relative to buyers is the most significant reason to consolidate in most industries, and this consolidation incentive doesn’t exist in the bitcoin mining industry. This is great for decentralization but limits the potential profits of miners.

Also, the low and likely diminishing margins of mining coupled with the industry's cyclical nature mean a certain number of players will be unable to escape the meat grinder of the periodic bear markets. As we have seen during this bear market, the biggest companies are often the ones that go bankrupt, as they were able to grow big during the preceding bull market by taking high risks that leave them exposed during bear markets.

The ultra-competitive nature of bitcoin mining has two implications. Firstly, the industry will likely stay decentralized, and secondly, only the lowest-cost operators will survive and thrive over the long term.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.