Power Prices and Bitcoin Mining Profitability in Bull and Bear Markets

The importance of minimizing electricity costs only becomes evident during bear markets. In this article, I show how little the electricity price impacted bitcoin mining profitability during the previous bull market and discuss how it incentivized miners to prioritize growth over efficiency.

We witnessed something remarkable during the past year: the most profitable environment in the history of industrial-scale mining quickly turned into one of the worst bear markets ever. Although the deteriorating market conditions were painful to watch, at least they allow us to examine how mining economics and the resulting incentives differ between bull and bear markets.

In 2021, super-profitable mining economics incentivized miners to prioritize growth over efficiency. The upcoming bear market then forced miners back to reality as they had to shift their focus to cost minimization.

Electricity makes up around 80% of a miner’s operating costs, making it the most crucial cost component to minimize. A mining operation powered by only mediocrely priced electricity might have been highly profitable when the bull market lifted all boats but is destined to become cash flow negative when the inevitable bear market arrives.

Electricity prices barely mattered during the bull market

2021 was the golden year of industrial-scale mining due to a perfect storm of events going in miners’ favor. Firstly, bitcoin went on a bull run to hit an all-time high of $69k in November. Secondly, supply-chain constraints caused by the lockdowns prevented new mining capacity from coming online. Thirdly, China banned bitcoin mining in June, forcing half of the existing mining capacity offline. The resulting combination of high industry-wide revenues and low competition led to a super profitable environment for the plugged-in miners.

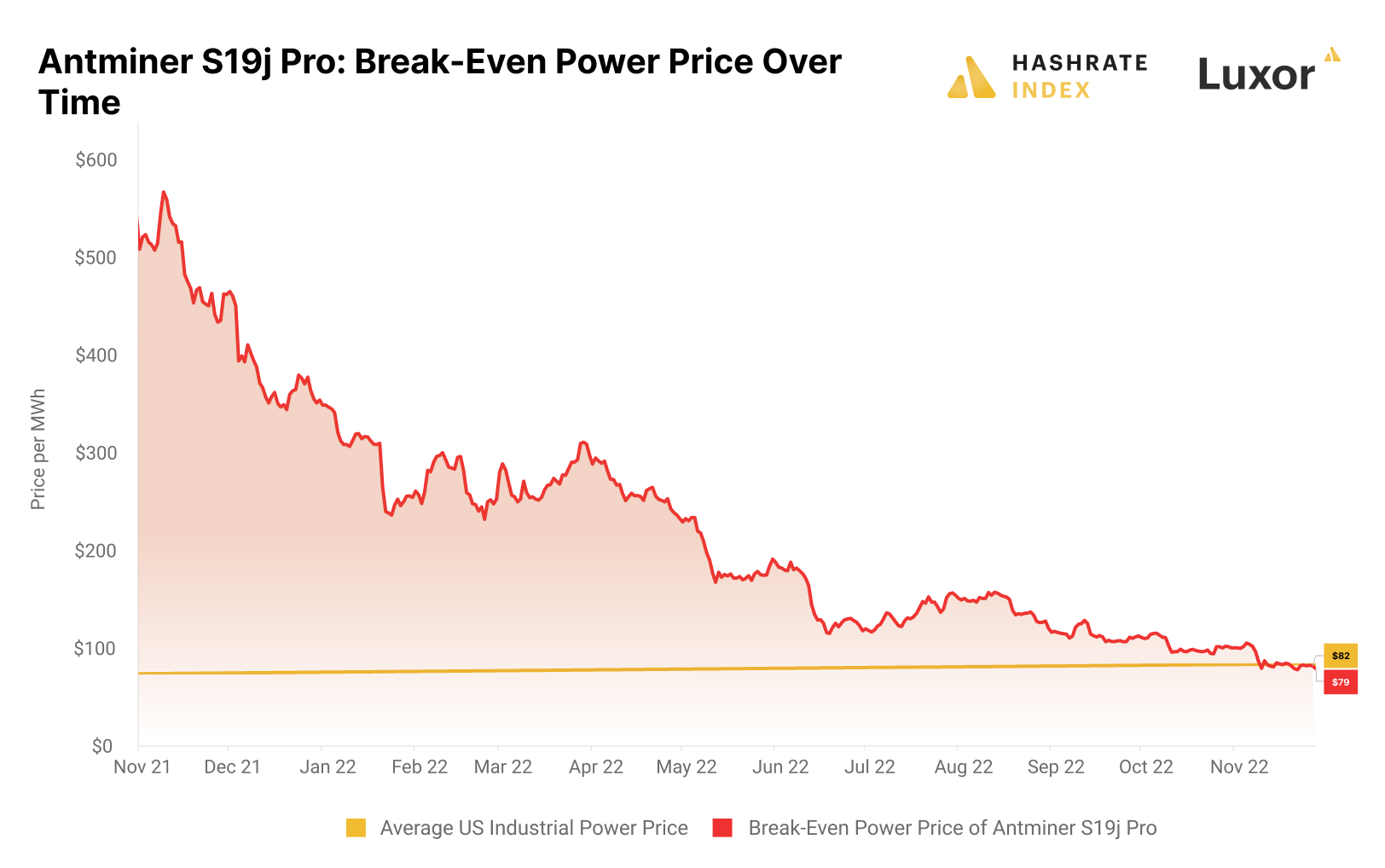

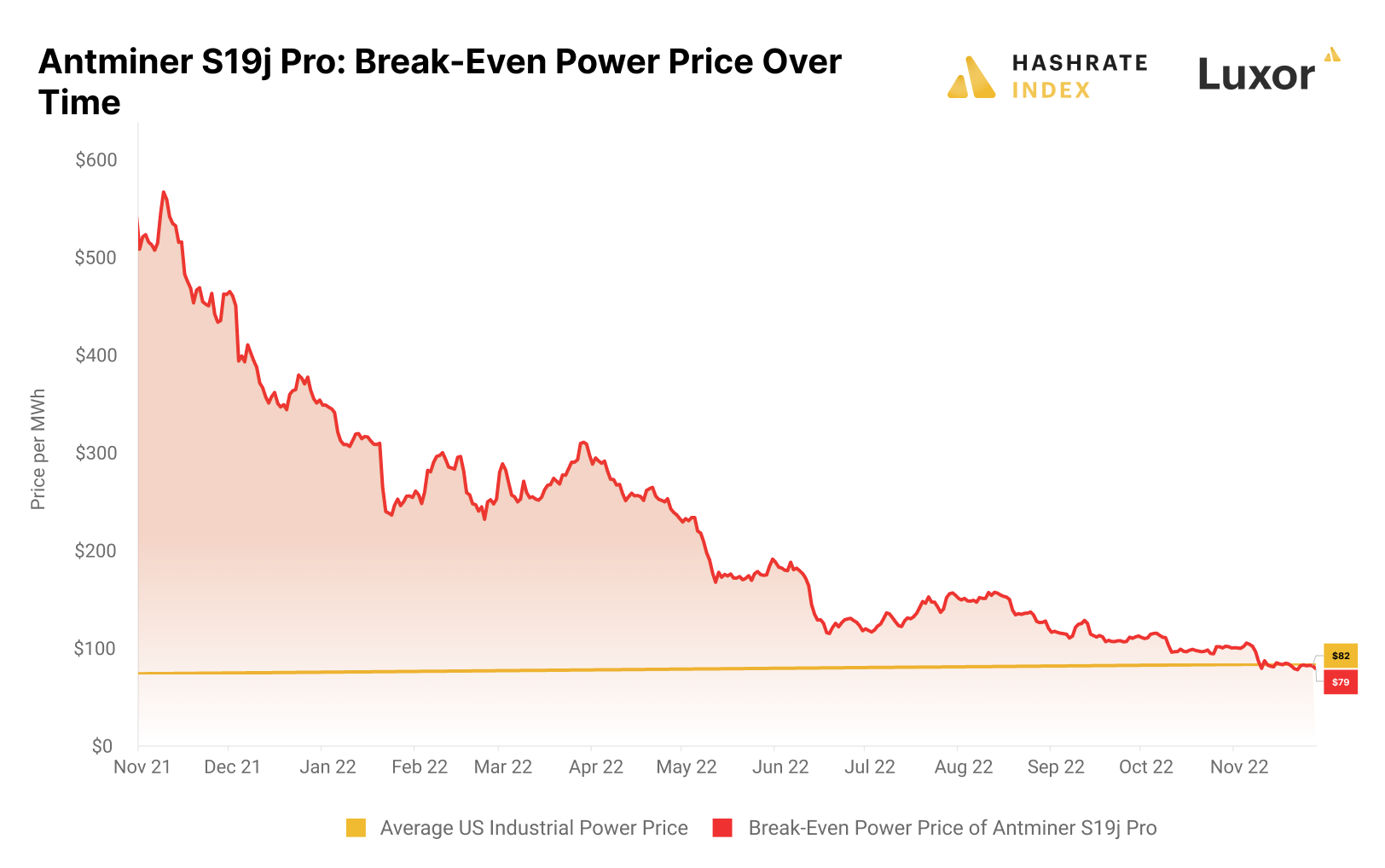

Let’s look at how mining profitability developed over the past year. At its core, bitcoin mining is energy arbitrage. For a miner, consuming a unit of energy is only profitable if it’s worth less than its potential bitcoin output. Therefore, the simplest way to analyze mining profitability is by looking at the break-even electricity price of mining, showing the bitcoin mining revenue per MWh consumed.

The chart above shows the development of the break-even electricity price using the Antminer S19j Pro – one of the most energy-efficient machines. At the peak of the bull run, its break-even electricity price was $567 per MWh. Meanwhile, the average US industrial electricity price was $73 per MWh.

This extremely fat energy arbitrage margin incentivized miners to ramp up capacity at relatively high electricity prices. By plugging in a machine, miners could earn such high revenues compared to their electricity costs that the difference between paying relatively low or high electricity rates was negligible. Even miners paying $100 per MWh – significantly above the average US industrial price at the time – would make excellent gross margins of 82%.

Fast forward to today, and the break-even electricity price of mining with the Antminer S19j Pro has plummeted by 86% from the peak to $79 per MWh. At the same time, the average US industrial electricity price has increased to $82 per MWh. Even miners using the energy-efficient Antminer S19j Pro are now disincentivized to run their machines at the average US industrial electricity price. As I will explain in the next section, many miners expanding heavily in 2021 pay electricity prices around $70 per MWh and barely scrape by in the current environment.

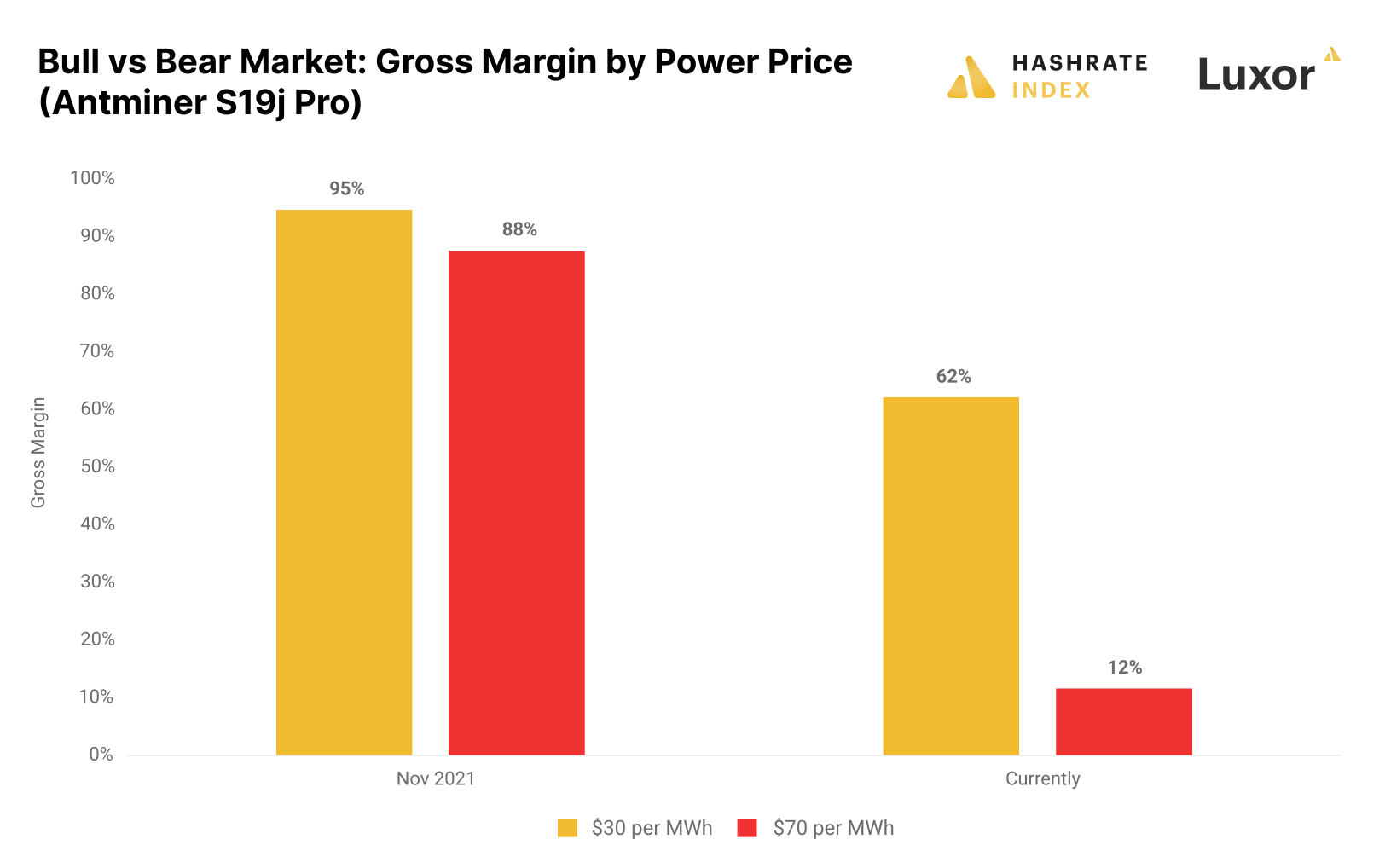

To understand why elevated profitability during the bull market disincentivizes miners to minimize their electricity costs, we only need to look at the chart above. As you can see, in November 2021, the difference between paying $30 or $70 per MWh for electricity was barely noticeable. A miner that had struggled to secure electricity at $30 per MWh only achieved a 7% improvement in gross margin compared to a miner paying $70 per MWh. This economic condition incentivized miners to expand at relatively high electricity prices.

Things look vastly different now in the depths of the bear market. The difference between having access to $30 or $70 per MWh is now a whopping 50% in gross margin. The prudent miner paying $30 per MWh still achieves an excellent gross margin of 62%, while the miner paying $70 per MWh barely scrapes by with a meager 12% gross margin.

The high-time preference induced by the extreme mining profitability of 2021 undoubtedly led to the buildout of many facilities paying unsustainable electricity rates. Naturally, the biggest expanders were those with the best access to capital. Many publicly listed miners and prominent hosting providers expanded massively in 2021 and early 2022.

Electricity prices have soared throughout the US, particularly in Texas – the go-to place for miners lately. The result is that many facilities pay electricity rates close to break-even levels at around $70 per MWh. We have already seen one hosting provider go bankrupt due to deteriorating market conditions, and two public miners have announced they are close to running out of cash.

A common trait among these three companies is that they didn’t secure long-term fixed-price power-purchase agreements. Their reluctance to hedge electricity prices was likely caused by underestimating the importance of controlling electricity costs since it was not as crucial during the bull market.

In the bear market, having access to cheap electricity is a matter of life and death

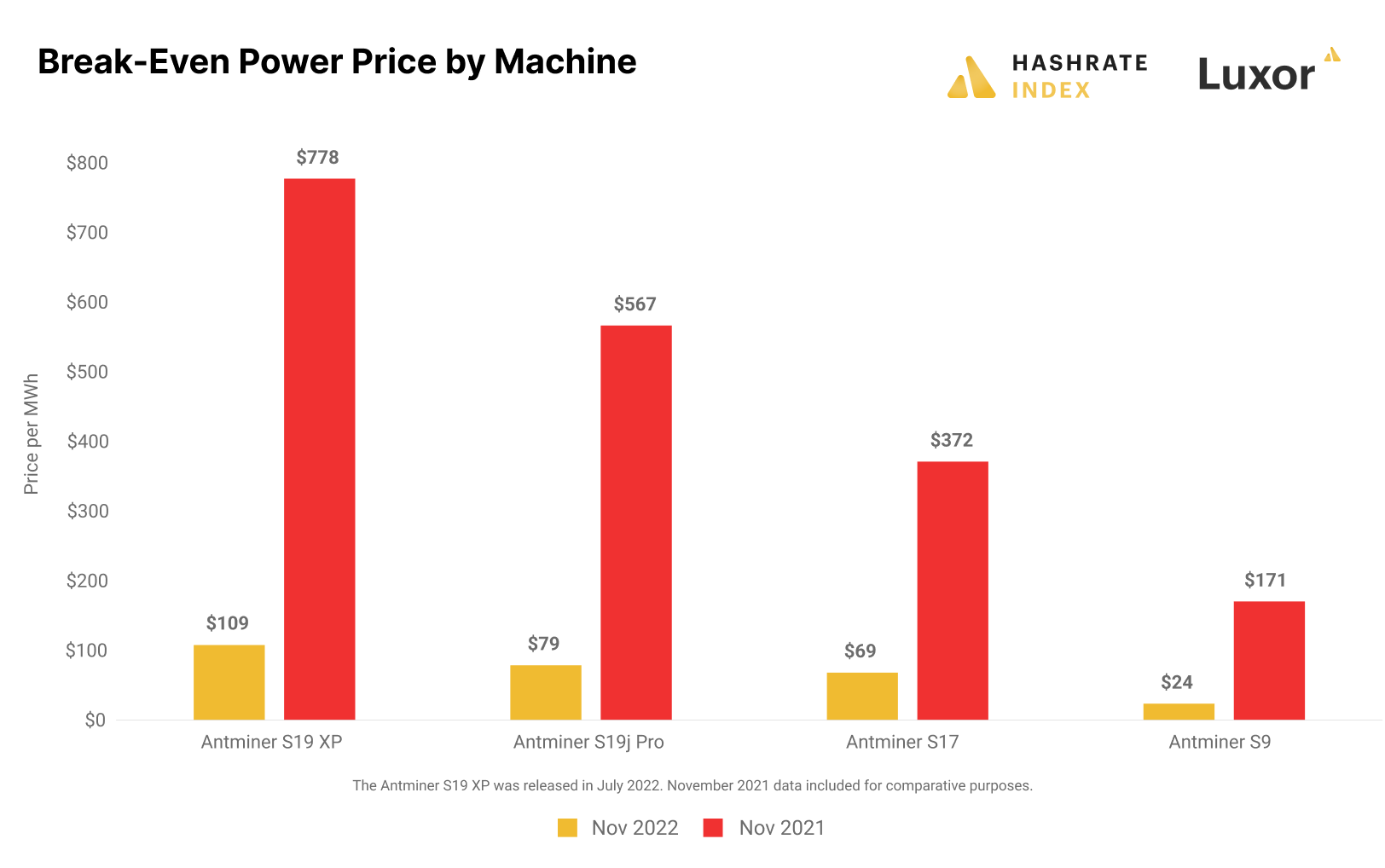

If 2021 was the year of relentless expansion, 2022 is the year of maximizing efficiency. To better understand how the bear market forces miners to minimize electricity costs, I have created a chart showing how the break-even electricity prices for different machines changed between November 2021 and November 2022.

We see that the Antminer S19 XP is the only machine on the chart with a break-even electricity price higher than the average US industrial electricity price of $82 per MWh. With a revenue per MWh of $109, the Antminer S19 XP still generates a decent gross margin of 25%, even with the relatively expensive average US industrial electricity price.

In the previous section, I showed how the break-even electricity price of the Antminer S19j Pro has developed over the past year. It currently generates $79 per MWh, slightly below the average US industrial electricity price. This machine is widely used, particularly among public miners. Most of these firms pay all-in electricity rates in the $40 - $60 per MWh range, meaning they still make decent gross margins with this machine. Still, as I explained in the previous section, some of these firms didn’t hedge their electricity costs and should pay close to the break-even cost of $79 per MWh.

To generate a positive gross margin with the Antminer S17, a miner must have access to electricity priced at $69 per MWh or lower. Many bitcoin miners pay electricity rates in this territory, particularly those relying on hosting providers. Therefore, many Antminer S17s should have been unplugged by now.

Having staunchly served the Bitcoin network since 2016, the Antminer S9 is the industry’s military veteran. Many mistakenly considered the machine as dying several years ago, but it made a strong comeback during 2021’s bull market. It achieved a break-even electricity price of $171 per MWh at the peak, meaning you could even run it with a profit in energy-deprived Central Europe. Its comeback didn’t last long, as its break-even power price has now dropped to $24 per MWh. A miner practically needs free electricity to generate a profit with this machine.

Most of Bitcoin’s hashrate is powered by electricity priced between $30 and $70 per MWh. As I showed in the previous chart, even the energy-efficient Antminer S19j Pro needs access to electricity priced lower than $79 per MWh, while the break-even is $69 for the Antminer S17 and only $24 for the Antminer S9.

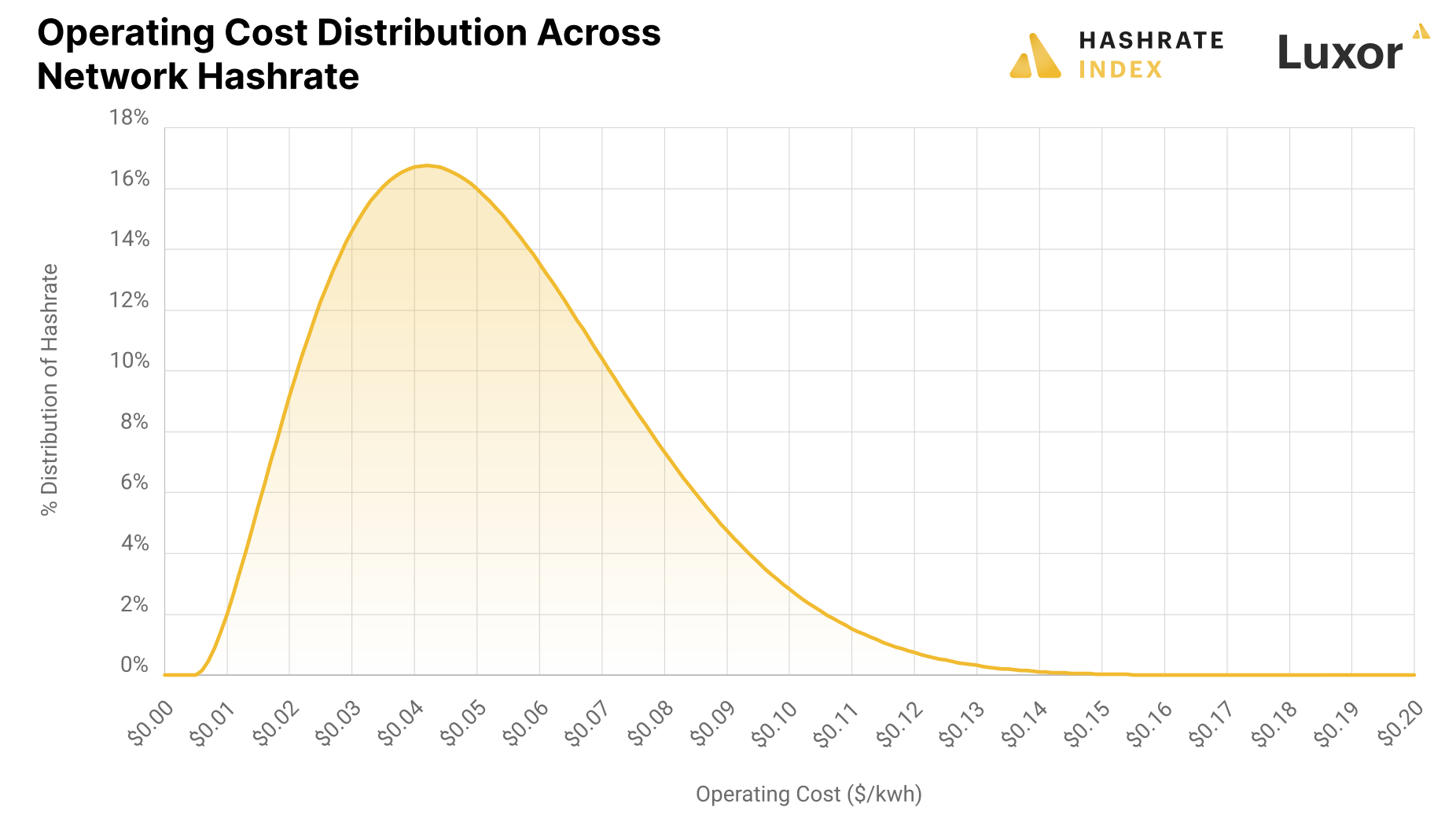

The chart below shows the operating cost distribution across Bitcoin’s hashrate. Of these operational costs, the vast majority is electricity. As we can see, there is still a substantial share of Bitcoin’s hashrate powered by electricity priced above $79 per MWh. These miners can only operate with a positive cash flow by using the latest generation models like the Antminer S19 XP.

The miners operating at the high end of the cost curve either expanded too aggressively with high-cost facilities during the bull market or have seen their electricity prices rise due to failure in securing a fixed-price power purchase agreement. These facilities are now dangerously close to being shut down.

The only way to survive in the current environment is to have cheap electricity. Low electricity prices don’t matter in a bull market but serve as downside protection during a bear market. In the long term, the ultra-competitive dynamics of the bitcoin mining industry will shift this cost curve to the left, meaning only miners with exceptionally low electricity prices will survive in the long term. Unsustainable facilities will gradually be shaved away.

Miners are now forced to scour for cheap electricity

The golden days of 2021, when miners could operate profitably with electricity priced at standard grid rates, are over. Even the most energy-efficient machines are now close to underwater at the average US industrial electricity price.

The difference between relatively cheap and expensive electricity was barely noticeable during the bull market. The super profits in this era undeniably incentivized the buildout of many facilities with access to rather expensive electricity, and many didn’t properly hedge electricity prices. The result is that a large portion of the hashrate is close to being underwater.

In the long term, securing exceptionally cheap electricity is the only way to run a mining operation sustainably. There are two ways in which miners can access such cheap electricity. The first is to be grid-connected in a grid suffering from inflexibility due to a high share of weather-dependent generation and provide demand response services. Riot is an example of a miner lowering its all-in electricity price by providing demand response services.

The other option for a miner seeking to minimize electricity costs is strategically locating its operations close to a stranded energy resource. Such stranded resources could be natural gas that otherwise would be flared or hydropower. The latter is the most viable due to the abundance of hydropower in specific geographies. Also, while wind and solar require the backup of volatile natural gas, hydropower is a dispatchable energy resource and doesn’t need this backup.

Since hydro-dominated grids are less vulnerable to global fuel price increases, I believe we will see hashrate gradually moving to such grids.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.