Up to 20% More Bitcoin: Luxor Pool’s Fixed Payouts Outperform FPPS After Halving

Understand the relative performance of post-halving hedging strategies.

Since the April 2024 halving, Bitcoin price has soared to new all time highs. However, over the same period, the mining sector faced a challenging trifecta: the halving-induced revenue cut, rapid increases in network hashrate (i.e., difficulty), and disappointing transaction fees. These dynamics squeezed margins for operators exposed to spot hashprice through a traditional FPPS mining pool.

However, not all miners were impacted equally. Those who hedged their exposure to difficulty and transaction fees through Luxor Pool outperformed their peers. By locking in fixed payouts via Luxor’s hashrate forward market, some operators earned over 20% more Bitcoin than those using traditional FPPS pools.

A Divergence Between Expectations and Reality

Following the April 2024 halving, most hashrate market participants expected a familiar pattern: a short-term hashprice decline, followed by a recovery through falling network hashrate (difficulty), rising transaction fees and upward Bitcoin price action. What actually transpired was different:

- Network Difficulty increased more aggressively than anticipated, driven by global fleet expansions and improving ASIC efficiency.

- Transaction Fees underdelivered, despite optimism around Runes-driven activity around the halving.

These headwinds significantly compressed mining margins. On average, USD hashprice declined 37% in the 10 months following the halving compared to the 10 months prior.

Fixed Pool Payouts Delivered Superior Outcomes

Luxor Pool’s forward market integration extends out to twelve months, allowing miners to hedge network difficulty and transaction fee volatility. Our following analysis demonstrates this strategy in action for up to five months in advance.

If a miner were to continuously enter into these “five month hedges” — i.e., sell their hashrate forward for a fixed BTC amount (at prevailing market rates) — they are effectively locked into a fixed payout through Luxor pool for that duration. Over the past 10 months post-halving, these “lock-in” strategies delivered measurable outperformance.

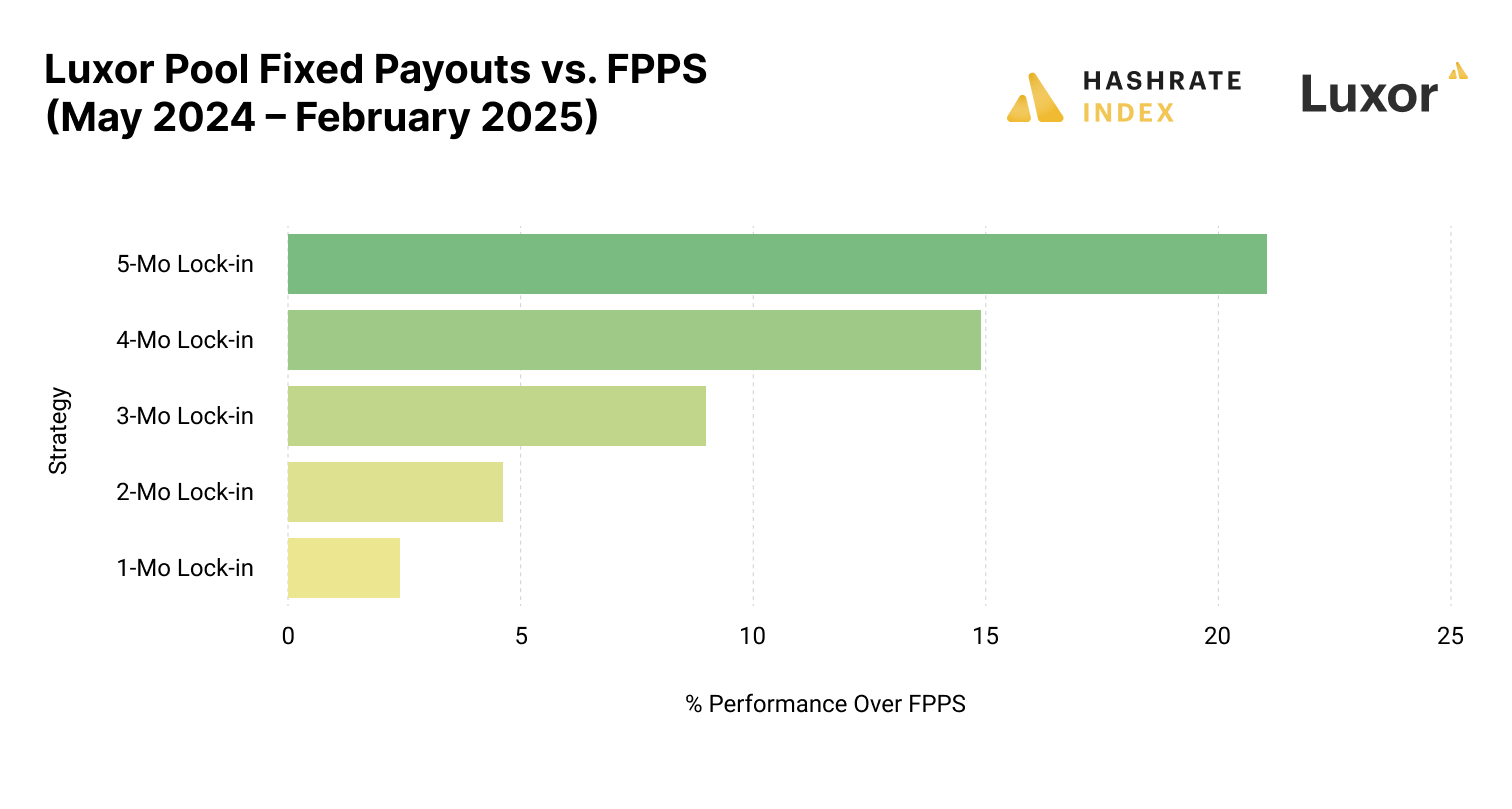

The table* below outlines the realized performance of these strategies relative to FPPS mining.

Relative to mining at regular FPPS (i.e., spot USD or BTC hashprice) payout rates, locking in fixed pool payouts, and doing so further in advance, yielded the best results for miners. The longer the duration, the better the result was. 1-month lock-ins modestly beat FPPS revenue, while 5-month lock-ins captured the most upside. This strategy allowed miners to guarantee favorable pool payout rate before difficulty continued its sustained climb, effectively mitigating the subsequent hashprice decline.

*Note: This table is strictly for demonstration purposes and based on the simplifying assumption of multiplying actual production figures by the percentage difference between hashrate forward contracts’ locked-in hashprice versus spot hashprice; it excludes fees and bid/ask spreads associated with entering into hashrate forward contracts.

A second caveat: Although selling forward proved to be favorable in this instance, it is critical to recognize that hedging is typically a cost of business rather than a revenue generation method. Hedgers willingly pay a price to buy certainty and obtain more predictable cash flows, which increases valuation, reduces cost of capital, and ultimately attracts investments.

Growth Hacking: Upfront Payouts

Beyond the optimal hedging strategy, some miners went a step further to utilize Upfront Payouts — a Luxor Pool payout option that enables BTC revenue hedging and access to capital. This dual-purpose structure combines hedging and growth capital, which is attractive to miners seeking capital efficiency and long-term growth.

A notable example was a publicly traded mining company — BitMine Immersion Technologies — which executed a 12-month contract through Luxor to hedge future hashprice exposure, while using upfront proceeds to expand their ASICs fleet.

Looking Forward

The post-halving period has reaffirmed the strategic value of Luxor Pool’s fixed payout offerings as a risk management tool. In a hashrate market defined by surging difficulty and weak transaction fees, Luxor’s integrated forward market gave miners the ability to lock in fixed BTC payouts. These fixed contracts allowed operators to eliminate revenue uncertainty from difficulty and fee swings up to five months in advance, while still benefiting from upside in BTC price.

As a result, miners on Luxor Pool not only protected their margins, they outperformed. In some cases, fixed payout strategies earned over 20% more than FPPS revenue. Those who combined hedging with capital access were able to de-risk earnings while accelerating growth.

As the mining industry continues to institutionalize, tools like forward market integrations will continue to play a central role in driving profitability, capital efficiency, and strategic flexibility.

For operators seeking to outperform in increasingly competitive environments, proactive hedging is no longer optional — it’s essential.

If you’d like to learn more about Luxor’s Bitcoin mining derivatives, please reach out to [email protected] or visit https://www.luxor.tech/derivatives.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.