Tokenizing Hashrate: Blockstream Mining Note 2 (BMN2)

Explore the advent of hashrate-backed security tokens.

This blog post was originally published on August 08, 2024 and updated on September 05, 2024 to reflect developments in the BMN2 offering.

Introduction

We covered Blockstream’s inaugural Mining Note (BMN1) note back in 2021 and have been observing the product as it comes to the end of its lifecycle. Building on its success, Blockstream has recently launched a second note, the BMN2. In this blog post, we will take a deep dive into the BMN, look back at BMN1’s performance, and provide an overview of the incoming BMN2.

What is the Blockstream Mining Note (BMN)?

First introduced in April 2021, the BMN is a pioneering example of a security token offering (STO). It is a digital security backed by real-world hashrate, which provides qualified non-U.S. investors access to bitcoin produced by Blockstream’s enterprise-grade mining facilities in North America. From a legal perspective, the BMN is an EU-registered security with a designated International Securities Identification Number (ISIN), issued through a Luxembourg securitization fund. A single BMN entitles investors to a predefined and fixed hashrate over a certain period of time.

Blockstream’s motivation in building the BMN was to make mining more accessible by reducing barriers to entry. On the one hand, there is a growing interest in gaining direct exposure to bitcoin mining without the idiosyncratic risks associated with other mining alternatives.

Basics of the BMN

The BMN lifecycle begins with qualified investors putting down funds to secure an agreed upon hashrate for a period of time. Blockstream directs these funds towards purchasing hashrate and ASICs machines to operate and manage in their mining facilities. Bitcoin mined throughout the term is held in cold storage custody, which investors receive into a desired bitcoin address upon maturity (minus costs). Expenses include a range of items such as setup, exchange listing, management, pool, custody, administrative, audit, and payout fees.

For institutional investors with experience in traditional commodities, this product carries many of the characteristics of a streaming or forward contract and provides exposure to bitcoin mining, similar to that of hosted-mining, cloud mining, or public miner equities. However, the BMN differentiates itself from prevailing alternatives in a number of ways.

The first differentiator is the contract tenor - there isn’t any other product in the market with a comparable duration of 3-4 years. For example, cloud mining companies typically have shorter durations and payout daily. Luxor Hashrate Forwards currently extend up to 12 months out into the future.

Second, BMNs are issued on the Liquid Network as digital tokens. Specifically, BMNs have the ability to fractionalize into smaller tradable units, trade 24/7/365 on secondary markets or through confidential peer-to-peer transactions, and be held in self-custody with compatible wallets.

Lastly, BMN investors are empowered with more transparency than your typical cloud mining contract through publicly available information. Blockstream released a BMN Dashboard for tracking real-time performance metrics, such as bitcoin mined and changes in mining economics, enabling investors to download daily rewards data and utilize a calculator to compare costs & benefits of purchasing BMNs versus alternative investments.

The BMN is built on a growing ecosystem of innovations in Bitcoin-native financial services:

- The Liquid Network - a separate Bitcoin-pegged blockchain (“sidechain”) developed by Blockstream, designed to facilitate fast and privacy-enhanced transactions. It operates using a federated consensus model where a group of trusted entities, known as functionaries, manage the network.

- Blockstream Asset Management Platform (AMP) - a suite of tools and protocols developed by Blockstream to facilitate the creation and management of digital assets on the Liquid Network, such as stablecoins and security tokens.

- STOKR - an asset tokenization platform, acting as the primary issuer for the BMN.

- SideSwap - a decentralized exchange (DEX) platform for trading Bitcoin and other Liquid-compatible digital assets, acting as a secondary market avenue for the BMN.

- MERJ Exchange - a trading platform for a wide range of financial instruments including tokenized securities, acting as a secondary market avenue for the BMN.

- Bitfinex Securities - a digital assets trading platform developed by Bitfinex, acting as a secondary market avenue for the BMN.

BMN1 Overview

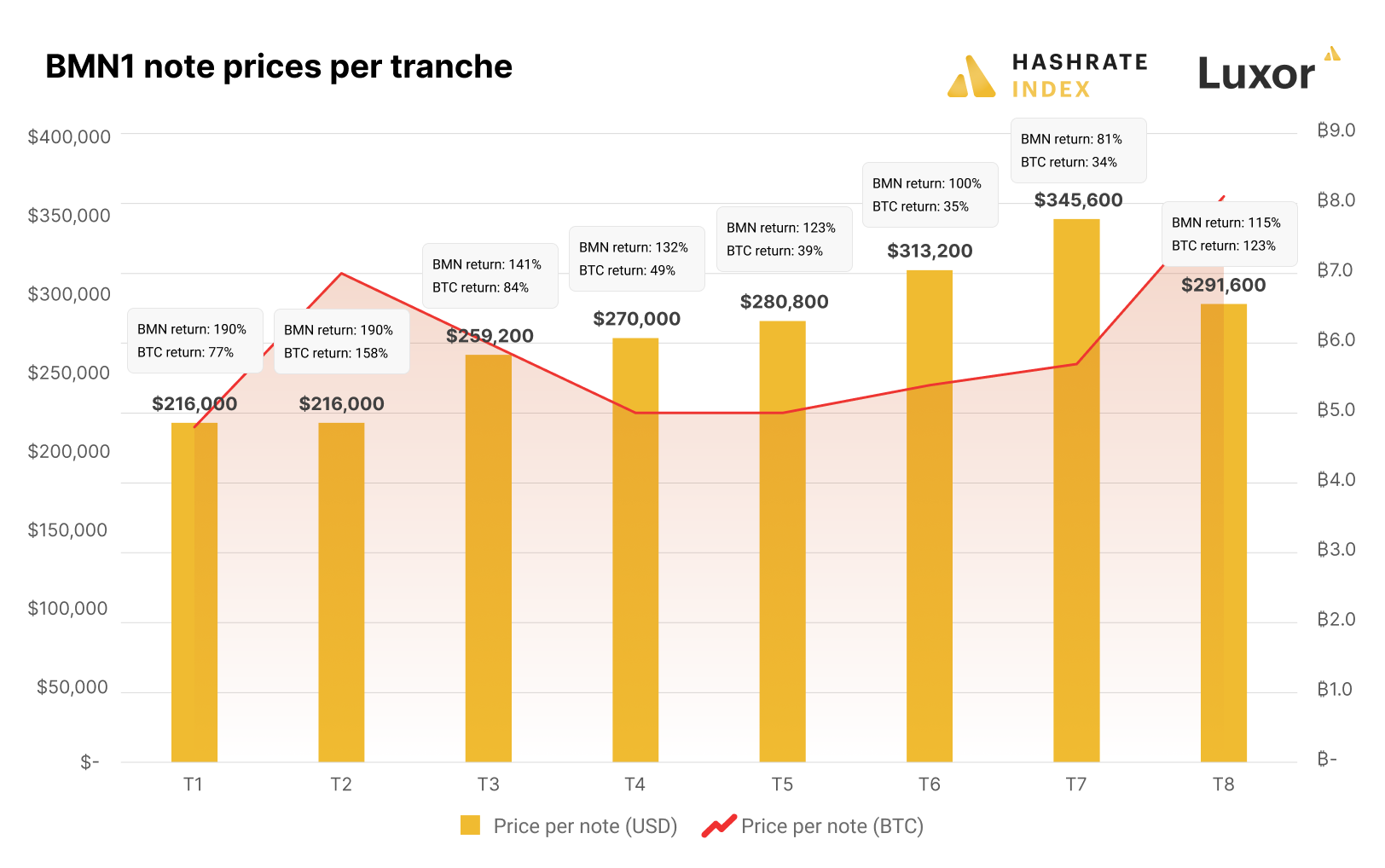

BMN1 was offered in eight separate investment tranches across April 2021- February 2022. This note provided 2,000TH/s/Day over a 36-month term and entailed an initial nominal token price of $216,000 at an implied hashprice of ∼$99/PH/s/Day. The first seven tranches were issued through STOKR which subsequently traded on SideSwap, MERJ, and Bitfinex; the last tranche was issued through Bitfinex Securities.

Although each tranche was released at separate intervals, the maturity date was the same for all at July 7, 2024. To account for this discrepancy in duration, each subsequent tranche entailed an incrementally higher nominal token price. This resulted in an overall issuance of ∼156BMN1, raising over $50M at a weighted average token price of ∼$279,000 per note.

Tranches enabled a staggered approach for Blockstream to deploy its mining operations. To ensure that all tranches would have an equivalent amount of bitcoin allocated to each BMN1, Blockstream employed a supplemental top-up strategy, by purchasing the exact amount of BTC on the open market that tranche 1 would mine up to the point of a newly released tranche. This was an important factor in ensuring fungibility and enabling liquid trading through a unified secondary market.

The secondary market allowed investors to actively manage bitcoin mining exposure. Out of the ∼156BMN1 issued, 6.5 BMN1 were traded on SideSwap at an average price of 7.4BTC and 37.4 BMN1 were traded peer-to-peer at undisclosed prices, with Blockstream and STOKR estimating overall trading volume to be ∼$20M.

BMN1 Performance

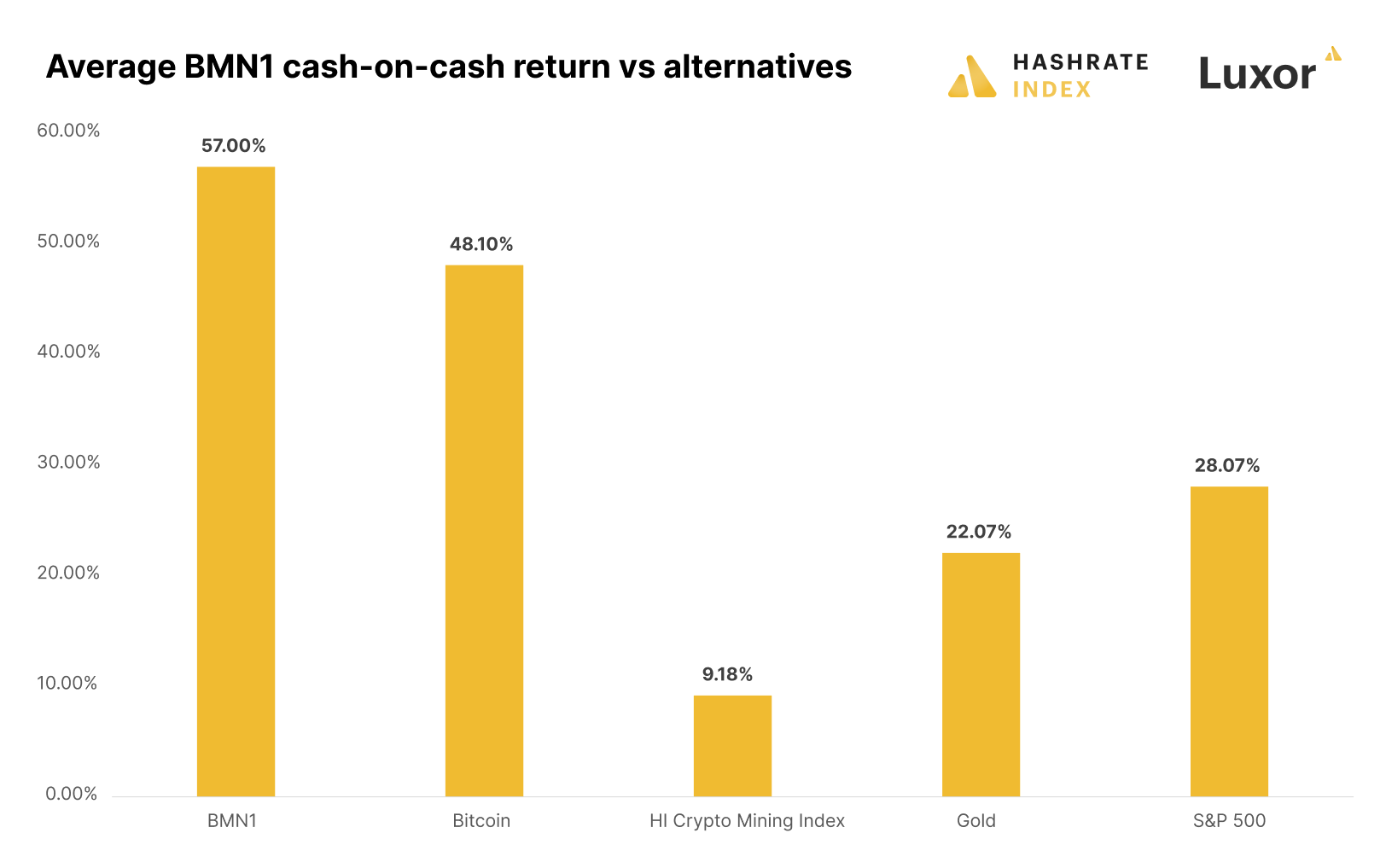

BMN1 commenced mining in July 2021 and produced a total of 1,242 BTC over the term, resulting in net proceeds of 1,212 BTC (~7.76 BTC per note). Overall, BMN1 generated a 57% fiat-denominated return (∼$437,517 per note) and a 32% Bitcoin-denominated return (∼294 BTC per note) for investors.

The chart below summarizes nominal BMN1 prices and associated cash-on-cash returns per tranche, denominated in USD and BTC:

Two factors had an influence on the return profile of individual tranches: market entry timing and subscription method. As previously mentioned, each progressive tranche entailed a higher fiat-denominated price to account for differences in timing of issuance and duration in the market. Tranches also varied in Bitcoin-denominated prices across the term, given the volatile nature of the asset. This confluence had a significant impact on the Bitcoin-denominated return profile for each individual tranche, presenting an opportunity for savvy investors to purchase BMN1 tokens at relatively cheap Bitcoin-denominated prices (during periods of high spot BTC prices) and sell BMN1 tokens at relatively expensive Bitcoin-denominated prices (during periods of low spot BTC prices). This was reflected in the distribution of BTC and USD investments across various tranches, with some seeing subscriptions exclusively in BTC and others in USD. STOKR reported an overall weighted average of 39% BTC-denominated and 61% USD-denominated subscription volumes across all eight tranches.

Comparing BMN1 to alternative investments from the issuance date of the last tranche until maturity, we can see that BMN1 outperformed spot Bitcoin, Hashrate Index Crypto Mining Index, Gold, and S&P500:

STOKR's comprehensive report on BMN1 performance results can be found here.

The Incoming BMN2

Looking forward, the security token offering (STO) for BMN2 was recently announced on July 17, with the latest investment period for tranche 3 set for September 05 through 26, 2024. This note will provide 1,000TH/s/Day over a 48-month term and entail a nominal token price of $31,000 at an implied hashprice of $21.23/PH/s/Day.

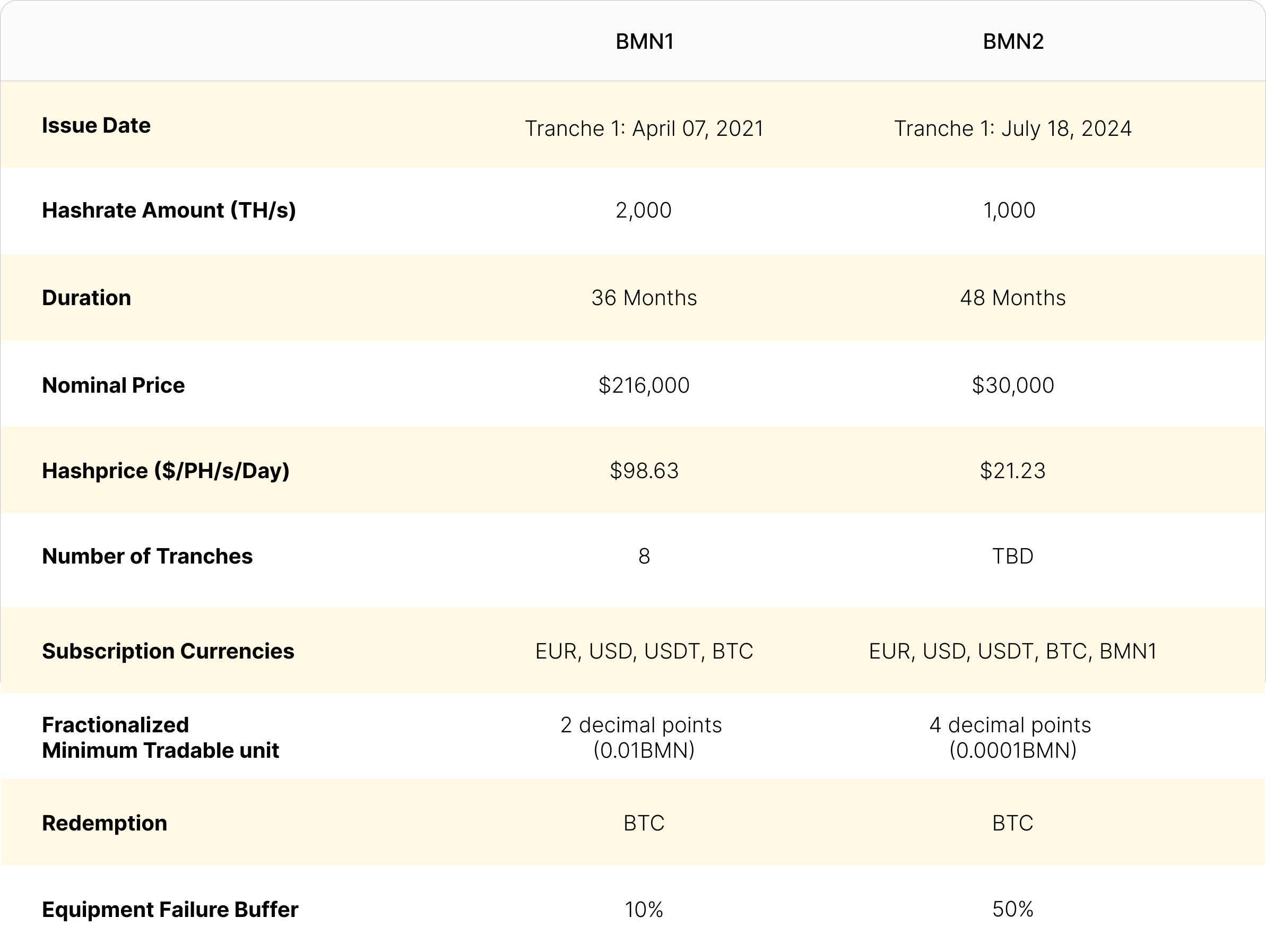

The table below summarizes key features of BMN2 compared to its predecessor:

The architecture for BMN2 is highly similar to BMN1, with a couple of key differences.

First, BMN1 investors did not hold any claim to bitcoin mined before maturity throughout its term. Mined bitcoin was held in cold storage by Blockstream and delivered to final BMN1 token holders only. With BMN2, interim redemption may be claimed under certain conditions for investors holding 30% of BMN2 in circulation. Second, it is contemplated that bitcoin mined by BMN2 may be held in cold storage through a third-party custodian, namely Fidelity Digital Assets (to be determined). In addition, BMN1 holders are able to roll over their BMN1 tokens into BMN2 tokens for a 3% bonus during the tranche 1 investment period. Lastly, Blockstream has significantly increased its buffer provision against potential miner failures from 10% to 50%, offering protection against any hashrate shortfalls and ensuring consistency throughout the full BMN2 lifecycle.

Mining is expected to commence in September 2024, with Bitcoin payouts tentatively set for September 2028, less a total expected expense ratio within 5%.

Full details regarding the BMN2 offering can be found here.

Key Risks and Considerations

As we come to a close, we present below a non-exhaustive list of key risks and considerations for aspiring miners and potential investors to factor into their decision making process around participating in proof-of-work through BMN2.

Risks:

- Bitcoin mining entails complex operational risks related to the degradation or failure of mining facilities and ASICs machines.

- Specific investments may suffer from a lack of price discovery or liquidity in secondary markets.

- Unsecured investment products necessitate enhanced due diligence efforts on counterparty credit profiles.

- Bitcoin-native financial services may entail technology risks, ranging from potential incidents around payment, delivery, or transfer of digital assets to cryptographic key management and custody practices.

- Investments in digital assets such as tokenized securities may be subject to abrupt changes in regulatory treatment.

Considerations:

- Bitcoin mining investments may be sensitive to the underlying price of Bitcoin, market entry timing, and other market conditions.

- Macroeconomic conditions and black swan events, such as the Chinese mining ban in 2021 or changes in mining economics, may result in unexpected investment performance.

- Other types of high-performance computing loads, such as Artificial Intelligence (AI), may result in competing demand for infrastructure and computer hardware resources.

Conclusion

This blog post has covered a range of Bitcoin mining concepts and developments in Bitcoin-native financial services, diving deep into Blockstream’s Mining Note series BMN1 & BMN2.

Happy hashing!

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.