Hashrate Derivatives

Luxor Hashrate Lookback Series – December 2025

December 2025’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

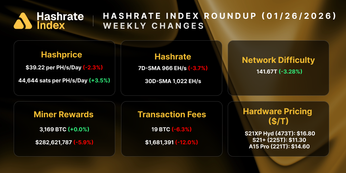

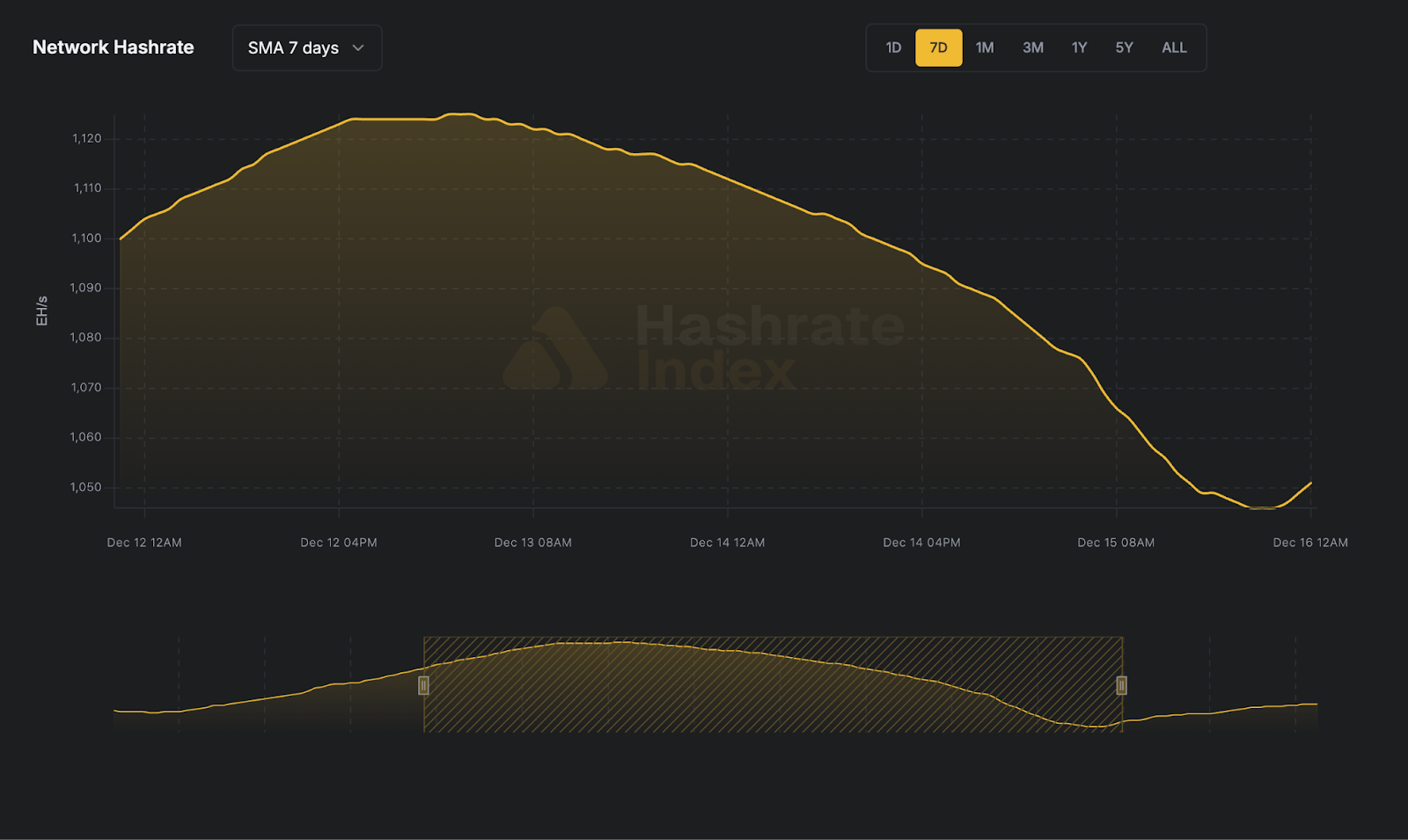

Why is Bitcoin Mining Hashrate Falling?

A Disturbance in the Force

Luxor Hashrate Lookback Series – November 2025

November 2025’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

Hashprice At All Time Lows

How Can Miners Utilize the Hashrate Forward Curve?

Luxor Hashrate Lookback Series – October 2025

October 2025’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

The Halving Since The Halving: Growing Bitcoin Network Difficulty

How Difficulty Cuts Miner Revenue Per Compute Over Time

Luxor Hashrate Lookback Series – September 2025

September 2025’s hashrate and hashprice trends, forward market participation, trading activity and contract performance.

Luxor <> Arch: Expanding Financing and Risk Management Tools for Bitcoin Miners

A comprehensive capital lifecycle for Bitcoin miners.