Hashrate Index Q3-2022 Report: Gradually, Then Suddenly

Gradually, then suddenly, Q3 exerted tremendous pressure on the Bitcoin mining industry.

Happy Wednesday, y'all!

Today, we're thrilled to present our Q3 report on the state of the Bitcoin mining industry!

Q2 wrapped up on a bleak note. As we covered in our previous report, the bear market started really bearing its teeth for Bitcoin miners after June's sell-off. In Q3, this reality sunk in to an even graver extent, as the sweltering summer heat strangled miner uptime and Bitcoin's declining hahsprice compressed mining margins.

Throughout the quarter, public companies continued to hock mining rigs and BTC to fund operations and pay down debt, distressed asset sales started to crop up, and we witnessed the first major bankruptcy of the bear market. As the summer months have cooled into autumn and Q4 is afoot, Q3's troubles are looking like they were only a sample of what's to come now that hashprice is in all-time low territory.

You can download the report below, and we've included a sampling of some of the findings throughout the rest of this newsletter.

Hashprice Teeters on the Edge

Bitcoin’s hashprice saw some reprieve in the middle of Q3 as hashrate came offline in the heat of the summer and Bitcoin’s price recovered from its June sell-off. This reprieve was short lived, though, and as Bitcoin’s price slipped back below $20k and difficulty ramped up, hashprice slipped closer and closer to all-time low territory.

- Throughout Q3, USD hashprice fell from $83.30/PH/day to $79.60/PH/day (-5%)

- Q3’s average USD hashprice was $92.70/PH/day vs. Q2’s average of $141.20/PH/day(-34%)

- Year-over-year (the end of Q3-2021 to the end of Q3-2022), USD hashprice declined from $290.40/PH/day to $79.60/TH/day (-73%)

Power Rates Rip

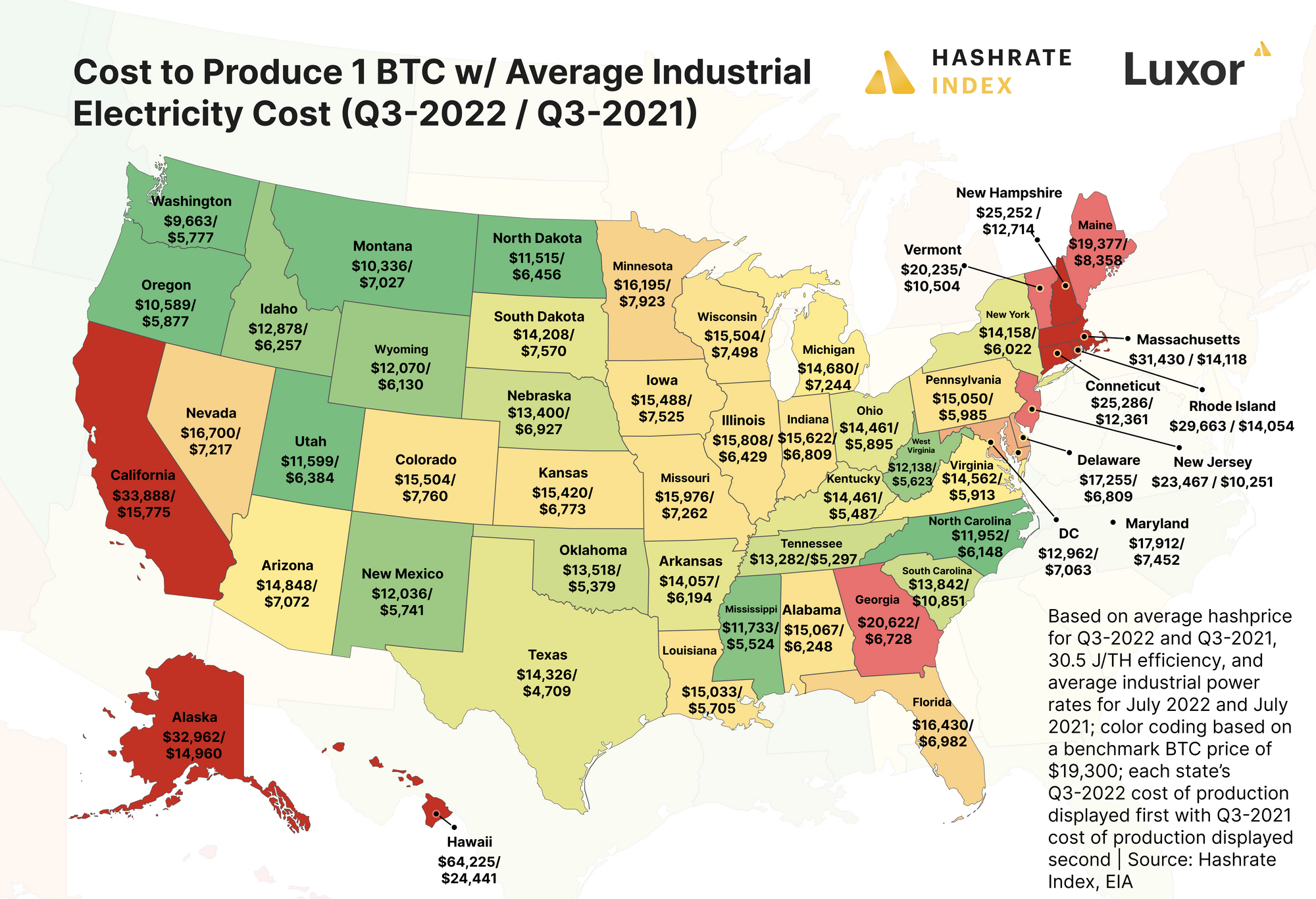

Turning an eye to power rates in the United States, the average cost of industrial electricity increased 25% from $75.20 a megawatt hour to $94.30 per megawatt hour from July 2021 to July 2022.

When looking at popular mining states in the US, some states saw even sharper increases. Very few states saw stagnant / minor growth in electricity rates or decreases in electricity rates.

With power costs swelling and hashprice crumbling, the cost to produce 1 BTC has risen drastically since last year. The below chart does not factor in machine cost and downtime; still, it’s a useful and novel way to illustrate just how much current mining economics have impacted the cost of BTC production.

Hosting: $0.08/kWh Is the New $0.06/kWh

Before 2022’s energy price inflation, a reasonable hosting contract might offer power prices at $0.05-$0.06/kWh. Now, it’s not uncommon to see $0.08-0.09/kWh, and many hosting contracts are switching from the standard ‘all-in’ hosting terms to profit/revenue sharing models. Anything below $0.075/kWh is considered “a steal” given market conditions.

Based on analysis that we conducted of public hosting rates from Hashbranch and Luxor’s ASIC Trading Desk, the majority of hosting providers in the United States are butting up against breakeven thresholds for even new-gen machines like the S19j Pro (100 TH/s). Admittedly, this dataset is not comprehensive and the rates are more geared toward small-to-mid-sized operations, but the prices are in line with private rates that Luxor’s business team has observed.

S19 XP Commands a Premium Over Other New Gen Rigs

Q3 saw the first deliveries of Bitmain’s Antminer S19 XP to the market. In Q1, the average price per terahash for the S19 XP was either cheaper than or on par with the price per terahash of new gen machines (those in the under 38 J/TH bucket on our ASIC Price Index). As hashprice dropped and margins evaporated, though, this trend flipped and the S19 XP began commanding a premium.

The following analysis compares futures prices for the Antminer S19 XP versus spot prices for other new-gen hardware per our ASIC Price Index. We did not have enough datapoints in our datasets to compare the S19 XP with futures prices for another new-gen rig (like the S19j Pro), though we are confident that the S19 XP premium per terahash would still exist based on the few weeks of S19J Pro futures data we could compare while conducting this analysis.

Mine High, Sell Low: BTC Liquidations Continue

With debt becoming more expensive and harder to come by, cash-strapped miners continued liquidating BTC treasuries in Q3.

Miners are still selling substantial portions of their BTC production each month, but this selling slowed progressively throughout Q3. For the first time since May, public miners sold fewer BTC than their monthly production in both August and September.

Happy Hashing, and have a great week!

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.