Hashrate Futures and Backwardation

Hashrate is an asset that usually experiences backwardation, which means that its expected future value is lower than the current spot price.

Hashrate is the digital commodity that powers the blockchain. On its own, hashrate is a raw, unrefined commodity. Its value comes from using it to submit shares to the network with the potential of mining blocks and being rewarded compensation for securing the blockchain.

Hashrate is an asset that usually experiences backwardation, i.e. it’s expected future value is lower than the spot price.

We were curious about why this is the case, what other assets trade like this and what it means for potential financial instruments built on hashrate.

Key Terms

Hashrate

Hashrate in its simplest definition is computing power used on crypto networks.

A technical way to understand it is the speed at which a compute is completing an operation in a cryptocurrency code that is based on the Proof-of-Work consensus algorithm.

Hashrate is an ephemeral asset, meaning that it needs to be instantly used to mine blocks. You can’t hold and store it. In some ways it is like electricity, but can be globally distributed instantly.

Spot Price

The spot price is the current market price for an asset. It is the price at which the asset can be bought or sold and changes over time due to supply and demand forces.

There is no spot price for hashrate yet because there is no liquid spot marketplace. The closest thing you can get is the Pay-Per-Share rate for a single chain. This is based on the price of a coin, the difficulty level and the emission rate of the chain. You can check out a service like whattomine to get a rough sense of the spot price for now.

Futures

Futures are financial contracts that obligate a buyer to purchase an asset and a seller to sell an asset in the future at a preset date and price. From a higher level you can think of it as betting on the future price of an asset.

Many future contracts are cash-settled, meaning that there is no actual physical delivery of the asset. Let’s say the spot price of BTC hashrate is $200/PH/Day right now. If we enter a futures contract and at the end of the period it's trading at $230, then the investor who went short hashrate owes the investor who went long \$30.

Backwardation

Backwardation is when a futures contracts’ price is lower than the spot price. This means the market thinks that the current price is too high and that the price will fall before the end of the contract.

Examples of Backwardation in Traditional Markets

A recent example of backwardation was during the conflict between America and Iran in early 2020. The conflict resulted in uncertainty in the oil industry given the amount of production that occurs in the region. In this situation the spot price of oil shot up because of the risk of short term production being impacted. The market went into backwardation, as the future price was expected to come down to more normalized levels.

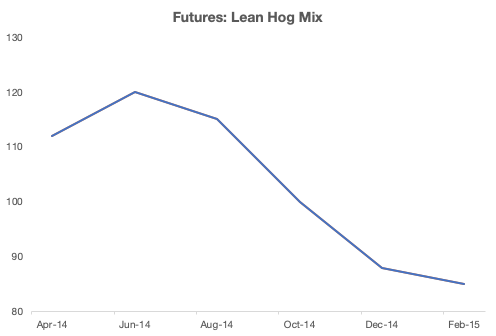

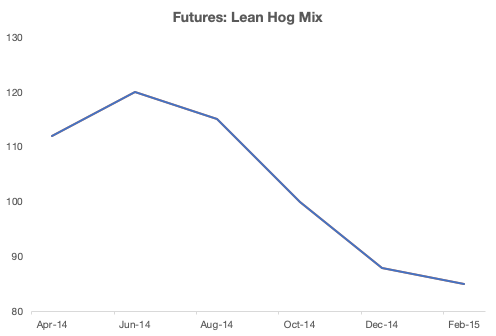

An interesting market to observe was the Lean Hog Mix from 2014–2015. For reference Lean Hog (pork) is traded on mercantile and option exchanges like the CME. It is an example where the market was mostly in backwardation, forecasting lower value of pork over time, but a few one-off events affected the price during the period. The price of pork was expected to rise temporarily before falling again.

What Creates Backwardation?

There are two prominent theories used to explain backwardation.

Understanding the dominant mechanism for pricing in the futures markets has important implications as it influences the expected returns to traders and the costs of hedging for miners.

The Theory of Normal Backwardation views speculative returns as directly linked to the bearing of risk. i.e. investors get rewarded for going long on the value of hashrate due to the risk associated with it.

The Forecasting Theory proposes that returns are determined by the ability of traders to forecast future prices accurately. i.e. the future price is lower than the spot price, given investors are accurately predicting a decline in value.

We think that it’s possible both of these theories can weigh into backwardation. Many situations could be a mixed payment for both risk-bearing and accurate forecasting, with the weighting of the two determinable only by empirical investigation.

It is also highly dependant on the type of asset. From our research the Theory of Normal Backwardation is more valid for financial assets and currencies. However for commodities, the Forecasting Theory seems to be more accurate.

We think that the backwardation for hashrate is a mix of the two but heavily weighted towards the Forecasting Theory.

Will Hashrate Trade Mostly in Backwardation?

It is important to understand the relationship between network hashrate, difficulty and mining reward.

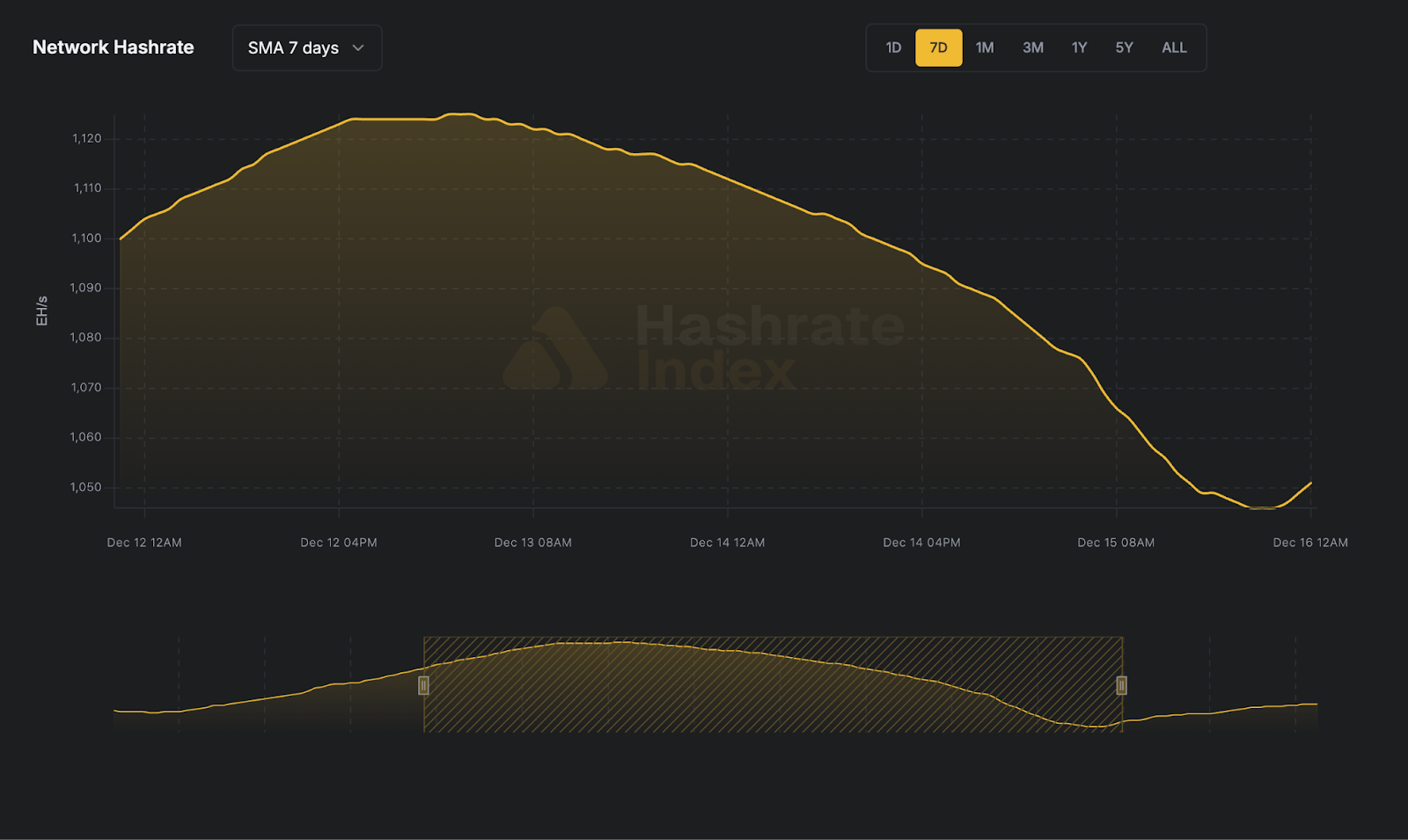

What we have observed overtime is that network hashrate increases. This is largely due to new technologic innovations (i.e. new chip technology) as well as more machines added onto the network.

The mining difficulty directly reflects the amount of hashrate that the network has. For Bitcoin the difficulty is adjusted every 2,016 blocks (~2 weeks) so that the average block solution time is 10 minutes.

If difficulty increases it is harder to find a block. So all else being equal the value of a unit of hashrate decreases.

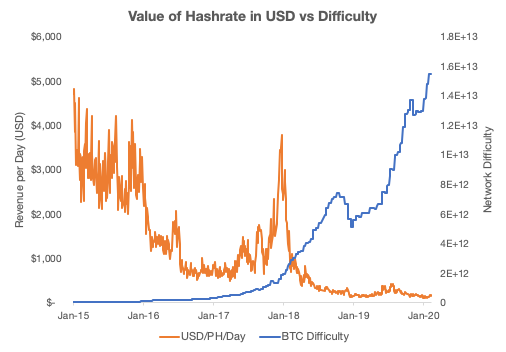

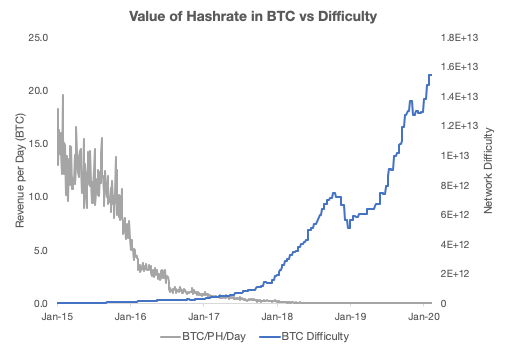

On a USD basis you can see that the price of hashrate has trended downwards over the long term. However, there are spikes in revenue with the bull runs of crypto.

When you net out the FX rate, and only look at it on a BTC basis, we notice that the value of hashrate almost perfectly declines with the increase in network difficulty.

So our conclusion is that over the long-term hashrate will mostly trade in backwardation.

Exceptions

Like our example of Lean Hog Mix above, there are times where the price would increase even if the market is usually in backwardation.

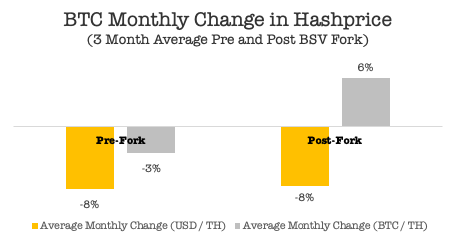

An example of this is during the period following a hard-fork. The outcome of a fork is that a whole new set of emission rate gets exposed to an existing supply of hashrate, leading to an increase in the value of hashrate. We did a deeper dive into a couple fork case studies here.

During the BCH-BSV fork we saw an increase in the price of hashrate in BTC.

What Does it Mean for Hashrate Futures?

We are still far off from futures built on hashrate. Before we get there we need a real spot price of hashrate that is based on the market supply and demand for an algorithm (i.e. SHA-256), not on a single chain’s PPS rate. However, it is still interesting to look at this now.

We don’t foresee an issue in having the market in backwardation. We know that usually the future value will be lower than the current spot price. The big question is how much lower will it be?

Bitmex and other resources online have some comments on trading in backwardation markets but this should be looked at differently for hashrate. As we previously mentioned hashrate is an ephemeral asset so investors can not hold or store it.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.