Fahrenheit-256: Inside US Bitcoin and Co's Buyout of Celsius' Bankruptcy Assets

US Bitcoin and others won 12 EH/s worth of ASICs from Celsius' bankruptcy auction.

A collective of investors have teamed up with mining company US Bitcoin and emerged with assets from Celsius’s bankruptcy sale – and they have a good sense of humor about it all.

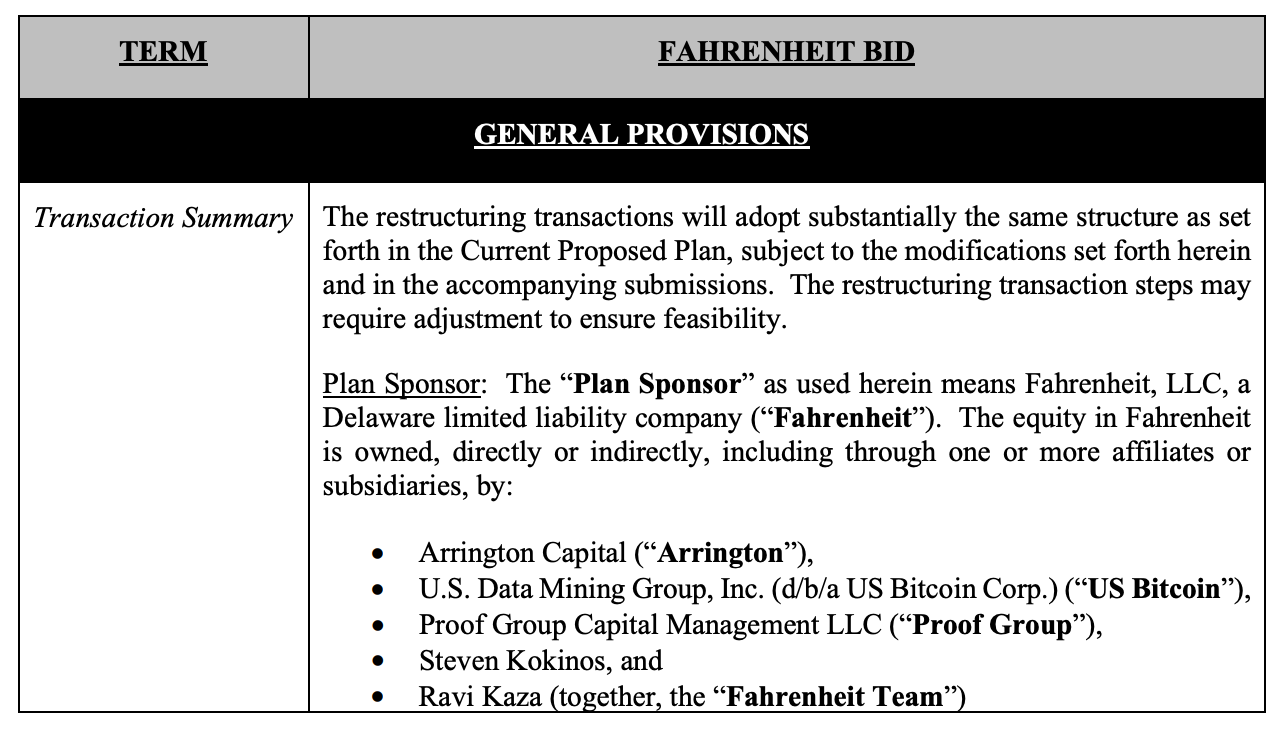

The cheekily named Fahrenheit group – made up of US Bitcoin, Arrington Capital, Proof Group Capital Management, and others – was named the successful bidder for Celsius’s assets, which includes up to $500 million worth of crypto assets and some 12 EH/s worth of new-generation Bitcoin mining ASICs.

Celsius was founded in 2017 and bootstrapped with an ICO in 2018. In late 2020, one of Celsius’s co-founders tweeted that they had plans to become one of the biggest Bitcoin miners in North America, and in June of 2021, Celsius officially entered the Bitcoin mining business with a $200 million investment, split between its own mining fleet as well as investments in Luxor, Core Scientific, and Rhodium. Celsius hosted the majority of its rigs with Core Scientific, which went bankrupt at the end of last year. They also signed a large hosting deal with Mawson for 100 MW. In 2022, Celsius began constructing a mining facility in Texas for its self-mining hashrate.

In a July presentation for its bankruptcy, Celsius revealed that it had more than 43,000 active Bitcoin mining rigs (4.3 EH/s of equipment worth ~$68 million) but planned to expand to 112,000 (~10.64 EH/s) by Q2 2023.

Now that the Fahrenheit Group owns these rigs and then some, they’ll likely get US Bitcoin to manage them. Per the agreement set forth, US Bitcoin would manage Celsius’ old fleet and host the rigs at US Bitcoin facilities across the US for the group (though this is not finalized yet, so we speak of it conditionally at times in this article). Fahrenheit’s financial partners will manage Celsius’ other assets. The “NewCo” – a company formed to oversee the buyout – will pay the Fahrenheit group a $35 million management fee to handle Celsius’ assets; $15 million of this is designated as a mining management fee, which will most likely go to US Bitcoin to manage Celsius’ fleet.

As part of the deal, US Bitcoin is tasked to build a 100 MW Bitcoin mining facility for the new company at a projected cost of $39.5 million, a price of $395,000 per MW. US Bitcoin will have one year to complete the facility once it’s approved, and the contract stipulates that US Bitcoin will lose $1 million from its management fee for each month delay (up to 6 months/$6 million). $35 million management fee total.

US Bitcoin may also develop a 240 MW behind-the-meter mining site for the Fahrenheit company. It will also facilitate ASIC manufacturer relationships for the Fahrenheit group with companies such as Bitmain, MicroBT and Canaan to give Fahrenheit the option to expand from 90,000 to 180,000 machines; this part of the agreement includes up to $100,000,000 in machine coupons.

The Fahrenheit Group will have the option to purchase US Bitcoin’s upstate New York turn-key 50 MW mining facility for $28.75 million ($575,000/MW), or they can opt to rent 8,500 rack spaces from this facility. Notwithstanding in-progress buildouts, US Bitcoin will provide 43,500 racks for the Fahrenheit group – enough for the 43,000+ rigs Celsius revealed it owned upon bankruptcy in a July, 2022 presentation.

Here’s a quick summary of US Bitcoin’s biggest deliverables to the Fahrenheit Group / Celsius debtors should the agreement go through:

- US Bitcoin to provide royalty free license for miner management software and curtail management software

- US Bitcoin to build 100 MW mining facility for a cost of $395,000 per MW; option to build out facility to 400 MW.

- To be energized within 12 months of contract effective date; for every month delay, $1 million to be deducted from US Bitcoin's miner management fee. If cost exceeds $39,500,000, excess will be taken out of management fee

- US Bitcoin to provide employment for all mining sites, including any self-mining sites purchased in the Celsius buyout

- US Bitcoin to attempt to develop a 240 MW behind-the-meter mining site.

- Fahrenheit Group to have the option to purchase a 50 MW facility from US Bitcoin in upstate New York

- If the group declines to purchase, they can enter a hosting agreement with US Bitcoin for 8,500 rigs

- US Bitcoin to provide up to 50 MW of containers and transformers to Fahrenheit Group mining efforts

- US Bitcoin to offer 20,000 rack spaces for a 5-year term at undisclosed locations to group mining efforts

- US Bitcoin to provide 15,000 rack spaces in facilities across the US to group mining efforts

- US Bitcoin to help Fahrenheit Group to acquire up to 180,000 additional rigs

- US Bitcoin will provide up to $100,000,000 in manufacturer coupons for rig orders

This is just the beginning for US Bitcoin's hosting of Celsius assets. The company expects to manage 12.2 EH/s (121,800 rigs) when the deal is finalized.

US Bitcoin continues its buying spree

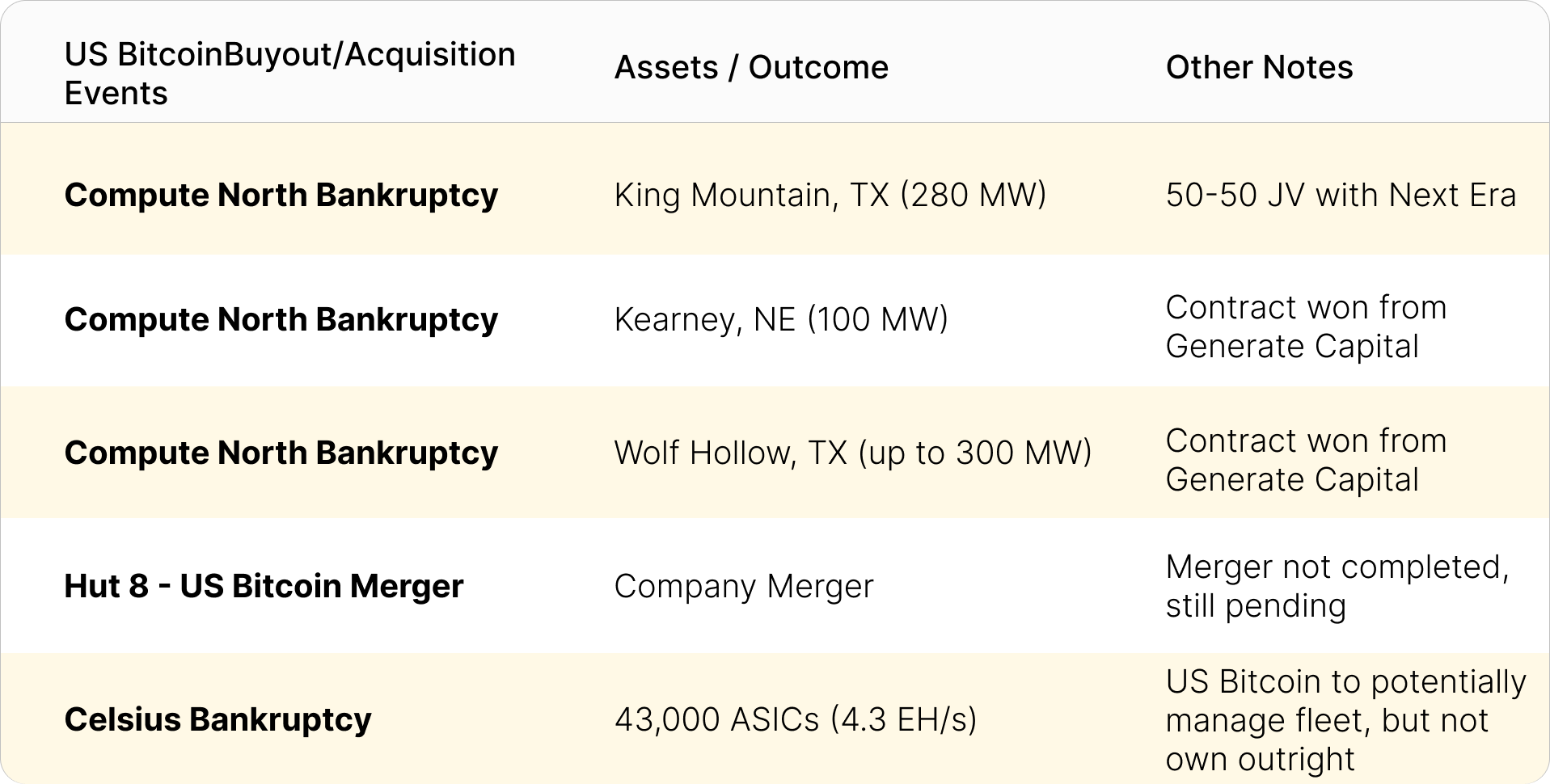

Over the last year, US Bitcoin has been at the center of key mergers and acquisitions.

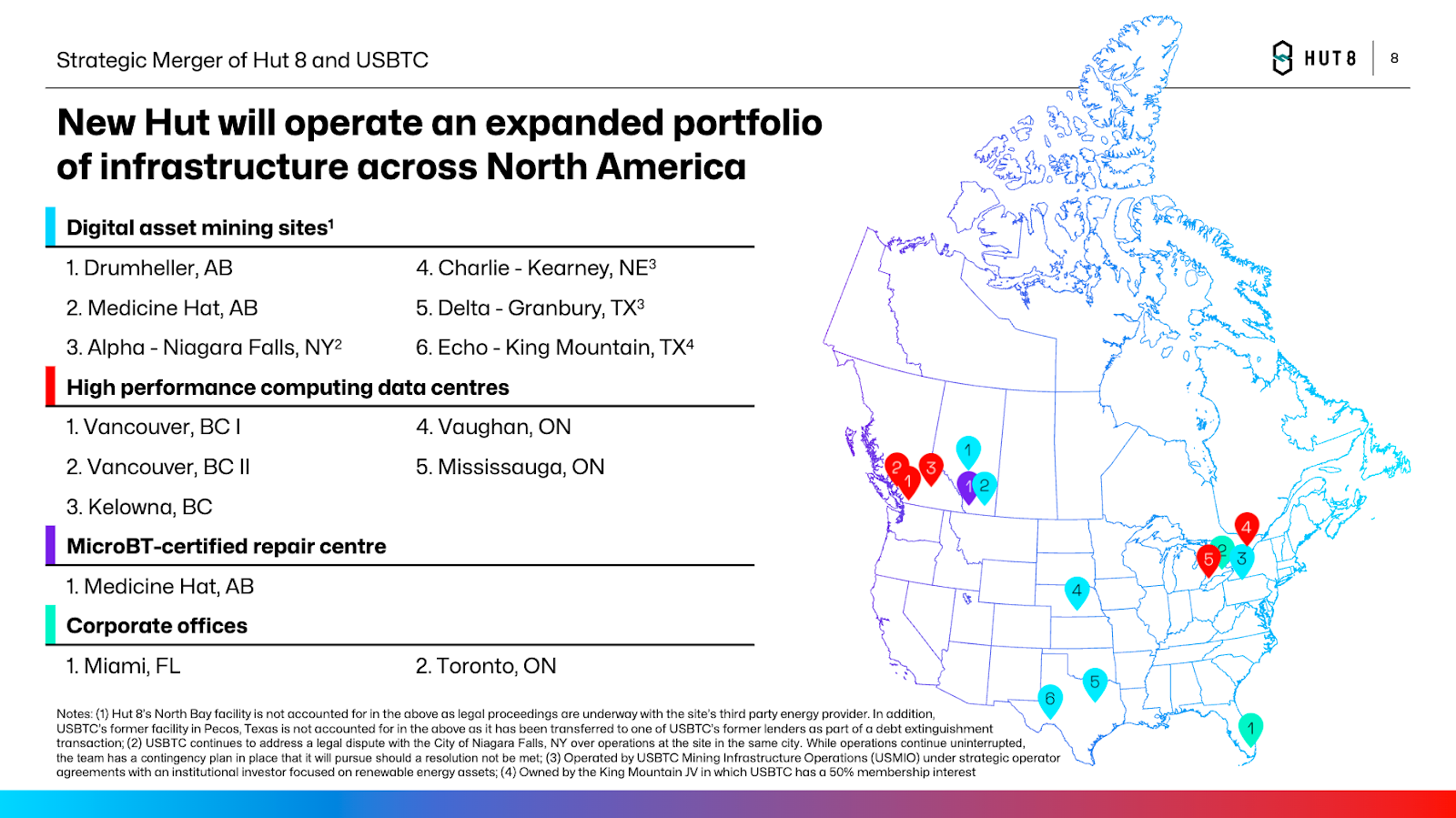

At the end of 2022, the company purchased the rights to Compute North’s King Mountain facility in Texas (a wind-powered 50/50 joint-venture with Next Era energy) during the former hosting provider’s bankruptcy sale. They also won the contract to manage two sites from Generate Capital – Compute North’s primary lender – in Texas and Nebraska. This process gave US Bitcoin the bankruptcy auction experience needed to beat out rival miner Novawulf in the bid for Celsius’s assets.

In February, US Bitcoin announced a merger with Hut 8 which is expected to close within the near future. With the acquisition of Celsius’ mining assets, the potential Hut 8 - US Bitcoin merger could be a power house in the North American Bitcoin Mining sector.

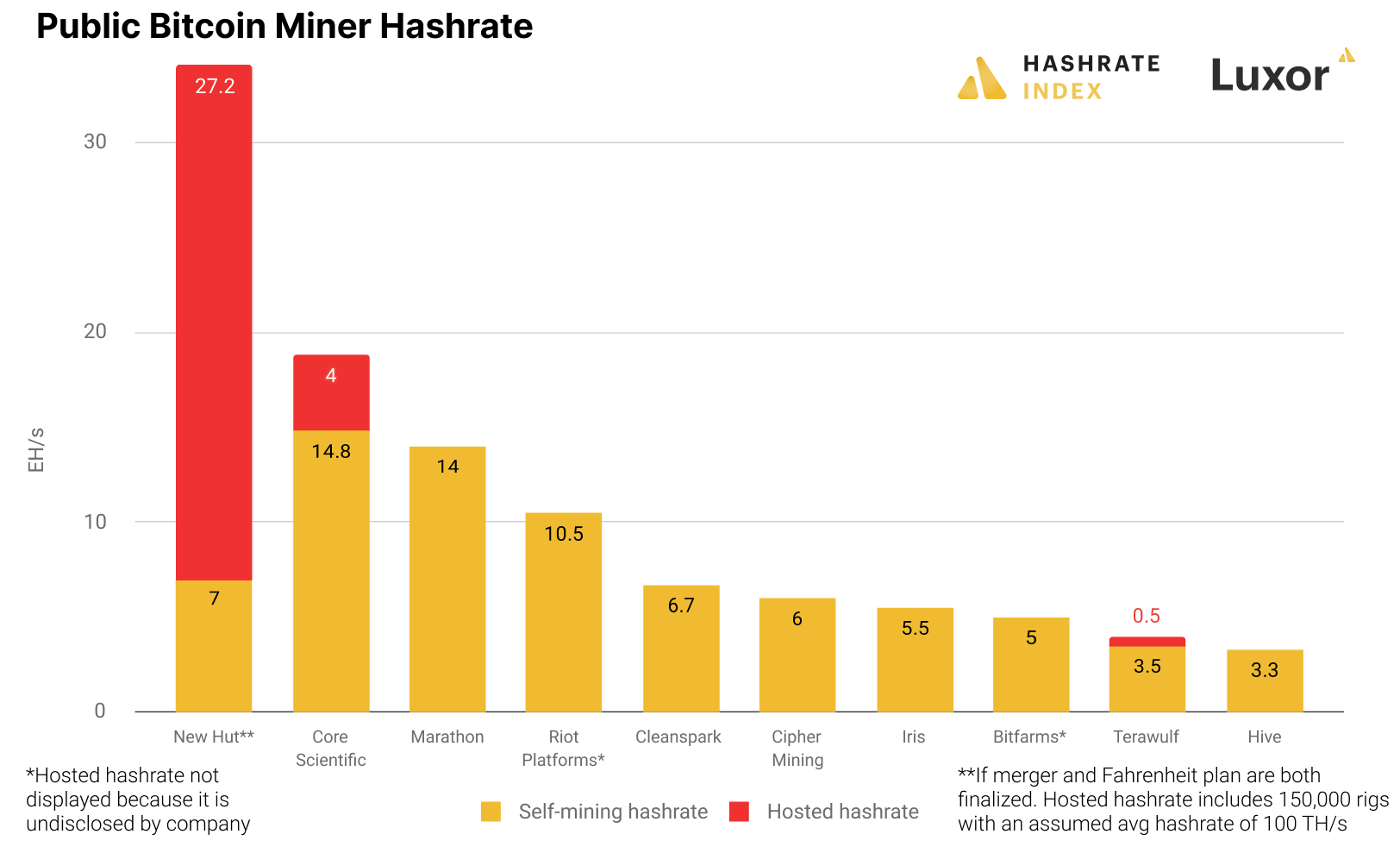

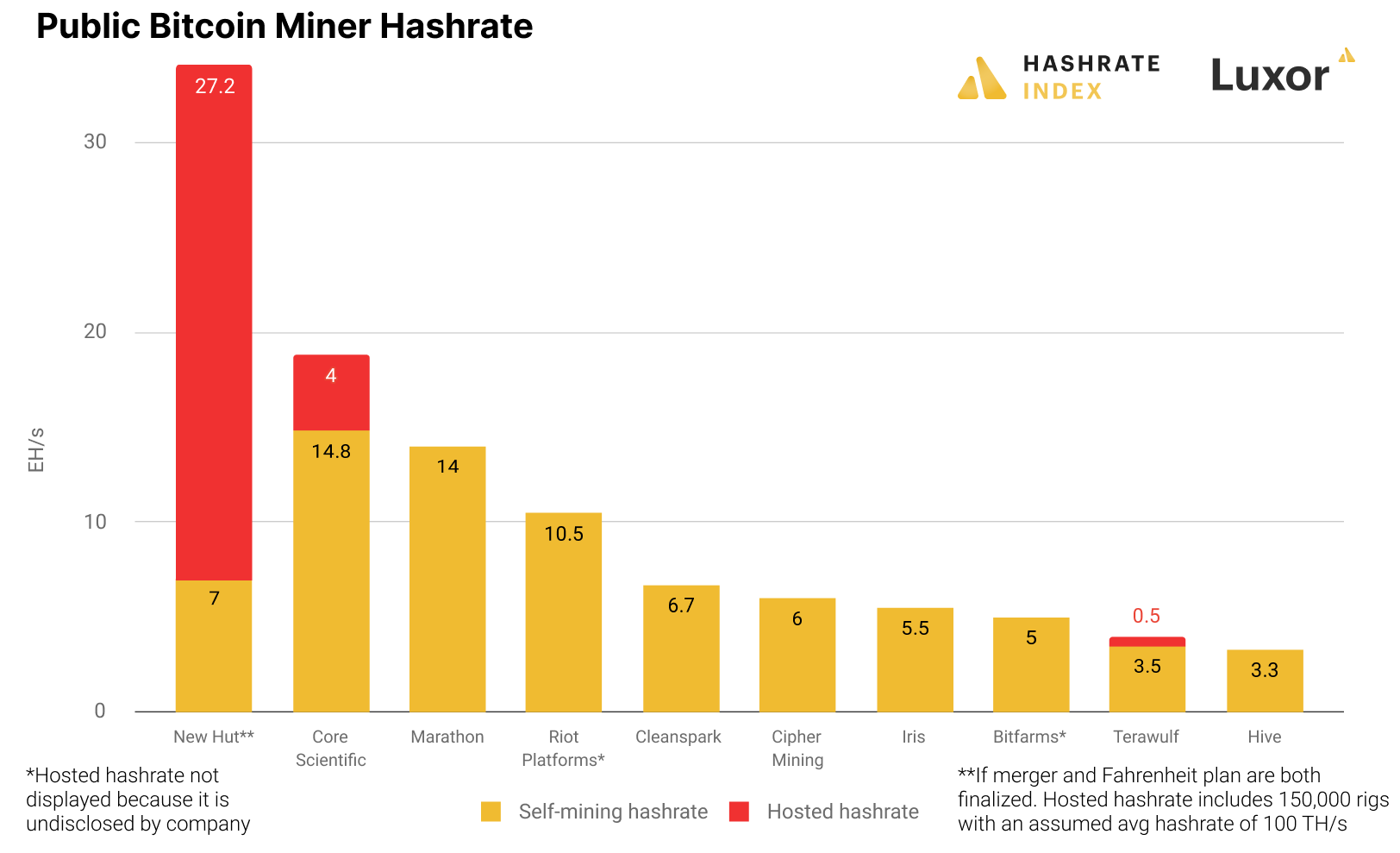

In fact, if everything goes as planned, the merged company would be the largest public Bitcoin miner in the world by hashrate under management.

If the merger goes through, “New Hut” positioned to be a North American Bitcoin mining juggernaut

“New Hut” as the co-op dubbed itself in an April investor presentation has 7.02 EH/s of self-mining under management spread across 11 sites in North America.

The Fahrenheit agreement won’t directly expand New Hut’s self-mining hashrate, but it does give them over 12 EH/s of additional hosting revenue – and this is on top of an estimated 15 EH/s in contracts for hosted hashrate that US Bitcoin acquired from the Compute North bankruptcy.

Assuming that Hut 8 and US Bitcoin’s merger goes through AND US Bitcoin is indeed the company that manages the Fahrenheit fleet, then New Hut would be the largest public miner in the world in terms of hashrate under management. The dual-company’s combined self-mining hashrate already puts it in the top four of all public miners.

US Bitcoin and Hut 8's merger gave either company the benefit of geographic diversification. This new partnership with Fahrenheit could also give New Hut a new business line and sizable new revenue source.

Industrial-scale, public miners structure their businesses differently. Some, like Marathon and Cipher, are asset light and prefer to own ASICs instead of infrastructure, so they rely on colocation/hosting services for their fleets. Others, like Stronghold and Greenidge, are asset heavy and own energy generating assets; this is extremely capital intensive, so these miners often have smaller self-mining ASIC fleets and need to rely on hosting revenue from other miners to utilize enough of the energy they produce.

Other miners, like Riot, don’t own energy assets, but they own their mining facilities. They generate revenue from a mixture of self-mining and hosting. New Hut finds itself in this position, with plenty of facilities that it can use to self-mine and lease rack space to other miners.

This dual revenue stream gives New Hut great operational flexibility. A strong hosting business could ensure that New Hut can energize new sites with hosted hashrate even when it doesn’t have the capital to invest in ASICs for self-mining. Once the facility is energized (and partially paid for thanks to hosting revenue), the company can then choose to use the hosted rack space for its own hashrate when it expands.

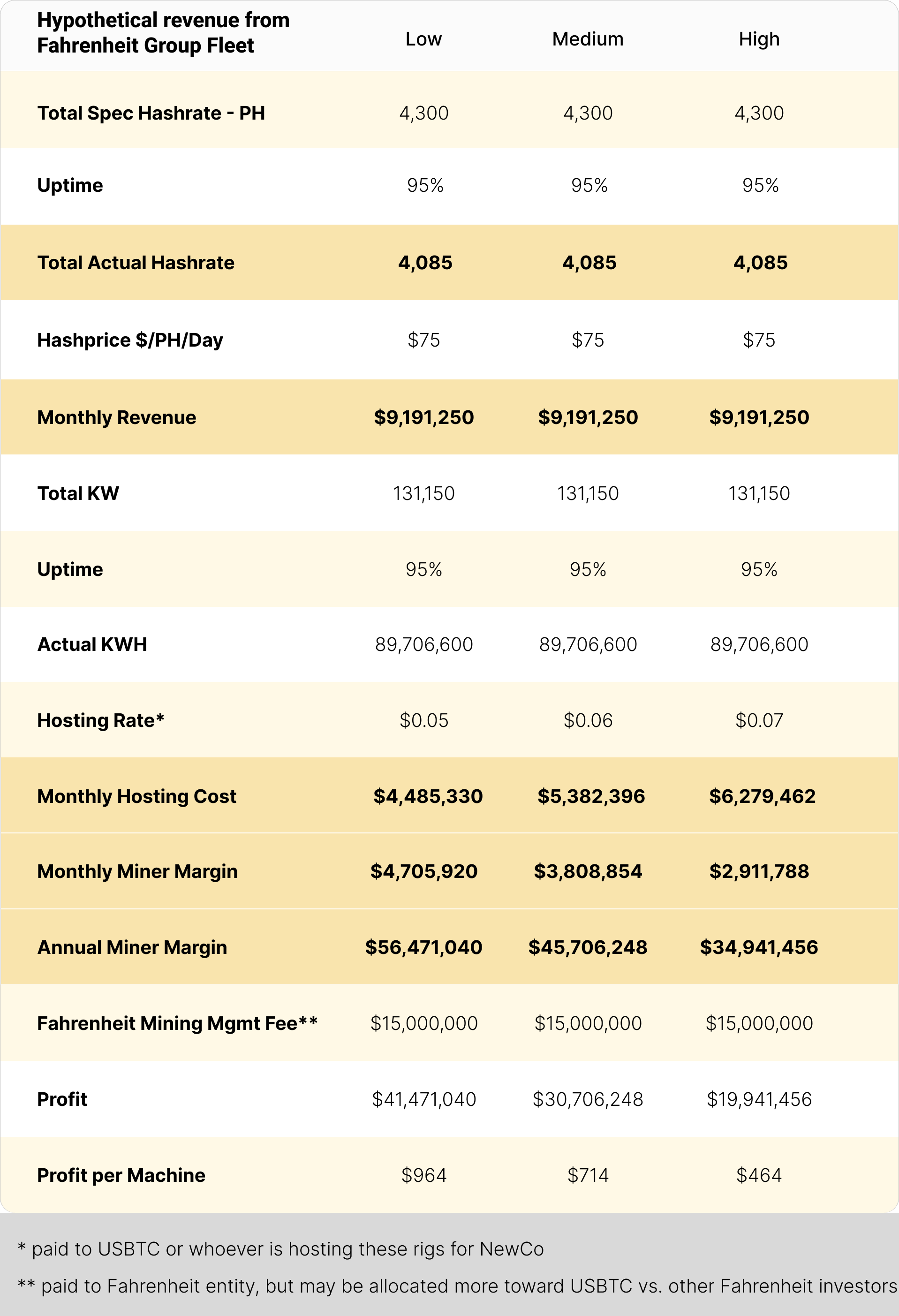

At any rate, US Bitcoin (assuming they manage the fleet) is poised to churn out some solid revenue from hosting rigs for Fahrenheit Group. Below, we’ve outlined scenarios for low, medium, and high hosting rates for the Fahrenheit fleet of 4.3 EH/s (we don’t have the exact details so this is just used as an estimate).

Additionally, the agreement also gives US Bitcoin the optionality to liquidate assets if needed instead of accruing hosting revenue. The agreement has a conditional clause that would allow the Fahrenheit group to either purchase US Bitcoin’s New York state mining farm for $28.75 million or host 8,500 rigs at this location. This gives US Bitcoin optionality to sell the facility if they need quick liquidity or monetize the excess rack space at the New York facility for steady income.

Either way, the deal demonstrates US Bitcoin’s ability to execute on favorable deals during the bear market when assets are distressed and selling at a discount. They have been the most proactive company in this bear market in terms of recognizing acquisition opportunities and capitalizing on them.

Has Bitcoin mining merger and acquisition activity peaked this cycle?

Hut 8 and US Bitcoin’s pending merger would be the biggest merger in the Bitcoin mining space to date, and it’s the latest in a spree of bear market buyouts.

To recap, US Bitcoin’s M&A activity has been strategic. The purchase of mining facilities in Compute North’s bankruptcy allowed them to expand their access to diversified energy assets, and their activity as part of the Fahrenheit group in Celsius’ bankruptcy could give them immediate access to hosting revenue at these sites. Plus, the merger with Hut 8 gives US Bitcoin a fresh source of liquidity via public markets, not to mention the combined brain, labor, hash, and capital power of one of the world’s premier public miners.

Celsius and Compute North filed for bankruptcy within 2 and a half months of each other, and US Bitcoin recognized either company’s misfortune presented complementary opportunities: for mining facilities / rack space from Compute North and ASICs from Celsius.

All of the activity floats the question of what (if anything) will US Bitcoin go after next, and what will Bitcoin mining M&A look like in 2023 and next year as we approach the halving?

We may have seen the fever pitch of activity this cycle already, but we won't know for sure until we get through the next halving next April and 2024.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.