Energy-Adjusted Hashprice: Bitcoin Mining Revenue in Energy Terms

There’s a new metric on Hashrate Index: Energy-Adjusted Hashprice. Here’s what it is, how it’s calculated, and how to use it.

What is Energy-Adjusted Hashprice?

The energy-adjusted hashprice expresses the revenue a Bitcoin miner earns per unit of electricity consumed, rather than per unit of computational power. This metric provides a measure of mining revenue based on energy usage, allowing Bitcoin miners, traders, investors and financiers to assess mining operations in terms of how much income is generated for every watt-hour of electricity used.

How is Energy-Adjusted Hashprice Calculated?

This metric is calculated by incorporating efficiency from Luxor’s Bitcoin ASIC Price Index with Luxor’s Bitcoin Hashprice Index. The calculation is fairly straightforward: to convert Luxor’s Bitcoin Hashprice Index – which expresses Bitcoin mining revenue in terms of a PH per day – we divide by machine efficiency and 24 hours to express Bitcoin mining revenue in terms of kilowatts or megawatts per hour.

Energy Adjusted Hashprice = Hashprice / ASIC Efficiency / 24 Hours

$/kWh = ($ per PH/s/Day) / (kW per PH) / 24 Hours

$/MWh = ($ per EH/s/Day) / (MW per EH) / 24 Hours

For ASIC efficiency, we use the mid-point from each bucket in Luxor’s Bitcoin ASIC Price Index. For example, for the 19-25 J/TH bucket we use 22 J/TH as the underlying ASIC efficiency. For the under 19 J/TH and the over 68 J/TH buckets, we use 17 J/TH and 72 J/TH respectively.

A key difference between regular and energy-adjusted hashprice is that unlike regular hashprice, which is globally standardized, energy-adjusted hashprice is different for every ASIC efficiency. This means that energy-adjusted hashprice can be a very useful metric for evaluating specific Bitcoin mining operations, however is relatively limited as a global or market measure.

Why is Energy-Adjusted Hashprice Useful?

Directly Comparable to Electricity Costs

Electricity is the primary input for Bitcoin mining operations. Energy-adjusted hashprice allows Bitcoin miners, traders, investors and financiers to directly compare revenue and costs per unit electricity for determining gross mining margins. This can be especially useful for communicating Bitcoin mining opportunities to those outside the sector and more familiar with energy markets.

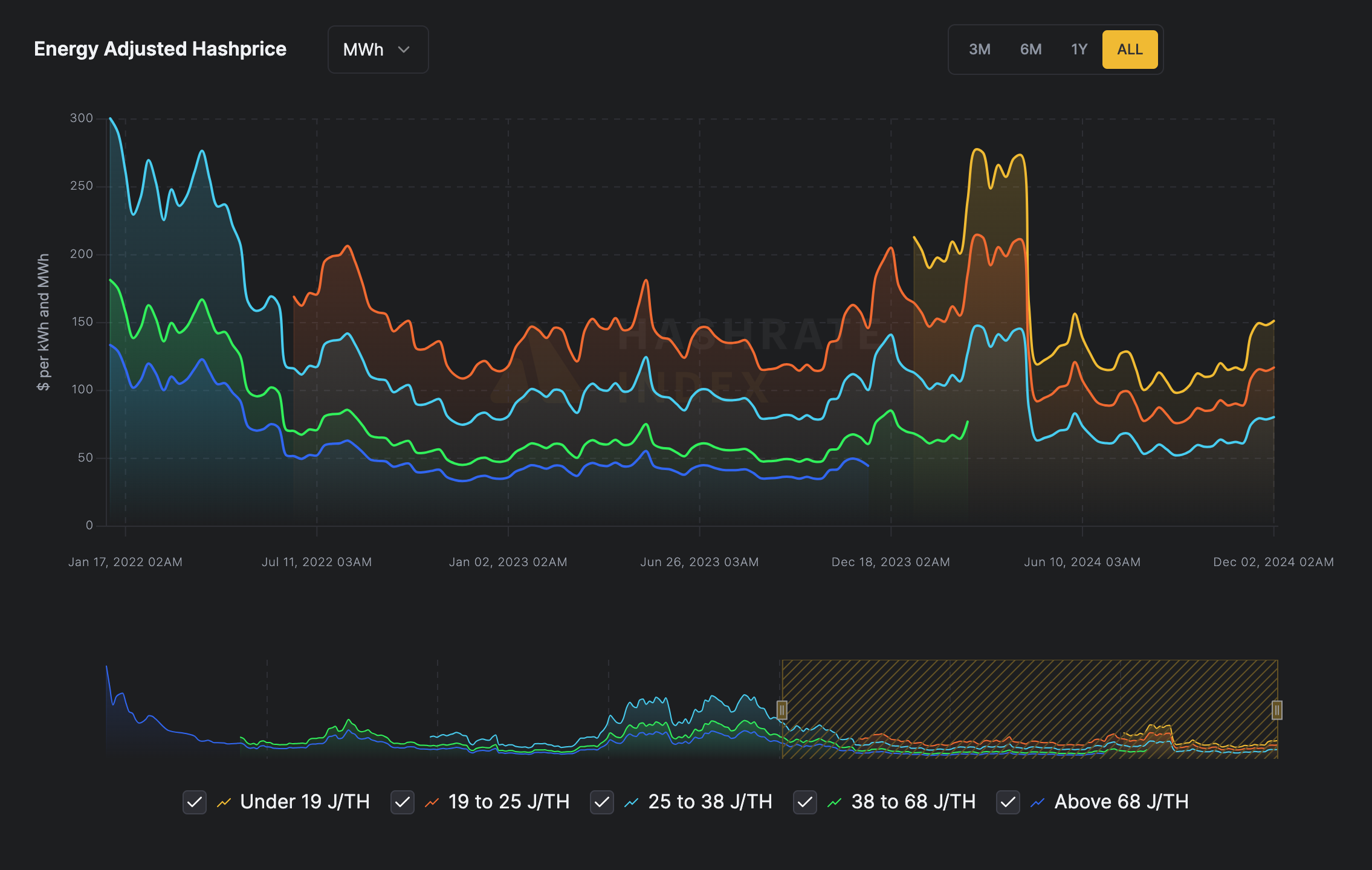

For example, let’s consider a Bitcoin miner with an electricity cost of $0.05 per kWh (or $50 per MWh) running a fleet of Antminer S21’s. A quick glance at the energy-adjusted hashprice (specifically the < 19 J/TH bucket) tells us that this ASIC miner is currently earning ~ $0.15 per kWh (or $150 per MWh) of revenue and a gross mining margin of $0.10 per kWh (or $100 per MWh).

Valuable for Long-Term Modeling

Hashprice is a valuable tool for modeling Bitcoin mining economics over the payback period of an ASIC investment. At Hashrate Index, our premium subscribers have access to quarterly 18-month projections for hashrate, difficulty and hashprice to do just that.

But what about modeling mining economics over a longer time period, say 5 or 10 years? Perhaps we are assessing a Bitcoin mining investment opportunity in conjunction with power generation assets or a long term PPA. Extrapolating hashprice projections could be an immediate answer, but what about more efficient ASICs coming in the future?

Energy-adjusted hashprice enables this type of long term modeling exercise. Using historical energy-adjusted hashprice and extrapolating into the future, we can make projections without specific assumptions about Bitcoin price, network difficulty (i.e., hashrate), transaction fees and ASIC efficiency.

Using historical energy-adjusted hashprice data for very long term forward projections embeds all relationships between these complex variables into a single insightful parameter. While no model can perfectly predict a 5-10 year horizon, this approach offers a clear framework for understanding the underlying mechanics of the system. There is a strong theoretical foundation for the assumption that ASIC efficiency and hashprice are related over time. From a hardware manufacturing perspective: the more efficient ASICs get, the more hashrate online we should expect (all else equal). From an economic perspective: the higher the Bitcoin price and transaction fees, the higher the network difficulty and hashrate we should expect (all else equal), and vice versa.

By simplifying these dynamics, energy-adjusted hashprice becomes a valuable tool for strategic planning and long-term forecasting.

A Look at the Data

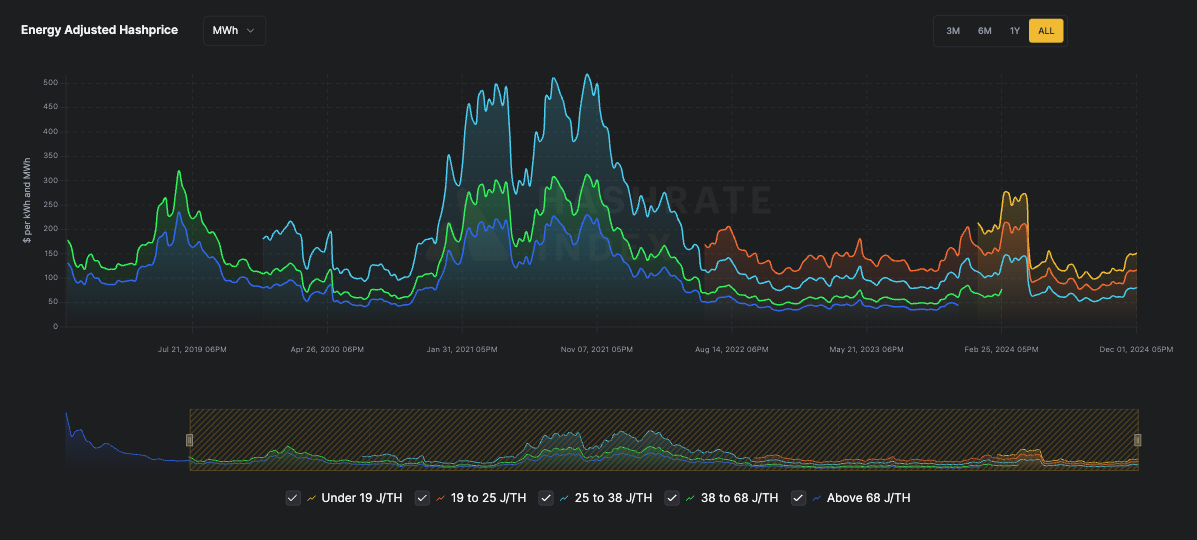

Ignoring pre-2021 data, we can observe that energy-adjusted hashprice has ranged between $45-$300 per MWh up until today. The previous cycle peak was over $500, but only for a short period.

Looking forward, we will observe how this metric evolves over the long run, as developments in ASIC efficiency grapple with the network difficulty and other components of hashprice.

Whether you’re a miner looking to maximize margins, an investor eyeing long-term opportunities, or a trader bridging Bitcoin and energy markets, the energy-adjusted hashprice metric offers a fresh, actionable perspective.

Ready to use it in your Bitcoin mining operations? Click here to get started.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.