Bitcoin Mining in Canada: 2022 Recap and Looking Ahead to 2023

2022 was a disappointing year for Bitcoin mining in Canada. Can the industry overcome political and economic headwinds in 2023?

2021 was a record year for Bitcoin mining in Canada. With access to abundant, low cost, sustainable energy, a highly skilled workforce, cold climate, underutilized industrial infrastructure (particularly in rural areas), and a relatively stable and secure political environment, Canada was naturally positioned to be a global leader in Bitcoin mining. Bitcoin’s price was booming, and with business flooding in from China following the country’s mining ban, Canada’s Bitcoin mining gold rush was in full swing.

2022 went very differently.

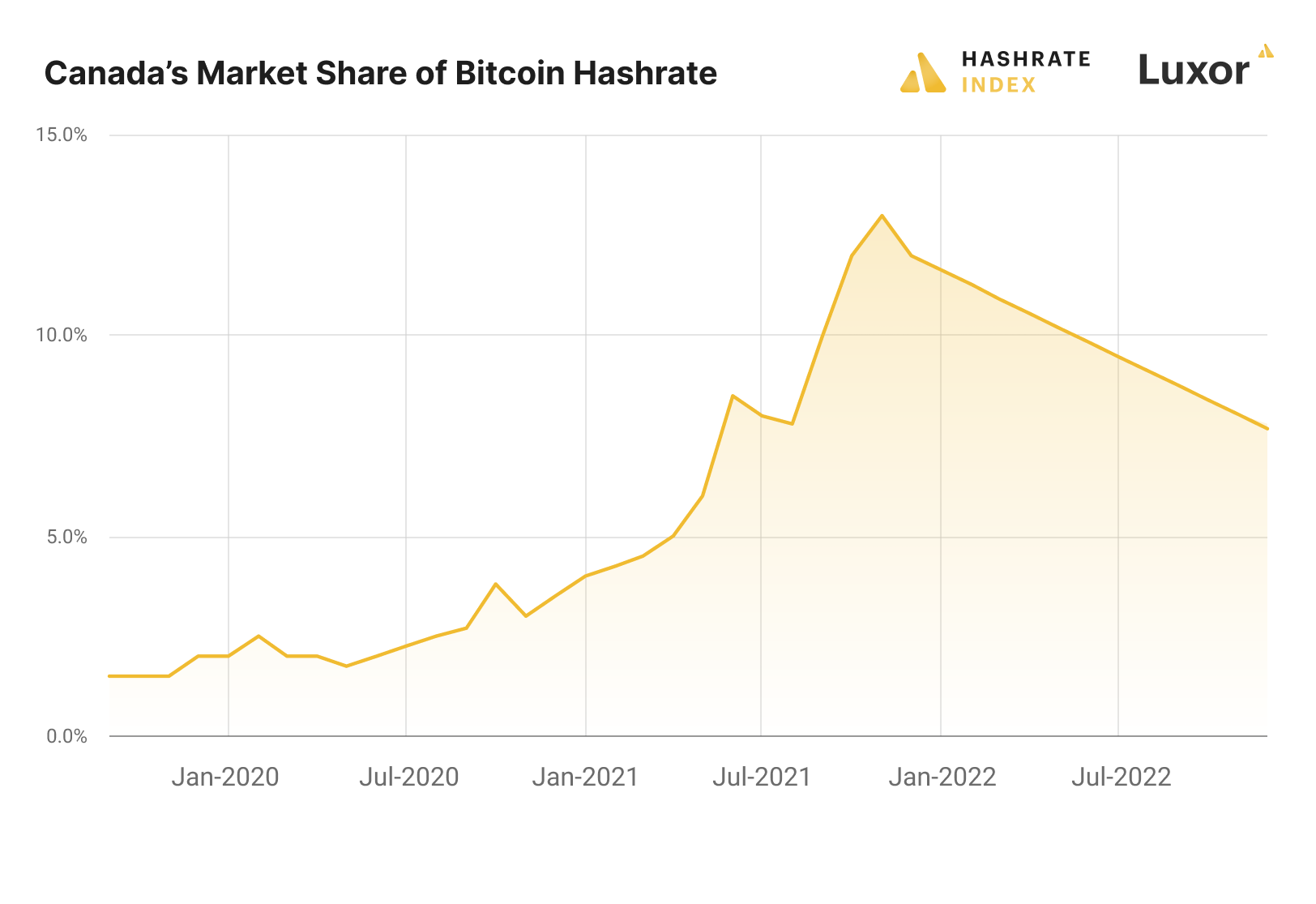

It started with momentum carried over from the previous year. Bitcoin mining companies were making new investments and expanding existing operations. But economic and political headwinds made for a disappointing end to the year. We estimate that Canada’s market share of global network hashrate peaked at 13% in 2021, only to fall to 7-8% by the end of 2022.

In Canada and around the world, unprecedented economic and fiscal intervention as well as significant monetary policy errors led to 40-year highs in consumer price inflation. Attempting to bring inflation back to target levels, central banks raised interest rates, causing the prices of most financial assets to crash – and Bitcoin was no exception. In the real economy, growth in Canada and around the globe slowed substantially, and the United States experienced a brief (technical) recession.

In the digital asset space specifically, rising borrowing costs and falling asset prices triggered a wave of defaults and bankruptcies, the most spectacular of which was FTX. The price of Bitcoin fell 65%.

To the further detriment of miner revenue, network difficulty rose almost 46% primarily due to ASIC and infrastructure investments made under better economic conditions months prior. Hashprice – what miners are paid for hashrate, the digital commodity they produce – was down almost 76% as a result. On the cost side, miner margins were further squeezed by rising energy costs in Canada and around the world.

Legislation, Regulation Are Becoming a Significant Headwind for Bitcoin Miners in Canada

On the political side, and in the aftermath of the Canadian trucker protest, governments across the country brought in harmful legislative proposals and new regulations which made life even more difficult for Canadian Bitcoin miners, pushing many to look elsewhere to expand their operations.

In February, without advance notice to industry, the Department of Finance proposed an amendment to the Excise Tax Act which would declare digital asset mining not a “commercial activity” in Canada. The Department of Finance proposed this despite the fact the industry employs thousands of Canadians all across the country, brings in billions of dollars in investment to rural and remote communities, and contributes tens of millions of dollars in tax revenue to support public services at all levels of government.

If the proposal passes, companies engaged in digital asset mining would no longer be eligible to receive Input Tax Credits for the value added taxes paid on mining inputs. This unprecedented proposal would create a hidden tax that increases the cost of Bitcoin mining by 5% - 15%, making Canada a significantly less competitive jurisidiction.

In response, Canadian miners formed the Fair Tax Treatment for Responsible Digital Asset Mining Coalition. They have so far been successful in pausing the proposed changes and have been imploring officials to consult with industry to learn more about digital asset mining, how it works, and how fair taxation and regulation can foster a healthy Canadian digital mining industry. Unfortunately, even while paused, the proposed tax change looms over all potential new investments in the country.

But policy challenges were by no means exclusive to the federal government.

In March, Ontario Energy proposed excluding cryptocurrency miners from participating in the Industrial Conservation Initiative (ICI). ICI is an electricity conservation program that allows participants to reduce their Global Adjustment costs, based on their ability to reduce demand during five top peak demand hours. In Quebec, Newfoundland, Manitoba, and British Columbia, governments removed electricity allocations for new mining operations citing energy-use concerns. All this, despite Bitcoin mining being a uniquely flexible electricity load, which can almost immediately shut down during times of energy scarcity (and is economically incentivized to do so), and Canada generating far more electricity per capita than any G20 peer by far – 30% more than the United States and 150% more than the G-20 average.

These misguided moves underscore the headwinds miners are facing from Canadian legislators and regulators. Canada is significantly behind jurisdictions, like Texas, which are leveraging large flexible loads like Bitcoin mining to stabilize their electricity grid and incentivize the build out of new renewable generation capacity. A lack of education and abundance of negative publicity are setting the policy agenda in Canada.

We believe the government’s misguided approach to Bitcoin mining is the main driver behind the decline in Canada’s hashrate market share in 2022.

All that said, 2022 wasn’t all bad news.

Canada’s largest public mining company, Hut8, made new investments in Canada, expanding their Bitcoin mining and other data centre operations to Ontario and British Columbia. Iris Energy built a 30 MW mining farm on the Columbia Lake Technology Centre in Canal Flats, British Columbia, which helped to support dozens of jobs in the area; the company also made an inaugural $500,000 donation to First Nation communities in the Canal Flats region, a donation it’s pledged to make annually going forward. For its part, DMG added energy demand for surplus hydro power in British Columbia, a move that lowers costs for taxpayers despite what regulators and politicians claim.

Private miners were also innovating. Companies such as CryptoTherm and Upstream Data released new air-cooled and immersion mining systems. Energy companies expanded Bitcoin mining operations to capture otherwise flared or vented gas and to act as a load bank for excess energy. Some miners were experimenting with prototypes for repurposing waste heat.

Alberta stepped forward as a welcoming jurisdiction for Bitcoin mining companies. In conjunction with the Canadian Blockchain Consortium, the province hosted a roundtable for digital asset miners in September to develop strategies to encourage Bitcoin and other digital asset mining in the province, and in November, led the country’s first ever blockchain trade mission to the Texas Blockchain Summit.

In 2023 and Beyond, Canadian Miners Need to Make Their Value Known

At first glance, the macroeconomic backdrop does not look favourable in 2023.

Despite central banks raising interest rates significantly, inflation remains far above target levels in advanced Western economies. As the real economy teeters, markets are hoping for a central bank pivot and return to easy money policies. They would do well to remember that inflation targets are legally mandated and central banks have yet to make meaningful progress on bringing inflation down – which means further increases in borrowing costs are likely.

Energy costs could come down, but with chronic underinvestment in the industry and the potential for geopolitical flare ups, there is risk to the upside. In Canada, generation capacity exists, it is just being hamstrung by ill-advised, politically-driven decisions.

For the macroeconomic variables outside a miner’s control, it would be appropriate to prepare for the worst and hope for the best in 2023.

On the policy side, Canadian miners are facing an uphill battle but have an opportunity to make meaningful progress in 2023. Canada is naturally positioned to be a leader in digital asset mining and can continue to bring benefits to the country via jobs and economic diversification. If Canadian miners can just prevent policy that explicitly discriminates against digital asset mining, there is long term upside potential in Canada.

Up to this point, government relations efforts for the digital asset mining industry in Canada have been fragmented across issues and regions. As a result, the industry is not presenting a coherent narrative of industry benefits, it’s not getting ahead of legislative and regulatory threats, and it’s constantly playing catch up as new issues arise.

In our view, Canada’s Bitcoin mining industry is well overdue for a serious, permanent, and coordinated cross-Canada digital asset mining lobbying effort. A permanent body signals to governments that our industry is not going away, which could help with a resolution on the Federal tax issue, establish a more credible deterrent for harmful policy endeavours in the future, and get ahead of issues on the industry's behalf.

The industry needs to better highlight how producers of digital commodities add value to Canadian society.

Digital asset miners create jobs (both upstream and downstream from site operators), including hardware manufacturers, infrastructure providers, and software engineers. They bring investment to their local communities, often in rural or remote areas with limited opportunity and underutilized industrial infrastructure. They improve environmental and energy system efficiency and sustainability, by using stranded gas that would otherwise be flared or vented, support electrical grid stability through demand response, and enable the build-out of new renewable generation assets. And perhaps most importantly, they help get stranded Canadian energy to international markets without physical transmission line or pipeline infrastructure, as hashrate is sold over the internet.

Canada’s success in digital asset mining in 2023 and beyond will be dependent on industry’s ability to change the narrative and educate policymakers on the benefits of welcoming responsible digital asset mining.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.