Bitcoin Difficulty Sees Second Largest Upward Adjustment of the Year

The bump to the current difficulty of 17.6 T is the third straight adjustment in a row, following the last two adjustments of 7.3% and 6%, respectively.

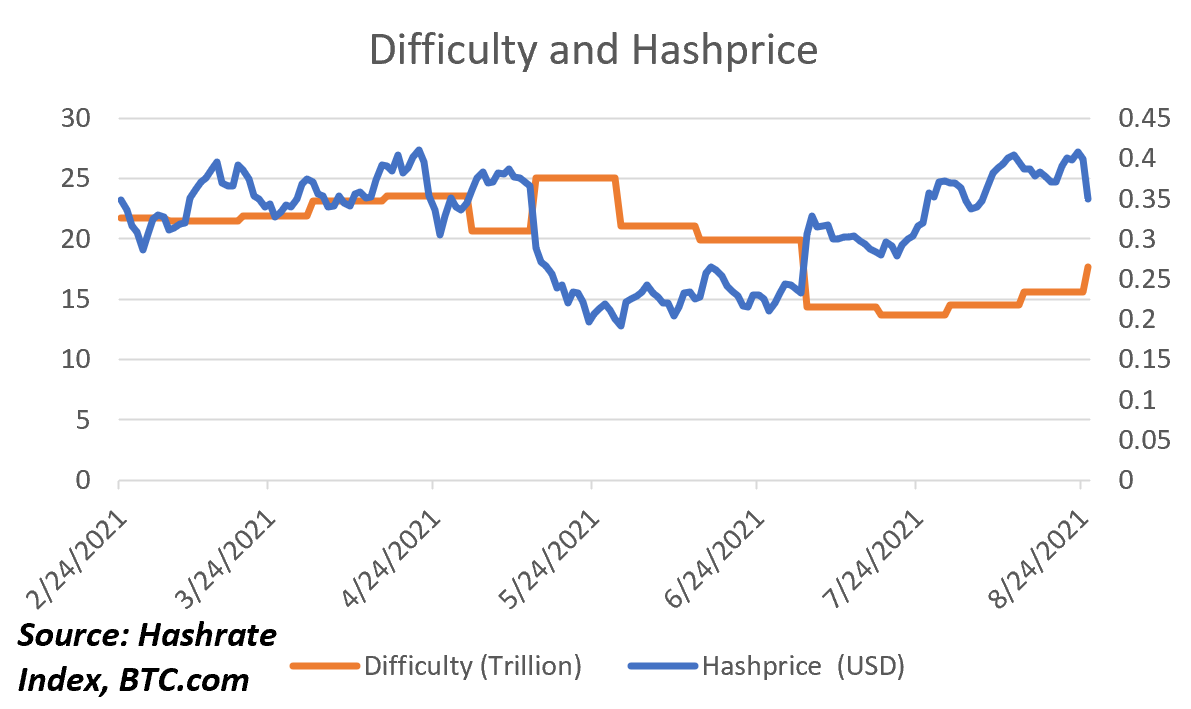

Bitcoin’s difficulty adjusted upward today by 13.24%, the second largest increase of the year as hashrate returns to the network at a rapid pace.

The bump to the current difficulty of 17.6 T is the third straight adjustment in a row, following the last two adjustments of 7.3% and 6%, respectively. This succession of stair-step adjustments follows a surge of hashrate coming online; since July 17, the last downward adjustment the network saw, Bitcoin's hashrate has grown 28% from 97 EH to 126 EH.

The sizable adjustment will take a chunk out of miner profitability, which was inching towards yearly highs before the adjustment as Bitcoin’s price continues to surge. Per Luxor’s Hashrate Index, hashprice fell by 10% from $0.39/TH to $0.35/TH immediately following the adjustment.

What is Bitcoin’s Mining Difficulty?

Mining difficulty is an internal, self-referencing score which dictates how hard it is for Bitcoin miners to find a hash for the next block in the chain (or, as the cool kids say, find a hash below the target value). Bitcoin’s difficulty began at a value of “1” and has been growing exponentially since Bitcoin’s inception. Now, the network's difficulty is measured in the trillions (the currently level is 17,600,000,000,000, or in shorthand, 17.6T).

This difficulty adjusts every 2,016 blocks (or roughly every two weeks), either up or down depending on how many miners are competing on the network. If more hashrate comes online during one of these two week periods (i.e., if more miners are producing more computations to find blocks than before), then difficulty will adjust upward; if hashrate goes offline and competition reduces, the difficulty decreases.

The difficulty adjustment ensures that bitcoin blocks will come out in line with the 10 minute average Satoshi Nakamoto set when they created the network. Additionally, it ensured that no one actor could outpaced the competition in the early days of the network, because if one miner employed so much hashrate that they were winning too many blocks, the difficulty adjustment would retarget and make mining more difficult and reduce their profitability (and give other miners time to deploy more hashrate).

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.